Motorola Solutions, Inc. (NYSE:MSI) is a reputable public safety and enterprise security company. The company’s performance in Q2 2023 showcased a strong financial position, marked by a significant backlog of orders, which, in my opinion, bodes well for its fiscal stability moving forward. The acquisition of Rave Wireless appears to be a calculated move to augment MSI’s software suite, potentially strengthening its recurring revenue streams, especially within the software and services sector. However, based on my valuation model, MSI seems to be trading near its fair value. Given the transparency and predictability of MSI’s recurring revenues, this assessment is plausible, allowing for a straightforward projection of the company’s financial trajectory. Hence, the market has likely already factored in the various merits and drawbacks of MSI’s operations and prospects. Consequently, I believe a “hold” rating is sensible due to the absence of a discernible undervaluation, which could have otherwise signaled a more aggressive investment stance. The seemingly accurate market valuation underscores a level of maturity and understanding among investors regarding MSI’s business model and long-term sustainability.

Business Overview

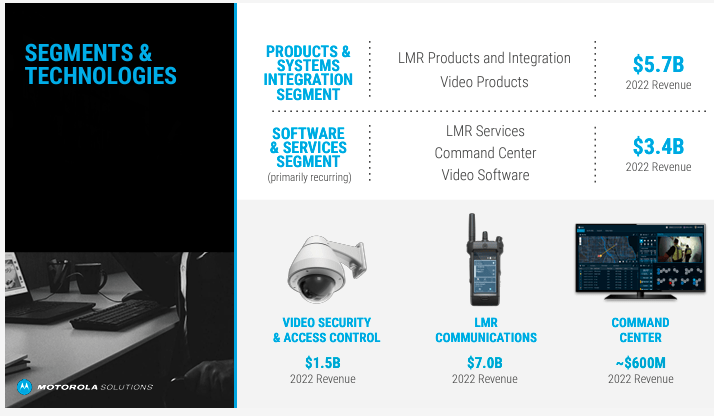

Motorola Solutions Inc. has strategically positioned itself as a crucial public safety and enterprise security player. MSI’s two segments are 1) Products and Systems Integration and 2) Software and Services. The company’s pivot from the original Motorola Inc. towards a more specialized focus mirrors a broader trend within the tech industry of embracing niche markets to foster growth and innovation. This separation allowed MSI to hone in on an increasingly pertinent sector in a global climate of escalating security concerns. Moreover, incorporating modern technologies such as artificial intelligence (AI) amplifies the efficacy and responsiveness of their security solutions. This tech-savvy maneuver is a rational response to the burgeoning demand for intelligent security systems, potentially propelling MSI into a vanguard position within this sector.

October 2023 Investor Overview Presentation

Moreover, MSI’s operations stretch across 48 global locations. Yet, MSI is mostly anchored in the United States. Still, MSI’s geographic spread is a wise tactic to buffer against local adversities while capitalizing on different markets. Moreover, MSI’s notable presence in mission-critical communications and video security sectors highlights its dedication to tackling modern communication hurdles. With over 10,000 employees globally, MSI significantly amplifies its ability to address complex communication requirements across varied sectors.

Q2 Performance and Strategic Outlook

MSI’s latest quarter showcased once again the effectiveness of its extensive range of products and services, positioning MSI as a contender adept at meeting the intricate needs of both public and private sectors in a digital era where communication is pivotal for safety applications. In fact, engaging with a broad spectrum of sectors, such as government, utilities, and transportation, demonstrates the universal allure and utility of MSI’s offerings. The balanced sales tactic of direct sales, supplemented by a distributor network, displays a pragmatic market approach and revenue diversification strategy. In my view, this engenders a more robust revenue flow, crucial for MSI’s operational steadiness and enduring growth in a fiercely competitive market landscape.

If we look at MSI’s 2023 Q2 earnings call, MSI’s had again solid financial performance, with revenue and earnings per share surpassing expectations. The Q2 backlog, totaling $14.3 billion in orders yet to be fulfilled, showcases strong demand. The promising outlook for future orders, driven by current market enthusiasm and customer engagement, could positively impact the company’s financial stability.

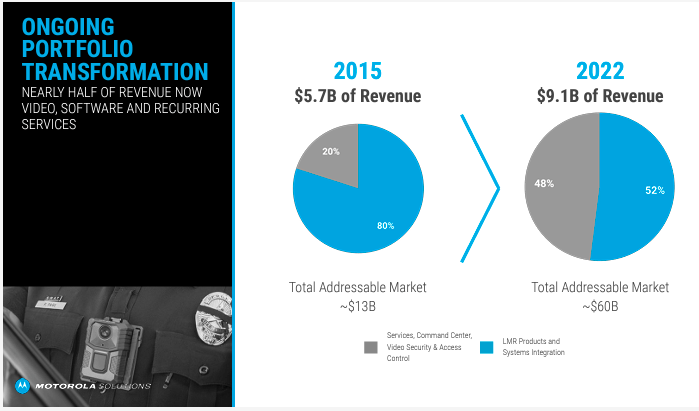

October 2023 Investor Overview Presentation

In my opinion, the upward revision of the full-year guidance, after a robust Q2 performance, bodes well for future sales and revenue. And indeed, integrating acquisitions like Rave Wireless is noteworthy because it potentially compounds MSI’s recurring revenues. Rave Wireless specializes in safety products, including panic buttons, mass notifications, and emergency calling systems. This acquisition, part of MSI’s strategic move to enhance its software suite, was announced in March 2023 and completed in April 2023. The deal, valued at $1 billion, aims to bolster MSI’s portfolio in public safety and enterprise security technology sectors.

MSI’s Ace: Recurring Revenues

Interestingly, acquiring Rave Wireless perfectly aligns with public safety and enterprise security, expanding its software suite and potentially enriching its recurring revenue stream in the software and services sector. The integration of Rave Wireless’s safety products amplifies MSI’s portfolio in public safety and enterprise security technology sectors, aligning with its broader vision of escalating its market share in video security and command center domains. Through this lens, acquiring Rave Wireless appears to be a well-calibrated move to bolster MSI’s recurring revenue model driven by software and services.

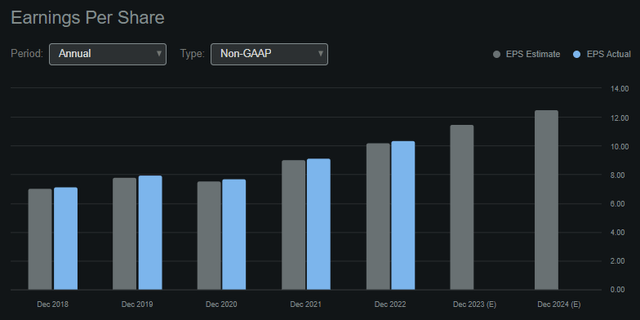

Recurring revenues lead to consistent EPS growth. (Seeking Alpha.)

In fact, Bank of America’s optimistic stance on Motorola Solutions (MSI) primarily rests on the company’s ascending recurring revenue, notably from its software and services sector, and a strategic alignment towards public safety and enterprise security, which yields substantial pricing power in a conducive funding landscape. Additionally, the forecasted market share growth in video security and command center domains, alongside the projected uptick spurred by the early upgrade cycle in the Land Mobile Radio segment and a favorable valuation underpinned by robust growth projections in key areas, collectively furnish a positive outlook for MSI.

Indeed, the trajectory of MSI’s recurring revenue growth, especially within the software and services segment, is significant. The shift from 27% of revenues up to 37% since 2016, which is now projected to hit 40% by 2025, denotes a successful transition towards a more reliable and sustainable revenue model. I believe this escalating focus on recurring revenue, evidenced by the surge in net sales from services to $1,054 million over the recent quarter, embodies a prudent strategy to shield MSI from market fluctuations while establishing a robust base for ongoing investment in innovation. Moreover, MSI’s emphasis on public safety and enterprise security is pivotal for its market positioning. It offers notable pricing power and a favorable funding environment, particularly bolstered by initiatives like the American Rescue Plan Act. This sectoral focus resonates with the public interest and unveils a significant growth avenue, given the escalating necessity for security and seamless communication in the digital era.

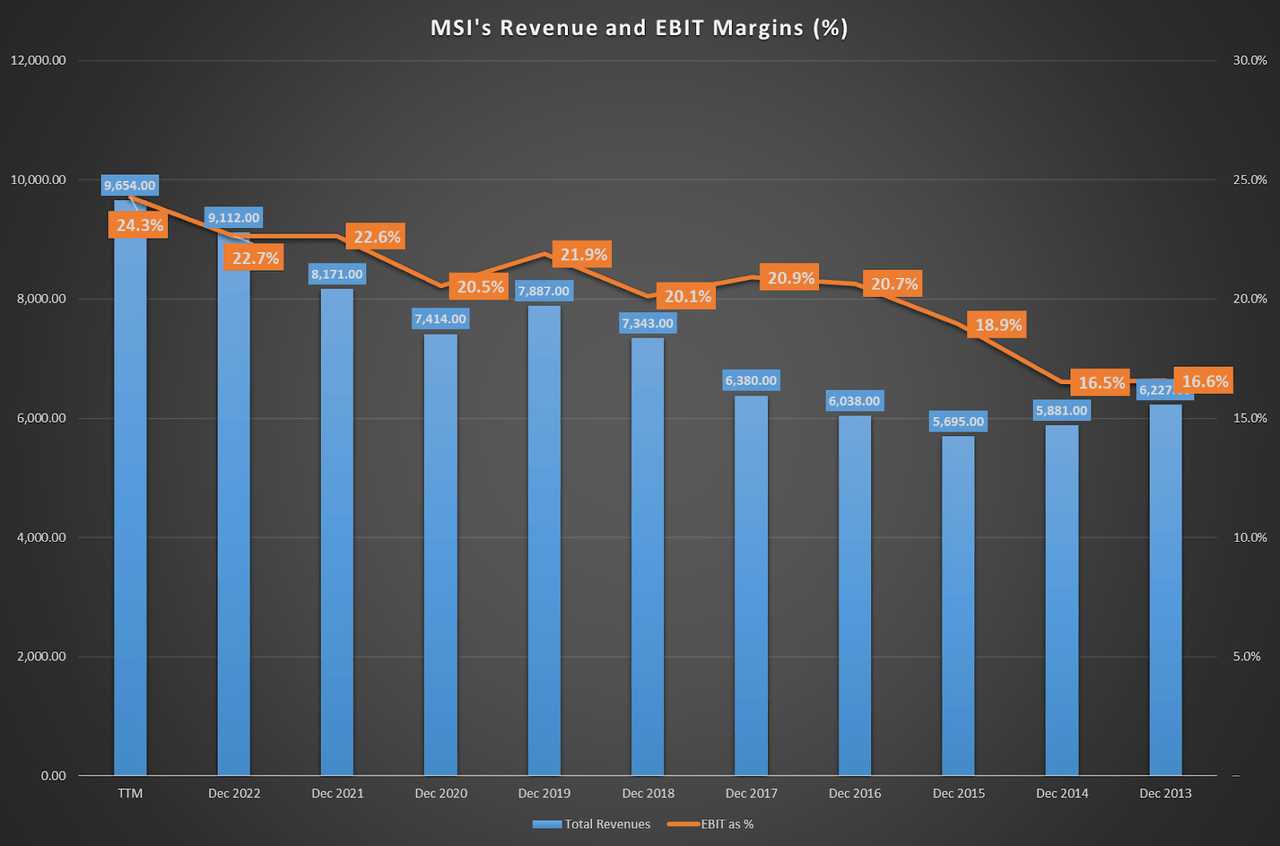

Recurring revenues compound over time, and EBIT margins have expanded as well. (Author’s elaboration.)

Although holding a modest market share in the video security and command center markets, MSI’s potential to escalate to 10% and 7% in these segments, respectively, hints at a promising market acceptance and a widening influence. The tailwind from Asian vendor polarization could potentially unfurl opportunities for MSI’s Video Security and Land Mobile Radio businesses in regions where certain Asian vendors might encounter restrictions. Furthermore, MSI’s share repurchase program exudes potent confidence within the company concerning its prospects. In my opinion, this is a robust indication of the firm’s internal growth expectations and could be construed positively by the market, aligning seamlessly with the upbeat outlook delineated by Bank of America.

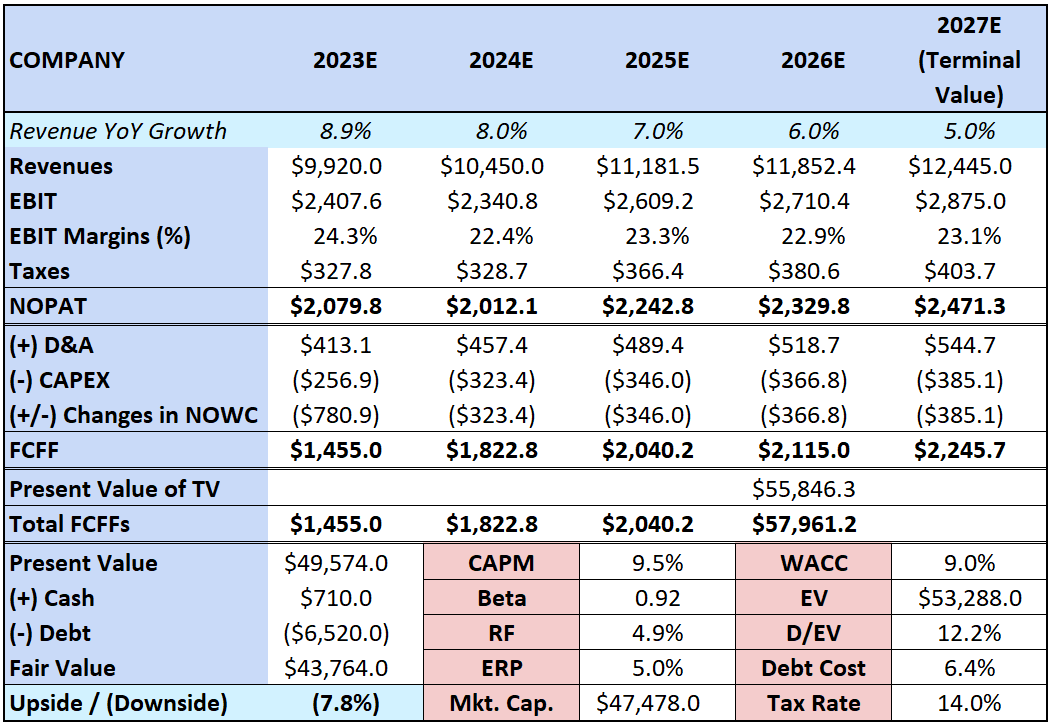

Valuation Perspective

For valuation purposes, I opted to base my analysis on the projected revenues of MSI for the current year, subsequently applying a DCF valuation method. It’s prudent to mention that I have anticipated a tapering revenue growth trajectory, underscoring the mature stature of the company, which typically has moderated growth rates over time. Beyond this, my forecasts were anchored on historical averages. A point of distinction for MSI is its relatively modest debt profile, particularly when juxtaposed with its enterprise value. However, in my view, this lean toward lower debt, while financially conservative, doesn’t optimize the company’s WACC as favorably as it could, given the lower cost of debt compared to the CAPM.

Author’s elaboration.

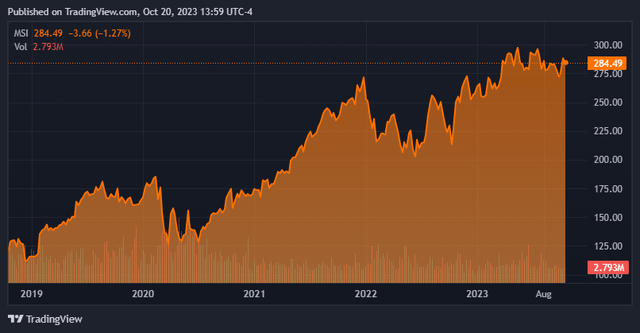

As you can see, my valuation model suggests MSI is near its fair value. The optimism towards MSI’s business prospects primarily stems from its strategic emphasis on generating recurring revenues, a model that is often seen as sustainable and stabilizing. And indeed, I believe the existing stock price aptly mirrors this positive outlook, thereby not presenting a compelling undervaluation to warrant an investment at these levels. Nevertheless, it is pertinent to acknowledge the fundamental strengths of MSI as a business entity. And while the modest dividend yield of 1.25% is a slight incentive for shareholders, it’s not significantly enticing to buy MSI for the dividend either. Thus, given the lack of a clear undervaluation and despite its business merits, maintaining a “hold” rating on MSI at the current price point is prudent. However, it’s advisable to monitor its stock performance for potential future investment opportunities should it ever go on sale.

Although not currently cheap, MSI has rarely been inexpensive over the years. (TradingView.)

Key Downside Risk

Additionally, note that MSI’s transactions with the UK government, especially through the Airwave and ESN contracts, bring the risks associated with government contracts to the fore. For instance, the termination of the ESN contract led to a $147 million fixed asset impairment loss, which, while seemingly small compared to Motorola’s $49.5 billion market cap, constitutes about 1.5% of the company’s current revenues. This scenario underlines the financial risks inherent in such contracts. Additionally, the UK Competition and Markets Authority’s decision to impose price controls on the Airwave contract necessitates a charge reduction of around $244 million (approximately £200 million) per year, which could significantly dent Motorola’s revenue stream from this contract. The four-year extension of the Airwave contract is valued at around $2.09 billion (£1.56 billion), highlighting the financial significance of this engagement. Yet, it’s evident that MSI’s risks related to regulatory action can severely impact contract terms and overall profitability.

This strikes at the heart of MSI’s downside risks because doing business with governments carries unique risks, including regulatory changes, pricing controls, and political factors that can lead to contract modifications or cancellations. For instance, removing Motorola from the UK government’s strategic suppliers list post-ESN exit could potentially limit future government contract opportunities. Furthermore, a broader risk is where a change in government or government officials’ decisions could impact several contracts simultaneously, thereby amplifying MSI’s financial risks. While Motorola’s recent figures show a positive growth trajectory, with net sales, operating earnings, and gross margins all witnessing an uptick, the financial and regulatory risks associated with large, multi-year government contracts, such as those with the UK government, present a significant concern. Therefore, as investors, it’s important to note that MSI largely depends on governments and, by extension, politics and lobbying efforts.

Conclusion

Overall, MSI demonstrates a solid footing in public safety and enterprise security, further reinforced by its Q2 figures marked by a notable backlog of orders. The strategic acquisition of Rave Wireless is poised to enhance MSI’s software suite, likely fostering the growth of its recurring revenue channels, predominantly within software and services. My valuation model’s revenue growth projections reflect this optimistic outlook. However, MSI seems to be hovering near its fair value, suggesting a cautious “hold” rating due to the absence of a clear undervaluation. The predictable and transparent nature of MSI’s recurring revenues lends a hand in forecasting the firm’s financial trajectory, which, I infer, is why its intrinsic value appears to be accurately encapsulated in its current market capitalization. This lack of apparent undervaluation restrains a more assertive investment stance. In my view, this positions MSI as a “hold” but worth monitoring for should a favorable price point emerge.

Read the full article here