The Company

The Westaim Corporation (TSXV:WED:CA) (OTCPK:WEDXF) is a $500-million market cap private equity firm based in Toronto, Canada. They specialize in various types of investments, including direct and indirect acquisitions, joint ventures, and fund-of-fund investments. They focus on a wide range of investment stages, from early venture to buyout transactions, primarily within the global financial services industry.

Westaim often acquires controlling interests in businesses and invests in both public and private companies with the goal of long-term capital appreciation and wealth preservation. They also offer advisory services to their portfolio companies, assisting with capital allocation, financing strategy, performance measurement, and mergers and acquisitions. Additionally, they collaborate with third-party capital providers to support their acquisitions and typically hold investments for 7-15 years.

As of the latest reporting date, the company’s principal investments consist of Skyward Specialty, Arena FINCOs, and Arena Investors:

Westaim’s IR materials As of March 30, 2023 [Westaim’s 10-K]

![As of March 30, 2023 [Westaim's 10-K]](https://quickyincome.com/wp-content/uploads/2023/10/49513514-16980378535566568.png)

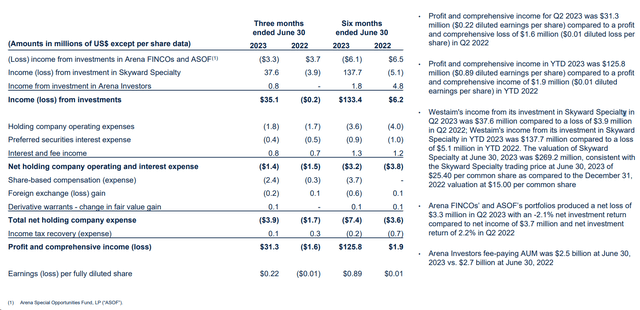

As I can see, The Westaim Corporation reported a mixed performance across its investment holdings in Q2 2023.

Arena Investors, an important part of Westaim’s portfolio, saw its net income improve significantly in Q2 FY2023, reaching $1.5 million, compared to just $0.1 million in Q2 FY2022. However, the year-to-date income decreased to $3.5 million from $9.4 million in FY2022. Arena Investors managed a committed AUM of $3.3 billion, with $2.5 billion in fee-paying AUM – that’s 5.7% and 7.4% lower than in June 2022, respectively.

Arena FINCOs experienced a dip in performance: In Q2 2023, they reported a net loss of $3.3 million, whereas they had an income of $3.7 million in the same quarter the previous year. For YTD FY2023, the net loss was $6.0 million compared to a net income of $6.3 million in FY2022.

Skyward Specialty (SKWD), another significant holding of Westaim, showcased strong growth. They reported a robust net income of $19.5 million in Q2 2023, up from $5.1 million in Q2 2022. YTD 2023 showed even more impressive results, with a net income of $35.0 million compared to $21.4 million in YTD 2022. The underwriting performance remained solid with a combined ratio of 92.0% in Q2 2023.

For Westaim itself, Q2 2023 marked a remarkable turnaround. They reported a net profit of $31.3 million, a stark improvement from a net loss of $1.6 million in Q2 2022. The year-to-date performance was even more striking, with a net profit of $125.8 million in 2023 compared to just $1.9 million in FY2022. Westaim’s financial strength also improved, with a book value of $473.5 million at the end of June 2023, marking a significant increase from their December 31, 2022, book value of $363.2 million.

Westaim’s IR materials

Westaim capitalized on its strong cash position by settling preferred securities liabilities and initiating share buybacks. In Q2 2023, they also sold 3,987,500 Skyward Specialty common shares [it went public in January 2023] and received substantial cash distributions from both Arena FINCOs and Arena Investors.

Overall, I like the assets of Westaim, their structure, and ownership stakes.

Arena Investors has successfully deployed ~$5.2 billion into over 360 privately negotiated transactions, with 203 exited transactions. These investments have yielded a realized gross IRR of 15.3%, with a track record of positive results in 82 out of 93 months since inception. The company’s AUM has experienced impressive growth, with a compound annual growth rate of around 44% from December 31, 2015, to June 30, 2023, reaching $3.3 billion in AUM. Arena Investors looks to be strategically positioned for significant operating leverage in the future as their fee-paying AUM continues to expand, driving valuable fee-related earnings and cash flow for distribution.

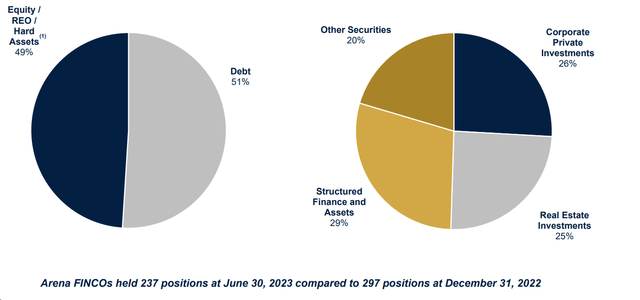

Arena FINCOs play a pivotal role as Westaim’s proprietary capital, and they invest in Arena Investors’ core multi-strategy initiatives. It’s actively managing its portfolio by using secured notes and a revolving credit facility, which helps optimize its treasury management and reduce the impact of cash drag. Their portfolio composition, with 49% in equity/REO/hard assets, contributes to fair market value volatility, resulting in unrealized net gains.

Westaim’s IR materials

The last holding in Westaim’s portfolio – Skyward Specialty – is a rapidly expanding and innovative specialty insurance company, whose strategic focus is on establishing strong positions in high-profit niche segments to consistently deliver top-quartile returns. The company’s success is driven by a team of top talent dedicated to disciplined underwriting, claims excellence, and efficient capital management. They operate across all 50 U.S. states and select international markets, boasting an AM Best rating of “A-“. As of June 30, 2023, Skyward Specialty had a workforce of 477 employees spread across nine offices.

But what about Westaim’s valuation?

The Valuation

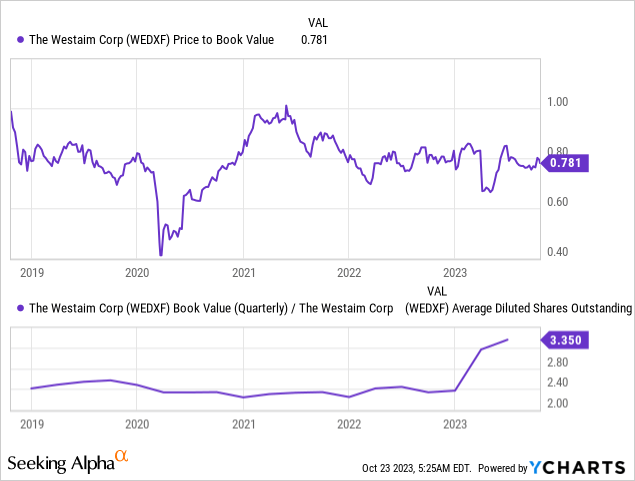

Due to the rapid growth in book value since the beginning of the year, Westaim shares are now trading at a price-to-book ratio of 0.78, which makes Westaim look quite cheap at first glance.

Since Westaim is a financial holding company so to speak, it’s best to use price-to-earnings ratios for analysis rather than metrics like EV/EBITDA or price-to-sales. This is because the concept of debt is different in the financial industry in the first case, and revenue in the traditional sense doesn’t work as a financial metric in the second case.

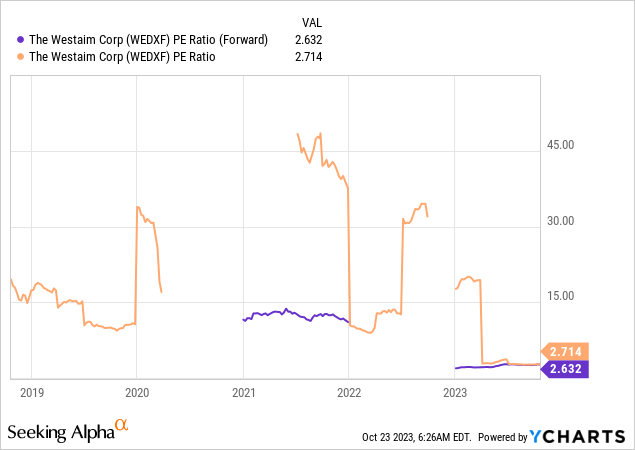

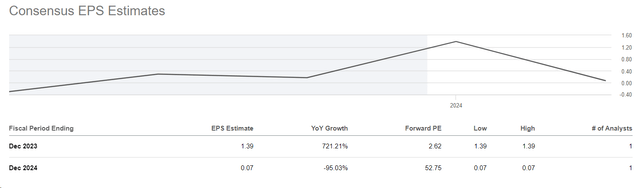

Looking at the forwarding P/E ratio, Westaim is trading at only 2.6x, which in itself is very low and well below the stock’s long-term average (even though the pattern looks quite volatile):

If the company’s business continues to move in the right direction – and it already has, otherwise Westaim’s stock wouldn’t be up > 40% – then I expect it to rise to 5 times P/E, which means great growth potential. At the same time, this is a rather risky idea, because analysts believe that the increase in earnings per share won’t last long. More specifically, Wall Street consensus data forecasts a sharp decline in EPS in FY2024, which seems like something of an anomaly to me.

Seeking Alpha

I couldn’t find a clear explanation for why that 1 analyst thinks that Westaim’s EPS will drop by 95% next year. So I think this anomaly is too pessimistic, which explains the current price/earnings ratio of 2.6x.

I tried to find another source for Westaim’s EPS consensus numbers, but due to the company’s origin (Canada) and its relatively small market cap, this was not possible. I had to resort to the help of Google AI assistant (Bard), which displayed completely different forecast figures:

Google’s Bard, author’s notes

Author’s notes: As of this writing, I do not have access to Bloomberg Intelligence, so I cannot verify this data.

The Bottom Line

Every investor should be aware that in the case of Westaim, he/she is first of all buying a rather risky asset that may behave completely unpredictably in the foreseeable future. Arena Investors – one of the biggest assets of Westaim – is an investment firm, which means that it is exposed to the risk of investment losses. If Arena Investors makes poor investment decisions, it could lose money for its investors, including Westaim.

Westaim’s success is heavily dependent on a small number of key executives, including Cam MacDonald, Dan Zwirn, and Stephen Way. The loss of any of these individuals could have a negative impact on the company’s performance.

Also important to keep in mind, is that Westaim is a holding company with a relatively concentrated portfolio. This means that a value-destructive acquisition by one of its subsidiaries could have a significant impact on Westaim’s shareholders.

But despite all the risks, Westaim seems to me to be quite favorably positioned precisely because of its high concentration on only a small part of its assets, which makes its management more effective in difficult times. Moreover, the stock is trading at a discount to book value and at less than 3 times earnings. Of course, that may change in the future, but even if EPS falls by 3-4 times, the P/E ratio will still remain very low. In my opinion, this provides investors with a kind of safety margin.

That’s why I rate this hidden Canadian small-cap alternative asset manager a “Buy.”

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here