Investment Thesis

Eurofins (OTCPK:ERFSF) is among the largest laboratory networks in Europe, offering essential services to stable industries such as food and beverages, as well as clinical diagnostics. This grants the company stable and predictable revenue characteristics.

In 2020 and 2021, Eurofins reaped the benefits of high-margin revenues generated by COVID-19 testing, the vast majority of which have now dissipated. As a result, the market shifted from assigning a high valuation with inflated profits to normalizing these figures and causing the stock to decline by approximately 60% from all-time highs.

However, with the numbers now fully normalized and considering the growth potential of a business of this caliber, the valuation becomes highly compelling, even when using conservative growth projections. For all these reasons, I have decided to assign it a ‘Strong Buy‘ rating.

Business Overview

Eurofins is a global life sciences company that provides a wide range of testing and support services to various industries, including food and beverage, pharmaceuticals, environmental, clinical diagnostics, and more. They are known for their expertise in analytical testing and scientific research.

Eurofins operates a network of laboratories around the world and offers services such as food safety testing, environmental analysis, genetic testing, and clinical diagnostics. The company plays a crucial role in ensuring the safety and quality of products and has dedicated itself to consolidating the industry in recent years, by acquiring small laboratories to integrate them into its network and thus optimize them, both in costs and increasing its sales through cross-selling.

Eurofins Laboratory (Eurofins)

Economies of Scale

The laboratories can be categorized into two types: Hub and Spoke.

The Hub laboratories are larger in size and conduct a high volume of tests per day. These laboratories benefit significantly from economies of scale because costs are relatively fixed.

For instance, in a laboratory where an analyst charges $10 per hour, what’s crucial is that this analyst handles a higher volume of tests for the cost per analysis to be minimized. A small laboratory that receives 2 tests per hour would have a cost of $5 per test, whereas if Eurofins processes 1,000 tests per hour, its cost would be $0.01 per test. This efficiency is made possible by medical devices that allow the analysis of multiple samples in a single device, such as those produced by Thermo Fisher (TMO) and Danaher (DHR). This underscores the significance of the company’s substantial scale and explains why its strategic focus has been on growth through acquisitions.

On the other hand, spoke labs are smaller and local, strategically located near their key clients. This is important because, to provide an example, a food company with a batch of products that need to be distributed to its customers requires the necessary tests to ensure quality and suitability for sale. In this scenario, the client is less concerned about the cost of the test and places higher value on the speed at which results are delivered.

COVID-related Revenues

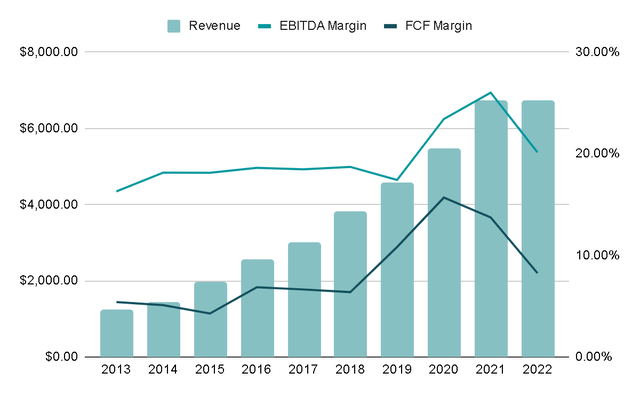

Revenues have consistently grown at annual rates of 20% over the last decade. However, they experienced a substantial boost during the COVID-19 era. This was primarily because there were a limited number of laboratories capable of conducting these tests, and both governments and clients were willing to pay almost anything for swift access to critical clinical results.

When you combine this soaring demand with the high profit margins associated with these services, it resulted in what can be described as ‘inflated’ profits that are currently becoming normal and are hindering business growth.

Author’s Representation

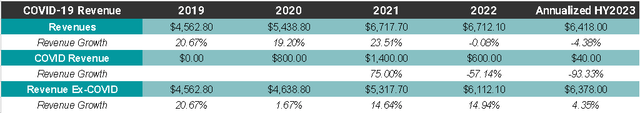

To gain a genuine understanding of the business’s performance, it is crucial to exclude revenues related to COVID-19.

In the following graph, we can observe that when these revenues are excluded, the company’s growth in 2020 was a mere 1.7%, a stark contrast to the reported figures that year. However, in FY2022, the company managed to achieve a growth of 15%, compared to the reported 0% that included COVID-related sales. When we annualize the numbers reported during HY2023, it becomes evident that COVID revenues are nearly negligible, signaling the approach of completely normalized figures. Despite the reported year-on-year decreases, when these special revenues are excluded, the growth is approximately 4%.

Author’s Representation

For the valuation, we will also take this into account and take the margins prior to FY2020.

Capital Allocation

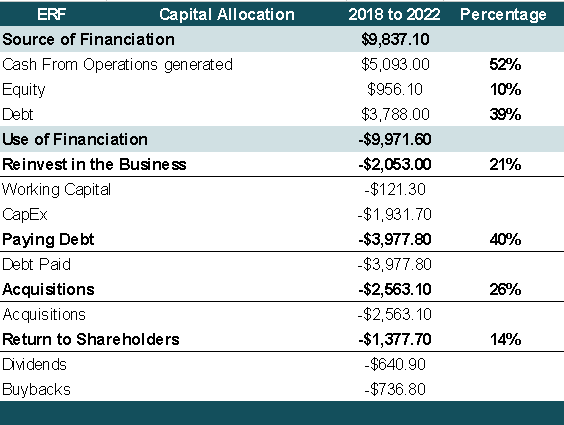

Over the past five years, it is evident that the company has relied on Cash From Operations and debt as sources of financing. This capital has been allocated for various purposes, excluding debt repayment. These purposes include making acquisitions, reinvesting in the business through Capital Expenditures and R&D, and, to a lesser extent, rewarding shareholders through both dividends and share buybacks.

Share buybacks typically occur during specific periods when management perceives the stock as undervalued. For instance, in both 2019 and 2022, a significant number of shares were repurchased.

Author’s Representation

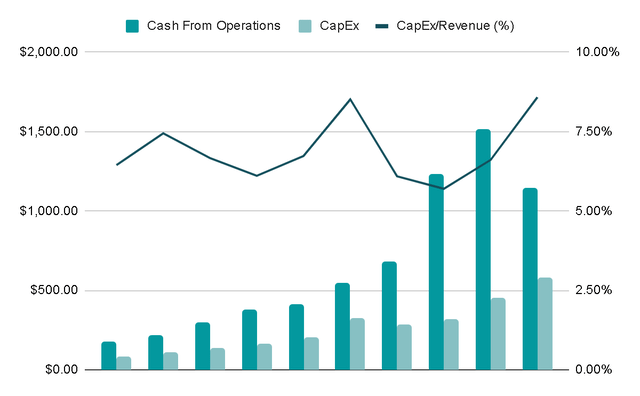

Currently, the company allocates its Capital Expenditures to acquire sites for which they pay leases. While this might not appear to be a sensible capital allocation strategy to many investors, if we consider the long-term perspective, it aligns with the company’s objectives. Owning a greater number of its laboratories has the potential to reduce interest expenses and boost profit margins. At the end of FY2022, the company owned 45% of the laboratories compared to 35% in FY2018 and the objective is to continue increasing this figure.

In the short term, this approach may require the sacrifice of shareholder remuneration and lead to higher margins due to the CapEx investments. However, when viewed from a long-term standpoint, it seems to be a beneficial strategy. Another significant advantage is that the company currently directs a substantial portion of its revenues toward CapEx. In the future, there’s the potential to scale back these investments, effectively transforming the company into a cash-generating machine. For example, while the company initially invests in developing a new test and acquiring laboratory sites, once these investments are made, the tests can be utilized for an extended period without the need for further substantial investment. The laboratories, too, will only require periodic maintenance.

Author’s Representation

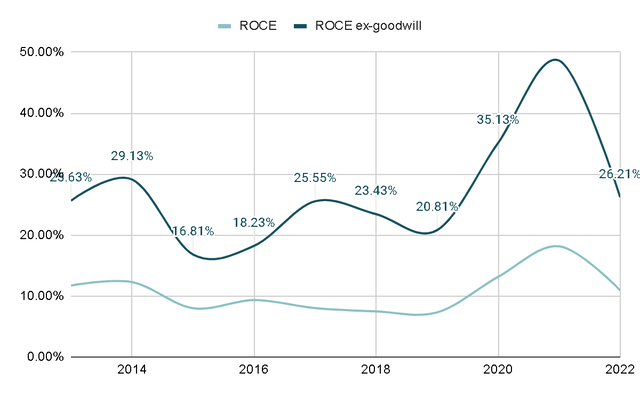

When calculating the Return on Capital Employed (ROCE) by dividing EBIT by Capital Employed, we observe a relatively low ratio that has averaged 9%, excluding the years 2020 and 2021 when the company benefited from COVID-19. However, Capital Employed is somewhat distorted due to the numerous acquisitions made by Eurofins, which generate Goodwill. In 2022, Goodwill represented 58% of the Capital Employed.

For this reason, I believe that a more accurate way to measure the underlying profitability of Capital Employed is to exclude Goodwill from the calculation. This adjustment yields a ROCE that has averaged 26% (excluding 2020/2021) and reflects the value creation resulting from acquisitions and organic growth.

While it is true that Eurofins will likely continue to be active in M&A, this adjusted metric helps us understand the potential return on capital that the company could achieve if it reduces its pace of acquiring businesses at some point in its lifecycle.

Author’s Representation

Valuation

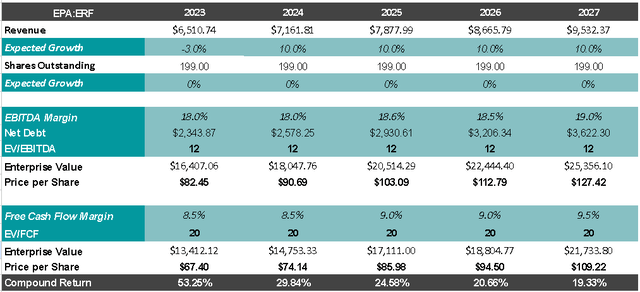

For valuation purposes, I will consider the guidance for FY2023, which involves a 3% decrease in revenues. However, I’ll exclude revenues related to COVID-19 tests to achieve completely normalized numbers by FY2024. In the subsequent years, I estimate that revenues can grow at annual rates of 10%, which is notably below the 20% CAGR of the last decade and the 13% of the last five years. Additionally, I anticipate that the company can gradually expand its margins, benefiting from the economies of scale mentioned previously.

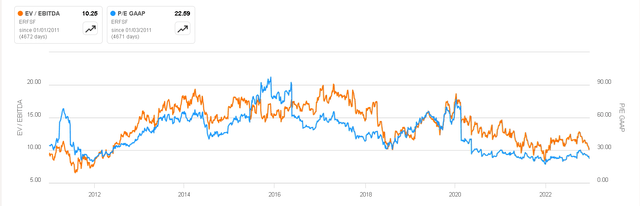

Using valuation metrics similar to historical ones, such as 12x EV/EBITDA and a P/E ratio of 20x, we could arrive at a price per share between €110 and €125 by 2027. This would represent an annualized return of 20% from the current price of €47 on the Paris stock exchange, although keep in mind that buying on the OTC market could lead to variations in these numbers.

The company has set a target to achieve €10 billion in revenues and €1.5 billion in Free Cash Flow by 2027, which means we are valuing the company with more conservative numbers than those considered by management.

Author’s Representation Valuation Metrics (Seeking Alpha)

Final Thoughts

In my opinion, Eurofins is a company with a product of critical and recurring use. It holds a dominant competitive position that allows it to benefit from economies of scale and its strong reputation.

The revenues derived from COVID-19 testing distorted the reality of the income statements, and combined with the market euphoria of 2021, led to a significant overvaluation that is now normalizing. Given the current valuation, I consider Eurofins to be an excellent long-term investment and have decided to assign it a ‘Strong Buy‘ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here