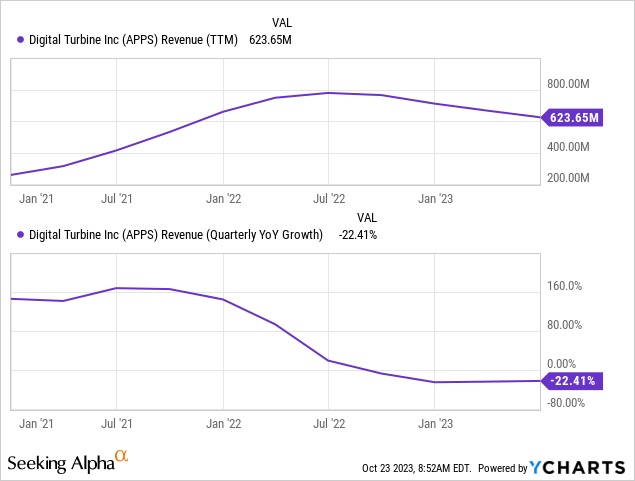

Digital Turbine (NASDAQ:APPS) has been in the doldrums for much longer than we envisioned a year ago on a combination of a soft digital ad and device market. We are especially disappointed with the lack of growth of their long-term growth drivers like SingleTap, and could not foresee the loss of a client in their content media business (T-Mobile).

These forces have conspired to turn a growth company into one with declining revenues, although Q1 produced some sequential growth so the worst might be behind us.

It’s now pretty clear management either oversold the opportunity of their growth initiatives as well as the integration advantages of the three ad companies that were acquired at top dollar a couple of years ago, as we can’t see the results of both of them in the figures.

None of these growth initiatives have produced material results yet, although that could very well change next year but it’s understandable that investors are not jumping the queue to get back in.

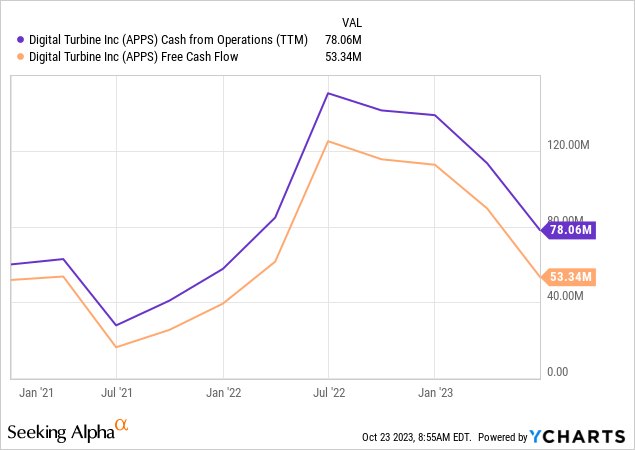

Nevertheless, it’s not all bad news. For instance, we should appreciate that even during this downturn the company manages to produce free cash flow with which to reduce its debt (a legacy of some large acquisitions a couple of years back) and invest in future growth.

The first quarter of FY24 showed a mixed bag, but there are some positive developments, so let’s start with these.

The good

- US RPD growth

- Sequential revenue growth

- Strong pipeline of new carrier and OEM partnerships

- Google partnership

- OpEx constant in dollar terms despite investment in growth

- Acquisition integration completed

- Cash flow and debt reduction

- Longer-term growth strategy comes into focus

- Inherent operating leverage if growth returns

- Barrier to entry; on hundreds of millions of devices, very interesting for advertisers, publishers, demand side platforms

- Investments will drop off at yearend and returns will start to emerge next year

In the US, RPD (revenue per device) keeps increasing (product growth, best square mile), from just over $2 in FY20 to $3 in FY21, to $4 FY22 to $5 FY23 and now (Q1 FY24) it’s over $6.

APPS IR presentation

This is mostly the result of having many more products to sell, as well as having the best real estate, and the privileged position of the home screen on hundreds of millions of mobile phones.

Management also sees possibilities to improve RPD for international markets (now 75% versus 25% US). The company announced a partnership with Google at the end of 2021 using Google’s Cloud and it was expanded in May 2023 to include SingleTap.

We will discuss the financials and the growth strategy below. First, a reminder.

Competitive advantage

Here is management (Q1CC):

we have this embedded base of many, many hundreds of millions of devices, and that’s extremely difficult for anyone to replicate.

Not only is it very difficult to replicate, it confers advantages such as:

- The software influences what users see on the prime real estate: the start screen of mobile phones.

- The software operates under the carrier or OEM’s user agreement producing a data advantage that enables more precise targeting and hence a higher ROI for advertisers.

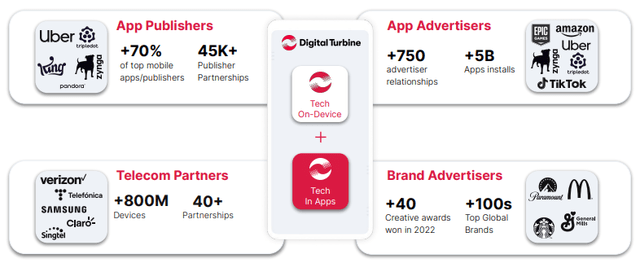

They used to publish roughly how many hundreds of millions, the last number they mentioned was 800M in the slide from the June/23 IR presentation below. Having agreements with OEMs like Samsung and carriers like Verizon, AT&T, Telefonica, and America Móvil.

APPS IR presentation

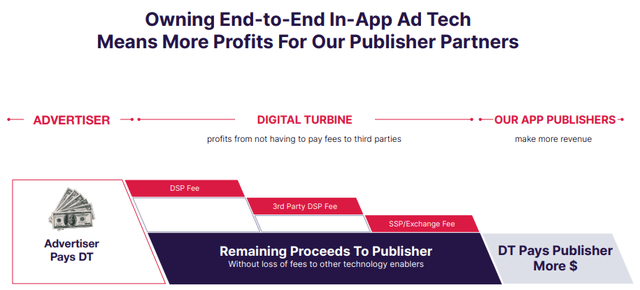

Additionally, the acquisition of Fyber and AdColony combines demand and sell-side (a bit like Perion’s iHub) taking out middlemen, which should also boost ROI for advertisers (a gain that can be shared with customers):

APPS IR presentation

Growth strategy

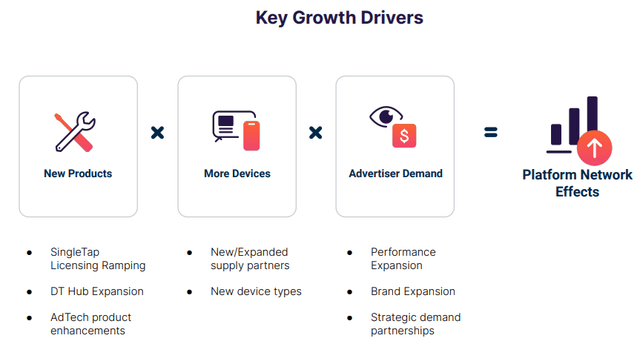

The company’s growth strategy is focused on three main planks

- DT Hub,

- Alternative app distribution

- SingleTap

Single Tap

ST is technology enabling single-click app installation, bypassing the app stores, and enabling up to 5x the returns on advertising due to higher conversions (turning ads into installations). In fact, in some cases, the returns can even be higher than that (see OTTO case study).

As the app store duopoly is in the crosshairs of regulators, especially in Europe with the Digital Markets Act coming into force on November 1, 2023. This enables third-party app stores and side loading, even if some uncertainty remains.

SingeTap can create no less than five different revenue streams and management will aggregate these so as not to confuse investors. We think by far the most important of these is licensing the technology (using it to generate revenue via its own DSP has been disappointing so far), as it creates by far the highest margins. During the Q4CC they said this:

Our install volume running SingleTap licensing was double in the March quarter from all of 2022, and our expectations are current June quarter will double the March quarter. We’re excited to have welcomed many top 25 grossing gaming customers such as PlayerX and FunPlus… we’ve made progress with multiple large social media companies and expect to have them begin the first pilots running SingleTap over their networks in the next few months. Bigger picture for SingleTap licensing, the product market fit is very strong.

So there seems to be some momentum here but even then they mentioned that it would take time for revenues to become material. Since they’re no longer going to split out revenue streams it’s a little hard to assess what has come of this.

What signaled further progress in the aggregate during the Q1CC, mentioned revenue from TikTok running SingleTap campaigns for their advertisers and a launch this quarter with LinkedIn which will use SingleTap to convert their mobile web users to its app. There was further mention of an upcoming pilot with (Q1CC):

with another large social media company across their entire user base here in the U.S. later this calendar year.

And then there is this, from The Verge:

Meta is planning to let people in the EU download apps through Facebook / Thanks to the EU’s Digital Markets Act, Meta sees an opening to compete with the app stores.

While not explicitly mentioned, there were persistent rumors for quite some time that Meta was piloting ST, although management didn’t confirm nor deny it during the Q1CC. It certainly looks like SingleTap and it’s difficult to imagine any alternative, as the plumbing behind app installation is quite complex (Q1CC):

there are some market pain points that need to be solved, such as at making it easy for the app publishers to port their app to a new version, managing the payments and advertising inside the application, installing the apps without friction as there may not be a store involved at all; and managing the curation of the applications. And these are all things that Digital Turbine is uniquely positioned to deliver on

There was also another interesting tidbit in that Verge article:

Meta isn’t alone in wanting to become a distributor of mobile apps when the EU’s DMA goes into effect. In March, Microsoft said it hoped to launch an alternative app store for games on iOS and Android in Europe next year.

DT Hub

Given the regulatory tailwind and company capabilities the company is very well-placed to offer app-store solutions, from the Q1CC:

We believe we’re uniquely positioned with our on device technology, our expansion of publisher relationships, and our operator in OEM relationships. We’ve launched our first alternative app distribution products, which we brand as DT Hub with four operators here in the United States, leveraging our Aptoide investment and are generating revenue today.

So this is another growth initiative that has been set in motion, it has launched a games hub with UScellular, for instance.

Again, it will take time for revenues to become material. Management sees higher RPDs for these stores, produced by a combination of incremental app purchase revenue and lower cost per installation.

In-App advertising and purchasing

Another growth initiative that isn’t producing material results yet, but certainly with the potential to do so in coming years (Q1CC):

We have not started leveraging our in app advertising assets into this alternative app distribution, but we do expect to add that as an additional revenue stream to this opportunity. And then all three of these monetization capabilities being drivers of RPD accretion into the future.

The bad

There are also some negatives

- Revenue is still contracting

- No new OEM or carrier agreements yet

- Soft device market

- Loss of TMUS content business and some AdColony revenue

- Rising interest cost

While there were no new carrier or OEM partnerships, management argued that they have a strong pipeline which they think can help offset macro weakness.

Finances

As explained above, growth has still not returned albeit sequentially things improved a little with revenue up 4% q/q and nearly 10% up for their AGP (app growth platform) segment due to rising eCPM’s, which is good news:

We’ll have to see whether this is the first green shoot and the beginning of a new uptrend. We haven’t seen much in the way of a new significant OEM or carrier partner, but apparently, they have a good pipeline here (Q1CC):

we expect a strong global pipeline of expanding telcos and OEM relationships to help offset any macro weakness in device sales in the future.

The declining revenue is the result of softness in the ad and device market, and the loss of T-Mobile for its content business (with Verizon and AT&T not making up the loss, at least not yet). They also eliminated some Ad Colony businesses.

However, the loss of T-Mobile’s content business should lap in Q3 and the decline in Ad Colony business should lap in H2, which (other things equal) sets the stage for y/y revenue growth next year.

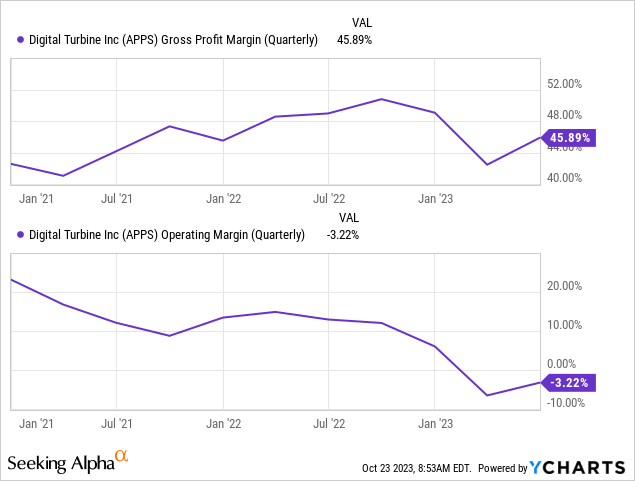

Gross margin recovered a little sequentially on product mix and management expects long-term margin expansion as the new products gain traction:

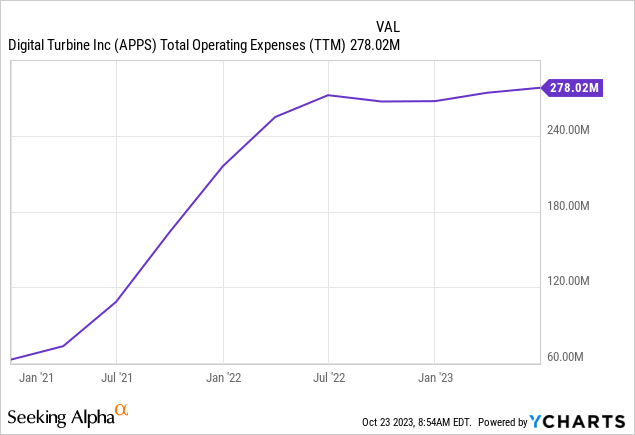

What the company has managed to do is keep OpEx relatively constant in dollar terms (cash operating expenses were 29% of revenue in Q2):

The company still produces considerable cash flow, although not as much as last year:

Which enables it to pay down debt and invest in new capabilities, which they say they are doing. The company had $58.6M in cash and $408M revolver debt.

Valuation

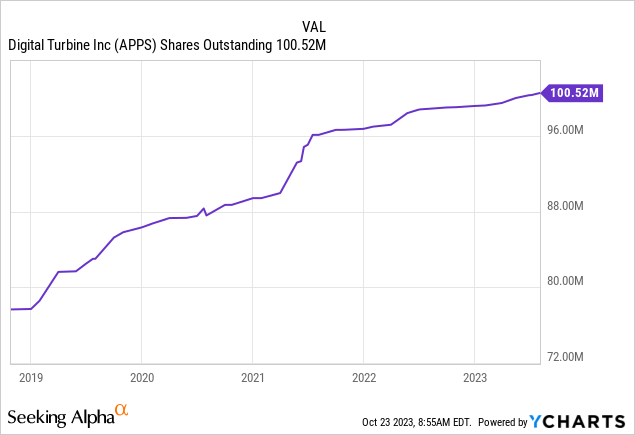

The acquisitions (Fyber, AdColony, Appreciate) were mostly financed with debt but there has been some dilution as well. There are 5.2M options that can be exercised so the full dilution share count is 106M.

At $5 per share that’s a market cap of $530M and an EV of $880M, with FY24 revenue estimated at $607.6M this amounts to an EV/S of 1.45x and the earnings multiples are even lower (well into single-digit territory with p/e at 8 for this fiscal year and 6 for the next). The stock is cheap, no doubt about it.

Conclusion

One could argue that when growth returns, the company is going to be very profitable as there is a substantial amount of leverage in their model and the integration costs are behind us.

One could even argue that the bottom seems to be in and the company is growing again sequentially, with RPD continuously rising and eCPMs recovering a bit.

On top of that, the secular growth story with SingleTap, App stores and in-app ads and purchases is about to become interesting.

However, one can equally argue against these. The recovery could be very weak and given the macro uncertainties could even reverse or peter out.

And we’ve heard about the wonderful growth opportunities of the growth initiatives in general and SingleTap in particular, and so far they have not created much in the way of material revenue.

So this is a management that has overpromised and underdelivered, they’re not going to get the benefit of the doubt, hence we are at $5, as surprising as that is given the very low valuation multiples.

What can’t be argued with is that the company still generates cash during this downturn and that it will generate lots more during a recovery (let alone when the growth initiatives finally start to deliver).

What also can’t be argued with is that the company does have several competitive advantages with its software stack on hundreds of millions of mobile phones and agreements with numerous carriers and OEMs and its SingleTap and App Store solutions and integrated ad business.

The upshot is that given the inherent leverage in the business, the stock will recover when its long-term growth drivers start delivering and/or the digital ad market recovers.

This is likely to be accompanied by valuation multiple expansion, so the stock price effect could be fairly dramatic.

We just don’t know when this will happen, so the stock could very well be dead money for a while yet and contrarian investors might have to exert a fair bit of patience

Read the full article here