At a Glance

United Therapeutics’ (NASDAQ:UTHR) Q2 performance underscores robust financials with a notable 27.7% YoY revenue increase, fueling investor optimism. On the clinical front, the transition to Tyvaso DPI (Dry Powder Inhaler) reveals a calculated strategic pivot aimed at retaining and possibly expanding market share in the face of looming generic competition. While the company’s ample liquidity and strong cash flow mitigate the near-term need for external financing, the potential for market share erosion as generics enter the fray necessitates vigilance. Equally, United’s ongoing patent dispute and the mixed signals from insider activity require careful scrutiny. These factors, when considered alongside strategic endeavors like production scaling and physician outreach, create a complex tableau that investors should navigate cautiously.

United’s Q2 Earnings

To begin my analysis, looking at United’s most recent earnings report for Q2 2023, total revenues increased to $596.5M, up from $466.9M YoY, a significant 27.7% surge. Operating income rose sharply to $313.4M from $201.8M YoY, highlighting robust operational control despite total operating expenses marginally increasing to $283.1M from $265.1M YoY. Cost of sales exhibited a more than twofold rise to $64.1M, suggesting pressure on margins. Notably, share dilution remains subdued with diluted shares increasing modestly to 49.5M from 48.1M YoY.

In the Q2 2023 breakdown of net product sales, Tyvaso (treprostinil inhalation) generated $318.9M, marking a 59% YoY increase (with DPI contributing $96.9 million). Remodulin recorded $127.2M, a 4% YoY decrease. Orenitram accounted for $95.1M, up 20% YoY. Unituxin stood at $44.3M, virtually unchanged from last year. Adcirca brought in $7.5M, a 28% YoY decline. The ‘Other’ category added $3.5M.

Financial Health

Turning to United’s balance sheet, as of June 30, 2023, the company held $1.07B in ‘Cash and cash equivalents’ and an additional $1.61B in ‘Marketable investments’, totaling to $2.68B in highly liquid assets. The current ratio, calculated by dividing the total current assets of $3.21B by the total current liabilities of $370.3M, stands robust at 8.68. The company’s total assets of $6.68B far outweigh its total debt obligations, including a line of credit of $800M, totaling $1.27B.

Over the last six months, United generated a net cash of $481.1M from operating activities, translating to approximately $80.2M per month. In light of the substantial liquidity, a solid current ratio, and a positive operating cash flow, the odds of United requiring additional external financing within the next twelve months appear low.

Market Sentiment

According to Seeking Alpha data, United’s $10.58B market cap aligns with its robust financial health, signaling market confidence. Growth prospects are promising; analysts project YoY revenue increases from $2.26B in 2023 to $2.77B by 2025, backed by strategic advancements like Tyvaso DPI. Comparing stock momentum to SPY, UTHR underperforms in the short term but has shown some resilience with a 1Y return of +4.44% versus SPY’s +15.23%, suggesting investor cautiousness.

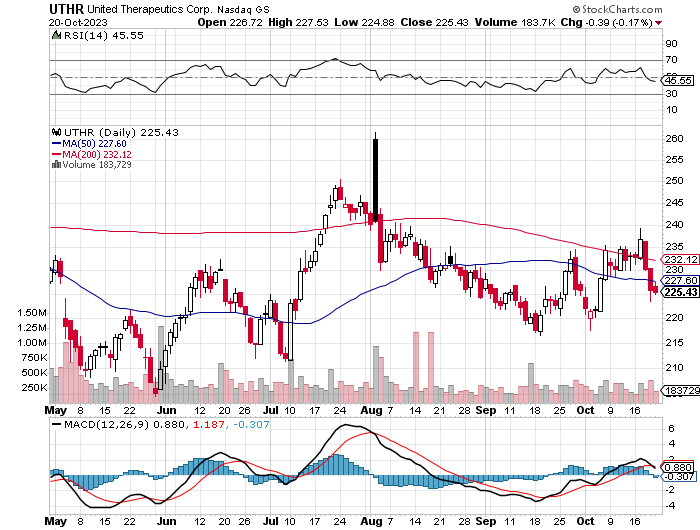

Technically, UTHR trades near the 50-day moving average (227.60) and below the 200-day moving average (232.12), indicating a cautious bearish bias. The RSI at 45.55 suggests a neutral momentum. Volume trends are consistent without notable spikes. The MACD line hovers above the signal line but is showing signs of potential convergence, which may hint at a short-term trend reversal. Immediate resistance is near the 200-day moving average.

StockCharts.com

A low short interest of 2.23% indicates limited bearish sentiment. Institutional ownership stands at 95.22%, with new positions at 895,306 shares and sold-out positions at 867,712 shares; major holders include BlackRock and Wellington Management. Insider activity shows a net sale of 38,383 shares over 3 months and 1,212,809 over 12 months, signaling potential caution among insiders.

Patent Dispute Could Reshape United’s Tyvaso Market

The patent dispute between Liquidia (LQDA) and United revolves around U.S. Patent No. 10,716,793, concerning a method of administering treprostinil via inhalation. The dispute escalated in September when United filed a patent infringement action under the Hatch-Waxman Act, claiming that Liquidia’s New Drug Application infringed three of its patents.

Liquidia intends to market an inhaled dry powder formulation of treprostinil for pulmonary arterial hypertension (PAH), competing with United’s Tyvaso. The FDA granted tentative approval for Liquidia’s generic, paving the way for potential market entry as Yutrepia for pulmonary hypertension associated with interstitial lung disease (PH-ILD) in March 2024.

The legal saga saw various developments, including a reaffirmation by the Patent Trial and Appeal Board (PTAB) to invalidate all claims of the ‘793 patent, though a federal appeals court later sided with United, maintaining Liquidia’s infringement.

The implications for United investors are manifold. The enforcement of patent rights can shield United from competition, safeguarding its market share and revenue streams from Tyvaso. On the flip side, a ruling in favor of Liquidia could have opened the door to generic competition sooner than anticipated, potentially eroding United’s market share and impacting its stock price. The stock prices of both companies have been reactive to the developments in the dispute, as seen on a particular day when Liquidia’s shares closed down 12.76% and United’s shares were down about 1%.

Dose of Convenience: How Tyvaso DPI Outpaces Its Predecessor

United has transitioned to Tyvaso DPI amidst the looming threat of generic competition for its original formulation, Tyvaso Inhalation Solution. This transition is part of a broader strategy to sustain and bolster its market share in the treatment of PAH and PH-ILD. Here are several factors and evidence that might suggest Tyvaso DPI could have a competitive edge over a cheaper generic version of Tyvaso:

Improved Formulation:

-

Portability and Setup: Tyvaso DPI is a small, portable device offering cordless flexibility, contrasting with the more cumbersome setup required for Tyvaso. Tyvaso DPI uses single-dose cartridges, making it a more convenient choice for patients. With Tyvaso, patients need to set up the device every morning and clean it every night, whereas with Tyvaso DPI, they only need to replace the inhaler every seven days.

-

Dosing: Tyvaso DPI is administered four times daily with one breath per cartridge for each dose, each dose being inhaled in less than two seconds. On the other hand, Tyvaso requires four daily administrations but entails multiple breaths per treatment session, with each session lasting 2 to 3 minutes.

Pharmacokinetics and Efficacy:

-

In a comparison of pharmacokinetic profiles, Tyvaso DPI showed a 13% greater geometric mean area under the curve (AUC) and a 33% greater geometric mean maximum concentration [CMAX] compared to Tyvaso, indicating potentially higher bioavailability and efficacy.

Safety and Tolerability:

-

The transition from Tyvaso to Tyvaso DPI appears to be well-tolerated, as suggested by high patient satisfaction rates and the efficient delivery of medication to the distal airways without the necessity of a strong breath.

The design enhancements of Tyvaso DPI cater to a more user-friendly, efficient, and potentially more effective treatment regimen. The simplified dosing, portable design, and improved pharmacokinetic profile collectively contribute to a significant advancement over the original Tyvaso formulation, offering a compelling alternative especially in anticipation of generic competition.

United Reinforces Tyvaso Market Position Amid Generic Competition

United’s proactive strategic discourse during the recent earnings call illuminates a forward-thinking approach to fortify its market foothold. Here’s a breakdown of the strategic thrusts in the face of generic rivalry:

Production Amplification:

-

Partnering with MannKind (MNKD), United aims to significantly bolster the production of Tyvaso DPI. A 250% surge in production capacity is projected due to recently concluded expansion and process enhancements. This step not only readies United to meet current demand but positions it competitively to counter the price pressures from generic entrants. The ongoing production capacity enhancement, slated for 2024, further underlines a long-term vision to sustain market leadership.

Physician Outreach:

-

The drive to heighten physician screening for PH-ILD among the ILD patient demographic is a judicious move. This initiative not only broadens the prescriber base but potentially offsets any market share erosion to generic competitors by expanding the patient pool for Tyvaso therapies.

Prescribing Depth and Patient Retention:

-

A mention-worthy trend is the 70-30 split between new patient starts on DPI and the nebulizer, respectively. This trend underscores a palpable shift towards the more user-friendly DPI, aligning with United’s objective to transition long-standing nebulized Tyvaso patients to Tyvaso DPI. This is pivotal as it showcases the acceptance and preference for Tyvaso DPI over the nebulizer, even as generic competition looms. Further, the strategy to deepen prescribing to three-plus patients and enhance patient retention on Tyvaso delineates a dual pathway to sustain revenue streams.

Commercial and Sales Augmentation:

-

Amid the generics’ shadow, realigning product promotional responsibilities and expanding the sales headcount is a pragmatic move to boost Tyvaso’s market penetration and patient loyalty.

United’s strategy, encapsulated in these focal areas, exudes a blend of offensive and defensive tactics. By ramping up production, engaging physicians, enriching prescribing depth, and honing commercial efforts, United is not only gearing up to meet the generic challenge head-on but is maneuvering to exploit the market dynamics to its advantage, leveraging the novel Tyvaso DPI as a significant differentiator.

My Analysis & Recommendation

United’s Q2 2023 earnings depict a picture of financial fortitude, underscored by a 27.7% revenue surge, robust operational control, and a solid liquidity position. Amidst the competitive landscape, the company’s strategic transition to Tyvaso DPI amidst looming generic competition is a proactive measure. The superior ease of administration and potential efficacy of Tyvaso DPI are its competitive edge, potentially cushioning against market share erosion when generics enter the fray. The legal landscape is an evolving scenario, with the recent patent skirmish with Liquidia casting ripples on stock dynamics. Should United maintain its patent stronghold, it may continue to shield its market share, yet a contrary verdict could hasten generic onslaught, posing a material risk.

Investors should keep a keen eye on the unfolding patent dispute landscape, the traction of Tyvaso DPI in the market, and the progression of the strategic initiatives outlined in the recent earnings call, especially the production amplification in partnership with MannKind. Risk mitigation could entail a diversified portfolio approach, perhaps counter-balancing with stocks from companies with lesser patent dispute risks or different therapeutic areas. The market sentiment, although cautiously bearish in the short term, still holds promise as United’s strategic play unfolds against generic competitors.

Given the orchestrated strategic efforts to bolster Tyvaso’s market stance and the financial health demonstrated in the recent earnings, a “Hold” recommendation is prudent. Investors may find a more opportune moment to adjust positions as legal and market dynamics evolve in the coming weeks and months.

Read the full article here