If you would, close your eyes for a moment and think about what the ideal investment looks like.

This, of course, will depend on your investing style and market philosophy, but if you’re like us, you’re probably thinking about a few key characteristics:

- Growing

- Profitable

- Reasonable Price

After all, when it comes to investing in anything, there are really only two things to be concerned with: the character of the ‘box’ you’re investing into, and the price of that ‘box’.

Given that we’re here on Seeking Alpha, the ‘boxes’ in question are all stocks.

When it comes to Datadog (NASDAQ:DDOG), it’s hard to argue that the company is anything but a near perfect setup, especially for folks who are interested in GARP (“Growth-At-A-Reasonable-Price”) opportunities.

The ‘character’ of the box is excellent, as the company continues to churn out revenue growth and stable profits quarter after quarter on the back of its highly rated, sticky product suite.

However, not only is the quality of the ‘box’ great, but the price you’re paying for it as an investor is reasonable as well. The company is trading at the extremely low end of its historical valuation range, and while nominally ‘expensive’, we think that DDOG’s continued growth prospects warrant such a premium.

Ultimately, we rate DDOG a ‘Strong Buy’.

Let’s dive in and explore further.

Financial Results

As always, let’s start by breaking down DDOG’s recent financial results.

As we just mentioned, DDOG has performed extremely well, financially, since IPO:

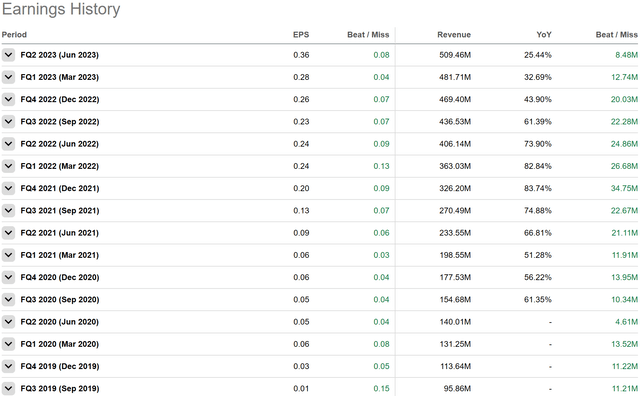

Seeking Alpha

The company has beaten on both top and bottom line every single quarter since it has been a public company.

This is an unbelievable feat, not easily pulled off.

In that time, the company has grown EPS from 1 cent per share to 36 cents per share as of last report, and revenue has grown from $95 million per quarter to over $500 million per quarter in that time.

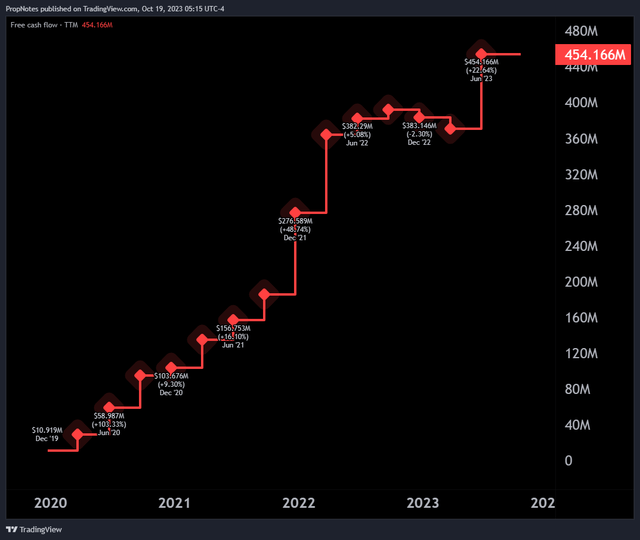

Zooming out, we can see that DDOG’s TTM free cash flow has also exploded since IPO, growing from $10 million in 2019 to $454 million today:

TradingView

This represents a healthy FCF margin of 23%, which, when combined with the nearly ~40% TTM revenue growth, puts DDOG’s growth and margin profile into rarified air.

As Gary Alexander pointed out in his recent article, DDOG is a card-carrying member of the “Rule Of 40” club:

Very few companies growing as quickly as Datadog are able to achieve meaningful profitability. Datadog has 20%+ pro forma operating margins. On top of 20%+ revenue growth, this puts Datadog into a stratospheric “Rule of 40” club, which is rare in the current environment.

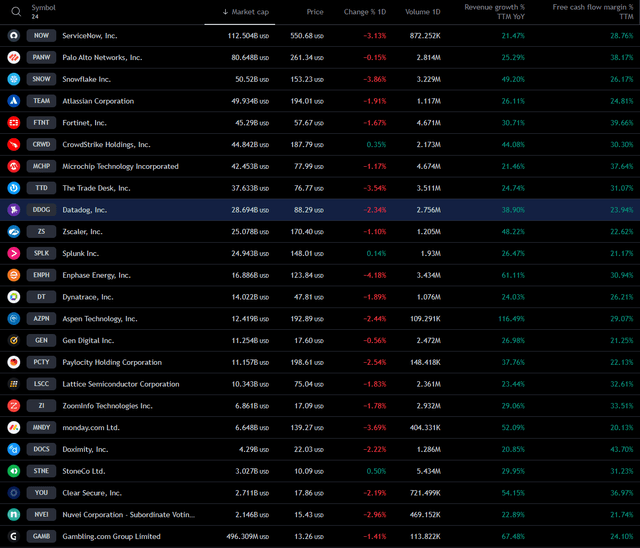

Curious what other stocks fit into this group? Check out the list below:

TradingView

Many of these stocks like ServiceNow (NOW), Atlassian (TEAM), and The Trade Desk (TTD) are some of the biggest multi-baggers of the last few years. This is a path that seems reasonable for DDOG to follow due to two main reasons:

1.) Product Suite

2.) Market Opportunity

Let’s take a look at each of these factors a bit more.

Product Suite

What has DDOG done to achieve such strong growth?

In short, DDOG is a SaaS company that sells a critical component of many modern tech stacks:

Our SaaS platform integrates and automates infrastructure monitoring, application performance monitoring, log management, real-user monitoring, and many other capabilities to provide unified, real-time observability and security for our customers’ entire technology stack. Datadog is used by organizations of all sizes and across a wide range of industries to enable digital transformation and cloud migration, drive collaboration among development, operations, security, and business teams, accelerate time to market for applications, reduce time to problem resolution, secure applications and infrastructure, understand user behavior and track key business metrics.

We generate revenue from the sale of subscriptions to customers using our cloud-based platform. The terms of our subscription agreements are primarily monthly or annual. Customers also have the option to purchase additional products, such as additional containers to monitor, custom metrics packages, anomaly detection and app analytics.

Today, as companies continue to digitize their operations to increase efficiency, managing, monitoring, and securing all of that technology can be a real hassle for IT admins.

Datadog makes it easy by unifying a company’s digital / operational records. This drastically simplifies the process of understanding the scope of a company’s digital footprint, pinpointing technology issues, and discovering security vulnerabilities.

While simple in concept, DDOG’s main product suite has real & ongoing value to customers. This is especially true going into the future, as trends towards digitization are only increasing.

For that reason, it should remain a sticky product in many of the IT stacks of tomorrow.

Given the high switching costs, it also seems reasonable to us that new revenue / clients will have extremely high lifetime value (LTV) for the company – a massive long term / compounding tailwind.

Market Opportunity

Datadog’s total addressable market (TAM) is estimated to be $62 billion in 2026, up from $41 billion in 2022.

For reference, Datadog’s TAM includes all organizations that use cloud computing and other IT infrastructure. This includes a wide range of businesses, from small businesses to large enterprises.

This number is key because it means that DDOG has only a sliver of penetration into the potential market opportunity. In other words, there’s still a ton of room to grow its business.

This growth is being driven by a number of factors, including:

- The increasing adoption of cloud computing

- The growing complexity of IT environments

- The rising demand for observability and monitoring solutions

In addition, Datadog is constantly innovating and adding new features to its platform. For example, the company recently announced the launch of Datadog Security, a new product that helps organizations monitor and respond to security threats.

These types of launches only expand the TAM over time.

Taken together, the company’s sticky product, long tail revenue advantages, solid operational results and massive market opportunity make it a compelling ‘box’ to own.

Valuation

But what about the price? How much are you paying for said box?

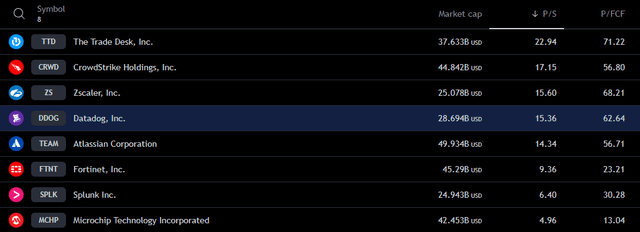

Well, as we mentioned at the start of the article, nominally, you’re paying a lot: 15 times sales and 63 times free cash flow. When compared with the S&P 500’s long term FCF multiple of ~16, this looks very expensive.

However, this ‘expensive’ price is softened by some context.

First, when looking at the other similarly sized “Rule Of 40” peers, DDOG is priced in the middle of the pack on Revenue:

TradingView

The Trade Desk sits at the top of the list with a top line multiple of 22x and an FCF multiple of 71x. This peer’s valuation (while also very expensive compared to the S&P), makes sense in the wider context of this cohort’s growth story, thus making DDOG look less pricey.

Being in the middle of the pack vs. peers also means that as long as DDOG keeps its growth status alive, it’s unlikely to sink considerably out of the valuation tier to which it currently belongs. Paradoxically, this also highlights the largest risk with owning DDOG – a slowdown in growth.

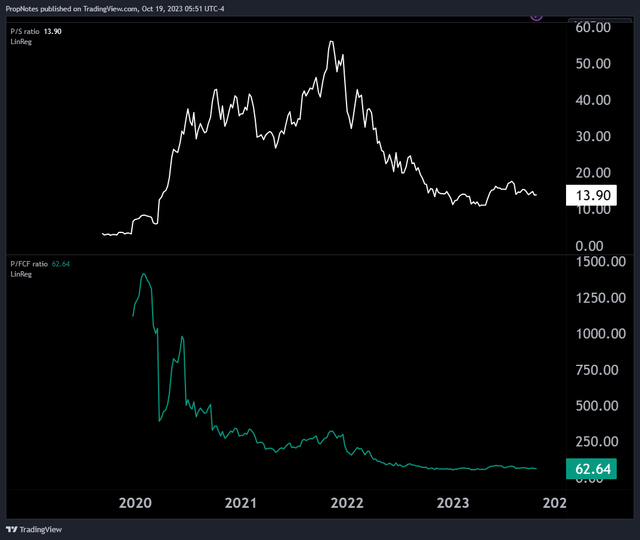

Additionally, when looking at DDOG’s own historical valuation, 15x sales and 63x FCF are relatively attractive:

TradingView

It’s true that much of this time was a period of unprecedented monetary easing which set the stage for wild sales multiples, but it still shows that there is potentially room to multiples to actually expand, should rates begin to drop. Remember – DDOG has this 14x top line valuation in a time when the 10 Year risk free rate is at ~5%.

Finally, the valuation looks cheaper once you consider the company’s continued growth.

If projections hold, in three years, DDOG is trading at only 6.6x 2026 sales – a more than 50% cut in the present multiple you get for investing now.

The discount is similar on a profit basis.

There’s a great quote out there by Hedge Fund Manager Steve Mandel:

“I don’t need an analyst to tell me when a 10 PE stock is cheap. I need an analyst to tell me when a 40 PE stock is cheap.”

The implication of this quote is that finding value is much less obvious when you’re searching in nominally ‘expensive’ names.

That said, it can be one of the best places for investors to make money.

Risks

There are some risks to investing in DDOG.

First off, the stock is volatile. Very volatile.

This is often the case with stocks that are growing very fast – the potential variance of outcome is massive. So, if you’re investing here, be sure that you won’t need it at an inopportune time where you may need to sell for a loss.

Additionally, the key risk here is any slowing to DDOG’s growth story. that will tank the multiple and hurt the stock considerably. Slowdowns in growth lead to second order consequences. Sure, sales are lower than expected which means that the multiple needs to re-rate for now, but FY2 and FY3 need to be adjusted significantly, which leads to a much bigger write down by the market.

Watching DDOG’s earnings that are coming up on November 7th, and all of the future earnings reports, will be key as an investor.

We don’t see any real secular risks that should hurt DDOG’s prospects aside from key personnel leaving, but the chance of black swan events is always there. Size your position accordingly.

Summary

All in all, DDOG is a well-oiled machine with a sticky, long tail product, solid financial discipline, great margins, strong growth, and a reasonable valuation.

The main risk is that there’s a hit to the company’s growth story, but aside from that, if the marketing team can continue to land and expand clients, and the product team can continue to increase the potential TAM for DDOG’s products, then investing at the present moment seems like a great long-term bet.

We rate DDOG a ‘Strong Buy’.

If you enjoyed this article, then give us a follow and send it to a friend who might enjoy it.

Cheers!

Read the full article here