3D Systems (NYSE:DDD) continues to struggle in the face of an uncertain macro environment and rapidly rising long-term interest rates. The stock price is now hovering near decade lows and the general operating environment is likely to remain a headwind in coming quarters. In addition, a merger with Stratasys (SSYS) appears unlikely, calling into question 3D Systems’ path to profitability. Weakness caused by 3D Systems’ dental business should soon begin to ease though as customers work through excess inventory. From a valuation perspective, 3D Systems’ valuation multiples are approaching historic lows, but given interest rates and the company’s declining revenues, there could still be further downside.

Market

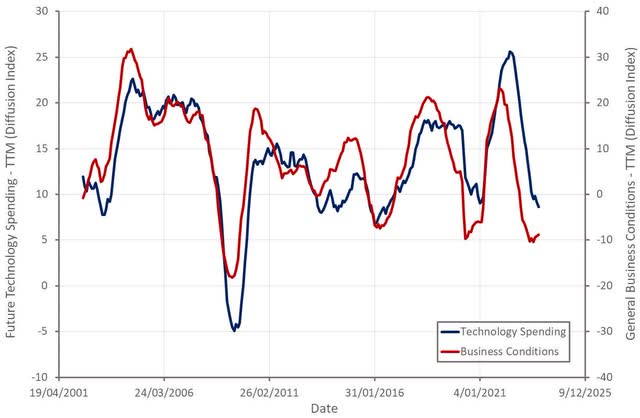

The combination of a difficult macro environment and weakness within specific verticals, particularly dental, has caused a significant decline in revenue and profitability for 3D Systems. During the second quarter 3D Systems saw printer orders shift into the third quarter as the result of elongating sales cycles, with higher ASP products particularly impacted. The company believes that rising interest rates are weighing on customer budgets, in addition to caution caused by macroeconomic uncertainty. Longer sales cycles are expected to persist through until at least the end of the year, negatively impacting 3D Systems’ full year sales expectations.

Figure 1: Manufacturing Survey Data (source: Created by author using data from The Federal Reserve)

Weakness has been acute within dental, due to depressed demand and high customer inventory levels. Volumes have begun to stabilize though, and 3D Systems is confident regarding its competitive positioning within the clear aligner space. 3D Systems is seeing solid growth in healthcare solutions outside of dental, driven by virtual surgical planning and orthopedic applications. This is a high margin growth area, but competition amongst companies like 3D Systems, Materialise (MTLS) and Stratasys is likely to increase. Industrials solutions are growing modestly, with strength coming from adoption in aerospace & defense, transportation, semiconductors and energy.

Longer term, 3D Systems believes that additive manufacturing has reached an inflection point, with applications expected to shift from prototyping to scale production. Software integration is becoming more important to the market, with machine learning becoming an important part of workflow optimization. The global 3D printing market was worth an estimated 15 billion USD in 2021 and is expected to grow to approximately 80 billion USD by 2029. Whether 3D Systems can capture value as the market expands remains unknown though. So far, benefits appear to be accruing to material and software providers, along with end users of the technology.

3D Systems

3D Systems is focused on scale production applications of additive manufacturing, believing that success requires a global presence, a strong technology portfolio and a sustainable business model. The company already has a global presence, and its planned acquisition of Stratasys aims to enhance its product portfolio and create the scale necessary to reach profitability. The Stratasys acquisition appears unlikely at this stage though, raising questions about 3D Systems’ technology portfolio and the company’s ability to achieve profitability.

Dental orthodontics is one area where 3D Systems has already achieved scale, with the business supporting multiple large-scale fleets of printers in factories on three continents. The orthodontics business remains a headwind for 3D Systems, although the business continues to grow organically outside of this segment and 3D Systems believes a bottom is within sight. 3D Systems expects its dental business to be down approximately 35% in 2023. This pullback comes after a period of significant growth in 2021 and 2022. 3D Systems has suggested that this is largely the result of inflation negatively impacting consumer discretionary spending, with customer inventory builds now contributing to the decline. Dental orthodontics is a material part of 3D Systems’ business, with one customer having an outsized impact.

Regenerative medicine is an area of 3D Systems business that has significant potential, but it is unlikely to impact performance in the near-term. This business covers human organs, non-organ tissues and bioprinted “organs-on-a-chip” for drug development. The company’s initial focus is on 3D printed lungs through a partnership with United Therapeutics, with a 2026 target date for human trials.

3D Systems’ h-VIOS organ platform enables pharmaceutical companies to test their drugs on a cellularized chip that mimics the body’s response. This business will potentially be supported by the fact that the FDA no longer requires animal testing in order to move new therapeutics into human trials. Systemic Bio has now demonstrated the four core technology advancements needed for success:

- Creation of precise computer models for vascularized tissue

- Conversion of computer model into a 3D scaffold

- Cellularization the scaffold in order to convert it into living human tissue

- Demonstration that the tissue structure can sustain cell life for an extended period of time

3D Systems signed its first contract with a pharmaceutical company in the last quarter and expects another contract award later this year. 3D Systems also has five additional programs with other pharma companies in its pipeline.

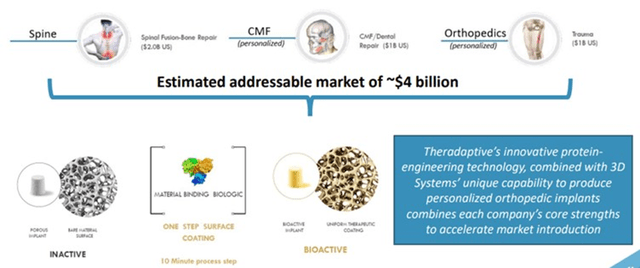

In the orthopedics space, 3D Systems recently announced a partnership with Theradaptive. Theradaptive’s Osteo-Adapt product is primarily used for orthopedic regeneration. The partnership aims to combine Theradaptive’s protein material with 3D Systems’ 3D-printed custom orthopedic implants to yield highly targeted bone regeneration. Initial applications will be for spinal and craniomaxillofacial repair. Theradaptive is hoping to enter human trials later this year.

Figure 2: Theradaptive Partnership (source: 3D Systems)

Stratasys Acquisition

While there still hasn’t been any definitive outcome from 3D Systems’ efforts to acquire Stratasys, a deal continues to look unlikely. Given the recent drop in 3D Systems’ share price and the fact that 3D Systems’ offers have largely been in the form of equity, Stratasys is less likely than ever to accept a bid at this point.

The proposed acquisition aims to strengthen 3D Systems’ product portfolio and create sufficient scale for the combined entity to achieve profitability. 3D Systems also believes that there are significant cost synergies in areas like COGS, R&D and SG&A.

Stratasys has shown a clear preference for a deal with Desktop Metal (DM) but has been unable to get a deal past shareholders. 3D Systems is currently allowing Stratasys to pursue strategic alternatives. Stratasys continues to suggest that 3D Systems acquisition attempts are being driven by weakness in its own business, although the truth probably lies somewhere in between the two narratives.

Financial Analysis

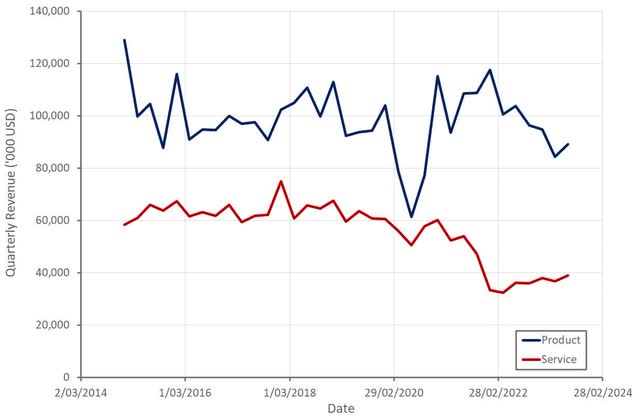

3D Systems’ revenue in the second quarter was 128 million USD, decreasing 8.5% YoY. Excluding the dental business, second quarter sales decreased approximately 2% YoY. Healthcare Solutions revenue decreased 15% YoY in the second quarter, due primarily to weakness in the dental market, which was down 23% YoY. Excluding dental, Healthcare Solutions revenue declined by approximately 4% YoY. Industrial Solutions revenue declined by approximately 1% YoY as a result of lower printer sales.

There was unexpected weakness in the second quarter caused by opportunities within both the Industrial and Healthcare segments pushing into future periods, a significant portion of these opportunities were reportedly booked in July though. Within the Industrial segment, growth in verticals like foundries, aerospace and defense, consumer and durable goods and semiconductors has been offset by weakness in verticals like service bureaus and energy.

3D Systems is currently guiding for 525-545 million USD revenue in 2023. Excluding the orthodontics business, 3D Systems’ guidance implies high single digit to low double-digit growth for the full year.

Figure 3: 3D Systems Revenue (source: Created by author using data from 3D Systems)

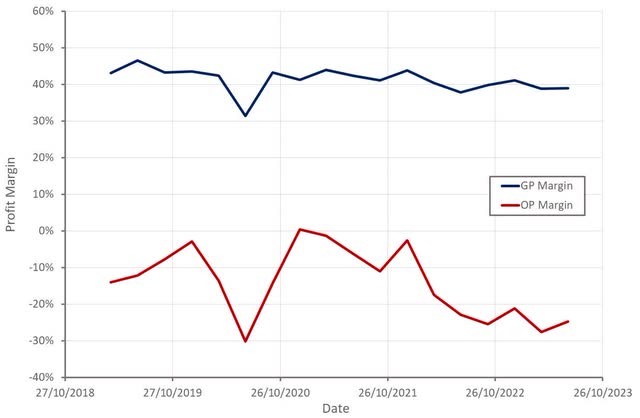

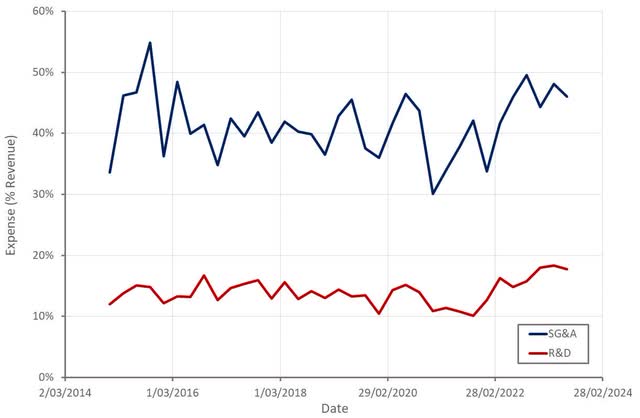

Margins continue to be a problem for 3D Systems, caused by a combination of inflationary pressures, weak demand and rising operating costs. Gross profit margins are expected to improve in coming quarters based on cost efficiencies and fixed cost leverage though.

Figure 4: 3D Systems Profit Margins (source: Created by author using data from 3D Systems)

Given ongoing revenue weakness, inflation and continued hiring; it seems likely that the burden of operating expenses will remain high, preventing meaningful progress towards profitability in the near term. 3D Systems’ margins have likely bottomed though, unless there is a substantial deterioration in the macro environment.

Figure 5: 3D Systems Operating Expenses (source: Created by author using data from 3D Systems)

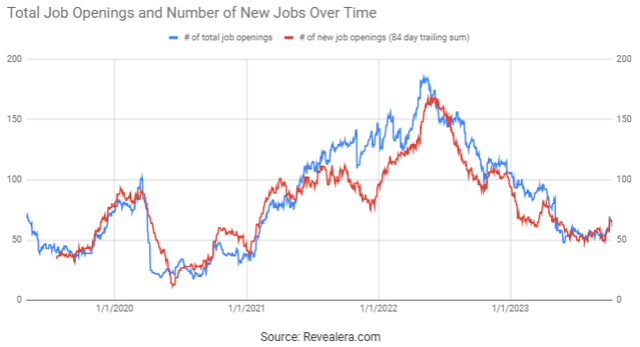

Figure 6: 3D Systems Job Openings (source: Revealera.com)

Valuation

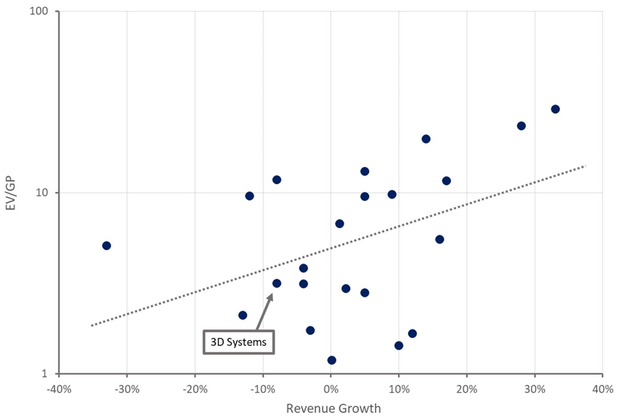

Valuations have crushed in the additive manufacturing space over the past 3 years, and 3D Systems has been no exception. There is little investor appetite for unprofitable, small cap technology stocks at the moment, and this situation will probably persist while interest rates remain elevated. While 3D Systems’ revenue multiple is near historic lows, the stock is priced in line with peers. 3D Systems may do well when the additive manufacturing market recovers, but there are better opportunities, and a recession may first be required to bring interest rates down.

Figure 7: 3D Systems Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here