With interest rates on the rise, it is no surprise that producers of high ticket consumer items (boats, RVs, cars) are under pressure. In this writeup we will focus on the market for sports boats, in particular on Brunswick (NYSE:BC), who is the manufacturer of the popular Mercury outboard engine, as well as of a host of boat brands such as Sea Ray and Boston Whaler.

Boats can often be financed on ~20 year mortgages, and higher interest rates are therefore pushing up the cost of ownership, at the same time that consumer discretionary income is under pressure. In addition, the high inflation of the last 2 years has already put boats outside of the price range of many consumer.

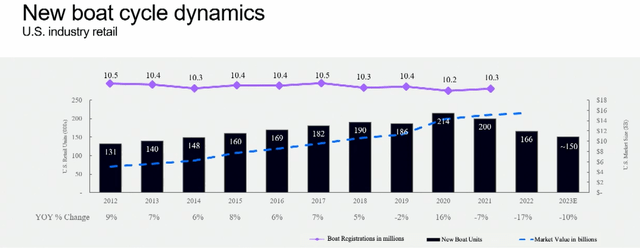

Fortunately for Brunswick, the weakening macro can be offset by 2 things: strong market share gains and a high percentage of predictable after-market sales. In fact, despite boat sales being down to levels last seen in 2014, BC’s 2023 EPS of $9.50 are only modestly below last year’s record level of $10.03. They would have been in line if it wasn’t for an unfortunate IT incident.

Brunswick Investor Day Slides 2023

Market share gains

First of all, Brunswick has been gaining market share on their main propulsion peer Yamaha (OTCPK:YAMCF). In the Q1 2023 earnings update, BC stated they have gained 600bps of market share in the US in the last 5 years. US market is around 47%, with a target of reaching 50% by 2025. Global market share is a little lower at 35%. Traditionally, Yamaha is stronger in salt water, whereas Brunswick is stronger in fresh water. Their fresh water market share might be closer to 80%. However, on field trips to a MarineMax (HZO) dealership, the dealer insisted on selling me either a Sea Ray or Boston Whaler with a Mercury engine. Even when pushing the dealer to sell me Yamaha (“I was told that Yamaha is better for salt water”), the sales guy insisted on selling me Sea Ray or Boston Whaler because of the 3 year corrosion warranty that Mercury offers, on top of the higher torque. Admittedly, this was before Yamaha launched their new V8 450hp engine.

The fact that boat propulsion is effectively a duopoly with Yamaha and Mercury owning around 80% of the market is due to the need to provide after-market support which requires distribution of spare parts and strong dealer relations. The remaining 20% is made up of players like Honda and Suzuki, who do not have as many boat servicing points.

The reason that Mercury has been gaining share is due to its higher investment in R&D. They are for instance the only manufacturer with a V12 600hp engine. In a world where boats need to be stronger and faster, that’s quite a game changer.

Brunswick also saw only minimal disruption to its supply chain in the last 3 years, which speaks to the quality of management. This has brought them even more market share gains.

Recurring earnings

Second of all, about half of Brunswick’s earnings are considered recurring. As most boat owners will know, boats require a lot of maintenance. Generally, an engine needs maintenance after 100 hours, or one per year, whichever comes first. This costs around 1200 USD per engine per year. Brunswick openly states that 42% of sales and about 50% of earnings is recurring. Other than Parts & Accessories, this also includes earnings from the Freedom Boat Club. You have to handicap that figure a little because Brunswick includes the sale of navigation devices, which I consider a discretionary purchase. The point remains though: a large portion of earnings are recurring and worthy of a higher multiple.

Self-help initiatives

There are also various self-help initiatives that help Brunswick’s earnings. In Q4 2022 Brunswick added new manufacturing capacity for high horse power engines in Fond du Lac. As a consequence, Q1 2023 saw EBIT margins for this segment jump by almost 330 bps to 20.1%.

Brunswick’s ‘Freedom Boat Club’ also continues to grow its member base and number of locations. This boat sharing club, where you can become a member for around $5k per year, is a great way to get people into the boating life style. Supposedly a high percentage of members ends up buying their own boat at some point in their life, although I have never seen good data supporting this argument.

One of the headwinds has been the acquisition of Navico, a manufacturer of boat navigation. Brunswick arguably overpaid for this business. The integration of this business also comes at a time that retailers are in destocking mode in anticipation of a weaker market. Brunswick still has some steps to take when it comes to rightsizing Navico’s manufacturing footprint.

Conclusion

The investment thesis for Brunswick is simple. In a market with declining boat sales they can keep earnings steady due to market share gains, a high percentage of recurring earnings, and various self-help initiatives. At some point the market will recover and earnings will be meaningfully higher. They target $15 EPS by 2027. Brunswick has historically traded at ~13x earnings and I think the quality of the business has gone up over the years. They are also currently displaying their earnings resilience in a weak market, which also warrants a higher multiple. When the market recovers and you combine higher EPS with a higher multiple, there is >200% of upside in this stock (15 EPS * 14 P/E = $210, versus $72 today). You can improve your IRR by timing the market recovery, or you can take the long-term view given the magnitude of the upside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here