Shares of Genuine Parts Company (NYSE:GPC) fell 6% on Thursday as investors digested a mixed set of Q3 earnings results. This has left the stock down 13% over the past year, and while it has outperformed competitors like Advance Auto Parts (AAP), shares have meaningfully lagged the S&P 500 (SP500). While the multiple has become more attractive and the ongoing autoworkers’ strike may be a minor tailwind, there is no rush to buy shares in my view as growth is set to decelerate.

Seeking Alpha

In the company’s third quarter, GPC earned $2.49 a share, beating consensus by $0.07 even as revenue missed by $90 million, rising 2.5% from last year to $5.82 billion. M&A contributed about 1.8% to sales growth with core sales rising just 0.5%. EPS rose 12% from last year as gross margins expanded 130bp to 36.2%. While the company does about three-quarters of its revenue in North America, its overseas markets showed solid growth, helping to offset weakness here at home. That weakness in the U.S. market, particularly for auto, is the primary concern weighing on shares, in my view.

Looking first at its smaller business, GPC has an industrial unit that operates under the “Motion” brand, selling everything from power tools to hydraulic pumps with a product lineup of over 19 million parts. It saw sales rise 0.6% to $2.2 billion with same-store comps of 0.3%. North America was essentially flat while its smaller Australian and South Asian businesses generated substantial growth, rising 14%. Thanks to pricing and e-commerce gains, margins expanded 180bp to 12.9%, pushing segment profits 17% higher to $283 million.

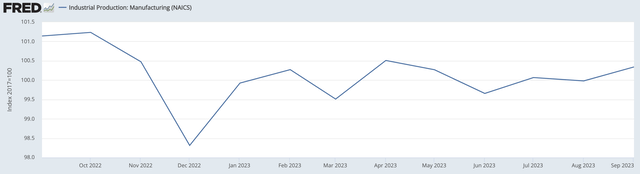

Last year, there was meaningful supply chain disruption and surging input costs which could not be fully and immediately passed on to end customers, causing some margin compression. As it has continued to raise prices and input inflation pressures have moderated, GPC has been able to recapture lost margin. This tailwind, which has led to faster earnings growth than top-line growth is largely complete in my view, particularly with end demand stagnating, as seen by just 0.3% comps. Indeed, given pricing gains, this points to a year-over-year decline in volumes. This is consistent with the fact that manufacturing activity has essentially been flat over the past year, according to industrial production data.

St. Louis Federal Reserve

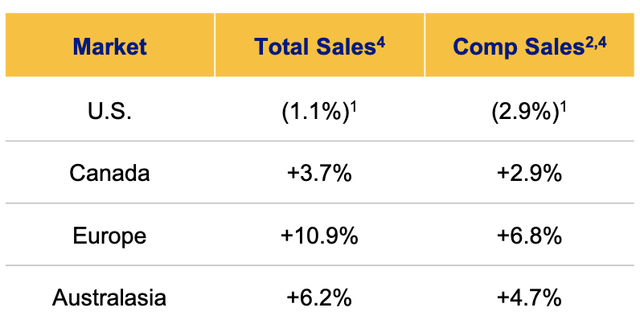

Auto parts are its primary business, accounting for over 60% of sales. It operates about 9,700 stores under the familiar “Napa” brand. 85% of sales are NAPA-branded products, allowing it to capture more margin and hopefully more loyalty from customers. 20% of sales are to consumers for do-it-yourself projects with 80% to professionals. Sales rose 3.9% to $3.6 billion, and margins were flat, leading to a 4% profit growth of $322 million. Same-store sales rose just 0.6%, weighed down by a weak performance in the United States where comps trended nearly 3% lower. As you can see below, there was a tremendous divergence in performance by market.

Genuine Parts Company

The U.S. accounts for about 55% of revenue, and so the underperformance is a meaningful drag on results. Now, some car repairs are non-discretionary, i.e., you need to replace your battery. Some projects, particularly DIY ones, like paint work can be discretionary, and many are in between these two categories as they need to be done but can be delayed, i.e., waiting for an extra 5,000 miles to replace brake pads. Given the fact inflation remains elevated and the personal savings rate is below 4%, more consumers are likely watching their discretionary spending and having to make tradeoffs. Based on the poor comp performance, it would appear some consumers are choosing to spend less on maintaining their cars.

Now, in the short run, if the UAW strike persists and auto production continues to suffer, some consumers will have to delay purchases of new cars. Older cars tend to require more maintenance work than new ones, and so this aging of the fleet should boost demand at GPC, but this is more likely to be a blip than a sustained sales tailwind as the strike will not go on forever. My bigger concern is that the U.S. economy has recovered more quickly from COVID than other developed economies, so just as we lead coming out of COVID, will we lead down? In other words, foreign sales at its auto unit may be strong as these economies are still catching up to where the U.S. is, but as their consumers increasingly get tapped out in six months, will comps begin to soften in two or three quarters as the U.S. has, which would weigh on results. That remains to be seen but is a risk that investors should consider.

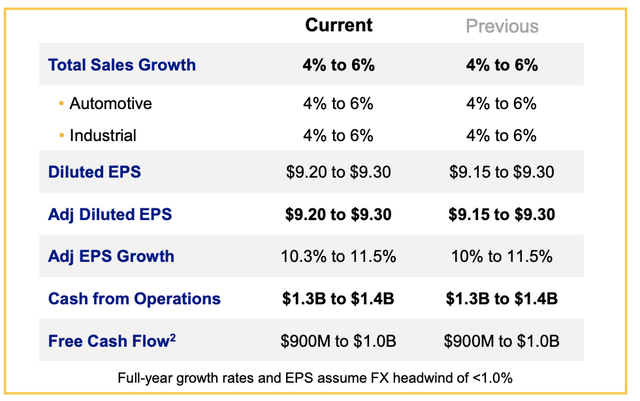

Alongside these results, GPC essentially reiterated guidance, just lifting the bottom end of its EPS and margin ranges. With year-to-date earnings of $7.08, guidance implies $2.12-$2.22 in Q4 EPS. That would represent just 6% growth from last’s year $2.05. That is a meaningful deceleration from Q3’s 12% growth and is consistent with my view that the margin accretion tailwind is fading and that comps are likely continuing to soften given stretched consumer budgets.

Genuine Parts Company

GPC has managed through this cycle fairly well, and the company has a history of strong performance. It raised the dividend about 5.5% to $0.95 earlier this year, marking 67 years of dividend growth. It also has repurchased $172 million in stock this year and likely will continue with moderate buyback activity, thanks to its solid free cash flow generation and strong balance sheet.

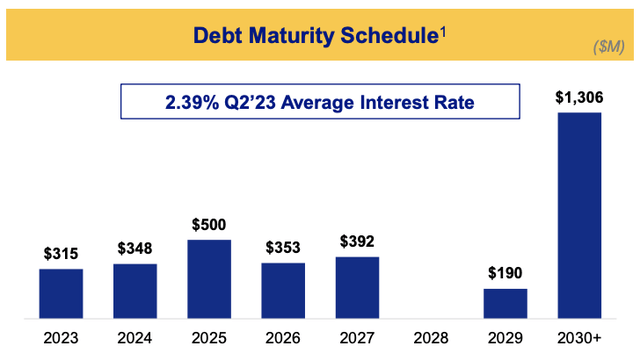

GPC has $655 million in cash on hand, and its debt to EBITDA leverage is a modest 1.6x times, giving it meaningful resilience through the economic cycle. I also am pleased with how staggered its maturity profile is, which limits the need for the company to refinance debt at today’s punitive interest rates.

Genuine Parts Company

Coming into this report, analysts were looking for earnings to rise about 10% next year to $10.25. Looking through this report, that feels ambitious. While the company managed an EPS beat in Q3 thanks to margin strength, slow comp sales, and declining volume growth are a concern, particularly in the U.S., its most important market. Based on Q4’s implied guidance, growth is already slowing meaningfully. With consumer budgets stretched and the easier comps overseas fading away, I struggle to see a catalyst for a sustained acceleration in growth. Rather, I think investors should view the 5-6% exit rate as a ceiling for growth in 2024, and if discretionary spending slows further, there could be some downside risk to this.

As such, I would look for $9.50-$9.70 to be a more reasonable range for 2024 earnings. That provides shares with a 14.2x on 2024 earnings after today’s large drop. That is not particularly expensive, but for a primarily retail business that is seeing operating conditions decelerate, that is also not a cheap multiple. And while its dividend growth is attractive, a 2.6% yield is not sufficient in and of itself to put a floor under the stock. I think shares will struggle to find a catalyst to recover lost ground, particularly given the concern that comp sales could continue to deteriorate, and the ongoing decline in AAP is a reminder that such a cycle can become particularly painful (though some of its problems are clearly of its own making).

Neither too cheap nor too expensive, and with no clear catalysts to re-accelerate growth and support the stock, I suspect Genuine Parts Company shares are likely to remain stuck around current levels and that GPC may prove to be dead money. While I would not actively short it, I think investors should look to rotate out of it as there are better opportunities for your capital. Given the deteriorating outlook, I would need to see a multiple closer to 12x or about $115 to justify buying into what appears to be a solid company facing a cyclical deceleration.

Read the full article here