Delek Logistics Partners, LP (NYSE:DKL) is in a period of transformation that includes recent integration of a large acquisition and a change in the business segments. The company also continues to report beneficial quarterly reports, including stable distributable FCFs and investments in third party opportunities. I do see risks from the total amount of debt and volatility in the price of crude oil, however DLK could trade at higher price marks.

Delek Logistics

With an integrated business infrastructure that covers the different stages of the storage, refining, and distribution processes of petroleum and related oils, Delek Logistics Partners is an American company belonging to the petroleum sector with twenty years of activity since its foundation.

In addition to the refining and logistics activities that the company has for its own use and that of its clients, Delek has retail distribution stores, mostly concentrated in New Mexico and Texas.

The activities are distributed in different segments, which were actually redefined very recently. The following lines are from a recent quarterly report.

The new reportable segments consist of Gathering and Processing, Wholesale Marketing and Terminalling, Storage and Transportation, and Investments in Pipeline Joint Ventures. Source: 10-Q

Although the largest revenues historically came from oil refining activities, the gap in relation to the other activities has narrowed, as part of the company’s efforts to bet on its integrated production and services model. Refining is operated through four facilities under its ownership, located within the reserve areas of the Permian Basin.

Logistic activities cover high-risk transportation and storage of oil and derivatives available, and are operated through pipelines under its ownership or through subsidiaries where the company has majority interest percentages. Retail activities are made through service stations in the aforementioned areas, and within this, income comes mainly from the retail sale of fuel to private customers.

With that about the business model, I believe that the recent figures delivered in October, lower leverage, FCF, and distributions to shareholders are great reasons to have a close look at Delek.

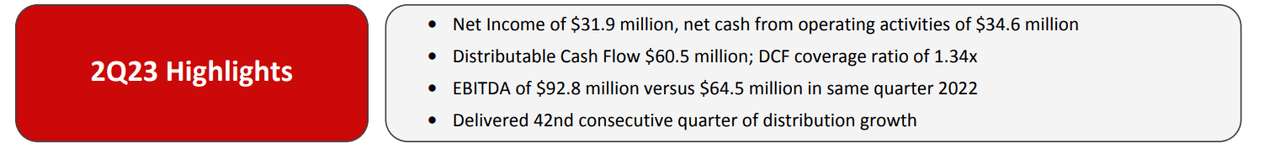

So far in 2023, the company has managed to greatly exceed the profit margins of the previous year, partly due to the general recovery of the industry and the risk management the company has done to adapt to macroeconomic conditions. In particular, the company reported quarterly distributable cash flow of $60 million, a DCF coverage ratio close to 1.34x, EBITDA better than that in 2Q 2023, and distribution growth.

Source: October Presentation

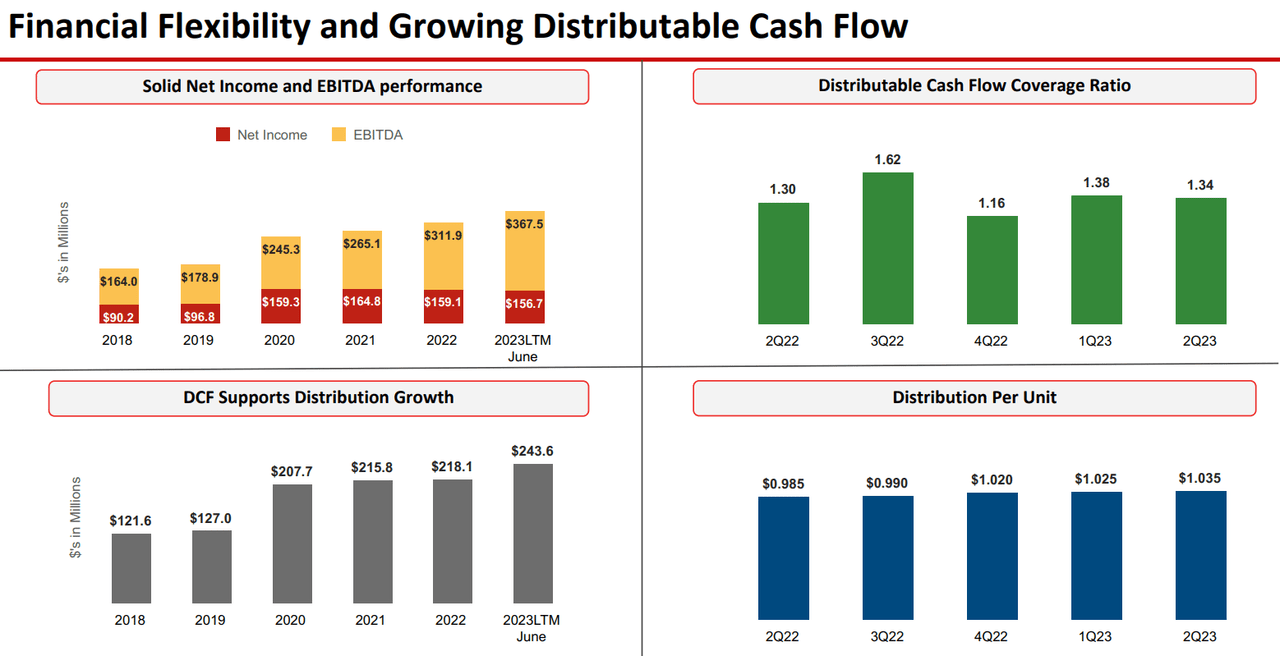

In the last quarterly presentation, the company offered an interesting slide showing stable distribution per unit, distribution growth since 2018, net income growth, and EBITDA growth. I believe that Delek may interest the investors looking for a solid business model with stable FCF generation.

Source: October Presentation

Balance Sheet: The Total Amount Of Debt Does Not Seem That Scary Because The Business Model And FCF Generation Appear Stable

I believe that the most appealing statement delivered by Delek is the cash flow statement because it reveals a significant amount of cash flow. With the cash flow in mind, most investors out there may worry a bit less about the balance sheet statement, which shows an asset/liability ratio lower than 1x.

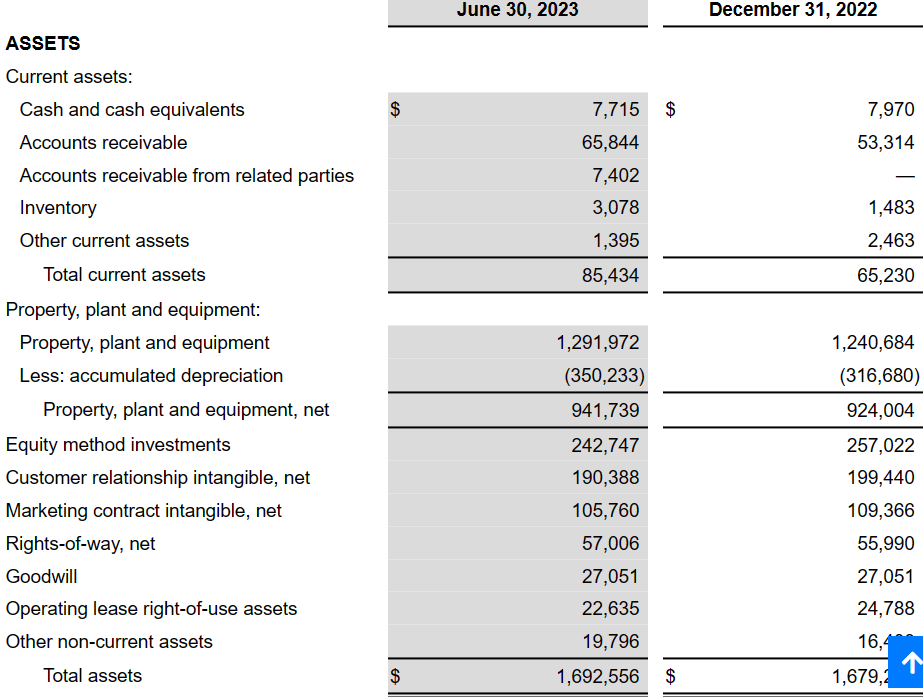

As of June 30, 2023, the company reported cash and cash equivalents of close to $7 million, accounts receivable of $65 million, accounts receivable from related parties worth $7 million, and inventory of about $3 million. The current ratio is larger than 1x, so the company does not seem to have a large liquidity issue. However, investors may have to pay special attention to the total amount of debt.

The net property, plant, and equipment stands at close to $941 million, which is a large asset, but it is still below the total amount of long term debt. Finally, with marketing contract intangibles worth $105 million, total assets stood at $1.692 billion.

Source: 10-Q

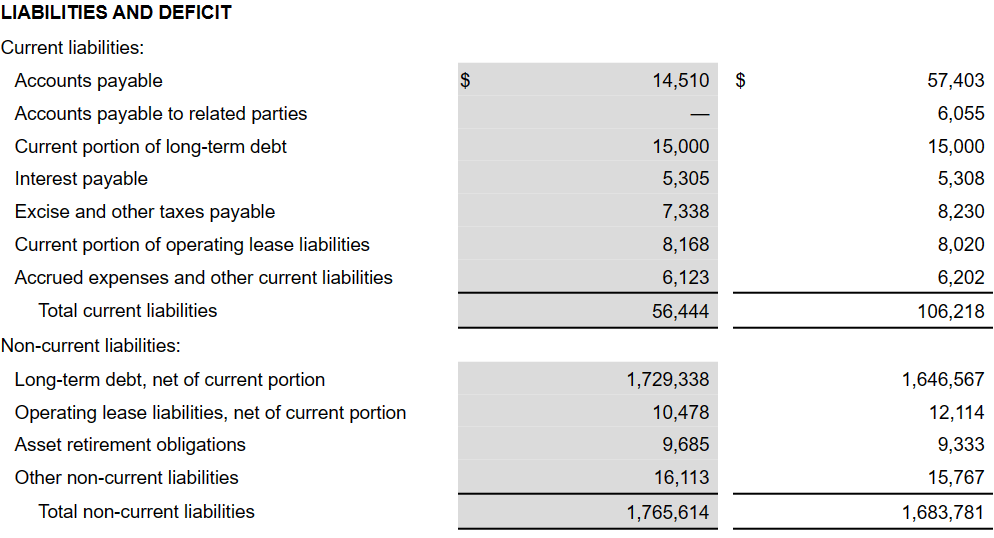

Among the different liabilities, the most relevant are accounts payable worth $14 million, current portion of long-term debt close to $15 million, and long-term debt worth $1.729 billion.

Source: 10-Q

Considering the total amount of long term debt, I believe that it is worth having a close look at the interest rate paid by Delek. The company signed agreements with banks, and issued senior notes and other facilities, which include interest rates close to 7.55% and 6.75%. With this in mind, the cost of capital that I incorporated in my model is close to 7.5%-6.75%. I believe that it is a realistic cost of capital.

On May 24, 2021, the Partnership and our wholly owned subsidiary Delek Logistics Finance Corp. issued $400.0 million in aggregate principal amount of 7.125% senior notes due 2028 at par.

At December 31, 2022, the weighted average interest rate for our borrowings under the DKL Credit Facility was approximately 7.55%. On May 23, 2017, the Partnership and Delek Logistics Finance Corp., a Delaware corporation and a wholly owned subsidiary of the Partnership, issued $250.0 million in aggregate principal amount of 6.75% senior notes due 2025 at a discount. Source: 10-k

Acquisitions Could Bring Significant FCF Growth

The company’s strategy aims to create long-term value for its shareholders, emphasizing the increase in profit margins of all its segments, and aiming for inorganic growth. This would occur through the opening of new retail stores, an aggressive strategy of acquiring oil facilities in areas of current activity, and purchasing distribution lines. In this regard, it is worth mentioning some of the most recent acquisitions, including the Delaware Gathering Acquisition for $628.3 million.

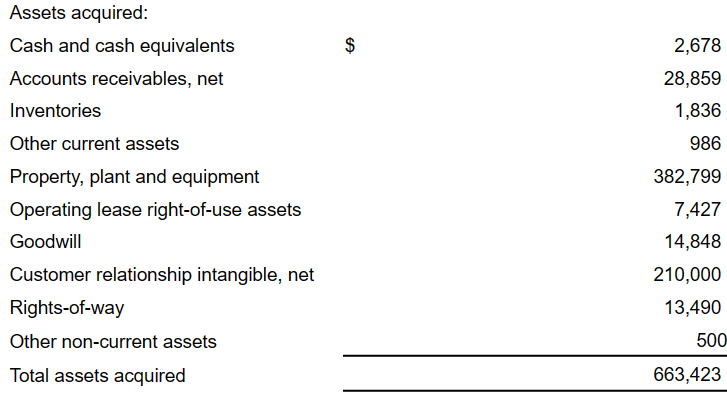

We completed the Delaware Gathering Acquisition on June 1, 2022, in which we acquired crude oil and natural gas gathering, processing, and transportation and storage operations, as well as water disposal and recycling operations, located in the Delaware Basin of New Mexico. The purchase price for the Delaware Gathering Acquisition was $628.3 million. The Delaware Gathering Acquisition was financed through a combination of cash on hand and borrowings under the DKL Credit Facility. Source: 10-Q

Source: 10-Q

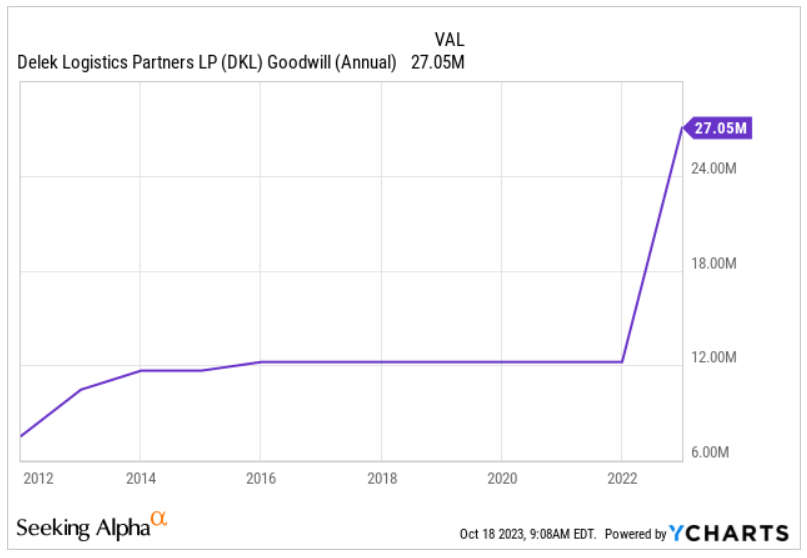

I was pretty impressed by the Delaware Gathering acquisition, and I expect beneficial transactions from Delek because management seems to have certain expertise in the M&A industry. It is worth noting that Delek reports some level of debt. I think that debt holders may block some transactions, which may lower the number of options that the company may have in the future. With that, adequate transactions at compelling valuations could bring significant FCF generation thanks to synergies.

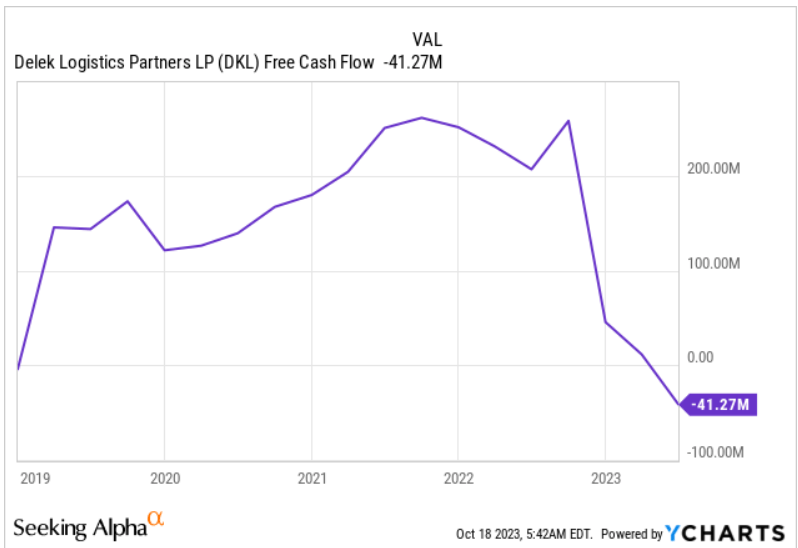

Source: Ycharts

The Recent Change In Business Segments Indicate That Management Is Open To New Transformations, Which May Bring Further FCF Growth

Considering the recent changes in business segments, Delek appears to be in a period of transformation, which may bring financial flexibility. I cannot really say right now whether the new way of reporting finances will improve future EBITDA figures, however I believe that this period of transformation could help the organization. In this regard, the following lines are a must-read for any shareholder.

The primary change in our segmentation as compared to prior presentations is that, now that we have substantially expanded our gathering activities, certain legacy gathering activities and operations are now managed as part of the Gathering and Processing segment. Additionally, we are also now segregating out certain non-segment specific costs and expenses and, when applicable, immaterial operating segments that may not fit into our existing reportable segments as Corporate and Other activities. Source: 10-Q

Accelerated Producer Activity And New Third Party Business Opportunities Could Bring Further Net Sales Growth

With that about the recent transformation activities and M&A efforts, it is worth noting that the company expects to invest in the development of the Permian Gathering System, and grow third party business opportunities to diversify gross margins. These initiatives were marked in a recent presentation given to investors. I suspect that some of these priorities will most likely bring net income growth as they did in the past.

Source: October Presentation

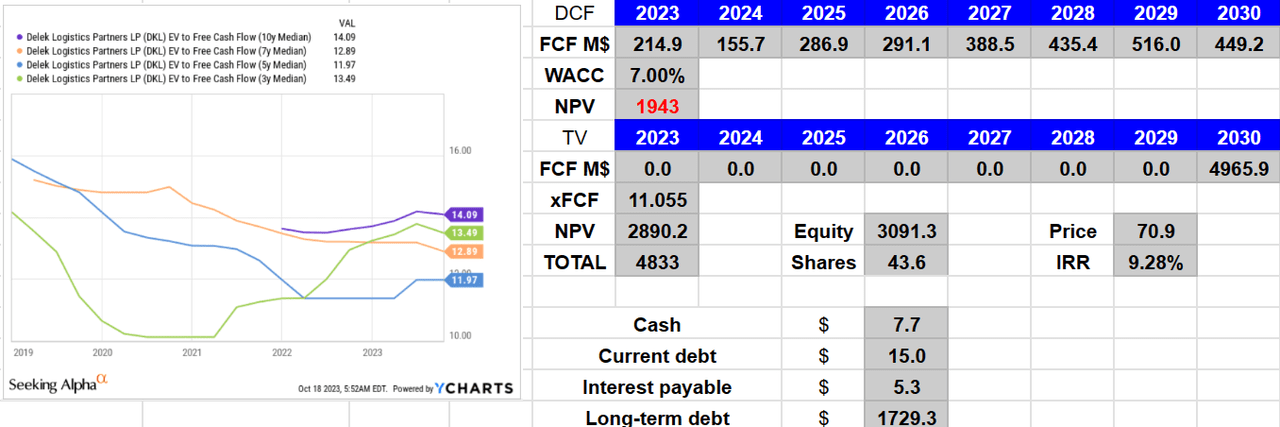

With Conservative FCF Growth, Realistic Cost of Capital, And Cheap EV/FCF Multiple, Delek Does Look Undervalued

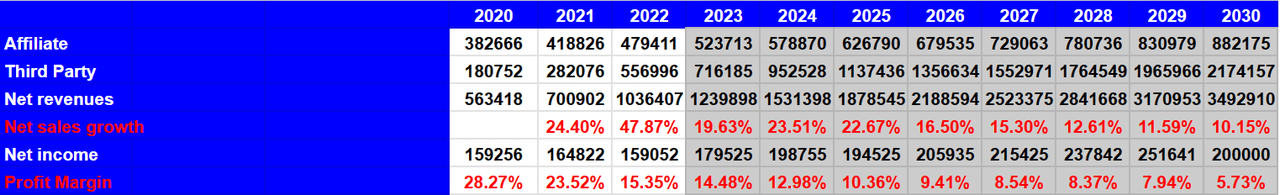

My financial model includes double digit sales growth from 2023 to 2030 and a decline in the profit margin from about 14% in 2023 to close to 5% in 2030. In particular, my figures included affiliate revenue of $882 million, with third party revenue close to $2.174 billion, and 2030 net revenues close to $3.492 million. Besides, my model also included net income worth close to $200 million.

Source: DCF Model

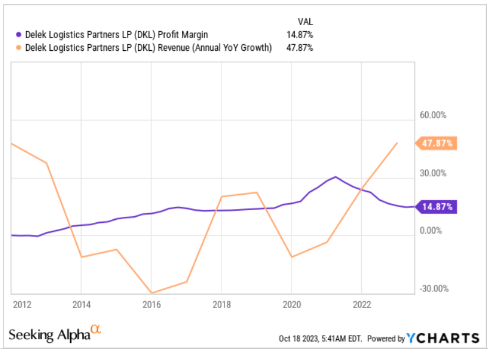

My numbers are not far from the figures reported by Delek in the past. The company reported significant net sales growth in 2022 and double digit profit margin. With this in mind, I believe that my figures are quite conservative.

Source: Ycharts Source: Ycharts

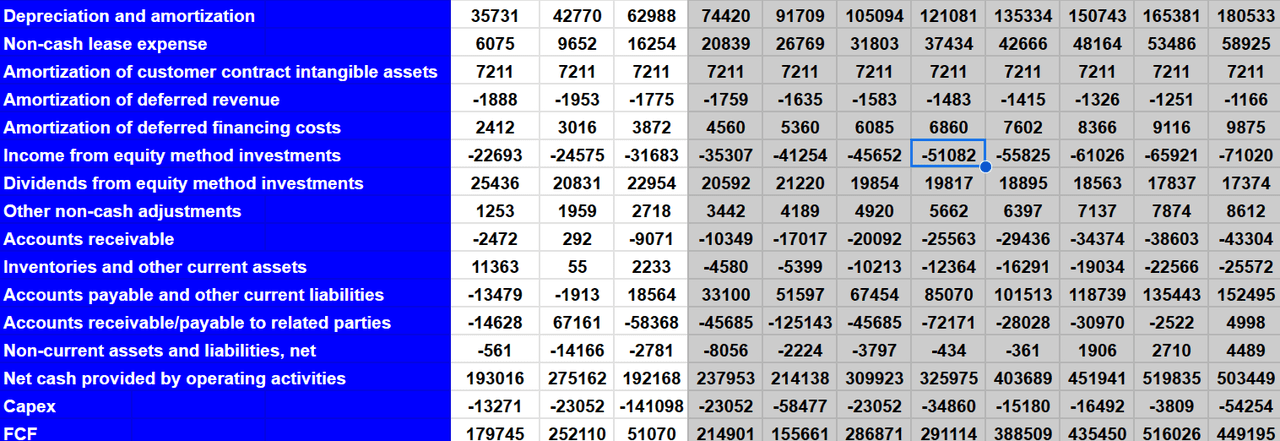

I also expect future cash flow statements to show increases in depreciation and amortization, decreases in changes in accounts receivables, increases in changes in accounts payable, and lower capital expenditures. As a result, I believe that Delek will most likely be able to report FCF growth.

More in particular, I obtained 2030 depreciation and amortization close to $180 million, with non-cash lease expense of about $58 million, amortization of customer contract intangible assets close to $7 million, amortization of deferred revenue worth -$2 million, and amortization of deferred financing costs of about $9 million.

Additionally, with income from equity method investments worth -$72 million, dividends from equity method investments of about $17 million, and changes in accounts receivable worth -$44 million, I also included changes in inventories and other current assets of -$26 million.

Finally, taking into account changes in accounts payable and other current liabilities close to $152 million and changes in accounts receivable to related parties worth $4 million, 2030 net cash provided by operating activities would be $503 million, with 2030 FCF of $449 million.

Source: DCF Model

Using the previous cash flow statements, free cash flow around $214.9 million and $515-$516 million, a WACC close to 6.95%, and terminal 2030 EV/FCF close to 11x, I obtained an implied share price close to $70 per share. Besides, the internal rate of return would be close to 10%. I believe that other investors could change my WACC, the terminal EV/FCF, and other parameters, however most people would reach the same conclusion: Delek does appear undervalued.

Source: DCF Model

Competitors

Due to the concentration of companies within the Permian Basin oil reserve, competition is high, and the market remains fragmented despite consolidation trends from the acquisition activity of numerous companies. The competition is given by the acquisition of lands of long-term value, such as through the purchase of existing infrastructure and the acquisition of distribution pipelines. In this sense, the development of pipes by some of its clients also generates indirect competition for Delek. Competition also extends to retail distribution, although few companies in the region have managed to establish models that include this type of commerce of their products in areas close to those of extraction. At an international level, competition for oil is highly affected by quoted prices and a large number of factors that imply, in some periods, high volatility in the sales margins of this type of company.

Risks

Increased competition and the general variability of fuel prices at a national and international level are one of the largest risks for Delek. Along with this, the risks of acquisitions, the integration of future expansions, and growth management in general are factors to take into account.

We can also mention the concentration of a large part of its business and the entire fuel refining segment in four facilities located in the same region, which would, if it suffered a climatic event or the forced suspension of activities for reasons of force majeure, generate a delay in the development of activities in this segment.

Besides, failure to comply with environmental policies as well as the inability to successfully execute cost restructuring strategies can mean operational and legal complications for the company. As a result, lower FCF margins would most likely lead to stock price declines.

Changes in the interest rates could also be risky for Delek. As a result, management may not be able to find cheap sources of financing, or may have to issue equity to repay debt obligations. I am comfortable with the current level of debt because FCF generation of the company is significant. With that, I cannot really know what may happen with further increases in the cost of debt.

Conclusion

Delek Logistics Partners appears to be in a period of transformation that includes a large acquisition and new business segments, so management appears open to invest in third party opportunities. Also, considering stable distributable FCFs and the recent beneficial quarterly results, I believe that Delek may be studied carefully by conservative investors. There are obvious risks coming from the total amount of debt and volatility in the crude oil price. With that, I believe that Delek appears undervalued.

Read the full article here