The ETFMG Prime Cyber Security (NYSEARCA:HACK) gets investors exposure to cybersecurity services and software companies. There are other ETFs that do that as well, including the iShares Cybersecurity and Tech ETF (IHAK). While there are some differences between them, ultimately the exposures are similar. The risk factors are also similar, namely to upwards revisions in long-term rate expectations and their effects on cost of capital. While we don’t see much reason to invest in tech at this current juncture, we would prefer even less HACK compared to IHAK.

HACK Breakdown

Let’s begin with some key information from HACK. The expense ratio is 0.6%, which is higher than IHAK’s 0.47% expense ratio.

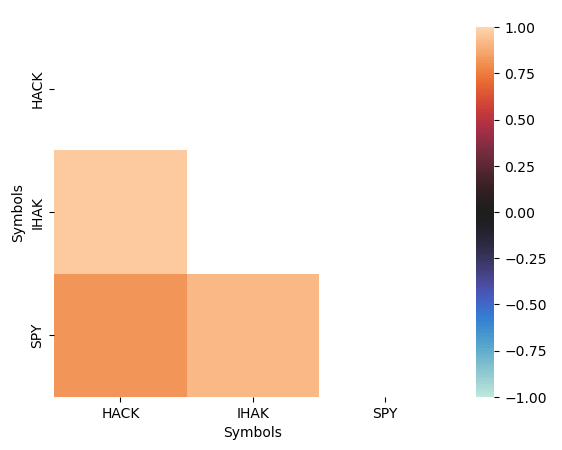

Broadly speaking, sectoral allocations are almost identical in quantum. Neither HACK nor IHAK are value weighted, they both employ discretionary weightings, and this active component is likely what contributes to higher expense ratios for both of them compared to other tech-heavy ETFs that become so due to the high weighting of tech in general indices. It also contributes to the relatively different spread of top holdings between each. However, since each takes a pretty uniform approach in allocation, the substantial overlap in the names also means they move similarly.

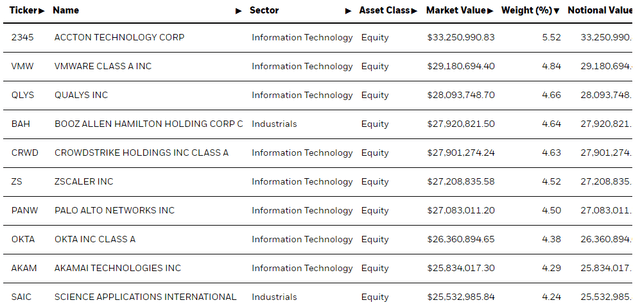

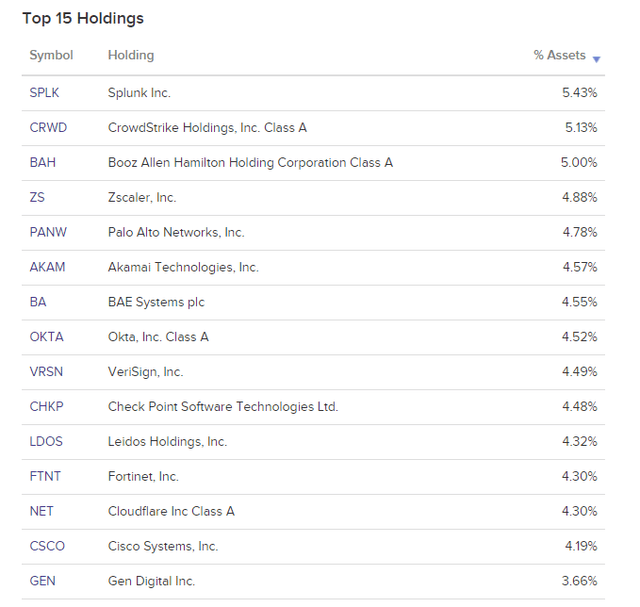

Correlations (VTS) IHAK Top Holdings (iShares.com) HACK Top Holdings (etfdb.com)

HACK is more US focused than IHAK, but it does feature some foreign exposures somewhat highly, such as BAE Systems (OTCPK:BAESF), which probably wouldn’t traditionally be considered a cybersecurity company, but has some amount of exposure to cybersecurity and cyberwarfare offerings as part of its product portfolio. Other than that, IHAK has more international diversification and its top holdings are Taiwanese.

Bottom Line

There’s a lot to like about cybersec exposures. There’s ample opportunity to apply AI. The economics are typically recurring, and it’s a non-discretionary cost centre.

But there are issues. Cybersec ETFs have very high PE ratios. IHAK has a PE in excess of 34x, while the inclusion of negative PE companies in HACK makes the data hard to collect, but overlap indicates that it would be similarly high.

While broader, tech driven markets have smaller drawdowns from highs, and less extreme performance even YTD, the cybersec ETFs have appropriately suffered more in the run-up of interest rates. Cybersec companies tend to have a smaller and more idiosyncratic profile within the world of tech, and therefore higher growth expectations. Higher growth expectations and multiples means more sensitivity to cost of capital assumptions.

Indeed, we believe this is the primary risk factor for the ETF. In addition to pressure of higher rates on CAPEX and general spending, which could create a recessionary pressure leading to a smaller growth counterfactual than in a non-recessionary scenario, the technical impacts on constituent securities from higher costs of capital has a large impact. Both for its recessionary pressures as well as for its cost of capital pressure, the threat of higher for longer rates, or even of higher rates, is a problem for reasonable forecasts of performance of the ETF over the next five years.

The balance of data shows that higher costs of capital should be expected. In particular, the apt focus of speculators on the jobs data, which should be a leading indicator of inflation through the wage-price mechanism, which is the most pernicious and in-focus mechanism for the Fed to concern themselves with. Continuing tightness in labour markets should worry investors, and it leads the market to correctly believe that the transmission system will require lower economic activity, indeed a recession, in order to achieve target rates of inflation, where the least 1% till the target has been reached is very stubborn.

In general, we see no incremental upside on tech stocks or cybersec. The potential disillusionment around AI is also another downside factor, and may reduce the premium on cybersecurity and its correlates to drive down prices.

Overall, HACK isn’t terribly interesting right now, and with expense ratios below the very similar IHAK, probably wouldn’t be interesting even in an environment where we might be overweight tech.

Read the full article here