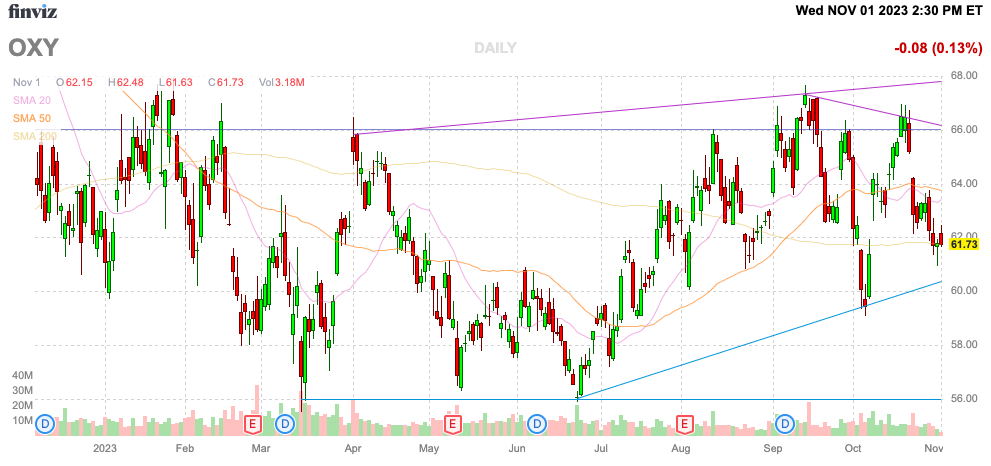

As investors were long warned, Occidental Petroleum Corporation (NYSE:OXY) trades at an elevated price due to Warren Buffett. The major energy deals in the sector reinforced this scenario. My investment thesis remains Bearish on the stock, with oil prices likely headed lower after even 2 wars can’t keep prices elevated.

Source: Finviz

Left Out

In the last month, Exxon Mobil Corporation (XOM) has agreed to pay nearly $60 billion for Pioneer Natural Resources (PXD) and Chevron Corporation (CVX) has agreed to pay $53 billion for Hess Corporation (HES). The 2 mega deals remove the largest potential acquirers from the pool, leaving Oxy with limited options other than an unlikely buy from a European energy company.

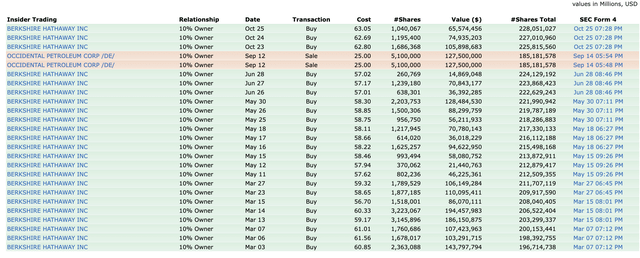

Nobody really knows why these energy giants bypassed Oxy, but Warren Buffett owning a large percentage of the company likely had an impact. Not to mention, Berkshire Hathaway (BRK.B, BRK.A) regularly bought shares in the $60+ range making any likely deal requiring a premium above an already premium price.

In fact, Berkshire Hathaway just bought more shares days after the Chevron deal for Hess was announced. The investment firm bought nearly 3 million shares from October 23-25 for ~$245 million, paying over $62 per share.

Source: Finviz

Buffett now controls 25.8% of the outstanding shares plus $8.5 billion in preferred shares, along with 83.9 million warrants to buy shares at $59.62 each. As mentioned above, the problem is that Buffett sees the stock as a buy at the current prices, suggesting any deal would require a premium.

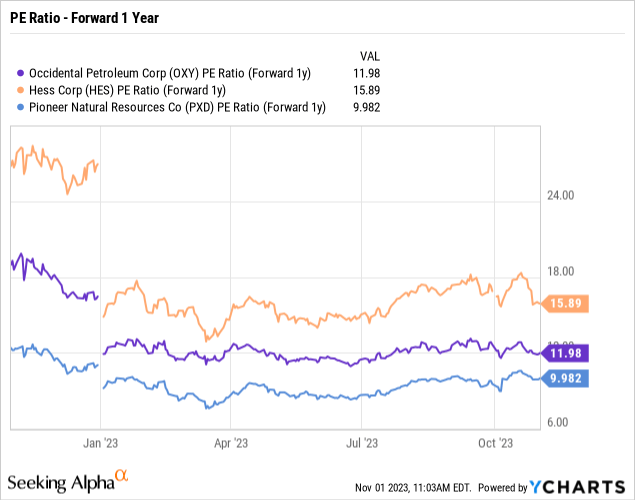

Remember, Buffett already owns $17.8 billion worth of shares of Chevron for a 6.5% position that might have complicated any deal, but Occidental is already an expensive stock in the energy sector. Even after these premium deals, Oxy is far more expensive than Pioneer Natural Resources, while Hess is technically more expensive at nearly 16x EPS targets.

Hess is a slightly different story, with analysts forecasting the EPS jumping to $9 in 2024 and surging again to $11 in 2025. The stock only trades at 13x the 2025 forecast.

Oil Trending Lower

With 2 wars ongoing in the world and oil dipping back to the low $80s, investors need to take note the risk to oil prices is lower due to recession fears and plenty of excess supply at OPEC+ now. The above P/E ratios are based on oil prices in the current range.

Back in Q2, Oxy earned just $0.68 for the quarter, leading to an annualized EPS rate of just $2.72. Analysts forecast vastly higher EPS targets requiring a repeat of the March quarter when oil prices were higher and the independent energy company earned $1.08 per share.

The energy company realized average Q2’23 WTI prices of $73.83/bbl with natural gas realized prices at only $1.36/mcf. OXY will currently see upside to those results with current prices higher, but the risk is for oil prices to head lower at some point due to normal energy price cycles.

Oxy reports Q3 ’23 results next week on November 7 with the following consensus estimates:

- EPS: $0.86 (down 64.6% YoY)

- Revenue: $6.96 billion (down 26.8% YoY).

The Q3 ’23 EPS target appears the peak level in the current cycle. WTI prices rushed to $90/bbl on the conflict in Israel, but prices ended the quarter down at $82/bbl, though natural gas prices will provide some life at $3+/mcf now.

The problem here is that a $4 EPS target appears aggressive and Oxy already trades above $60. The stock has a 15x P/E multiple, and the risk is for EPS to slip more towards the $2 to $3 range reflected by the Q2 ’23 results.

Takeaway

The key investor takeaway is that Occidental Petroleum Corporation wasn’t bought in the mega deals in the energy sector possibly due to the stock valuation from Warren Buffett buoying the price higher from consistent stock purchases. Our view is that investors should continue avoiding Occidental Petroleum Corporation stock, with the likelihood Oxy is actually trading at over 20x normalized EPS targets of sub-$3 with oil prices heading lower.

Read the full article here