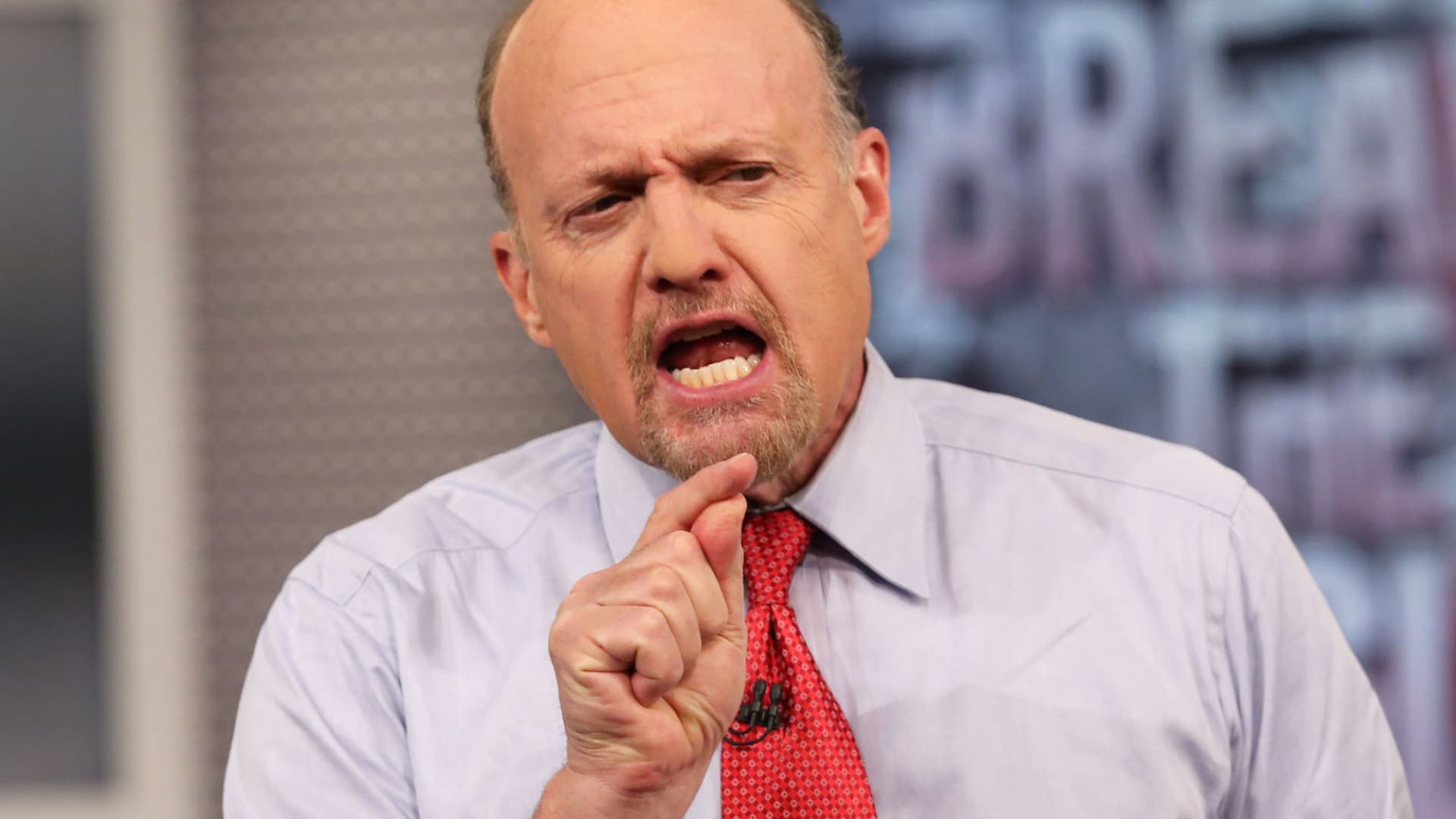

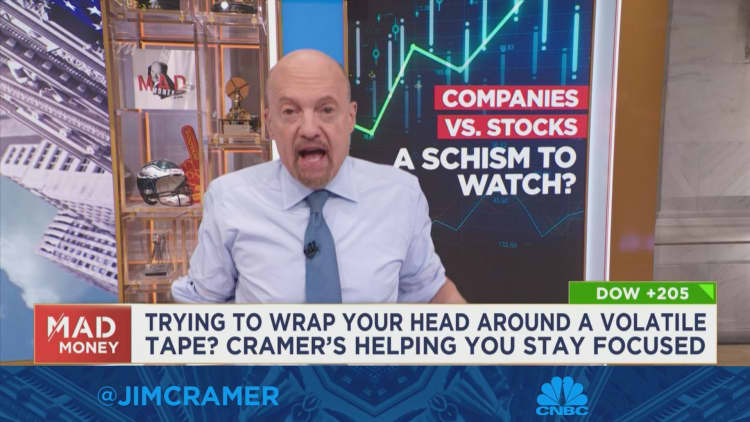

CNBC’s Jim Cramer on Tuesday told investors they may be wise to hold out on buying until interest rates rise and resulting sell-offs make stocks cheaper.

“For now, your best bet is to wait for the next move up in interest rates, which will trigger the next sell-off in stocks — that’s when you buy,” Cramer said. “If you are able to think longer term, things can work out with companies that are doing well, but you have to be willing to stay the course.”

Cramer suggested there is a “schism” between what certain companies are truly worth versus where their stocks are currently trading.

He cited several companies that reported Tuesday: Coca-Cola, 3M, RTX, General Electric and Verizon. With the exception of GE, Cramer said these companies seemed to be performing poorly but saw rallies after their reports. He attributed these gains in part to low expectations investors had going into the report.

Cramer said it’s not worth the risk of “betting on a beat and raise quarter” that may rely on the performance of S&P 500 futures.

“You’ve got to run an insanely tough gauntlet to capture these points,” he said. “I’d argue that it’s almost better to simply wait until the averages are down again before you buy given the nature of this market. I bet there’ll be another opportunity.”

Read the full article here