After surging earlier this year, Zillow Group (NASDAQ:ZG) shares have fallen nearly 20% over the past month as mortgage rates have soared to ~8% driving housing market transactions to 20 year lows. While housing market woes will undoubtedly pressure Zillow’s results in the near term, the company has made tremendous strides in increasing the amount of revenue and profit it extracts from each transaction.

Zillow has significant growth opportunities ahead as it continues to expand its Zillow Flex/Enhanced business model to new markets. Over a 3-5 year timeframe, I expect Zillow’s profitability to expand significantly even if the housing market remains weak. When housing market transactions eventually return to historical levels, I see Zillow generating nearly $2 billion in Adjusted EBITDA and offering investors the opportunity to more than triple their money.

Housing Market on Pause

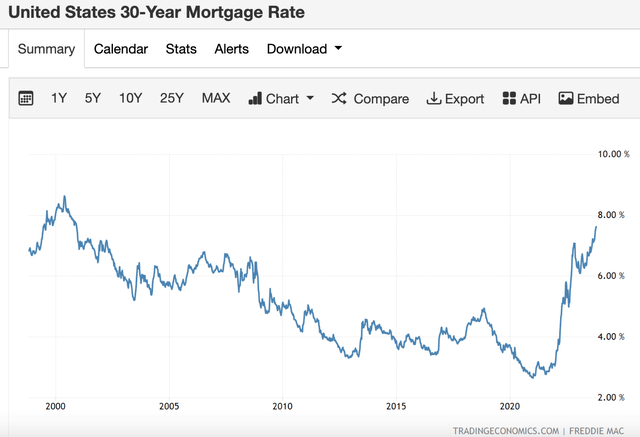

As shown below, the surge in long-term interest rates have driven the cost of a 30 year mortgage to 20+ year highs:

30 Year Mortgage Rates over Time (Trading Economics; Freddie Mac)

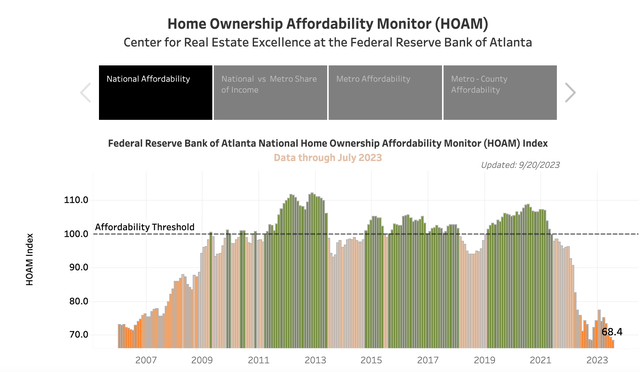

The surge in interest rates has lead to a lock-in effect whereby would-be home sellers are unwilling to sell homes and give up low locked in mortgage rates (80% of homeowners have locked-in rates below 5%), depressing inventory. Meanwhile surging mortgage rates have pushed housing affordability to multi-decade lows:

US Housing Affordability (Atlanta Federal Reserve Bank)

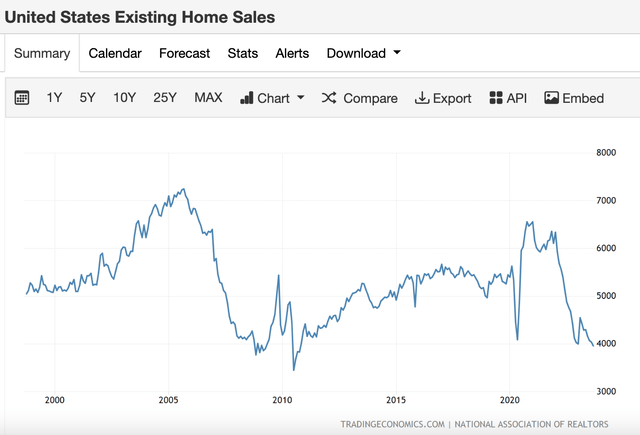

The lock-in effect (depressing supply) coupled with the high cost of home ownership (curtailing demand) as measured by the home affordability index has caused sales of existing homes:

US Existing Home Sales (Trading Economics, National Association of Realtors)

Suffice to say with mortgage rates of ~8% this has created an incredibly difficult external environment for Zillow in the near term.

Zillow is Executing on Long-Term Objectives

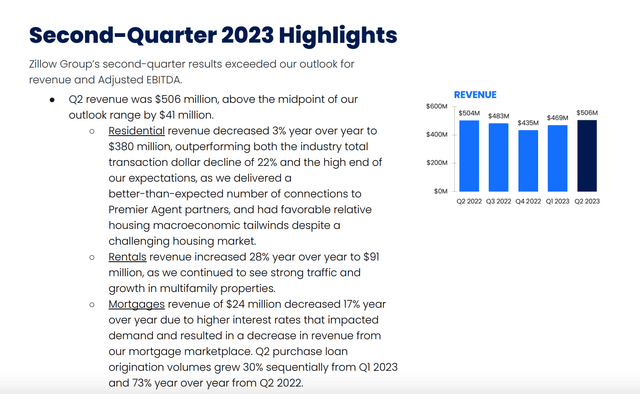

Despite an awful external environment, Zillow has produced exceptional results thus far in 2023. In 2Q23, Zillow’s residential revenue (linked directly to the housing transaction market) fell just 3% year-over-year despite a 22% decline in total housing transaction dollars:

Zillow 2Q23 Results (Zillow Shareholder Letter)

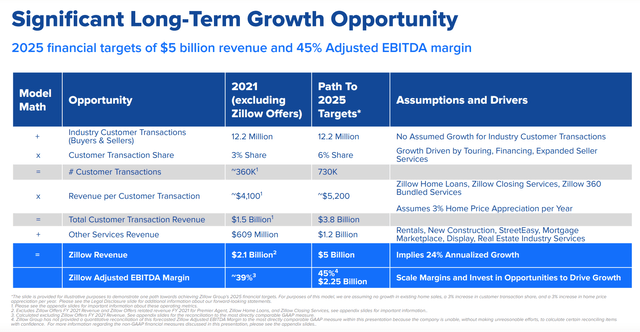

The strength in Zillow’s results confirm the company is executing on its long-term plan to increase its market share from 3 to 6% (as laid out in its 2022 investor day presentation, shown below):

Zillow Long Term Targets (2022 Investor Day Presentation)

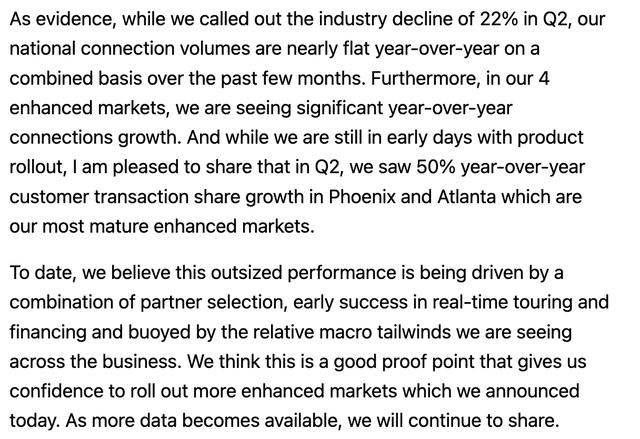

Growth in transaction share has been driven by growth of Zillow Enhanced markets (also known as Zillow Flex), where Zillow has pivoted from merely selling leads to partnering with the most capable agents within a local/regional market and collecting a 30-40% share of the total commission from a transaction. As noted on its 2Q23 conference call, Zillow is already seeing a dramatic increase in market share in Flex Enhanced markets:

Flex/Enhanced Gaining Marketshare (Zillow 2Q23 conference call transcript from Seeking Alpha)

This strategy allows Zillow to capture a greater share of housing transaction economics while also improving service to customers and benefitting capable agents which have embraced this new way of doing business.

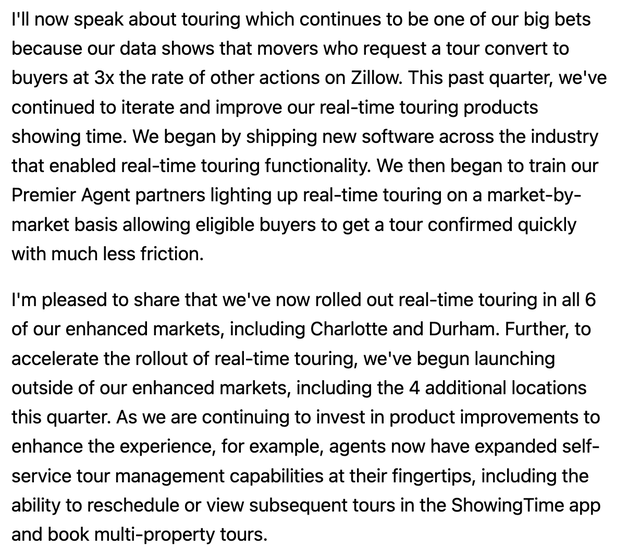

Touring Drives Conversion (Zillow 2Q23 Conference Call Transcript from Seeking Alpha)

Zillow Flex/Enhanced fundamentally changes workflow of partner agents. The goal of the Flex/Enhanced strategy is to improve lead conversion rates. Participating agents are carefully selected, trained, and monitored by Zillow to ensure that they are responding to customer inquiries in a timely manner and successfully converting leads to a home showing appointment. To comply agents must adapt to the Flex/Enhanced business model using a team based approach – relying on teams rather than an individual improves the agent response time which is a critical factor in acquiring new customers. Further Zillow is actively involved in how team members interact with customers to ensure that a trained team member focuses on setting a showing/touring appointment (Zillow trains agents to use a script focused on setting an appointment facilitated by the 2021 acquisition of ShowingTime).

Another piece of evidence which indicates that Flex/Enhanced has been successful is that Zillow has actually increased its take rate from 35 to 40% in some markets. This price increase demonstrates that Zillow Flex/Enhanced is adding significant value to its partner agents and I suspect we will see take-rate increases in more markets over time.

I believe Zillow shares will more than Double Looking out 3-5 years

While the near term picture is very ugly, I see Zillow as a compelling long term investment as Zillow Flex/Enhanced is expanded to more markets and Zillow gains share within existing Flex/Enhanced markets.

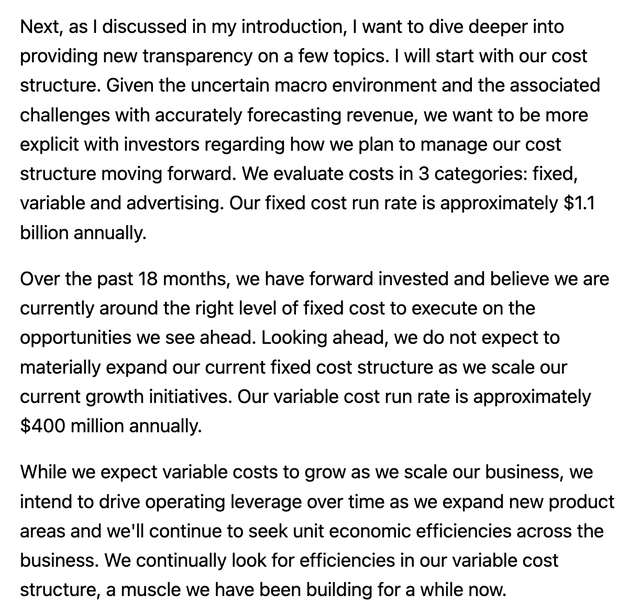

On its 2Q23 conference call, Zillow broke its cost structure into fixed and variable costs.

Zillow Operating Leverage (2Q23 Conference Call Transcript from Seeking Alpha)

Given a largely fixed (70+%) cost structure, as Zillow continues to gain share, the company should see tremendous growth in operating profits. Assuming the company is able to double its market share (in-line with medium-term targets), but assuming that housing market transactions remain depressed (4.5 million, a modest bump relative to today’s level but well below 5.5 million long-run average), and taking into account the operating leverage described above, I expect Zillow will generate $1.2-$1.3 billion in adjusted EBITDA (likely in 2026-27). This implies Zillow is trading for just 6.2x 2027e EBITDA after adjusting for $1.7 billion in net cash on the balance sheet.

Given the company’s dominant 63% market share, high operating margins and returns on invested capital (30%+), and opportunities for continued growth well in excess of GDP (discussed below), I think a multiple of at least 15x adjusted EBITDA is warranted. Assuming a multiple of 15x adjusted EBITDA (and factoring in $1.7 billion in net cash), gets me to a 2027 fair value of just over $90 per share which is +130% above the current share price.

Should the housing market transactions revert back to its long-term historical average, I estimate Zillow would earn roughly $1.9 billion in adjusted EBITDA (slightly below the company’s medium term EBITDA targets). Using the same 15x adjusted EBITDA multiple (and crediting for net cash), gets me to a 2027 fair value of $130 per share or 230% above the current share price.

In addition, there is further upside from:

- Further market share increases beyond 6% in buyer connections

- Success in penetrating mortgage origination – given its dominant position as the leading platform for finding a home, Zillow is seeking leverage this position to build a large mortgage origination business. The company has approached this two ways. First by improving the integration of its mortgage offering with the Zillow app. Secondly, under the Flex/Enhanced operating system Zillow has levers to pull to incent agents to refer mortgage origination to Zillow (see conference call transcript excerpt below) which I believe could ultimately lead to a meaningful profit contribution here.

Commentary on Mortgage Initiatives (Zillow 2Q23 Conference call Transcript from Seeking Alpha)

- Sell-side solutions – thus far Zillow has largely been a buy-side platform but there are opportunities to expand into attracting more home sellers to connect with agents through Zillow. This is a huge opportunity as this commission pool is roughly the size of the buy-side market.

Conclusion

The depressed/declining housing market have presented long-term investors with an opportunity to own the dominant residential real estate platform at a very attractive price. I own and have been adding to my Zillow position.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here