Investment thesis

Our current investment thesis is:

- PSMT has successfully replicated the proven warehouse retailer model in Central Am / Caribbean, with innovation in product assortment and the optionality of e-commerce. We do see a good runway for store growth and further market penetration, which should support revenue growth in the long term.

- We are, however, concerned by numerous factors including the FX conversion of its overseas earnings and its declining ROE. The primary investment thesis with PSMT is its growth potential vs. its US counterparts but this is not the current reality. We believe these are likely the reasons for its poor share price performance.

- Investors weighted heavily toward valuation may see upside with PSMT but we are not totally convinced currently.

Company description

PriceSmart Inc. (NASDAQ:PSMT) is a leading international operator of membership warehouse clubs. With operations in Central America, the Caribbean, and South America, PriceSmart offers a wide range of high-quality products to its members, including groceries, electronics, and other consumer goods. The company operates under a membership-based model, providing exclusive benefits to its paying members.

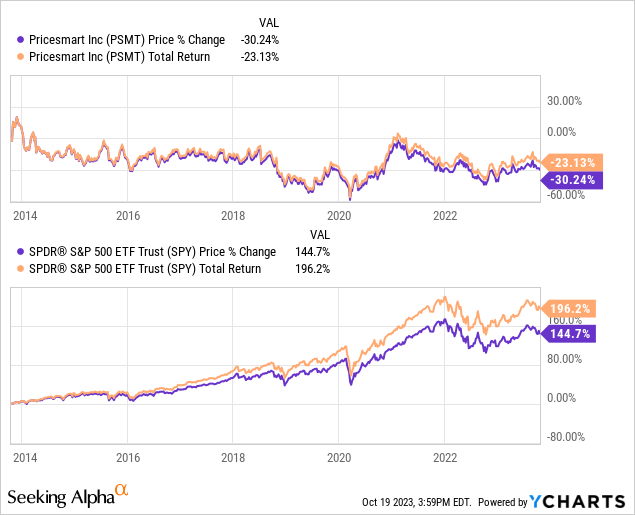

Share price

PSMT’s share price performance has been disappointing, losing >20% of its value during the last decade while the S&P has performed well. This is a reflection of its mild financial performance and an elevated valuation.

Financial analysis

PriceSmart financials (Capital IQ)

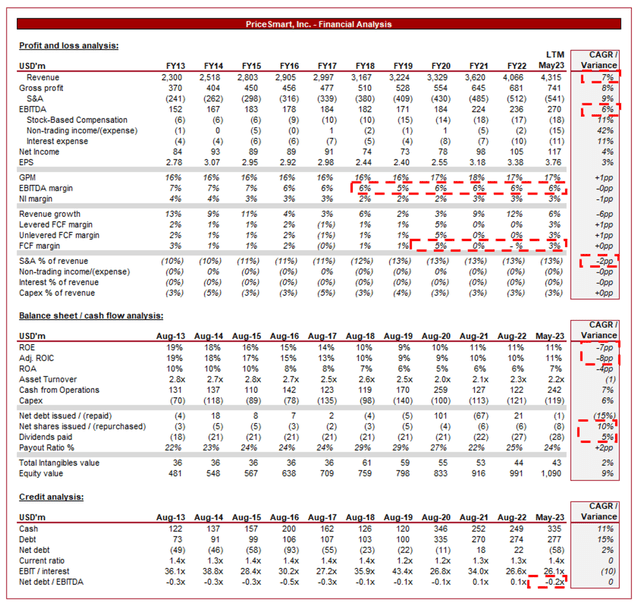

Presented above are PSMT’s financial results.

Revenue & Commercial Factors

PSMT’s revenue has grown at a CAGR of +7% during the last decade, with impressively consistent revenue growth despite the impact of the pandemic and macroeconomic developments. EBITDA has slightly lagged behind this, growing at +6%.

Business Model

PSMT operates large warehouse-style stores, allowing it to stock a wide variety of products across the retail spectrum. The large format appeals to businesses and individuals looking to buy in bulk. PSMT operates on a membership-based model, requiring customers to pay an annual fee to access their stores. This membership approach fosters customer loyalty as consumers seek to get “value for their money”, while benefiting PSMT by providing a stable revenue stream. This requires that the value proposition is sufficient to offset the cost and is clearly marketed as such, otherwise winning and returning customers will be extremely difficult.

PSMT focuses on sourcing products directly from manufacturers and suppliers in large quantities on a recurring basis. By eliminating intermediaries and providing this income certainty, it has been able to negotiate better prices, ensuring competitive retail prices relative to traditional retailers. Supply chain management is absolutely critical to the success of the business model, which simplistically involves acquiring products that are desirable at margin-neutral/accretive prices and selling them quickly.

PSMT offers private label products, which often yield higher profit margins compared to branded products and reduces its reliance on the pricing structure of its supply chain. These products are developed and marketed exclusively by PSMT, with this strategy only possible due to the success of its brand (creating trust within its markets).

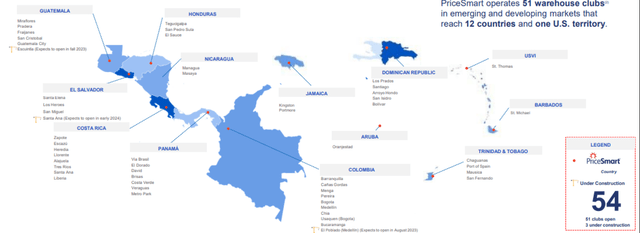

Unlike its well-known industry peers, PSMT strategically targets emerging markets, particularly in Central America and the Caribbean. These regions often have a growing middle class with an increasing disposable income alongside economic development.

Geography (PriceSmart)

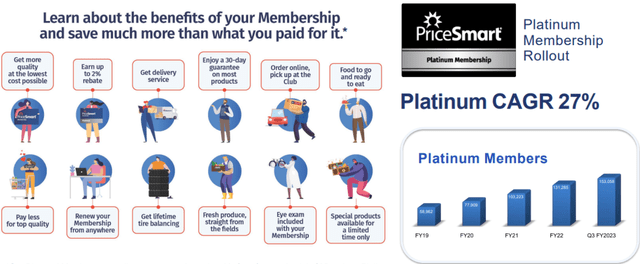

PSMT offers various benefits to its members, including exclusive discounts, promotions, and access to members-only events. These perks incentivize new customers and renewals, with Management currently focused on expanding its value proposition to improve these incentives.

PriceSmart Platinum Membership (PriceSmart)

PSMT has integrated e-commerce into its business model, a departure from many of its discount peers, allowing members to shop online and enjoy the convenience of home delivery. This omnichannel approach caters to the digitalization trend, with consumers demanding convenience through deliveries.

Growth Opportunities

We see the following as key growth opportunities:

- Market Expansion – Strategically expanding its presence in key emerging markets where there is a demand for affordable, quality products has the potential to accelerate its trajectory. Central America, the Caribbean, and LatAm are highly populous countries, most of which are growing their middle class well.

- Brand Reputation – Continued market penetration with its existing markets will assist with rolling out new stores in existing geographies. The business relies quite heavily on positive word-of-mouth and customer recommendations to achieve this given its conservative financial approach.

- Membership Loyalty – The membership-based model ensures a loyal customer base. What we would like to see more of, and what Management is currently focusing on, is the encouragement to shop more frequently and spend more due to the benefits associated with their membership. This will also act to market the service further, allowing for new customer growth.

- Adaptability and Innovation – Although this is a highly mature, slow-moving industry, the ability to adapt to changing market trends and consumer preferences has the potential to ensure leading growth and market share improvements. By integrating e-commerce, as an example, PSMT provides value that is relatively unique.

- Competitive Pricing – PSMT’s ability to negotiate favorable deals with suppliers and pass on the cost savings to customers will allow for market share growth. With scale and growth, the scope for this should improve.

- Diversification – Exploring new product categories or expanding private label offerings have the potential to attract a broader customer base and improve margins.

In conjunction with sequential store and organic growth, we believe these factors should allow PSMT to achieve a continuation of its current trajectory.

Margins

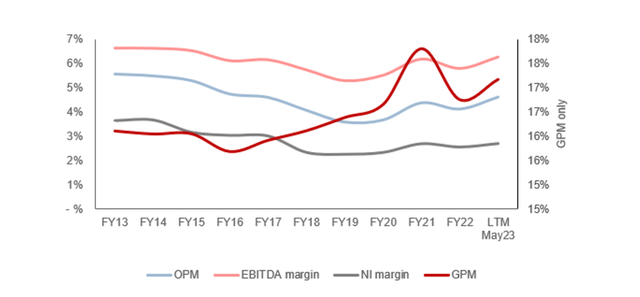

Margins (Capital IQ)

PSMT’s margins have broadly remained flat over the historical period, although with a dip relative to the FY13-FY15 level. The tight margin ranges are a reflection of operational excellence. The only way for its business model to create value is to minimize costs in every facet. The key factor is that PSMT directly sources products, utilizing its scale to ensure cost savings. This said, we would have expected sequential improvement during this period, implying any cost savings are offset by increased customer acquisition costs.

Management illustrates this below, with operational consideration at the forefront of how it positions the business. The key is to ensure no value to the business is foregone by providing consumers enhanced value, it must be mutually beneficial.

Value (PriceSmart)

Quarterly Results

PSMT’s recent performance has been strong, although has declined relative to FY22. In its last four quarters, the company achieved top-line growth of +12.3%, +8.1%, +10.0%, and +6.4%. In conjunction with this, margins have slightly stepped up, with two quarters of >6.9% EBITDA-M.

We believe this financial strength is a reflection of the qualities of the industry. The demand for essentials, which comprise a large portion of the products sold by PSMT, are inelastic in demand. Despite the wider macroeconomic environment, demand continues to remain healthy and is enhanced by positive pricing action.

Key takeaways from its most recent quarter are:

- A new warehouse was opened during Q3, with a further addition following this. The total number of warehouse clubs has now reached 52.

- Comparable merchandise sales increased by +5.8%, illustrating the underlying strong trajectory of the business during difficult conditions.

- FX rate fluctuations have positively impacted comparable merchandise sales by +1.5%.

- Omnichannel penetration continues to be strong, particularly given the nature of its services. This is a highly important option for its customers.

Balance sheet & cash flows

PSMT’s balance sheet is incredibly clean. The company utilizes minimal debt to fund operations, contributing to a ND/EBITDA ratio of (0.2)x. This allows the business to maximize its returns to reinvest in growth and distribute to shareholders.

Distributions have grown well during the historical period, with a dividend growth rate of +5% and the recent announcement of a $75m share buyback plan.

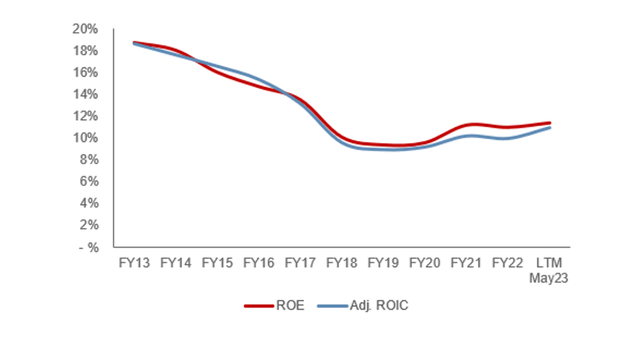

Despite the consistent profitability, ROE has fallen since the early part of the decade. This is attributable to an accumulation of cash and, importantly, growth in PPE exceeding revenue growth. When taken in conjunction with the dip in margins, it appears PSMT’s new locations are less profitable than its core historical stores. This is disappointing and implies a go-forward concern as PSMT is rapidly approaching the minimum returns investors expect and this is without pricing in the various risks associated with PSMT (exposure to EMs, competition, etc.).

Return on equity (Capital IQ)

Outlook

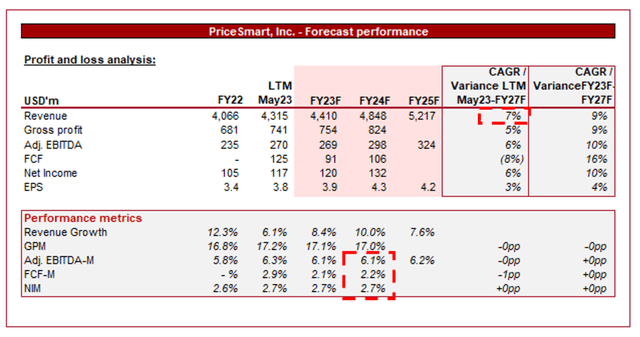

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 3 years.

Analysts are forecasting a continuation of its strong growth trajectory, with a CAGR of +7% into FY25F. In conjunction with this, margins are expected to remain broadly flat.

We concur with both estimates, owing to the company’s strong organic growth trajectory alongside the scope for new store locations. PSMT has a long runway for developing its brand further and opening new locations, with scope for benefits from economic development. Margins remaining flat are also reasonable, particularly due to the downward pressure on store profitability as per our ROE analysis, factoring in the recent leveling off.

Industry analysis

Hypermarkets and Super Centers Stocks (Seeking Alpha)

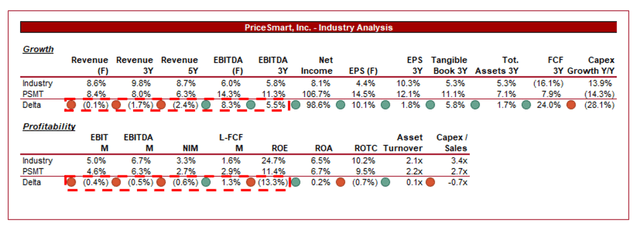

Presented above is a comparison of PSMT’s growth and profitability to the average of its industry, as defined by Seeking Alpha (10 companies).

PSMT’s performance is disappointing relative to its peers. The company’s revenue growth has lagged behind the market, although its profitability has consistently exceeded the market. The below-average growth is attributable to PSMT’s mild growth strategy, as although it is performing well on an organic basis, new store growth has not been significant. We are not overly interested in the profitability growth, as its peers have supremely consistent margins and so growth is unlikely to be large.

Further, PSMT’s margins are slightly below average, although with better LFCF. This is a reflection of the company’s scale, as many of its peers are substantially larger and so generate superior returns through economies of scale.

The key investment rationale for PSMT is its potential to outgrow US peers through exposure to new markets. This does not look to be the case.

Valuation

Valuation (Capital IQ)

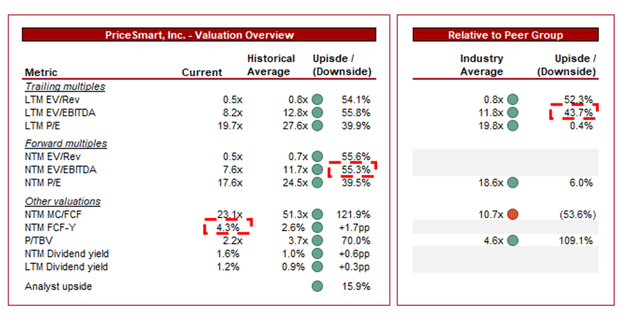

PSMT is currently trading at 8x LTM EBITDA and 8x NTM EBITDA. This is a discount to its historical average.

A discount to its historical average is warranted in our view, principally due to the deterioration in margins, its inability to materially deliver superior growth as investors have expected, and its lower store returns. This said, a ~55% discount appears extreme.

Further, PSMT is trading at a ~44% discount to its peers on an LTM EBITDA basis, although this shrinks to ~6% on a NTM P/E basis. We believe the discount is warranted given its poor comparable financial performance and lack of scale. Again, however, we struggle to justify the size of the LTM discount the margin performance on an EBITDA-M and LFCF level is small.

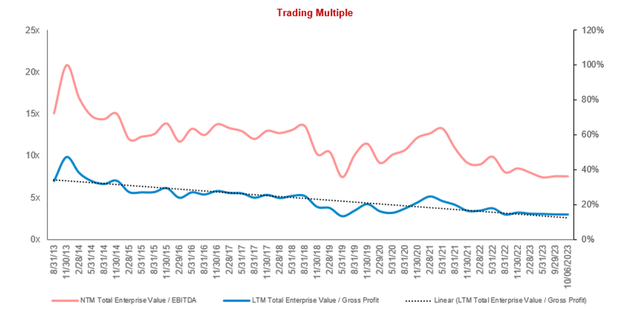

Based on this, we do see upside with PSMT. Reiterating this is its current FCF yield, which is +1.7ppts above its historical average. This said, investor sentiment has negatively developed and as the following shows, its valuation multiples have consistently declined. This is likely due to the inability to identify sufficient to warrant owning the business.

Valuation evolution (Capital IQ)

Key risks with our thesis

The risks to our current thesis are:

- Economic recessions affecting consumer spending – With a wide assortment of products beyond just groceries and essentials, PSMT revenue growth could be materially slowed if economic conditions continue to ladder down.

- Increased competition eroding market share – As economic development occurs over time, the risk is that competition increases and forces margins down.

- Geopolitical tensions and Geographical issues – Geographic issues, such as climate-related events in the Caribbean, as well as geopolitical concerns, could impact growth.

- FX – As the business reports in USD but generates revenue in a range of currencies, the conversion FX risk is high.

Final thoughts

PSMT is a solid business in our view. The company is operating within markets with reduced competition and scale, allowing it to aggressively gain market share and grow its brand. The company operates in the traditional warehouse retailer format, although we like its e-commerce optionality, creating a compelling value proposition for consumers.

Looking ahead, we believe MSD/HSD growth is sustainable, alongside its existing margins. This said, the decline in ROE is highly disappointing, leading to concerns about the value created from the reinvestment of FCF. This is particularly the case given the numerous risks associated with investing in this business.

Based on PSMT valuation, we see low single-digit upside, which given the broader risks, financial performance to its peers, and current market conditions, we do not see as sufficient to warrant a buy rating.

Read the full article here