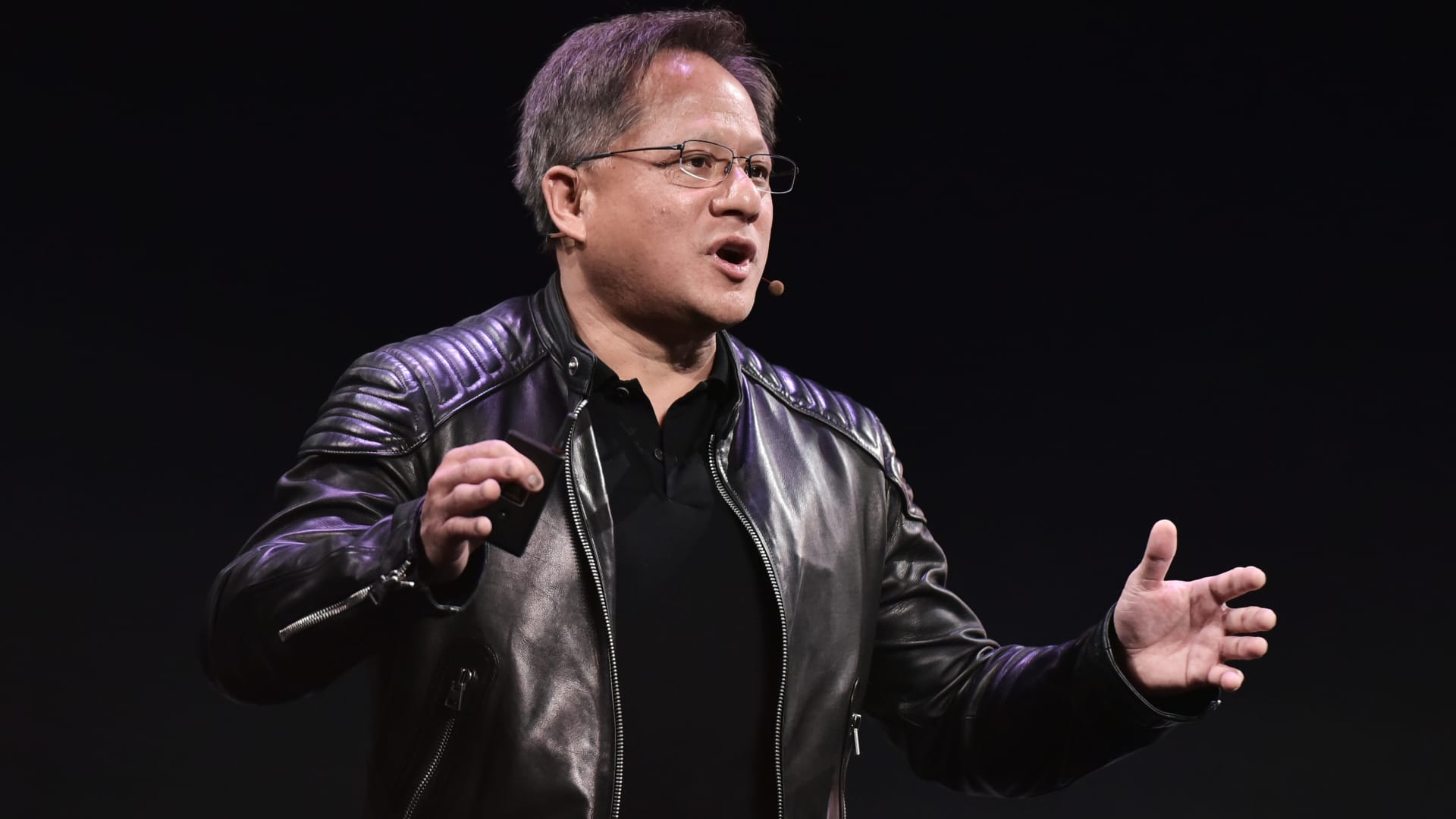

Nvidia (NVDA) has needed help from its Big Tech friends to become Wall Street’s artificial intelligence darling. Those friends haven’t left the party yet. In their earnings reports this week, Club holdings Microsoft (MSFT), Alphabet (GOOGL), Facebook-parent Meta Platforms (META) and Amazon (AMZN) indicated continued investments to advance their AI ambitions — a good sign for Nvidia. All four companies are buyers of Nvidia’s cutting-edge AI chips, which dominate the market for training the massive models that power applications like the viral ChatGPT. Investors will hear directly from Nvidia in late November when the Jensen Huang-led company releases quarterly earnings. “I think that Nvidia is the quiet partner behind the winners including Microsoft,” Jim Cramer said Friday. “Not saying it will be the best [quarter], just saying it is best positioned.” The encouraging signs for Nvidia come as the chipmaker grapples with the U.S. government’s new curbs on AI chip exports to China, weighing on investor sentiment and its stock price since the restrictions were announced early last week. Fervent demand for Nvidia’s chips in the rest of the world should make up for lost China sales in the short run, the company has said. However, the primary worry for investors — including here at the Club — is whether a substantially diminished China opportunity will prevent Nvidia from meeting The Street’s loftiest long-term growth projections. While Nvidia has, by far, been the best-performing stock in our portfolio this year with a gain of roughly 175%, it has dropped 20% since its all-time high of $502.66 back in late August. NVDA YTD mountain Nvidia YTD Nevertheless, the earnings reports and commentary from Microsoft, Google-parent Alphabet, Meta and Amazon help illustrate why Nvidia has repeatedly been able to downplay the near-term financial impact of Washington’s export controls. Spending by U.S. tech giants on AI infrastructure is soaring, and orders for Nvidia’s advanced chips are an essential part of those capital expenditure budgets. The demand for AI is so strong that those customers may be willing to take on the modified AI chip s that Nvidia can no longer send to China, Jim has said. Capital expenditures, or capex, is money spent to acquire or upgrade physical assets, which in the context of Big Tech companies encompasses data-center facilities and the computer hardware inside them. Microsoft Microsoft’s total capital expenditures totaled $11.2 billion in the three months ended Sept. 30 , up 5% from the prior quarter and 70% from the same period a year ago. Notably, Microsoft expects to spend more on capital expenditures in its current quarter than in the one just reported, “driven by investments in our cloud and AI infrastructure,” CFO Amy Hood said on the post-earnings conference call Tuesday evening. Microsoft’s AI strategy – including investments in OpenAI , the buzzy startup behind ChatGPT – is showing signs of success. Microsoft’s cloud-computing service Azure posted better-than-expected revenue growth in the September quarter, jumping 29% compared with the Wall Street estimate of 26%. Notably, about 3 percentage points of Azure’s growth was linked to customer AI spending, Hood said. This evidence that Microsoft is already monetizing AI is why investors tolerate Microsoft’s surge in capex spend. Alphabet Alphabet’s capex was $8 billion in the third quarter , up 17% from the three months ended June 30 and 11% year over year. The largest component of the spending, according to CFO Ruth Porat, was servers – the powerful computers inside data centers that contain AI chips. Servers also were the biggest piece of Alphabet’s second-quarter capital expenditures. “We continue to invest meaningfully in the technical infrastructure needed to support the opportunities we see in AI across Alphabet and expect elevated levels of investment, increasing in the fourth of 2023 and continuing to grow in 2024,” Porat said on Alphabet’s call Tuesday evening. In addition to buying Nvidia products and partnering with the company , Alphabet’s Google Cloud uses a custom processor in its AI work. That in-house chip, known as a Tensor Processing Unit , is developed alongside Broadcom (AVGO), another Club holding. Meta Platforms Meta’s third-quarter capital expenditures were lower year-over-year, as the company prepares to transition to a new data center design that’s more energy-efficient and optimized for running AI workloads. Next year’s spending will see a boost as that transition takes hold, the company said. Meta’s initial 2024 capex outlook is between $30 billion and $35 billion, compared with its projected 2023 levels between $27 billion and $29 billion. The 2024 outlook suggests a roughly 16% increase from the midpoint of guidance, with the growth fueled by “investments in servers, including both non-AI and AI hardware, and in data centers,” Meta’s finance chief, Susan Li, said on the call. Amazon Amazon’s results and earnings call Thursday added to the body of evidence on AI spending as a priority at U.S. tech giants. Amazon’s Web Services has long been the largest cloud-computing provider by revenue. Its overall capital expenditures were down 24% year-over-year in the third quarter and are expected to total $50 billion in 2023, compared with $59 billion last year. But the breakdown of the spending tells the story. Capital investments on the e-commerce side of Amazon’s business are falling, but that’s partially being offset by increased spending on the cloud-computing side of its business, according to CFO Brian Olsavsky. On the call, he specifically mentioned investments in generative AI efforts and large language models. “I still think we’re very early in generative AI,” Amazon CEO Andy Jassy said. Like Alphabet, Amazon’s spending on AI processors goes toward both Nvidia chips and custom products, such as the AWS Trainium , which is designed for large-language model training, and the AWS Inferentia , which is geared toward the day-to-day deployment of AI models. The exact breakdown of Amazon’s spending on silicon is unclear, but analysts at Loop Capital earlier this month said it expects Amazon “will be a large customer of Nvidia for the long term.” On Thursday’s call, Jassy said the limited supply of graphics processing units – the technical name for chips like Nvidia’s – is a boon to interest in Amazon’s in-house processors. “I still think we’re very early in generative AI,” Amazon CEO Andy Jassy “It’s really hard to get the amount of GPUs that everybody wants,” Jassy said. “It’s just another reason why Trainium and Inferentia are so attractive to people. They have better price-performance characteristics and things than the other options out there, but also the fact that you can get access to them.” Nvidia has been working with its suppliers — including foundry partner Taiwan Semiconductor Manufacturing Company (TSM) — to address the chip shortages, though. And, management has forecast improvements each quarter into its fiscal 2025. Nvidia, which became the world’s most valuable chipmaker this year due to AI excitement, will report its fiscal 2024 third-quarter earnings Nov. 21. This week’s slate of Big Tech earnings left little doubt that, as more Nvidia chips become available, there will be a place inside data centers for them to go. (Jim Cramer’s Charitable Trust is long NVDA, MSFT, GOOGL, AVGO, AMZN and META. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Nvidia (NVDA) has needed help from its Big Tech friends to become Wall Street’s artificial intelligence darling. Those friends haven’t left the party yet.

Read the full article here

Post Views: 34