You got ‘em. But at what cost?

The summer and fall of 2023 have offered music fans endless opportunities to drop big dollars on concerts. Artists ranging from pop icons like Beyoncé and Taylor Swift to newer acts like Olivia Rodrigo have announced tours or hit the road, giving fans a reason to splurge on tickets, merchandise and rhinestone cowboy boots.

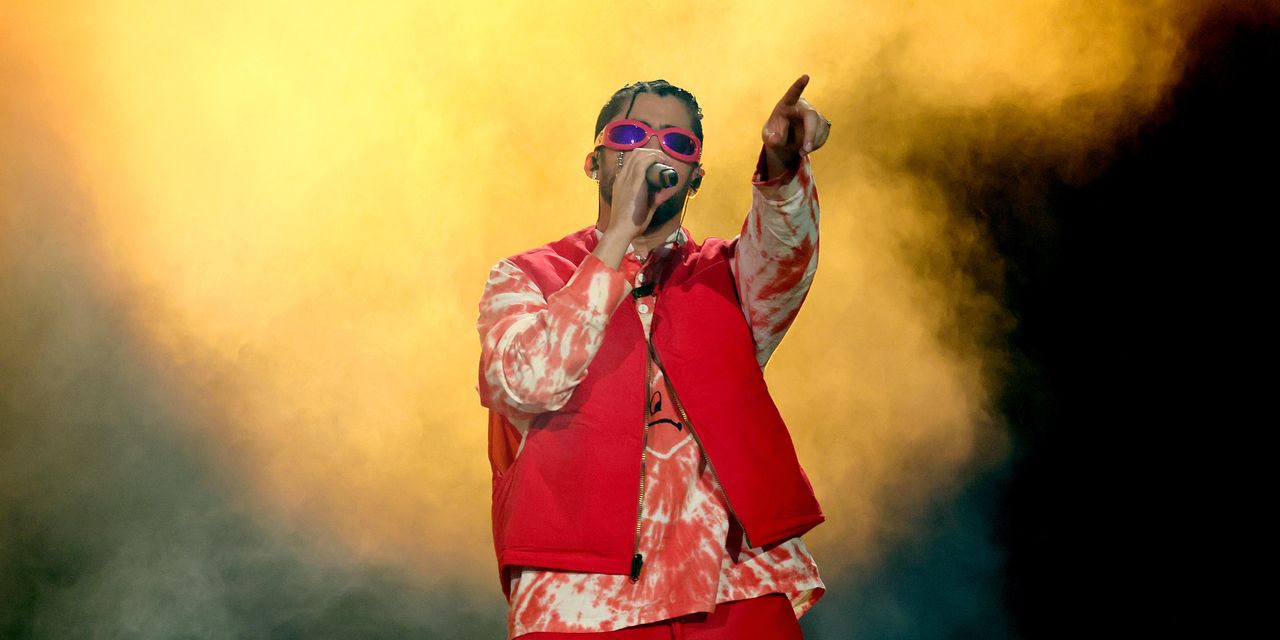

The latest hitmaker to confirm they’re hitting the road is Puerto Rican singer Bad Bunny, who announced the dates for his “Most Wanted” North American tour on Oct. 19.

Some fans who participated in the tour’s presale were surprised to see the prices. Several took to social media to express their sticker shock, noting that even nosebleed seats were listed at a few hundred dollars each. The exact prices could only be viewed by select fans who were granted access to the sale.

“Benito should’ve named this tour ‘most expensive tour’ cause what are those prices,” one user posted.

Another called Bad Bunny “disrespectful,” and posted a screenshot showing nosebleed seats going for $300 and a floor seat priced at $1,101.95.

Americans have spent big on entertainment this summer and fall, shelling out on recreational expenses like movies, shows and travel. A study from QuestionPro found that concertgoers who went to Taylor Swift’s The Eras tour spent an average of $1,300 per show, including tickets, clothing, merchandise, food, and travel.

Related: Springsteen is one of many older rockers canceling shows for health reasons, making ticket purchases risky for fans

That kind of spending has fueled the country’s still-pumping economy, which grew at a 4.9% clip in the third quarter.

That being said, dropping four figures on one ticket can put a serious dent in your savings — or your credit-card balance. But who among us hasn’t considered blowing our budget to scream our favorite songs in a packed stadium? MarketWatch talked to experts for advice on how to bounce back from doing just that.

United Talent Agency, which represents Bad Bunny, did not respond to requests for comment. Ticketmaster directed MarketWatch to an FAQ page about tickets and ticket prices on their website.

Step 1: Don’t freak out

First things first, “take a deep breath,” said Emy Lee, a former accountant and spending coach with more than 40,000 followers on TikTok. A one-time purchase like a concert ticket likely won’t ruin your finances for good, she said — but it can pose a much bigger risk if it sends you into a cycle of shame and overspending.

“I see this in my clients, too: somebody will make a big purchase, and then they beat themselves up for it and feel guilty,” she said. “Then they just keep spiraling and making impulsive purchases.”

There’s nothing inherently wrong with spending a lot of money on a concert ticket, said Kimberly Palmer, a personal-finance expert at NerdWallet.

“For a lot of people, buying a concert ticket, even though it’s a huge splurge and outside of their normal budget, is not necessarily a bad choice. It’s spending money that really aligns with their values,” she said. “What’s a good choice for you is not necessarily something that can be answered just by looking at numbers or your budget or your income.”

Tours for huge artists like Beyoncé or Taylor Swift can also create a huge sense of FOMO, Lee noted, piling on even more pressure to snag a ticket no matter the cost.

Jack Heintzelman, a certified financial planner from Needham Heights, Mass., recommended giving yourself some grace.

“Life happens! This is completely okay and very common,” he said over email. “That’s what we save money for in the first place.”

Step 2: Make a plan

After you’ve cleared your head, it’s time to make a plan. The steps to getting back on track financially will look a little different depending on how you paid for the ticket.

Did you put the purchase on a credit card? Then you’ll want to make a plan to pay down the balance as quickly as you can, Palmer said — ideally by the end of the month, before it starts accruing interest.

But even if it will take a little longer, you should prioritize those payments, she said.

“You want to make sure you have a plan where you’re paying it down so it doesn’t snowball and become an even bigger amount of debt,” Palmer said. “You can get hit with late fees, and it can quickly get out of control.”

That’s especially important in a high-rate environment, where interest rates on many credit cards are especially high. Last year, the average late payment fee for credit cards was $32.

If the cost of the ticket came out of your savings account, you’re not in danger of the debt ballooning over time. Still, Palmer said, you should focus on replenishing your savings so you’re still in a good position to weather any emergencies that come your way.

“That could mean setting aside a small amount from every paycheck until you feel comfortable again,” she said.

Step 3: Move on

After making a plan, it’s time to start thinking about how to avoid overspending like this in the future, experts said.

“Planning is way easier than recovering as far as big purchases go,” Lee said.

That doesn’t mean you have to sit on the sidelines every time your favorite artist comes to town. In fact, part of smart money management is spending intentionally on the things that are truly important to you, Palmer added: “For plenty of people, buying that concert ticket is going to bring them a lot of joy.”

But sticking to a monthly budget will help you make big purchases with confidence, experts noted.

Building a budget often starts with tracking your income and expenses to understand just how much money you’re making and what you’re spending it on. The primary part of your budget should cover your needs. What’s left over can be split between savings and variable expenses — like entertainment.

“Entertainment gets tricky, because a lot of people feel that it’s a need because it makes you happy,” Lee said. But most often, it should be considered a variable expense.

After you have a sense of where your money is going, you can trim unnecessary costs, and allocate a portion of your income each month to saving or other financial goals.

Heintzelman recommended automating a portion of your income to deposit straight into your savings account.

“That savings will start to build up and be available for that next ‘unexpected’ expense that comes up,” he said over email. “If you automate your savings you can be less stressed about these times where you have to spend down your emergency reserve, because you know you’ll build it over time.”

Sometimes, making a savvy financial decision will entail finding a more cost-effective way to celebrate your favorite artist.

That could mean something like skipping the concert in favor of throwing a themed party at home, Lee said. You can still get dressed up and dance to your favorite songs with your friends — just with cheaper concessions and no lines for the bathroom.

Keeping a budget and making a financial plan will save you a lot of stress in the future, Palmer said. Sticking to one now means you can buy another ticket stress-free when the next tour comes around.

“Focusing on making a budget means you have a framework for these decisions,” she added. “It takes the guilt out of the equation.”

See also: ‘We’re literally being stolen from, in plain sight’: Musicians are tired of venues taking their T-shirt money, and they’re fighting back.

Read the full article here