Key takeaways

- Big banks have collectively laid off over 20,000 employees, with more rumored to be on the way in the coming months

- The news comes as several of the major banks have performed well financially in the third quarter

- JPMorgan Chase is the only major bank to see positive headcount growth in 2023

Even if others are making positive noises about the economy’s resilience, apparently, the banking sector doesn’t share the enthusiasm. Almost all of the major banks in the U.S. have been quietly cutting headcounts, with some indicating during earnings season that more job losses could be on the way.

It might seem like an odd move, especially given so many of the big banks performed well during the third quarter, with many seeing profits up. But on the flip side, the regional banking sector is still struggling – so the major banks are trying to shore up their businesses ahead of time amid a change in consumer habits.

Here’s the latest about the big banks’ layoffs and how the major banks performed during the third-quarter earnings season.

What’s happening with the big banks?

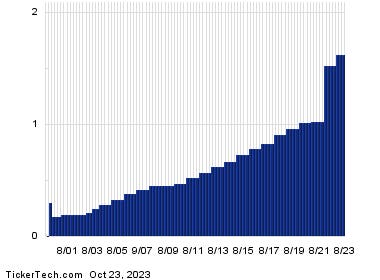

Regulatory filings have revealed that the major U.S. banks have laid off a combined 20,000 workers since the start of the year.

The biggest drops in staff headcount have been at Wells Fargo and Goldman Sachs, with both cutting around 5% of their workforce. Wells Fargo has confirmed more job losses are on the way, having already slimmed down the organization by 50,000 in the last three years, with CFO Mike Santomassimo commenting that “very few parts of the company” will be spared from the axe.

Goldman Sachs has said it doesn’t anticipate another mass layoff round like the bank experienced back in January, where over 3,000 employees were fired, but still intends on reducing its headcount by a further 1% to 2% in the coming weeks. The bank has also made plans to divest its consumer banking business, including selling off fintech lender GreenSky.

Morgan Stanley has lost around 2% of its overall workforce since the start of the year, while Bank of America’s headcount has fallen by 1.9% despite hiring for over 12,000 positions in 2023.

Citigroup may also have some deep job cuts ahead as CEO Jane Fraser continues her plans to completely overhaul the company structure, with over 7,000 potential job losses already identified. Plans to sell off the bank’s overseas retail operations will also further lower headcount.

The only outlier is JPMorgan Chase, which has over 10,000 open positions and has grown its headcount by 5.1% this year alone. Part of that has been thanks to acquiring First Republic after its dramatic collapse in the spring.

How did the big banks perform during earnings season?

The layoffs come as the major banks reported better-than-expected earnings for the third quarter but warned that cautious consumer behavior was another sign of the economy slowing.

JPMorgan saw its net interest income rise by 30% to $22.9 billion and raised its full-year forecast to $89 billion, a $2 billion upgrade from its previous net interest income estimate. Taking away First Republic’s impact, the NII rise was still 21%. JPMorgan’s stock was up 1.6% at the news.

Meanwhile, revenue at Wells Fargo climbed to $20.86 billion, up 7% from the previous year, and net interest income was up 8% to $13.11 billion. But Wells Fargo leadership was still keen to stress there were clouds on the horizon. “While the economy has continued to be resilient, we are seeing the impact of the slowing economy with loan balances declining and charge-offs continuing to deteriorate modestly,” CEO Charlie Scharf commented in a statement. Shares in the bank rose by 3.1% after the earnings report.

Citigroup’s turnaround showed glimmers of hope after the bank reported better-than-anticipated revenue of $20.1 billion, but credit costs also increased to $1.8 billion – a 35% increase from last year’s quarter. The bank said this was due to “continued normalization in net credit losses”.

It wasn’t the only bank to remark on the changing consumer landscape. Wells Fargo said it saw increased loans being written off in its credit card portfolio, and regional lender PNC Financial Services saw an uptick in consumer loan delinquencies.

But perhaps it’s not all doom and gloom. JPMorgan economists have revised their outlook for the U.S. economy to reflect modest growth in the first couple of quarters in 2024, instead of a mild recession as predicted by others.

The bottom line

The big bank layoffs are a sign of the times: businesses are uneasy about cash flow in a high interest rate environment, so layoffs are the answer. For the banks, a worrying rise in credit card and loan delinquencies will be one for investors to watch in the coming months.

Read the full article here