Novo Nordisk (NVO) stock is up more than 30% YTD after having already tripled since 2020.

Seeking Alpha

Despite the stock’s fantastic past share price performance, I continue to see upside in NVO stock. In fact, as I see Novo Nordisk doubling revenues by 2027, and generating $100 billion in revenues by 2030 on a greater than 30% EBIT margin, my valuation model suggests that Novo Nordisk may be more than 50% undervalued. On the backdrop of surging demand for diabetes and obesity care, with an annual TAM potential of $350-450 billion by 2030, I see Novo Nordisk becoming the first European Champion topping the one trillion dollar market capitalization benchmark. Strong Buy.

A Focused Pharma Company

Novo Nordisk is a Danish pharmaceutical company that operates in more than 170 countries. The company’s primary focus is on diabetes care and other serious chronic conditions, such as obesity, hemophilia, and growth hormone therapy. In that context, Novo Nordisk has a broad portfolio of pharmaceutical products, ranging from insulin products (NovoLog, Levemir, and NovoMix) to GLP-1 Receptor Agonists treating type 2 diabetes (Victoza, Ozempic, and Rybelsus) to hemophilia treatments (NovoSeven and NovoEight), obesity treatments (Saxenda), and hormone replacement therapy products.

Novo Nordisk

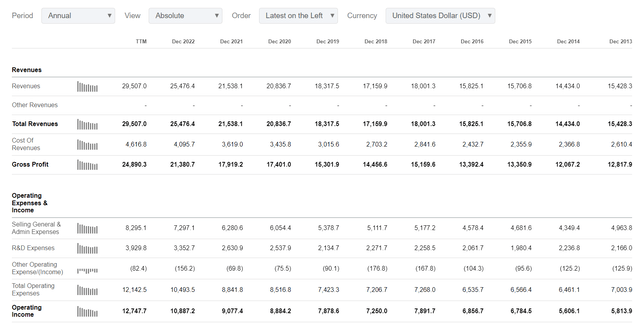

With a focus on treating metabolic diseases, Novo Nordisk has positioned itself in the “bulls-eye” of the global pharma market, as evidenced by the company’s long-standing, strong track -record of revenue growth and value accumulation: Over the past decade, Novo Nordisk has managed to grow its topline every single year since FY 2014, more than doubling the company’s revenue base from $14.4 billion in 2014 to $29.5 billion for the trailing twelve months, an implied CAGR of close to ~8%. In the same period, a similar trend is notable for gross profit and operating income, with compounded annual growth rates of ~8% and ~9%, respectively.

Seeking Alpha

Growth Outlook Is Very Promising

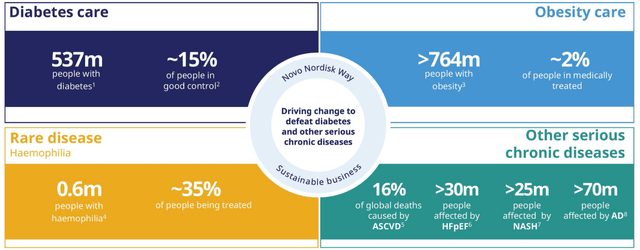

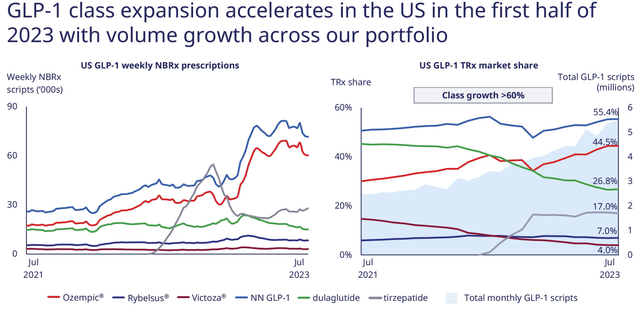

Novo Nordisk’s growth prospects are promising, with the company’s market share in obesity care growing rapidly over the past few years. With that frame of reference, it is worth pointing out that the obesity market is expected to exceed $100 billion by 2031, according to Jefferies, with likely additional, material upside depending to what extent obesity can be linked to broader health issues. In August, for example, Novo Nordisk successfully proved that Wegovy, the company’s weight-loss-drug, reduces the risk of cardiac events like heart attacks by approximately 20%. More recently, it has also been suggested that Novo’s GLP-1 franchise may support kidney health.

According to Novo Nordisk itself, the full future potential of the obesity care market may actually be much larger than what Jefferies estimated — referencing 764 million people diagnosed with obesity health issues, of which only 2% are currently medically treated, according to Novo Nordisk estimates. In fact, projecting that every obesity patient equals approximately $12,000 in annual revenue, in line with past spending on obesity drugs per patient, and estimating that about 4-5% of the market is serviceable with obesity drugs by 2030 (as compared to 2% currently; discounting for affordability, willingness to take drugs, insurance coverage, as well as access to treatment), the global obesity market may reasonably be estimated at $350-450 billion, annually.

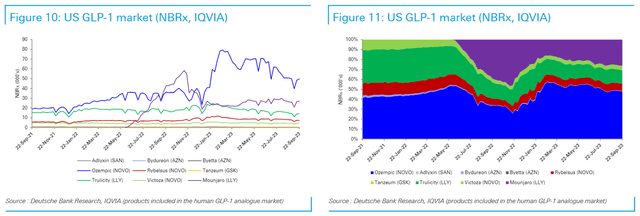

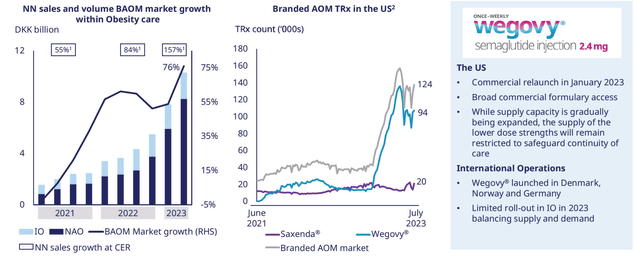

Novo Nordisk

If my market sizing is correct, and assuming that Novo Nordisk does not lose more than 20-25 percentage point market share in the GLP-1 market (taking U.S. market as enclosed as the benchmark), then Novo Nordisk’s FY 2030 potential for the company’s GLP-1 franchise would top $100 billion. Now, in my opinion, assuming a 20-25 percentage point market share loss is very pessimistic already; and thus, my estimate should carry risk to the upside.

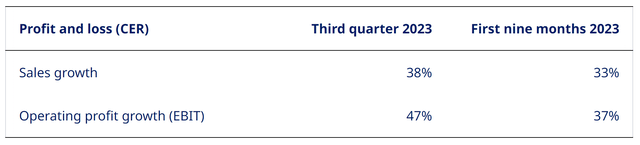

Deutsche Bank research, IQVIA

Again expanding on Novo Nordisk proprietary estimates, it is worth pointing out that the company’s management targets a 30% group CAGR through 2025. That said, it is worth noting that Novo Nordisk quarterly results reveal a strong tendency of underestimating the company’s future growth, as suggested by 7 upward revision in sales guidance over the past 12 quarters. In fact, only recently (13 October), Novo raised sales growth and earnings guidance once more, after raising in August with Q2 reporting, commenting on the exceptional strength of the GLP-1 franchise:

The sales outlook for 2023 is updated, primarily reflecting higher full-year expectations for Ozempic® volumes sold in the US and gross-to-net sales adjustments for Ozempic® and Wegovy® in the US.

For Q3 2023, Novo now expects sales growth and EBIT growth of 38% YoY and 47% YoY, respectively.

Novo Nordisk

In my opinion, it is reasonable to estimate Novo Nordisk’s compounded annual growth for GLP-1 closer to ~28-30, if the company can manage supply chain limitations. Just to give some context, in FY 2021, FY 2022, and FY 2023, obesity sales actually jumped YoY by 55%, 84%, and 157%, respectively. Needless to say, these numbers do not suggest a slowing in growth rates, but an acceleration.

Novo Nordisk Novo Nordisk

Residual Earnings Model

Novo Nordisk stock does price a lot of optimism, trading at a forward P/E of approximately 37x. However, the optimism is still underestimating Novo’s potential. There have been many stocks that were a bargain at similar valuation metrics, at similar market capitalization (Nvidia, Microsoft, Apple, Tesla, to name the most notable); and I believe Novo is one such opportunity.

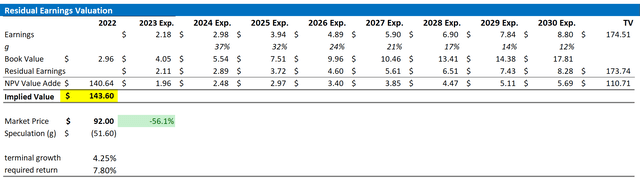

To back up my confidence, I have constructed a residual earnings model for NVO stock. The residual earnings model anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With that said, for my Novo Nordisk stock valuation model, I make the following assumptions:

- To forecast 2025 sales, I anchor on my previously discussed 30% CAGR growth estimate; I see $100 billion for 2030 on a 25-30% market share in the $350-450 billion obesity care TAM.

- To estimate the capital charge, I anchor on NVO’s cost of equity at 7.8%, in line with the CAPM model.

- For the terminal growth rate after 2025, I apply 4.25%, which I believe is a reasonable estimate post-2030, as my obesity care SAM estimate by 2030 only references about 30% addressability.

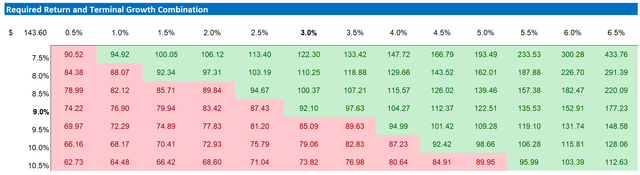

- Investors with different assumptions regarding NVO’s cost of capital and terminal growth may take reference from the sensitivity table enclosed.

Given the above assumptions, I calculate a base-case target price for Novo Nordisk of about $143.6/share, discounted to 2023 value. (Repricing up to 2028, Novo’s valuation would break the $1 Trillion market capitalization benchmark).

Company Financials, Author’s EPS Estimates; Author’s Calculation

As promised, below is also the sensitivity table, testing various terminal growth rate and cost of equity assumptions.

Company Financials, Author’s EPS Estimates; Author’s Calculation

Thoughts on Risks

Investing in Novo Nordisk enormous potential is not without risks. Specifically, investors should note that the pharmaceutical industry is subject to rigorous regulations that can affect pricing, reimbursement, and drug approvals. In that context, the faster Novo Nordisk’s addressable market is growing, the more are healthcare systems/ governments motivated to regulate pricing. In addition, increasing competition in diabetes and obesity care market must not be ignored. Considerations about competition are especially noteworthy in the context of the success of Eli Lilly’s (LLY) Mounjaro. Moreover, Novo Nordisk’s growth outlook may be constrained by supply limitations, as the company may struggle to meet the enormous, surging demand for its obesity drug, Wegovy. Finally, broader market conditions and economic factors can also influence Novo Nordisk’s stock price.

Conclusion

Novo Nordisk’s stock has enjoyed an enormous growth tailwind from obesity care, providing investors with impressive multi-year gains. Despite this remarkable performance, however, the Danish pharma company appears to still have significant upside potential. The company’s GLP-1 franchise is a key driver of this growth, with a potential TAM of $350-450 billion by 2030. Anchored on this, my projections suggest that Novo Nordisk could double its revenues by 2027 and achieve $100 billion in revenues by 2030, with a stable EBIT margin above 30%. This analysis, in combination with a residual earnings model, implies that the stock may be undervalued by more than 50%. Novo Nordisk stock is a Strong Buy on an exceptional growth outlook and product strength.

Read the full article here