Editor’s note: Seeking Alpha is proud to welcome WA Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Offering a double-digit upside potential as my price target sits above $42 per share, investing in Suncor Energy (NYSE:SU) stock seems like an obvious choice currently. The average 5-year net income growth has been 6.47% and the dividend growth during the same period is 7.33%. The management is moving the company into a phase where it’s leveraging its solidified asset base and distributing large sums of earnings to shareholders. The price indicates a 23.5% upside at the moment and with market sentiment somewhat mixed, the light is shining on the buyers right now.

Long-Term Outlook

SU is strategically positioned to harness the potential for an imminent oil price surge over the next few months. Moreover, the company is well-prepared for the long-term challenges posed by a world where economically viable global oil reserves are becoming increasingly scarce. SU boasts one of the industry’s most impressive reserve life ratios, emphasizing its strong foothold in ensuring a sustainable and robust energy future.

Operating Results (Earnings Report)

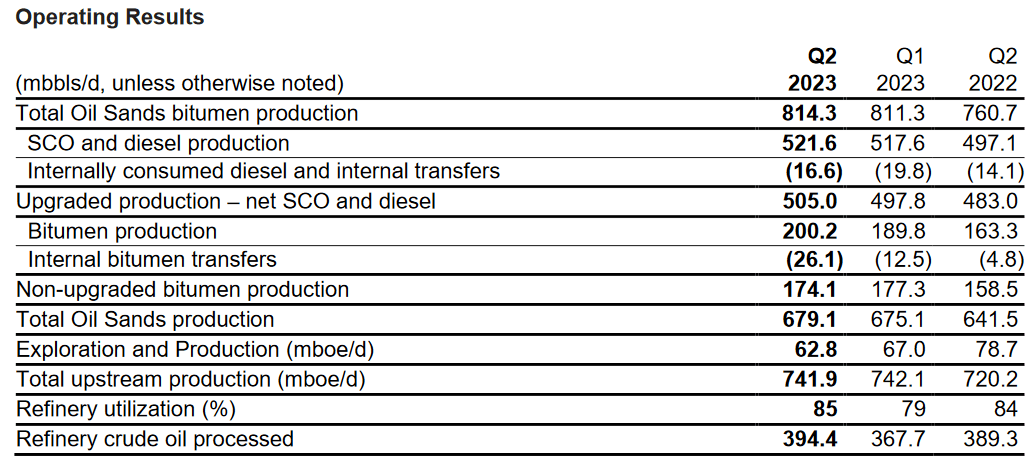

Even with the push towards renewables, the production levels of SU have been growing very well on a YoY basis, up to 814 mbbls/d as of Q2 FY2023. Utilization rates have also been increasing and sit at 85. The price of crude oil has increased substantially in the last few months and sits at over $87. In 2022, the oil prices averaged at $100 for the year. Should we see a rapid increase here, it seems likely that we will see a rapid increase in the share price as well for SU to display optimism for future earnings. But I do think there is a case to be made here as well that SU can provide a strong dividend-paying opportunity for a portfolio. SU has the qualities I seek right now like strong margins and further utilization rate of the assets as the top line has appreciated faster than total assets. Seeing as the management is already growing production levels I think this is indicative of their positive view on the market conditions.

2023 Budget (Investor Presentation)

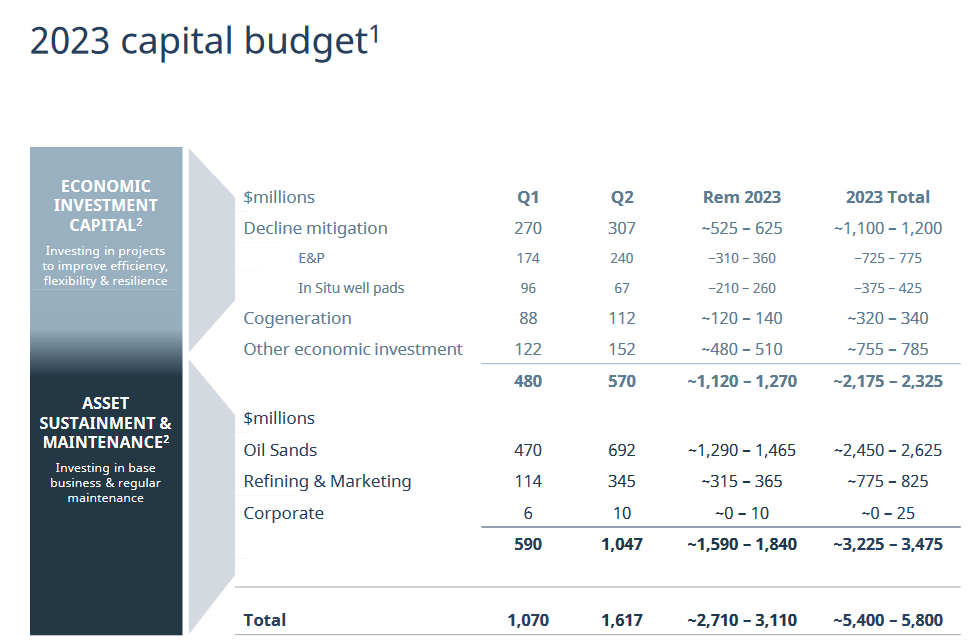

To underscore the company’s current trajectory to grow its production levels, it seems they are impressively increasing economic investment capital. For 2023, guidance sees a total investment and sustainment & maintenance capital rate of $5.4 – $5.8 billion. Since 2020, the capital expenditures have increased to $4.2 billion, but sit below where it was back in 2017. That year had expenditures of $5.2 billion, and it seems we are heading back there too. Revenues that year were $25 billion, which SU has surpassed by a long shot this year and last too. The reason I am bringing this up is to highlight the improved efficiency of the business and its capability to limit expenditures whilst also quickly raising the bottom line.

Why I’m Buying

With SU you are getting a solid dividend payer as the yield inches above 4.5% currently. The long-term outlook as we have discussed is positive for the company as necessities like oil and gas are going to be persistent. My argument for this lies in that the sheer cost and amount of resources needed for transitioning fully to an energy renewables society is just not going to happen in a few years, it’s a slow and steady transition.

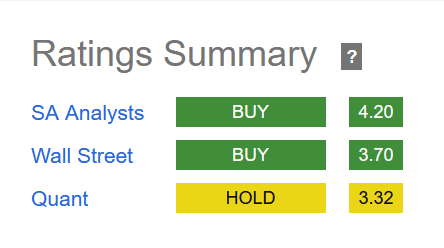

Ratings (Seeking Alpha)

The market seems quite positive on the business right now, with SA analysts and Wall Street both rating it a buy. I fall in the same camp as the fantastic margins of the business has made it a winner in my book.

NI Margin growth (Seeking Alpha)

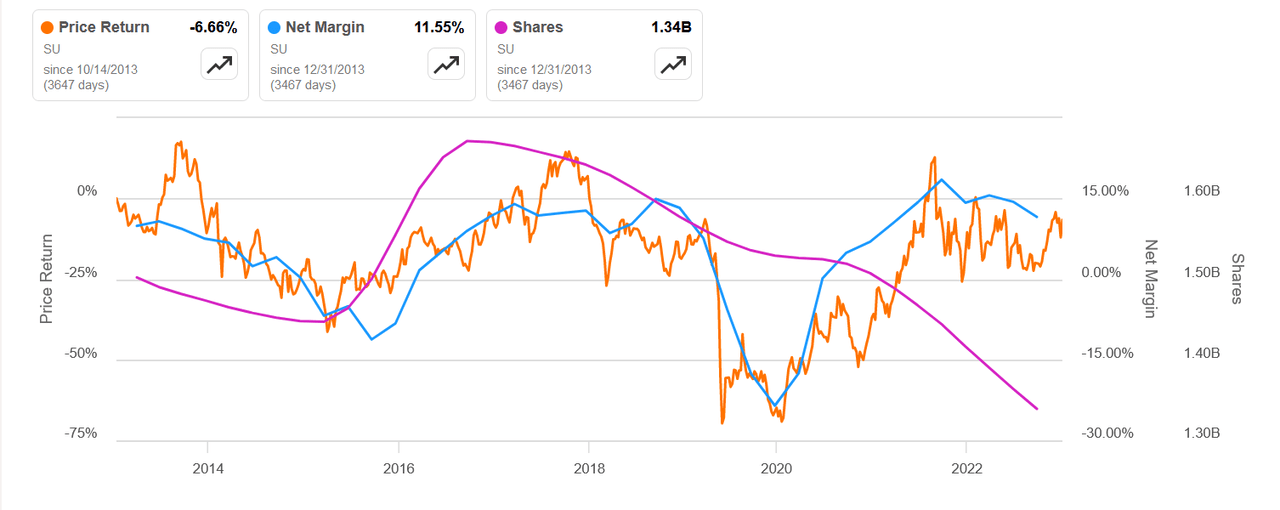

The chart indicates very well the relationship between the share price and the net margins of the business. During 2020 we saw a steep decline as oil prices plummeted. It has recovered very well since but did cause SU to have a negative NI margin of over 15%. Oil prices averaged $41 that year and the company had $4.1 billion in EBT, Including unusual items which pushed earnings down. I think SU stands in a better position these days than in 2020 as interest expenses have declined to $610 million TTM, a result of impressive debt repayments of over $6 billion since then, $4 billion in 2022, and $2.1 billion in 2021. There seems to be a consensus that rates will stay higher for a longer time. I find it likely that interest expenses of over $600 million TTM is likely for SU even if they pay down large amounts of debt as refinancing may be done at higher rates. Below we will get into more of the price targets I have for the company, but in short, I see the outlook for oil and gas as very positive and the forecasted price target I have for SU indicates a 23% upside potential currently.

Financial Position And Income Statement

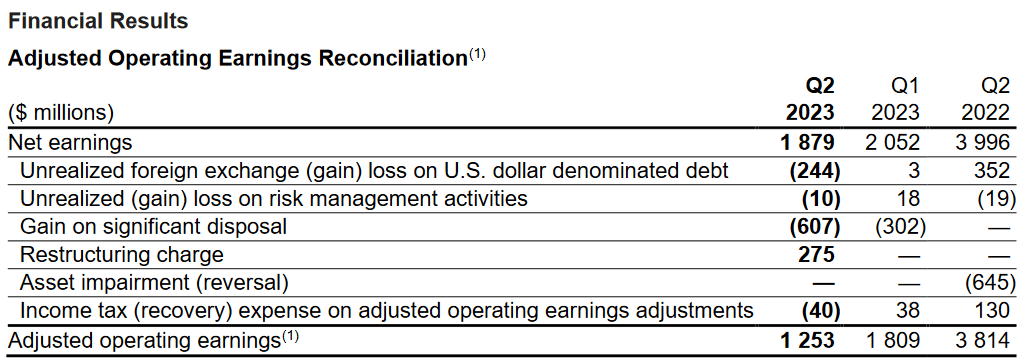

Income Statement (Earnings Report)

Last quarter showcases a net earnings decline of over $2 billion from Q2 FY2022 results. This has been the result of softer commodity prices. It’s important to remember though that volatility is to be expected in this industry as we have seen above. In times of strong oil prices the distributable cash flows for SU increase and so does quite often the optimism from the market causing the share price to appreciate in value. But then of course in times of lower oil prices the SU dividend prospects somewhat decrease, but over time I think will average out.

Income Statement (Earnings Report)

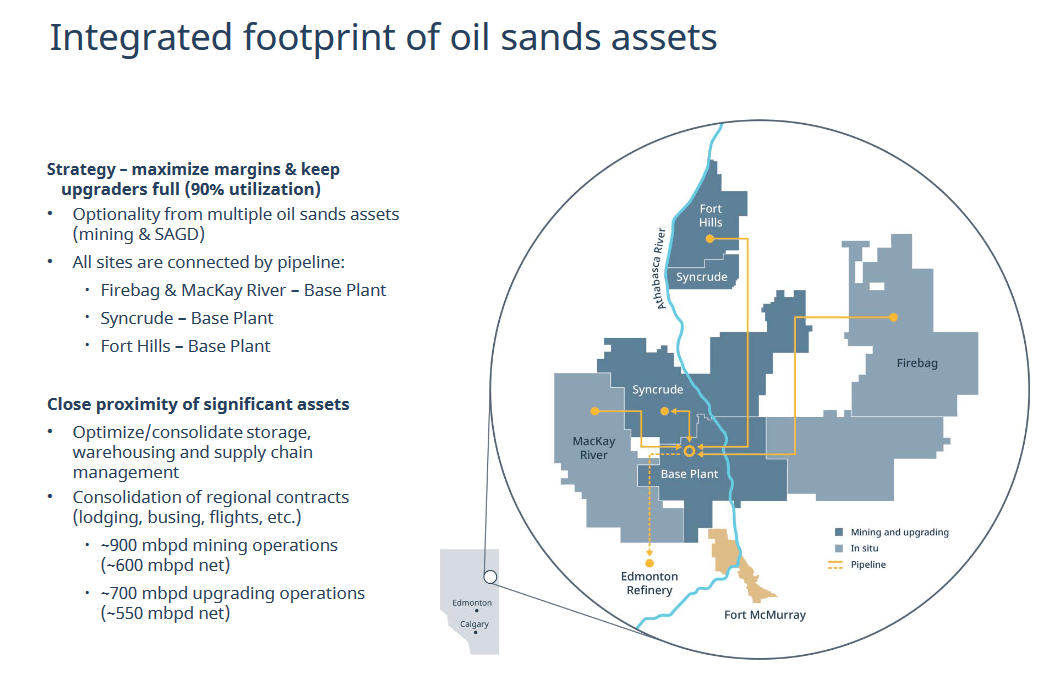

The returns to shareholders have still been quite positive though, sitting at $1.3 billion, still down from $3.2 billion a year prior. I think it’s important to realize that the increase in shareholder returns largely came from increased buybacks. The dividends have been growing steadily over the years and are higher than in 2022, averaging a 5-year annual growth of 7.33%. What I am looking more at though is the repayments of debt that SU has focused on, declining over $1 billion since December 31, 2022. Whilst other companies have been largely affected by higher interest rates, SU has not seen the same rise as prioritizing debt repayments has been maintained.

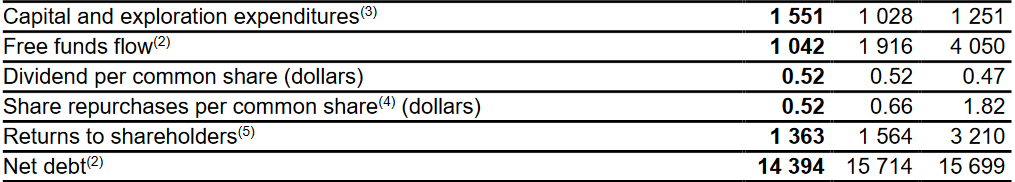

Oil Sands Asset (Investor Presentation) FCF Statement (Income Statement)

The oil sands assets of the company have still been very positive on the business as it was over $1.5 billion last quarter and $3.2 billion YTD. Capital expenditures for the assets have grown, and the inflated oil prices the previous year’s quarter offered inflated the FCF too. I don’t expect similar numbers for either Q3 or Q4, but a slight increase in both capital expenditures and FCF I see as likely. In most years the price of oil prices rallies somewhat into the colder months of the year which supports the previous statements about raised FCF in the coming quarters. As a final price, I want to include the positive work SU has done on its cash position, which is the highest since 2017 at over $1.9 billion. This amount is capable of covering over 10% of the debt position which I factor as a strong position, and is one of the several arguments I have for a slight premium valuation and buy case.

Investor Update Q2

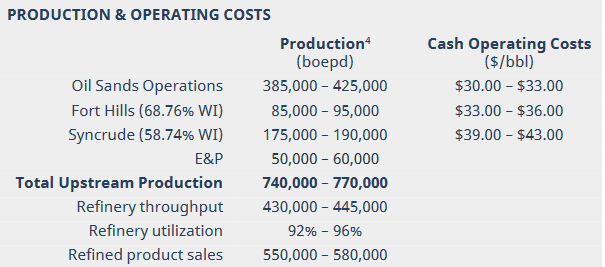

On the overview of productions and operating costs, I think SU is in a good position right now. The company remains profitable at $30 – $33 bbl for the oil sands operations. This is also the largest site for productions, anticipated to generate 385.000 – 425.000 for 2023. The Syncrude operations are the least profitable at $39 – $43 per barrel. The guidance indicates strong refinery utilization rates at 92 – 96% and with the low threshold for strong profits SU will likely post strong earnings for 2023.

Investor Update Q2

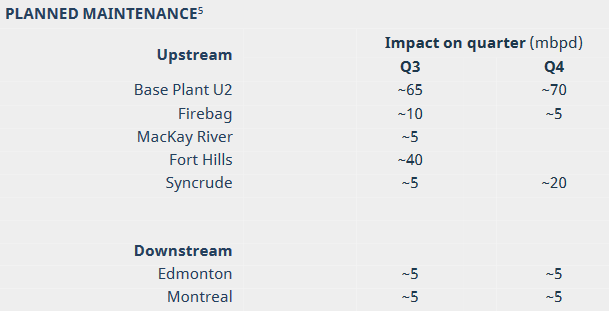

There are some planned maintenance for 2023 and this will impact the quarterly mbpd with Base Plant U2 at the largest, 65 and 70 in Q3 and Q4 respectively. Should it be revealed that impacts may be prolonged or maintenance behind schedule I think we should anticipate a slight dip in the share price, but something that likely will be short-lived.

Price Targets And Valuation

Price Targets (Seeking Alpha)

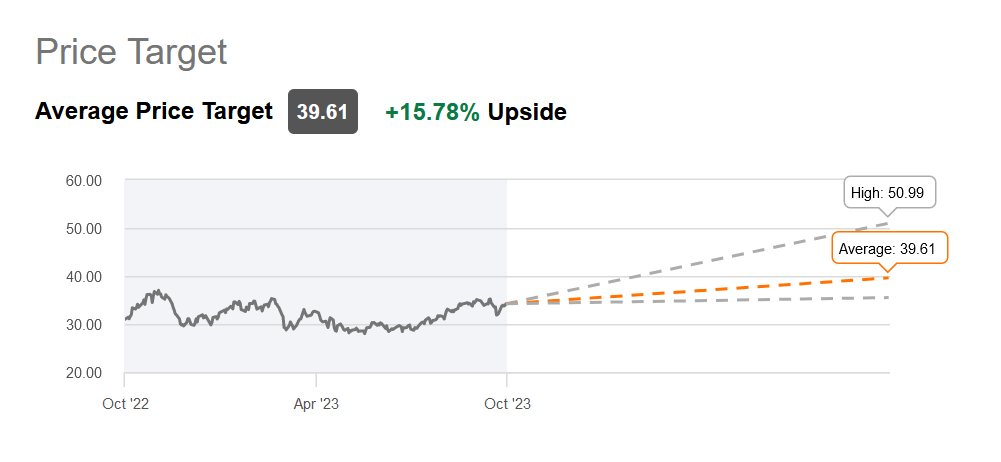

Above we have the current price targets for SU, ranging from $50.99 to $35.88 with an average of $39.61. This average is under my price target of $42, which I justify by the fact SU has made implied improvements in the last few years, like significant debt repayments which have limited the impacts of higher interest rates. The interest expenses are far below that of a few years ago and have enabled strong returns to be sustainable for shareholders. At a share price of $42 SU trades at an earnings multiple of 10.79, given current 2023 predictions of $3.89. The 10.79 p/e is above where SU has been historically, which is 10.52. But as I said, SU is in a better position today than in 2020 and has as a result grown into a premium valuation. The $42 target implies roughly a 23% upside from today’s levels, an immediate upside far outperforming that of broader market indexes, enabling a buy to be made here.

Risks

Over the short term, the oil market remains highly vulnerable to substantial price fluctuations, largely influenced by the dynamic geopolitical landscape. Notably, elevated oil prices can evolve from economic matters to political challenges, potentially involving government actions such as tax policy modifications and trade regulations, all of which can introduce an element of unpredictability into SU’s near-term financial prospects. The intricacies of managing this multifaceted energy market underline the intricate nature of the industry.

We have seen negative oil prices affect companies in the industry previously. During 2020, which was a surprising year, the price of oil declined heavily and so did many oil companies. But what has been proven is a certain resilience in businesses like SU as shareholder returns continued, with dividends and buybacks amounting to over $1.5 billion. Short-term volatility is a risk with companies like SU, but I don’t think it’s an adequate risk that trumps the prospects of making it a long-term position.

Conclusion

My target of $42 is within reach as SU is growing its assets and paying back debt efficiently. The impact of higher interest rates has been limited, and I think as they decline SU will post even higher EPS results. The upside is over 23% and recent spikes in oil imply that Q3 and Q4 may showcase strong NI YoY growth, as production levels remain high. The 4.5% dividend is a solid addition to the buy case as well, one that seems sustainable as well given the positive outlook for traditional energy sources like crude oil.

Read the full article here