Alibaba trading floor

Alibaba Group Holding (NYSE:BABA) stock is once again taking a beating. On Friday, it fell below $80, sending its P/E ratio down to single-digit levels. Historically, Alibaba has not remained below $80 for prolonged periods of time. So, its stock is again at a level at which it has typically been a good buy.

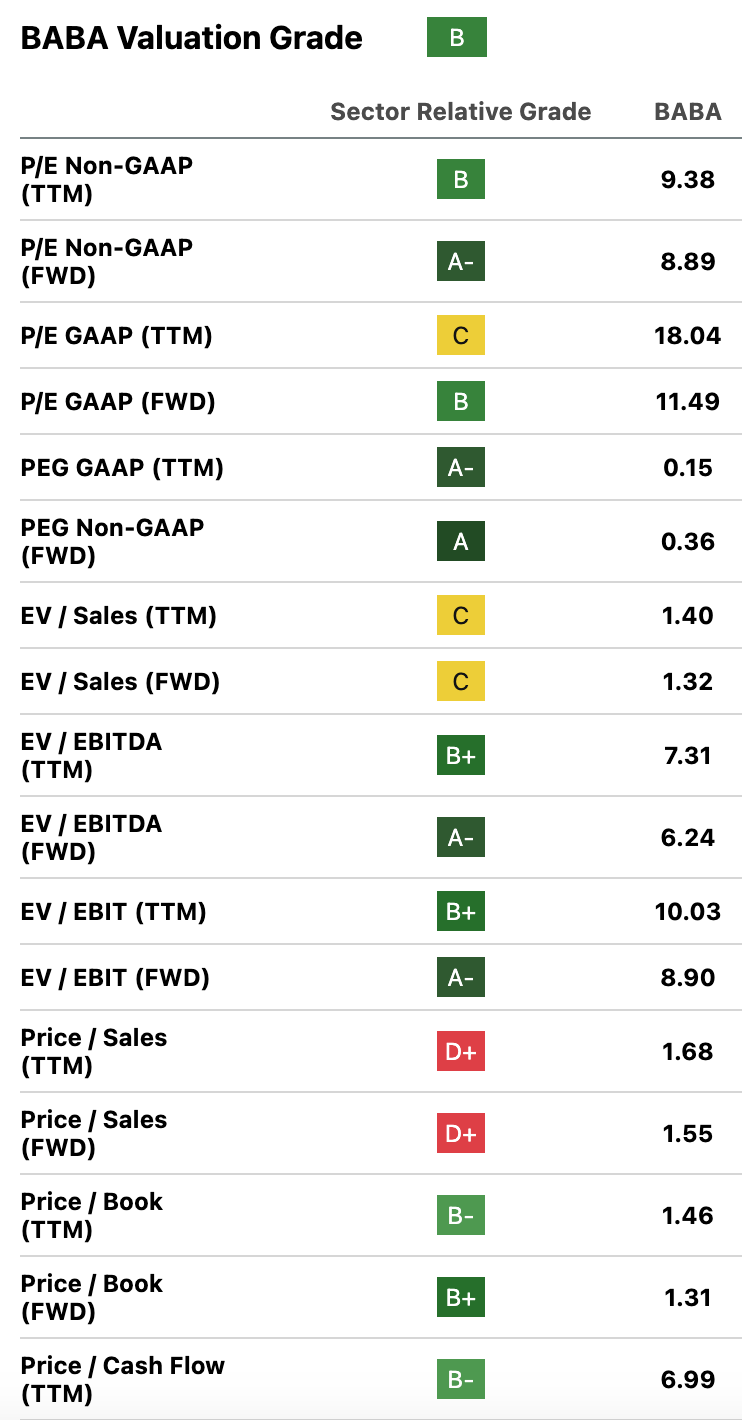

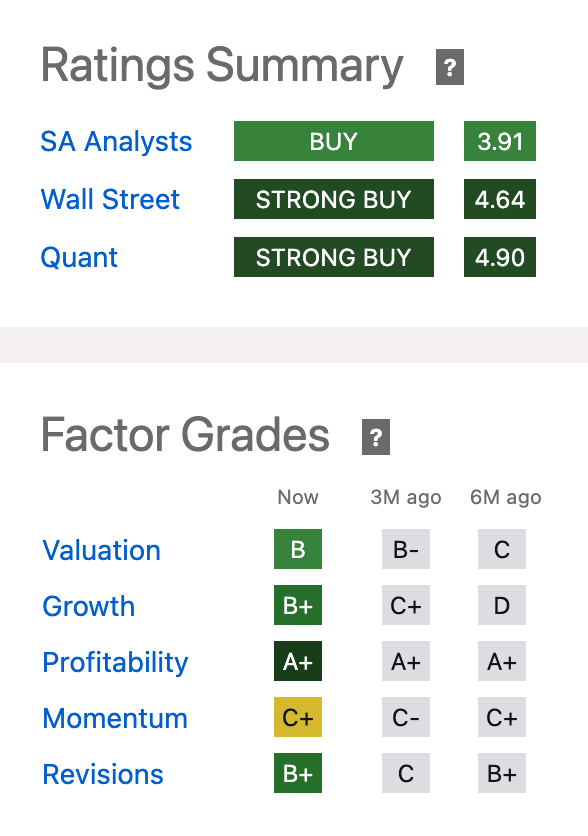

Indeed, BABA stock is beginning to acquire characteristics that “Big Short” hero Michael Burry would describe as “absolute cheapness.” As you can see in the screenshots below, Alibaba scores a ‘B’ on valuation in Seeking Alpha’s Quant System, along with a B+ on growth and an A+ on profitability.

Alibaba valuation ratios (Seeking Alpha Quant) |

Alibaba ratings and factor grades (Seeking Alpha Quant) |

So, Alibaba scores high marks on every single one of Quant’s factors except momentum, on which it scores a C+ – far from the worst possible score.

More than anything else, it’s Alibaba’s valuation that makes it appealing. Some of its multiples – such as the 0.15 PEG ratio-are outrageously low. Others, such as the P/E ratio, are reasonably low, and very low for the tech sector (the NASDAQ-100 trades at 29 times earnings even after its recent selloff).

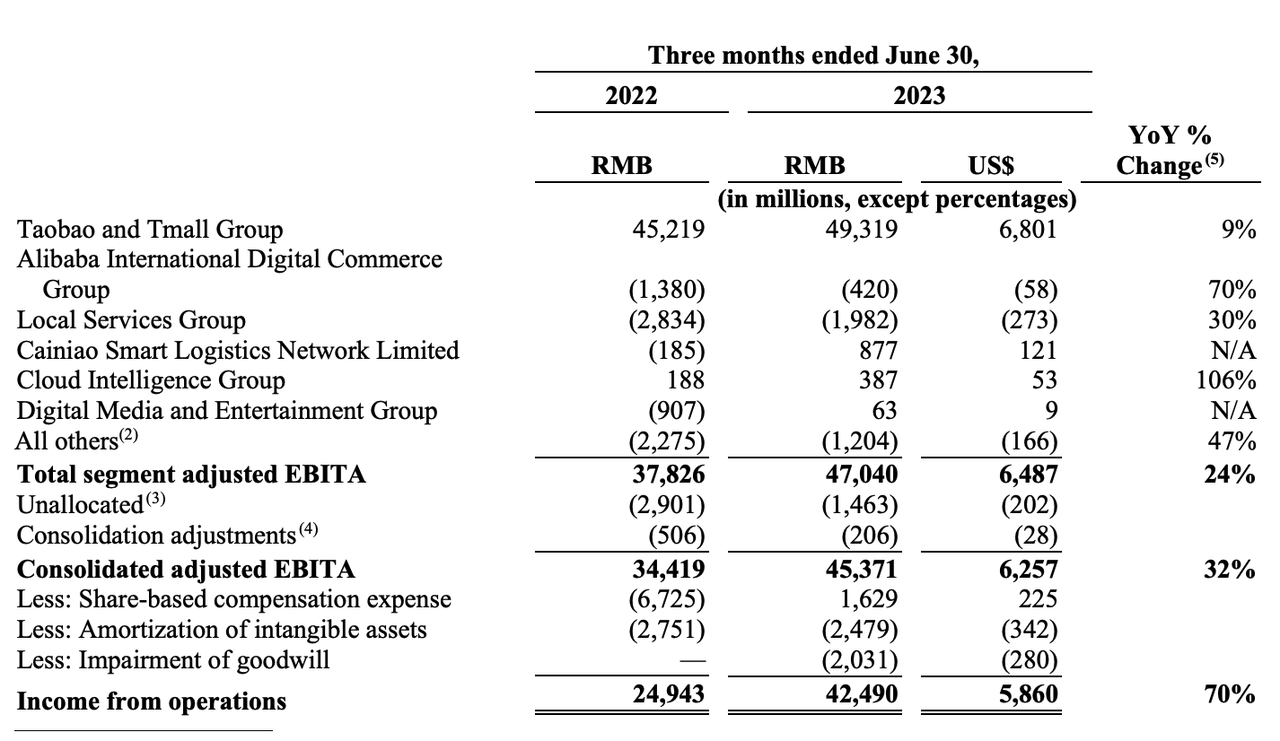

Does this constitute ‘absolute’ cheapness? Factoring growth into the equation, it does. While Seeking Alpha’s Quant ratings are sector-relative, some of BABA’s value metrics are also low in the absolute sense. Last quarter, Alibaba delivered 48% growth in net income and 76% growth in free cash flow. A lot of that growth came from lower expenses (the company began cutting costs early in 2022), but some of BABA’s segments had strong top-line growth too. The company as a whole grew revenue 14% last quarter, and the international segment grew revenue 70%. If Alibaba can keep growing its international segment at the pace it has been growing it, then that segment will eventually become a massive contributor to the company’s results.

Alibaba earnings (Alibaba)

As you likely know, the markets have not recognized Alibaba’s growing earnings and free cash flows. The stock is down 13% for the year, and many commentators think it has further still to go. True, the stock has recovered admirably from its October 2022 low (about $60), but that’s little consolation to those who bought at, say, $200.

Still, there are reasons to think that Alibaba is a good buy at its current level. As I mentioned at the start of the article, BABA has tended to bounce back after reaching the levels it’s currently at. Secondly, the company now has the full backing of the CCP when it comes to buybacks. It was long thought that China took a dim view of buybacks, because the government preferred that companies spend their money on social causes. Now, however, the CCP is explicitly telling firms to be net buyers of equities. In other words, the party approves of moves that stimulate stock prices, of which buying back stock is an example.

Taking into account the stock’s valuation, the company’s profitability, and the current priorities of China’s government, Alibaba looks unlikely to remain at today’s extreme lows. All it would take would be a ramped-up buyback to take BABA out of its current slump, and the company’s management has all the approval in the world for such a move. For these reasons, I’m currently extremely bullish on Alibaba stock – and will become even more bullish on it should it move lower.

Plenty of Dry Powder for Buybacks

When a stock is cheap compared to the underlying company’s earnings and cash flows, then the company can deliver more value to shareholders than would otherwise be possible. A company’s earnings determine how many dividends can be paid and how large of a buyback can be done. The multiples to those earnings and cash flows determine what percentage of the individual shareholder’s wealth is “returned” to him/her by the dividend or buyback. In Alibaba’s case, the company has a large amount of cash on its balance sheet and is generating significant cash flows on a periodic basis.

First up, the balance sheet cash. At the end of last quarter, it stood at $31 billion, enough to buy back 15.2% of the company’s market cap (ignoring the effects of purchases driving the price up).

Second, the annual free cash flow generation. There are different ways of calculating this. As I showed in a recent Tweet, Seeking Alpha’s FCF calculation for BABA is more stringent than the company’s own calculation. So, using Seeking Alpha’s FCF estimate (the lower estimate), we have $15 billion in FCF in the trailing 12-month period. That plus the balance sheet cash takes us up to 25% of the current market cap that Alibaba could buy back in the span of a year!

Of course, Alibaba is not actually using all of its balance sheet cash and annual free cash flow. The company is buying back shares, but the pace of buybacks has only been about $2.5 billion per quarter. Nevertheless, with China explicitly asking its firms to buy back stock, we can infer that Alibaba will at least feel comfortable ramping up its buybacks should it choose to do so.

The Return of Growth

As I showed in the previous section, Alibaba has enough cash on its balance sheet, and produces enough free cash flow annually, to measurably improve the value of its shares. That’s an encouraging fact, but on its own, it doesn’t mean much. A company having a large buyback authorized doesn’t mean that it will use every penny of the authorized amount, and as far as effects on stock prices go, buybacks can be offset by selling from other shareholders.

So, we need to look at Alibaba’s growth prospects.

As you might already know, BABA’s double-digit growth returned in the most recent quarter, coming in at 14% after several quarters of 0% or low-single-digit growth.

So, BABA got its revenue growth back last quarter, and the earnings/FCF growth was even stronger. That looks good, but it was just one quarter’s worth of results. We need to know whether Alibaba’s management can keep it up. The FOREX was very favourable to Alibaba in calendar Q2 (the dollar depreciated), but not in Q3 (the dollar strengthened). What this means is that BABA can’t rely on its Yuan revenue increasing in value upon translation to USD – particularly in the sequential comparisons. So, Alibaba will need strong organic growth.

Will it be able to achieve such growth?

The macro seems to suggest that it will. China’s GDP grew 4.9% last quarter, its retail sales grew 5.5% (beating expectations).

Corporate earnings tell a similar story. Nike’s (NKE) China sales grew 5.5% year-over-year last quarter, suggesting strong demand for apparel (a category that BABA is strong in).

Finally, Alibaba’s competitive position suggests that it may be able to grow well into the future. While much ado has been made about Alibaba’s competition with JD (JD) and PDD Holdings (PDD), those companies don’t compete head-to-head with BABA in all of its markets. Both JD and PDD are in the domestic Chinese market and competing with Alibaba. JD is not very active in international markets, and PDD only competes with BABA in a handful of the latter’s markets. So, the “head-to-head” competition that Alibaba faces worldwide is not overly intense.

Basically, we have several indicators pointing to the possibility of BABA continuing to grow. It does face competition, but not an endless amount of it, and China’s economy is slowly but surely getting back on its feet. This points to Alibaba having a future that’s brighter than its recent past.

The Ever-Present Risk

Despite all of the things Alibaba has going for it – they’re manifold if Quant’s “strong buy” rating is any indication – the company is subject to one serious risk factor:

Geopolitics.

Alibaba is a Chinese company, and the U.S. and China have been at odds with each other for the last several years. Most of the U.S./China disagreements are basically immaterial to Alibaba, but one is a source of potential risk:

The Status of Taiwan. Taiwan is a de facto independent country. It’s not recognized as one by the United Nations, but it behaves like one in practice. China does not want Taiwan to declare formal independence. It aims to re-unify with the Island Nation, which was once part of its territory. The U.S. does not want this to happen, as much of the world’s semiconductor manufacturing takes place in Taiwan. Were the U.S. and China to go to war, the consequences for Western shareholders could be extreme. Potentially, brokers would suspend trading in Chinese ADRs, China might ban Westerners from Hong Kong, and the physical war itself could knock out the infrastructure that Alibaba needs to carry out its business. So, the rail risk is pretty extreme here.

However, Alibaba is not alone in being exposed to geopolitical risk stemming from Taiwan. Over 90% of Apple’s (AAPL) manufacturing is done in China, a smaller proportion of Tesla’s (TSLA) manufacturing is there, and countless Amazon (AMZN) products come from China. There are few global companies that wouldn’t be hit hard by the fallout from a Taiwan war. Therefore, Alibaba’s total risk in this situation is as much about market risk as specific risk; the stock is not “uniquely” risky. Given the strength of the company’s fundamentals and the cheapness of its stock, then, it’s as intriguing a buy as any other “outrageously cheap” value name in this turbulent market.

Read the full article here