Introduction

Bank7 (NASDAQ:BSVN) is a small regional bank with a presence in Oklahoma, Kansas, and Texas. It has consistently demonstrated strong performance, navigating the regional banking crisis without any significant setbacks, and even managed to increase its deposits during this challenging period. While the bank’s performance generally mirrors that of the sector and is currently down 13% year-to-date, it has maintained a consistent growth in book value per share. As of now, it is trading at a relatively undervalued 1.3 times book value, especially noteworthy given the company’s consistent achievement of ROEs exceeding 20%. Not only that but the bank is exposed to Texas which I’m quite bullish on.

Regional Banking Crisis

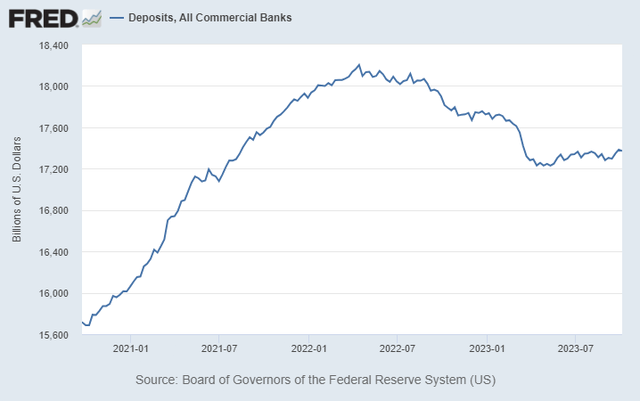

The regional banking crisis that started when SVB collapsed in March 2023 has quietly faded from headlines but is still ongoing. The principal cause of this is the fact interest rates have risen a lot faster than interest earning assets on bank balance sheets have risen. This is due to banks having a lot of long duration fixed residential mortgages on their balance sheet. This prevents banks from offering competitive deposit rates compared to money market and short term treasuries because that would eat into their net interest margin. This has led into a flight in deposits as over 1 trillion dollars has been pulled from banks in the US. However we are still well above covid so deposits are somewhat sticky.

Source: FRED

If a bank faces a substantial deposit outflow, it may be compelled to sell long-term fixed-rate loans or securities to cover the withdrawals. These loans or securities were originally issued at much lower rates because of the low rate environment the past 10 years. This forces the bank to recognize unrealized losses on their balance sheet. In some cases, these losses can accumulate to the point where the bank becomes insolvent. The regional banking index represented by (KRE) is down nearly 30% due to these factors.

Source: TradingView

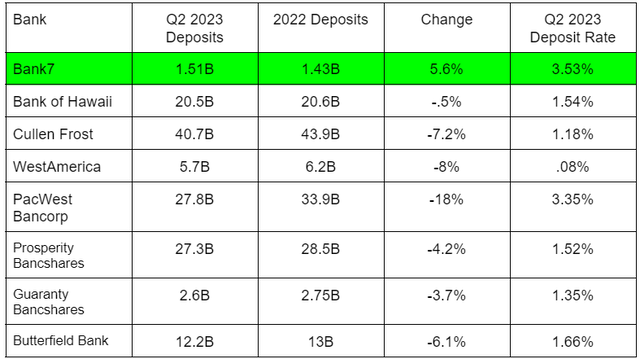

Even though Bank7 hasn’t averted the sector sell-down, down 13% YTD. the bank has averted the actually fundamental portion of the crisis. Bank7 has actually grown deposits 5.6% since the end of 2022. Compared to some of their peers this is quite good as most of them have lost deposits in that same time. The bank was most likely able to achieve this due to their 3.53% deposit rate which is double most of their peers.

Source: Author created table, data from company 10-Q’s

-

PacWest has a high deposit rate but a net interest spread of just 1.07% as of Q2 2023. Which tells me they had to jack up their deposit rate alot more than they wanted because they were bleeding deposits.

The bank’s ability to offer such high deposit rates is attributed to its loan portfolio. Bank7 has a significant 72% of floating loans relative to their total loan portfolio. This unique composition enables their loans to reprice to market rates more rapidly than the majority of other banks, allowing them to increase deposit rates without significantly impacting their margins. In contrast, many peer banks in the list mentioned have a higher ratio of fixed-rate loans, which has proven to be a disadvantage in the current economic environment, affecting their deposit growth and rates. Not only is Bank7 gliding by this crisis they have also been a very well run and profitable bank for some time now.

History

Bank7 was founded in 2004 by William Haines who is also the largest shareholder. In 2014 the bank made an acquisition to enter the Kansas market and in 2015 the bank entered organically into the Dallas market. Most of the company’s growth has been organic with the company only making a few acquisitions in its history.

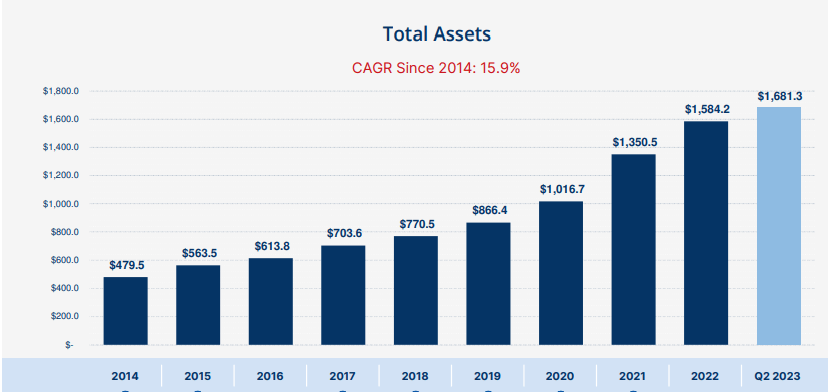

The company has grown assets rather quickly since 2014 as total assets have grown from $480M To $1,681M As of Q2 2023. This is a 15.9% CAGR.

Source: Bank7 Q2 2023 Presentation

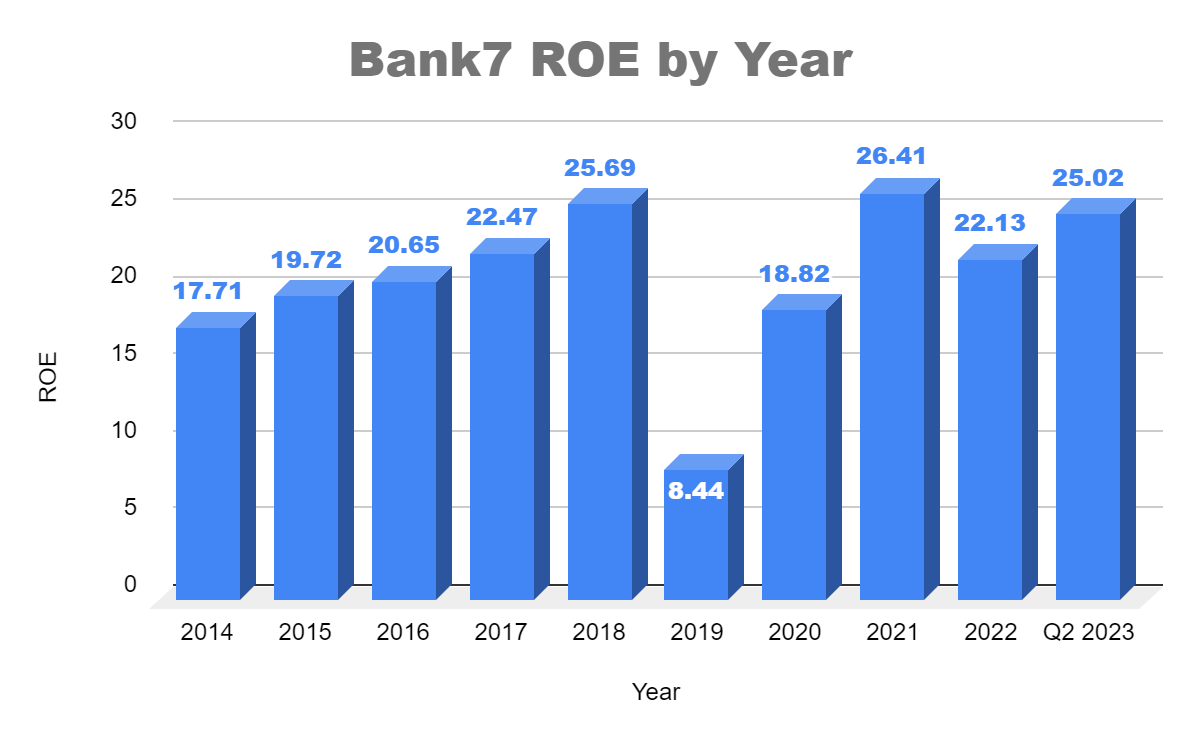

This growth has been quite profitable as the bank has done it with ROE’s over 20% for most of that period. ROE since 2014 has averaged 20.7%. This includes the year 2019 which was an outlier due to the company executing a special stock transaction. Excluding the stock transaction ROE would have been 20.53% for that year.

Source: Author created chart, data from annual reports

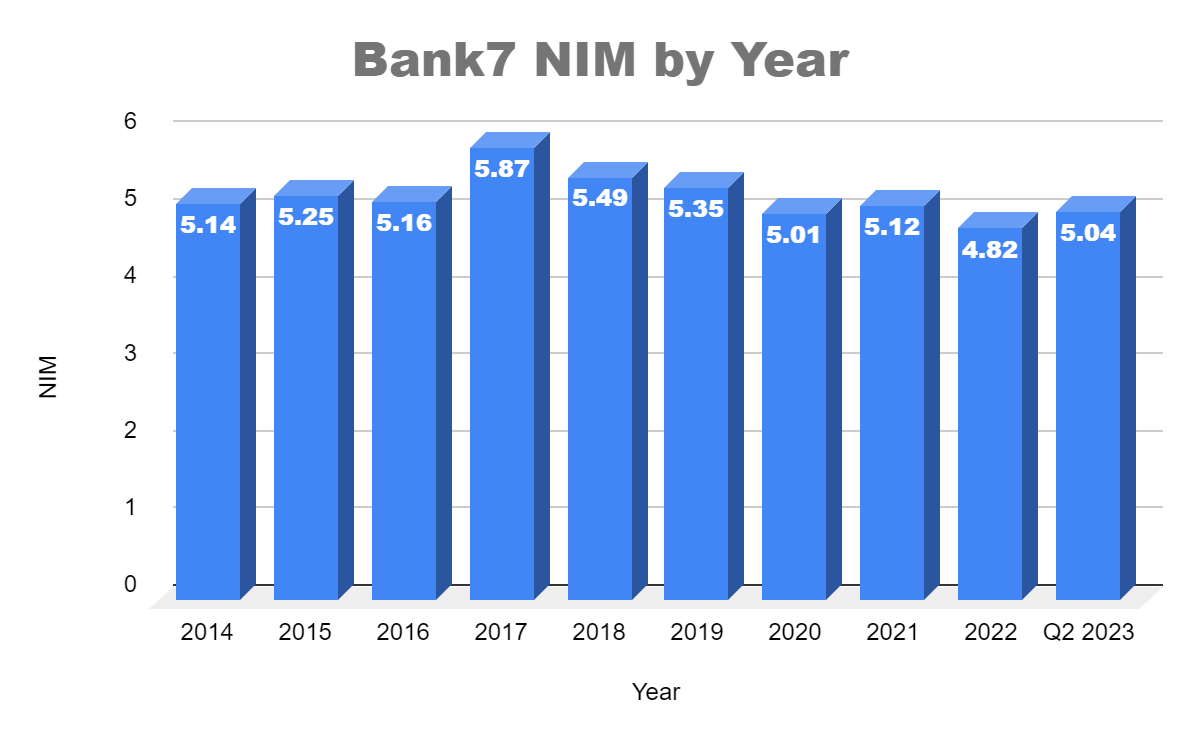

The company has managed to accomplish this by achieving a low efficiency ratio and a high NIM or net interest margin. The high NIM is due to the fact that the company makes mostly business and commercial real estate loans which have higher interest rates then residential mortgages which is what most banks have. Even better this NIM has been remarkably stable averaging 5.2% since 2014 even while interest rates have experienced extreme volatility. In that time the 10 year treasury has varied from .55% to 4.63%.

Source: Author created chart, data from annual reports

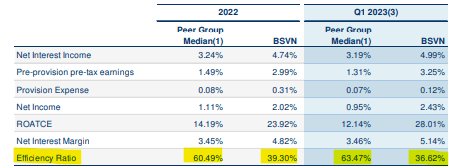

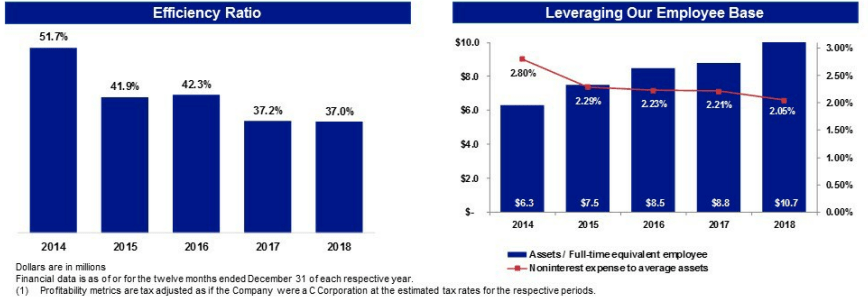

Bank7 also has one of the best efficiency ratios I’ve ever seen. The efficiency ratio is a key financial metric used in banking to assess how effectively a bank manages its expenses. As of Q1 2023 Bank7’s efficiency ratio was 36.62% which is well below peers which averaged 63.47%. And has averaged 40.7% over the last three years.

Source: Q2 2023 Bank7 Presentation

Management had been aggressively lowering the efficiency ratio since before the IPO and it has stayed remarkably flat since. This is a strong contributor to the bank’s high ROE.

Source: Q4 2018 Bank7 Presentation

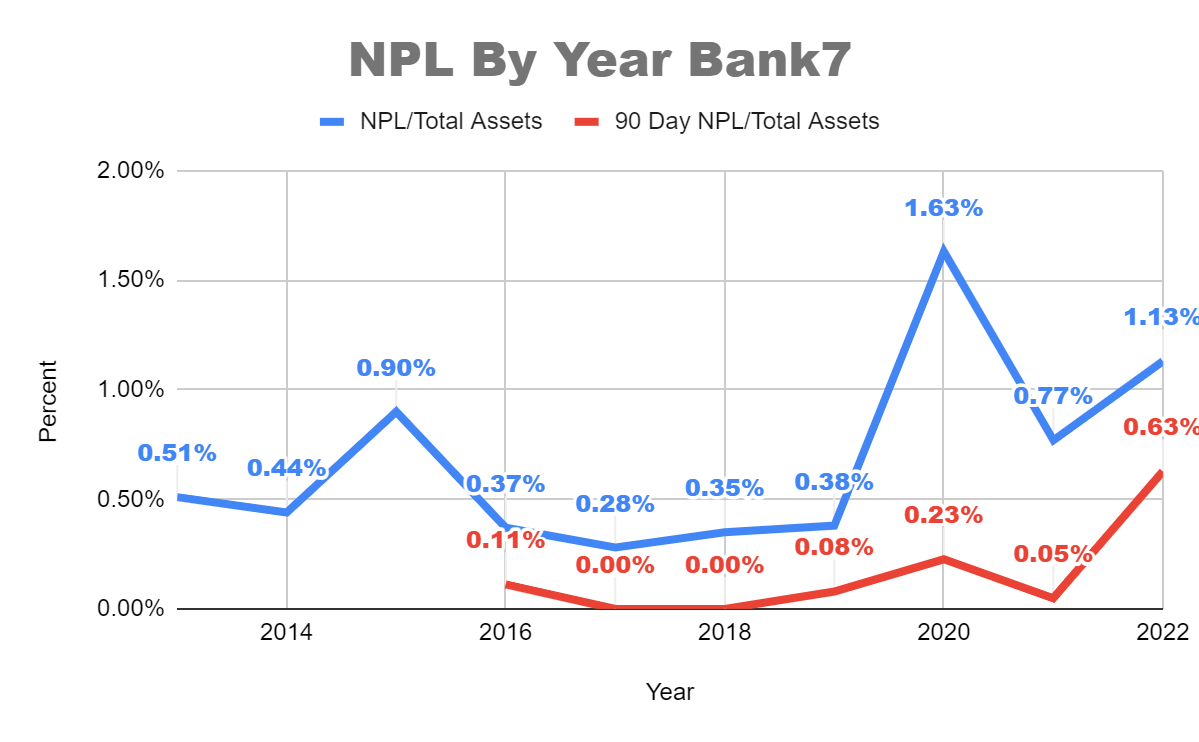

Now usually fast growing banks can be dangerous as the lender might prioritize growth over the quality of the loan portfolio. However Bank7 has maintained a relatively low NPL/Assets ratio considering their NIM. NPL’s or non-performing loans include loans that have not made payments in 90 days as well as loans management deems to be impaired in some way. In the chart below I also look at what I’ll call 90 day NPL/Asset ratio which only includes the loans that haven’t made payments in 90 days as it eliminates management’s conservatism. NPL’s peaked in 2020 due to covid which is understandably and also increased in 2015 due to the Oil price shock. Both these peaks didn’t hamper the bank too much as ROE’s were still near 20%. Also 90 day NPL’s were much lower throughout the period proving that Bank7’s underwriting has been superb.

Source: Author created chart, data from annual reports

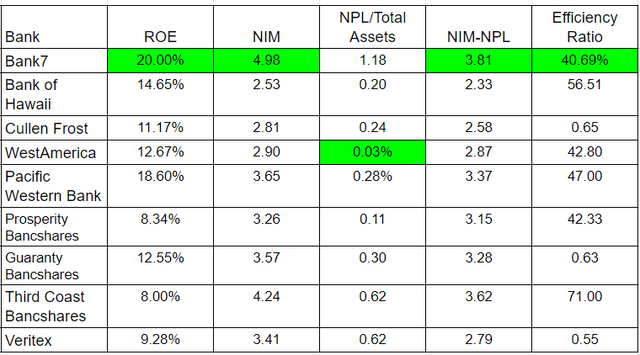

When we compare these metrics to those of peer banks , Bank7 stands out as one of the top performers. I collected data from 2022-2020 to compare the banks. I highlighted the best numbers in green. Bank7 has the top ROE, NIM and efficiency ratio out of the selected banks. Bank7’s NPL/Total assets was a little higher than the pack at 1.18% as their portfolio is a little riskier than the average bank. But even after adjusting their NIM by the extra risk which is what the NIM-NPL column is, Bank7 still has the best risk adjusted NIM.

Source: Author created table, data from company annual reports

Loan Portfolio

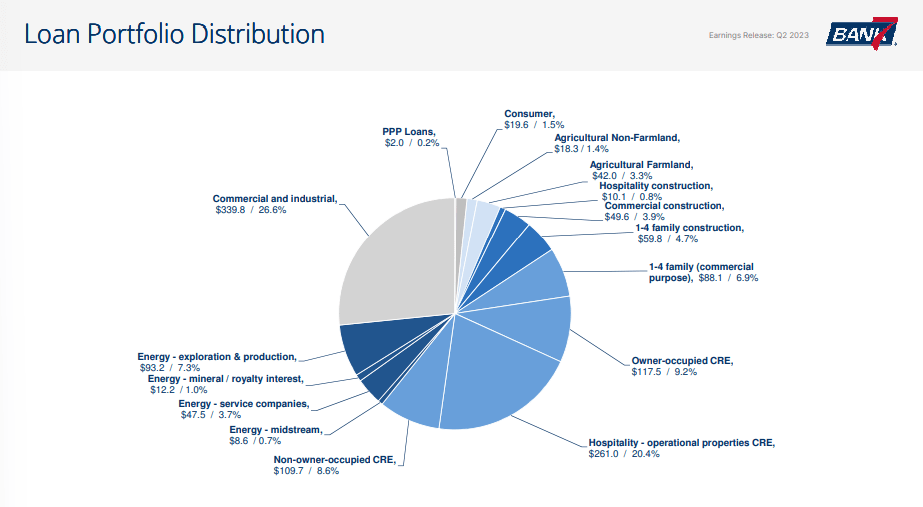

Like I said above Bank7’s loan book is mostly concentrated in business and commercial real estate loans or CRE. With 27% in business loans, 45% in CRE loans and also 13% in energy loans.

Source: Q2 2023 Bank7 Presentation

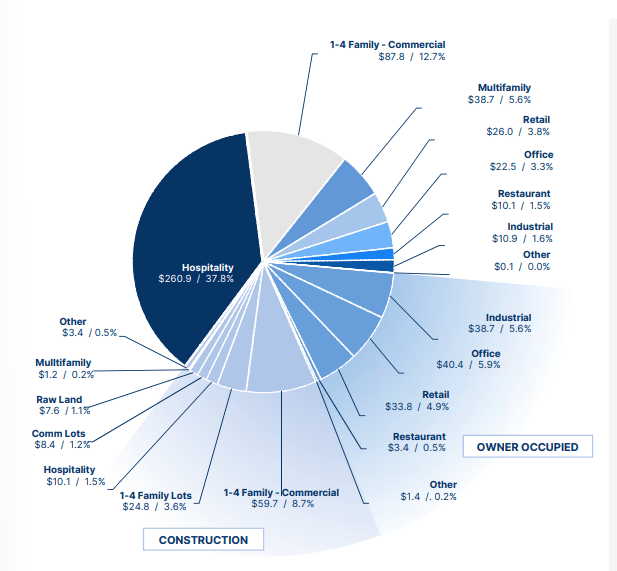

In terms of industry concentration for CRE, hospitality was the largest at 38%. The bank had very little office exposure with only 9.2% of the CRE portfolio and 4.4% of total loans.

Source: Q2 2023 Bank7 Presentation

In terms of the bank’s commercial real estate and business loan exposures that is actually pretty common for a Texas bank but pretty uncommon for most others. The hospitality exposure is definitely something unique to Bank7. Bank7’s loan portfolio allows them to have a higher interest rate on average than other banks and also a higher percentage of floating rate loans to total loans. As business and CRE loans typically have shorter duration and are usually floating. This type of loan book can be considered more risky than a book filled with residential mortgage loans(unless 08 happens). But as I laid out above the bank seems to have good underwriting standards as NPLs never got out of hand and have allowed the bank to maintain high ROE’s.

I consider the portfolio to have been tested twice so far in 2016 and in 2020. The bank was also tested in 08 but since it wasn’t public I can’t see how they did but it seems they survived.

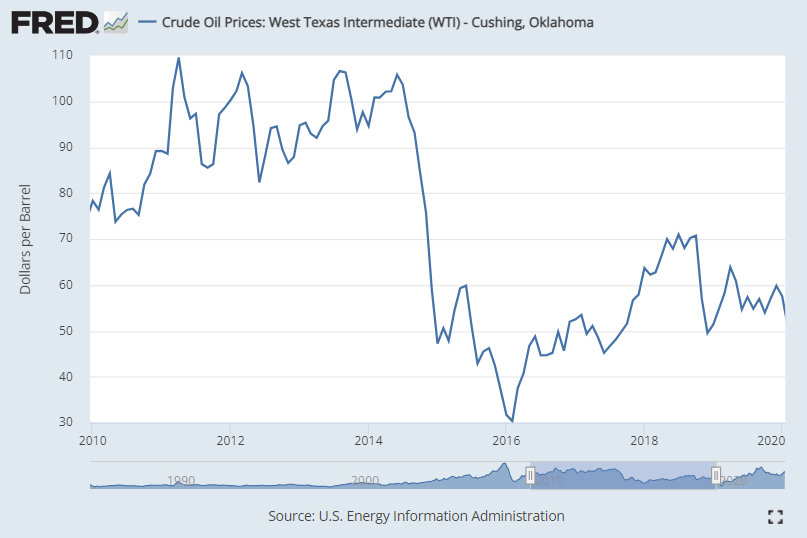

In 2014 the oil price took a hit and with Bank7’s high concentration in energy related loans you would think the bank would have taken a hit. Looking at NPL’s between 2014 to 2016 we don’t see much of an uptick peaking at .9%. This provides confidence that Bank7s energy loan exposure is to strong companies in the space.

Source: FRED

In 2020 the coronavirus shut down the economy and killed most industries, especially travel. With travel not really recovering till last year. You would think Bank7 with its large hospitality loan book would have had a dramatic rise in NPLs. Looking at NPLs from 2019 to 2022 we do see a rise but not really as much as I would have thought. NPL’s peaked at 1.63% in 2020 but 90 day NPL’s peaked at less than half that at .63% in 2022. In the Q3 2020 conference call the bank talks about the hotel exposures that were in the NPLs and saying they were under 50% occupancy. If the bank needs their hospitality loans to drop to under 50% occupancy to see them drop to underperforming that is pretty strong. In 09 for example full service hotels averaged occupancy of 62.5%.

To sum up, the loan portfolio of Bank7 allows the bank to achieve high NIMs which in turn gives it those high ROEs. Some may say the portfolio is a lot riskier than other banks but the portfolio has been tested twice so far in public markets and they have passed twice.

Geography

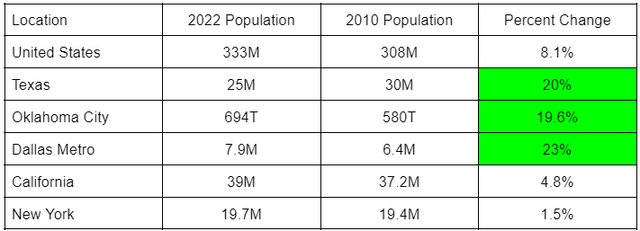

Bank7 is located in favorable locations of Dallas and Oklahoma City. These cities also represent the majority of the company’s loan book. Both Texas, Dallas Metro area, and Oklahoma city have been some of the fastest growing areas in terms of population in the entire US. Both Oklahoma City and the Dallas Metro Area have grown at twice the rate of the US since 2010. Of the places I look at in the table below, the Dallas Metro Area was the fastest growing at 23% population growth since 2010 with the state of Texas in general growing 20% in the same time. Oklahoma City was right behind them with 19.6% population growth. The reasons for the growth are simple Texas and also Oklahoma city have lower cost of living then west and east coast states while also still offering relatively high incomes, and big city living.

Source: Author created table, data from Census.Gov

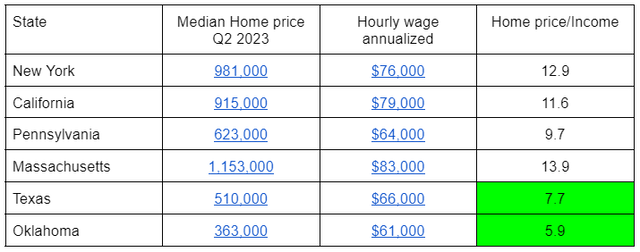

I expect this trend to continue, using a simple metric of median home prices/income per state to approximate cost of living both Texas and Oklahoma are still relatively cheaper than east and west coast counterparts. By my metric Texas is 33% cheaper while Oklahoma is 49% cheaper than California. In lists of states that have the most people leaving both New York and California rank near the top due to their extreme cost of living.

Source: Author created table, data from FRED

With more population comes more loan and deposit growth. And Bank7 is perfectly positioned to continue to benefit from this trend. In the company’s prospectus they said their goal would be to continue to expand along the I-35 Corridor which connects Oklahoma City to Dallas and look for opportunities in other Oklahoma and Texas markets.

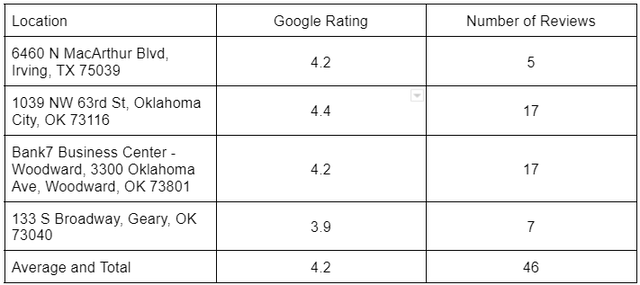

Consumers

Another check I like to do on a company is to look at google reviews. Overall Bank7 only has a few locations with reviews but in general they are positive with an average review of 4.2 stars.

Source: Table created by author, data from Google

One review by Neal Trogdon commented on the bank’s great digital experience which is a must for a bank in this day and age. A lot of other reviews commented on the great customer service at the branches. As a whole the good reviews give me an extra data point that the bank is well run. As even though the bank has grown fast they have been able to keep a good relationship with customers.

Valuation

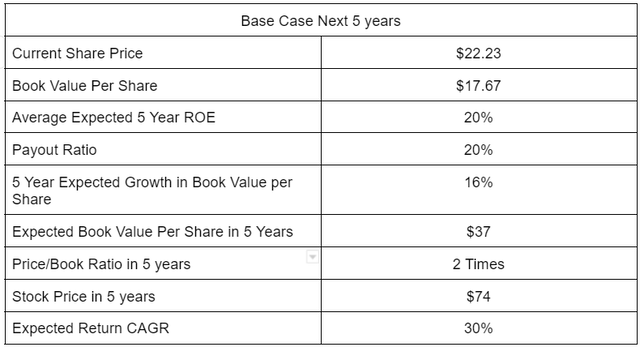

The bank is currently trading at a price to book of 1.3 times while so far achieving a 25% ROE in 2023. This would put the P/E ratio at under 5 times. These cheap prices are due to the general downturn in stock prices across most regional banks even though Bank7 continues its growth. Like I said above, Bank7 has largely been unaffected by the regional banking crisis and should probably be trading at the 2-3 times book range given its ability to reinvest and earn high returns on capital. In the past this is where the bank has traded.

Assuming a base case scenario where over the next 5 years Bank7 can deliver 20% ROE while paying out its historical 20% payout ratio with the bank rerating to 2 times book I am projecting a 30% return CAGR at current levels. The assumptions may prove to be too rosy but given the high expected rate of return there is ample leeway to give while still achieving a high rate of return.

Source: Author created table, author assumptions

I’m confident of these assumptions moving forward due to stability in ROE, NIM and Texas.

- Stability in ROE and NIM

- Bank7 has shown a remarkable stability in their ROE and NIM since 2014. This I expect to continue due to their high floating rate loan ratio. This allows the company’s loans to rise and fall with current market rates. So regardless of where interest rates are in the future the bank should be able to maintain NIM which in turn maintains the companies high ROE. With a high ROE maintained the company will be able to grow fast in their markets.

- Texas

- The bank is located in the highly favorable areas of Dallas and Oklahoma City, which are also the primary locations for the majority of its loan portfolio. These cities have experienced remarkable population growth, outpacing the national average. I expect this trend to continue, as Texas and Oklahoma remain significantly more affordable than their coastal counterparts. This will allow the bank to reinvest the majority of its earnings at high returns since there will be an abundance of loan growth. Also the bank has plenty of room to expand into other Texas jurisdictions.

Even though I’m quite rosy on the stock every investment has risks and in the next section I’ll go into the most pressing I see for Bank7.

Risks

In terms of risk I see deposit and loan concentration, geographic exposure, hospitality loans, and rising delinquency rates to be the biggest risks Bank7 could face.

Deposit and Loan Concentration

Due to the small nature of the bank with only 1.6B in Assets as of Q2 2023 Bank7 has higher levels of deposit and loan concentrations among customers than a bigger bank would have. The company’s largest 20 loan relationships accounted for 35% of total loans with the top 20 deposits accounting for 30% of total deposits. If one of these borrowers or depositors were to go into default or pull their deposits it would have an outsized effect on the bank. As the bank continues to grow this will become less of an issue.

Geographic Exposure

Bank7’s loan exposure is almost entirely in Oklahoma City and Dallas. Any downturn in these markets could have a more severe impact on their profitability compared to other banks with more geographic diversity.

Hospitality Loans

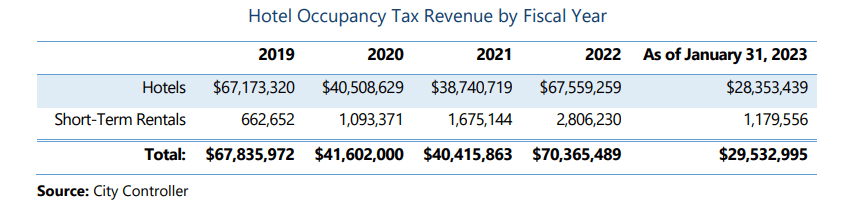

The company has a substantial loan exposure to the hospitality industry. 20.4% of Bank7’s loan portfolio is tied up in Hospitality. The hospitality industry is closely tied to economic conditions and travel patterns of both business and leisure travelers. Both of which can be quite cyclical. While many of the company’s hospitality loans are with well-established hotel operators in strategic locations, a general downturn could impact the borrowers’ ability to repay. A significant loss in this portfolio could have a substantial negative impact on the company’s financials. A great way to track the Dallas’s hotel market is the Hotel Occupancy Tax which Dallas collects on hotel operators.

Source: City Controller of Dallas

Rise in Loan Delinquency

A large rise in defaults has become a concern given recession fears. A rise in defaults would cause Bank7 to raise its loan loss allowance which would lower its profitability. Currently there seems to be no cause for concern as the delinquency rate on all loans tracked by the fed is quite low and stable since 2018. However the future is always uncertain. An advantage of Bank7’s floating rate loan ratio is that in a higher default rate environment interest rates would continue to increase to offset the default risk. The higher interest rates that Bank7 would receive in a high default rate environment could offset the defaults in its portfolio.

Conclusion

In conclusion, Bank7 stands as a resilient small regional bank with a robust presence in Oklahoma and Texas. Remarkably, it has navigated regional banking challenges without harm and has consistently expanded its deposits during this time. Despite aligning with the broader sector’s performance, the bank’s year-to-date decline of 13% does not reflect its consistent growth in book value per share, now trading at an attractive valuation of just 1.3 times book value. Furthermore, Bank7 consistently achieves impressive ROEs exceeding 20%. Notably, the bank’s strategic exposure to the promising Texas market adds an additional layer of bullish potential to its investment proposition.

Read the full article here