This title may sound weird as tech is not normally associated with value, far from it to be more precise, but, we are at a juncture where conventional wisdom no longer seems to apply. Thus, in a macroeconomic environment where interest rates are at decades high while the U.S. economy continues to remain resilient contrarily to expectations, the aim of this thesis is to show the value proposition represented by the big technology companies held by the Technology Select Sector SPDR® Fund ETF (NYSEARCA:XLK).

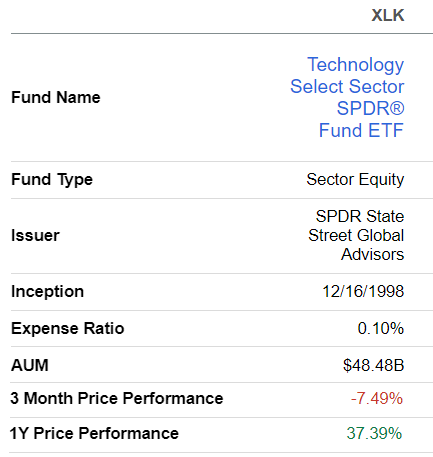

Some main metrics (seekingalpha.com)

After delivering one-year gains of over 37%, there has been some pullback with its shares losing around 7.5% during the last three months, which provides an investment opportunity. I start by showing that what really matters is capital gains, not discounted valuations when it comes to investing hard-earned money.

Rethinking Our Idea of Value

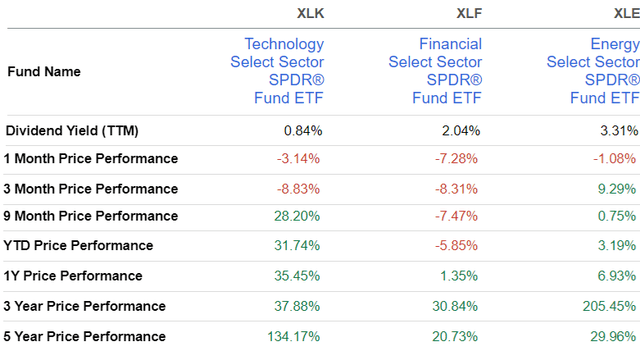

First, a value stock or ETF refers to shares of a company or fund that appear to be trading at a discount relative to their fundamentals, such as earnings. This makes the investment attractive as investors can obtain more shares for the same amount of money spent than they would have if they had chosen the growth criteria, as most tech companies or ETFs qualify for. Tellingly, XLK comes with a hefty Price-to-earnings ratio of 23.66x, which is nearly double the Energy Select Sector SPDR® Fund ETF’s (XLE) 11.51x and the Financial Select Sector SPDR® Fund ETF’s (XLF) 12.84x.

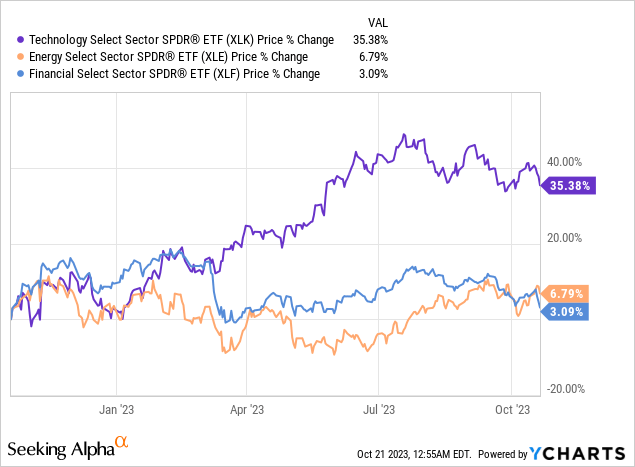

However, once the investment has been made, shareholders are subject to the whims of the market and one of the caveats of strictly adhering to the value strategy is missing out on capital appreciation, and the performance comparison in the chart below illustrates my point. Here, XLK has outperformed by at least 28.5% (35.38-6.79) which is considerable, as it translates into a profit differential of $2,850 on an initial investment of $10K, excluding fees.

Now, looking further into history, the five-year performances take into consideration the COVID-19 pandemic and a period when the U.S. Federal Reserve hiked interest rates at an unprecedentedly aggressive pace (in recent times), more precisely from March to November 2022. This induced volatility in tech names with XLK seeing more than 25% of its value eroded. Now, the reason for higher rates posing a problem for tech stocks is that they already trade at a premium and tighter monetary conditions, by ricocheting through different sectors of the economy dampens demand, and makes it more difficult for them to deliver on the growth narrative and justify their higher multiples.

Comparison of metrics (seekingalpha.com)

However, with higher interest rates also came better yields and the banking turmoil.

Here, in addition to discounted valuations, some investors also associate value with regular distribution to shareholders. In this context, with rising interest rates both risk-free short-term treasuries and CD accounts have become attractive since they deliver above 5% yields, thereby competing directly with dividend-paying XLF and XLV with yields of only 2.04% and 3.31%, respectively.

Secondly, during March’s banking turmoil caused again by higher rates, big banks suffered from volatility as the value of their overall assets suffered due to the devaluation of long-dated treasuries. Now banks are often perceived as value stocks due to their much lower P/E but treasury-related risks remain as long as the Federal Reserve prioritizes the “higher for longer” narrative. Furthermore, the financial sector now faces more regulatory oversight which can limit lending, despite their high valuation, big tech ended up acting as a defensive sector or safe haven during the crisis.

This calls for a rethink of what we associate with value, especially since XLK’s long-term outperformance was achieved despite suffering from acute volatility and also tends to illustrate that the risk factor associated with tech is not necessarily something that should be avoided in view of potential capital appreciation rewards.

Furthermore, another reason for tech becoming attractive again as of January this year is thanks to value-adding artificial intelligence.

Valuing XLK

First, tech’s rise after Microsoft (MSFT) revealed its $10 billion investment in OpenAI back in January is not just because of investors’ optimism about the wonders of innovation but also because of potential margin gains. In this respect, a study by McKinsey focusing on the productivity aspect of Generative AI across a range of industries found that there could be roughly $2.6 to $4.4 trillion of gains by 2040 globally, or a mid-point of $3.5 trillion with the functions to benefit the most including software engineering, marketing, customer operations, and product R&D. As for the industries these are Advanced Electronics and Semiconductors, Telecommunications, and High Tech.

Translating these numbers into percentage figures, I found that nearly $75 trillion could be added to global GDP by 2040, signifying that Generative AI could engender ((3.5/75) x 100) or 4.7% of productivity improvements. This remains an estimate, depending on the values used in the calculation, but nonetheless helps to juxtapose some mind-blowing numbers, in this case, trillions of dollars into metrics more relevant to the investment context.

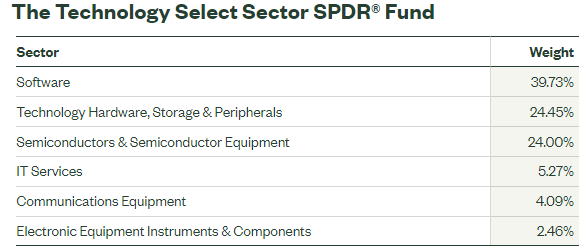

Now, software, semiconductors, and communications are indeed represented in XLK’s sector breakdown as shown below signifying that the ETF should benefit.

www.ssga.com

Now, productivity is about doing “more with less” or using AI tools to automate business processes which allows for the substitution of labor, also offsetting the effects of higher wage inflation for early AI adopters. As a result, profitability should benefit culminating in corporate earnings improvement which I estimate at 4.7% for XLK based on the above calculation. Now since earnings form the denominator of P/E, this translates to a target price of $171.64 (163.94 x 1.047) based on the current share price of $163.94.

Noteworthily, this optimistic outlook is aligned with the latest data from FactSet dated September 22 which stipulates that the wider IT sector should see a YoY increase in earnings growth for the third quarter of 4.4% instead of the previous estimate of 0.4% made on June 30.

To this end, positive third-quarter earnings could revive the rally in tech stock by up to 15% according to analysts at Wedbush Securities basing themselves on “transformational AI growth and stabilizing IT spending environment”. They could be right as big tech has acted early to harvest productivity gains as seen by the massive number of job cuts, estimated at nearly 171K since the beginning of this year while the economy remains resilient. Also, to its advantage, XLK has a momentum grade of A+.

The Risks

Still, with so many expectations built around the AI theme, there are risks of “bubble-bursting” style volatility risks as suffered by Oracle’s (ORCL) stock following the company’s AI executive forum on October 20. The pains also extended to Adobe (ADBE), and Microsoft.

www.ssga.com

Pursuing further, when you are a big tech, either a large cloud provider or giant semiconductor company, you have more exposure to the rest of the world and face foreign exchange risks especially due to a rising dollar as in October 2022 when the U.S. Dollar Index was at its highest at $114. Now, the index stands at around $106 and could again reach a dangerously high level in case the combination of a strong economy and high inflation were to trigger the Fed to continue on its aggressive monetary policy stance.

Another risk is the Israel-Hamas conflict escalating and engulfing other neighboring countries or even drawing the U.S. directly into the fight. Along the same lines, geopolitical tensions with China remain high with the latest U.S export restrictions on AI-enabling chips causing both Nvidia’s (NVDA) and Advanced Micro Devices (AMD) shares to slide on October 18. However, with its AI-enabling chips being highly sought after, Nvidia could offset revenue shortfalls by fulfilling demand from the rest of the world.

Furthermore, as I highlighted in a recent thesis on the Apple-Huawei rivalry, the iPhone maker could lose market share in case the Chinese company is able to produce large volumes of its Mate 60 smartphones, but, as a large conglomerate valued at $2.75 trillion, the American company can rely on the consistency of its service revenues to mitigate certain device-related risks.

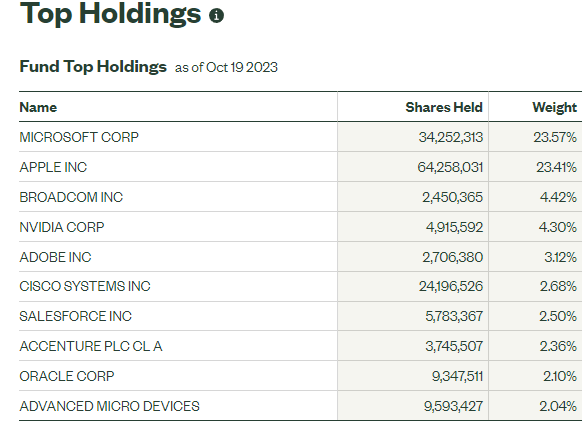

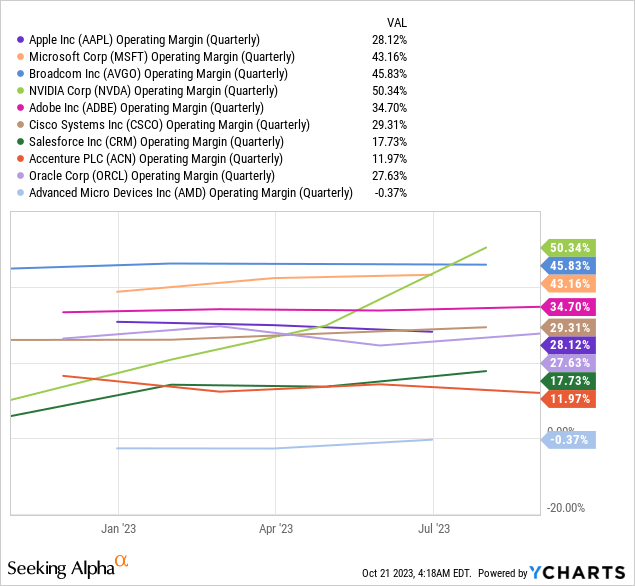

Therefore, size matters as these are big companies with XLK’s median market cap averaging $39.7 billion which is huge. Equally, important, these are predominantly profitable businesses too as seen below.

In addition to profitability which is another value characteristic, these are established businesses with moat, but, in the current high-interest rate environment, another metric that matters even more is cash.

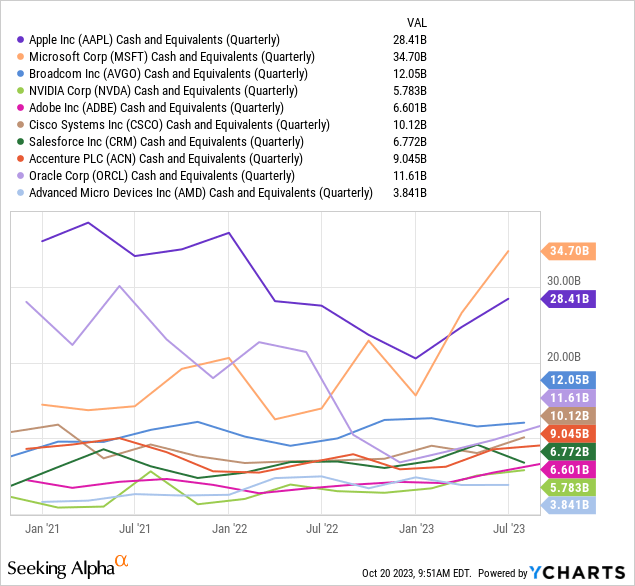

Cash As A Cushion Against Uncertainty

Now, in view of the risks mentioned above, these cash piles pictured below not only provide insulation against short-term uncertainties but also open avenues for inorganic growth through M&As as exemplified by the software giant’s acquisition of Activision Blizzard (ATVI) or Apple buying up AI companies since the last five years.

Now, some will argue that with oil prices above $90, it is energy ETFs like XLE with holdings that are generating high free cash flows that represent value. Well, given that these are the result of windfall gains due to the Middle East conflict rather than a real increase in demand, the question is when the opportunity lasts. At the same time, there is also a need to invest in production capacity at high borrowing costs.

Therefore, in a macroeconomic environment characterized by the absence of stable forecasts for the future and in an increasingly uncertain world, tech appears as a beacon of value. As such, XLK’s holdings combine the development potential of new technologies with the qualitative development of established companies together with longevity. Therefore, for those ready to embrace volatility, the pullback represents an opportunity for a 15% gain or a target of $188-$189. Tellingly, my bullish position contrasts with my earlier Hold position in October while the ETF delivered gains of around 35%. That thesis was largely based on valuation multiples which proved unfounded.

XLK has Value Characteristics

Furthermore, for those who are not yet convinced about AI, this development has nonetheless brought to the fore the value of the data asset. In this respect, XLK’s price-to-book multiple of 7.21x is much lower than for its top five holdings which account for about 55% of the ETF’s overall weight thereby making the ETF an attractive investment. Additionally, book value is based on the corporate balance sheet at a specific point in time and does not reflect the ability of its holdings to leverage real-time data, whether it is Microsoft using its massive database of customer information to penetrate new markets, or Apple promoting its healthcare apps vertical through its IOS ecosystem.

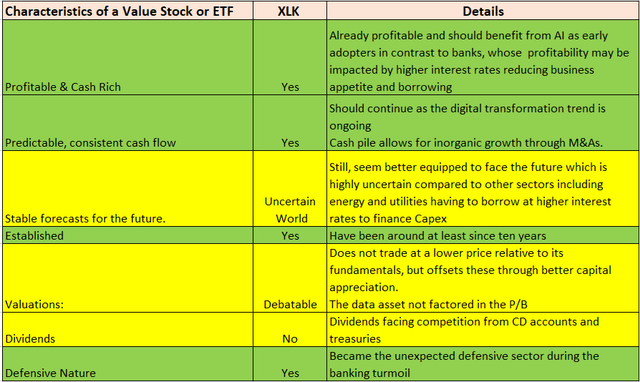

In conclusion, as shaded in green below, it is found that XLK possesses more value characteristics like profitability, and predictability of cash flow, while also acting as a defensive ETF during the banking turmoil. It also compensates for its higher price relative to fundamentals through better capital appreciation, but, adopting a dose of caution, having a longer-term posture, and the ability to stomach volatility are essential qualities to possess when investing in tech.

Table built using data from (www.seekingalpha.com)

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here