Company Snapshot

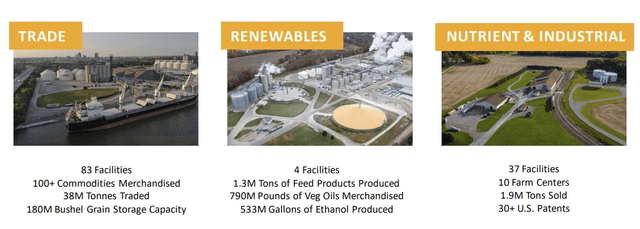

The Andersons, Inc. (NASDAQ:ANDE) is a small-cap staples stock that is particularly well-positioned across the North American agricultural supply chain. The company reports under three key segments- Trade, Renewables, and Plant Nutrient.

Investor Presentation- Aug 2023

There are a lot of moving parts that weigh on the ANDE stock, and different investors will gravitate to the stock for different reasons, but here are three broad reasons why we are optimistic about ANDE.

Underappreciated Opportunity With Renewable Diesel Feedstock

When it comes to ANDE, a lot of focus tends to be centered around the ethanol side of the business, but we think the company’s growing merchandising activities, particularly its efforts linked to beefing up various renewable diesel feedstocks could generate some pleasant surprises for the renewables division.

We say this because recent reports have shown that there is a strong undercurrent of renewable diesel capacity in the works, with renewable diesel production volumes recently overtaking biodiesel production for the first time. All in all, between 2021-2023, the renewable diesel capacity in the domestic shores have grown at a whopping 94% CAGR.

We feel renewable diesel is here to stay and will be less immune to the growing popularity of EVs as it is predominantly used in large commercial vehicles, a sub-terrain that hasn’t exactly warmed up to EV battery usage. Nonetheless, forecasts through the next two years, suggest that renewable diesel capacity could double again by 2025, before growing to 7.4 billion by 2026.

With such mammoth capacity due to come online, entities such as ANDE that play a key role in the sourcing and merchandising of renewable diesel feedstock stand to gain tremendously. For context note that in Q2, the total volume of vegetable oils merchandised by ANDE grew at an impressive pace of 64% YoY!

Because of their low CI (carbon intensity) content, feedstock from animal fat, vegetable oil, used cooking oil, etc. are not penalized by the Indirect Land Use Change (ILUC) and should have plenty of takers. ANDE set up their 3rd party renewable feedstock desk a couple of years ago, and have stepped up efforts to grow and broaden their supply arrangements all through this year. Management suggested they are even prepared to engage in more M&A in this field to procure greater feedstock (ANDE certainly has the balance sheet to press the pedal on M&A; more on this in the next section).

Some Useful Defensive Qualities

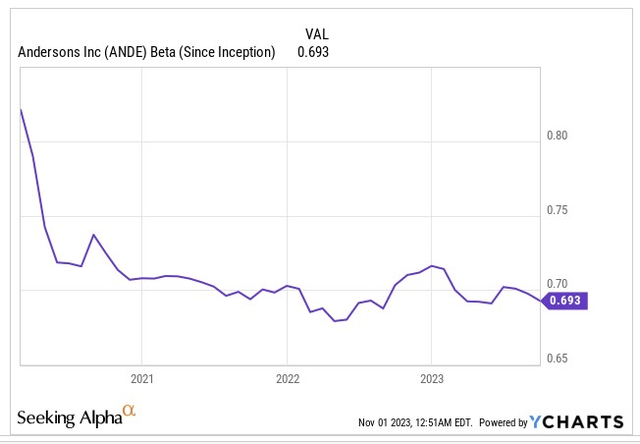

Recently we’ve seen how volatile and damaging the broader markets can be, and during times like these, increasing exposure to low-beta plays such as ANDE could do a world of good for your portfolio.

Note that Anderson stock’s sensitivity to the broader market has continued to diminish over time, with beta currently standing at 0.69x.

YCharts

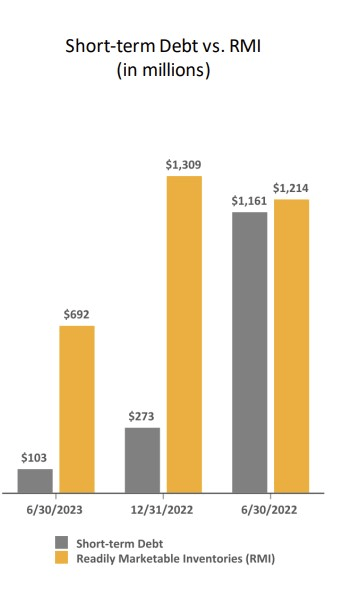

ANDE also possesses some other useful traits that you’d normally associate with a defensive stock, and this is something that could see it attract increased flows in an environment such as this. Despite being active on the M&A front (in H1 the company closed two deals), and also having plenty of growth projects (in avenues such as fertilizer, premium food, etc.) on the anvil, this is not a business that inundates itself with external capital. For context note that the company’s goal is to keep long-term debt to EBITDA at less than 2.5x, and currently that ratio is only at 1.6x. Meanwhile, also note that even though ANDE has been heavily liquidating its inventories in Q1 (+178M) and Q2 (+557m), it still has more than ample readily marketable inventories that can cover its short-term debt by almost 7x!

Investor Presentation- Aug 2023

Now, given how low the leverage ratio currently is, don’t also be surprised to see a marked step-up in the buybacks, which could offer decent support to the share price. For context, in August 2021, ANDE kickstarted a $100m buyback plan, but so far it has only bought back shares to the tune of $14.5m. What’s key is that this program looks poised to expire within the next 9 months (August 2024).

Even if they don’t ramp up buybacks, you still also have quite a handy dividend theme that brings added protection. For context, most companies in this field have been paying dividends for only 14 years or so, but ANDE has now been distributing dividends for the last 26 years on the trot.

Closing Thoughts – Supportive Valuation and Technical Backdrop

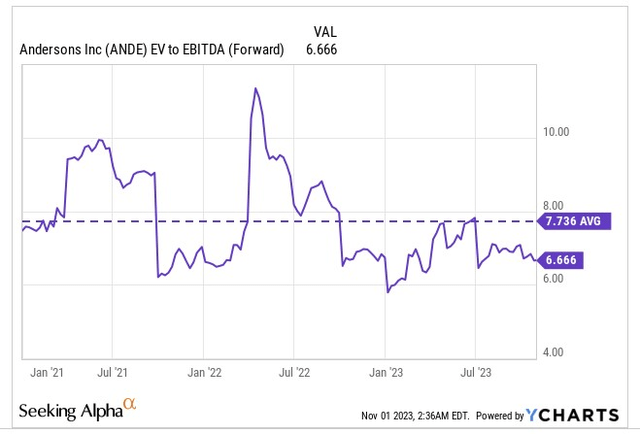

Finally, even if one gauges ANDE from the valuation and technical viewpoints, it’s hard not to feel encouraged.

On a forward EV/EBITDA basis, ANDE can currently be picked up at a multiple of just 6.66x, which incidentally translates to a 14% discount over the stock’s 5-year average.

YCharts

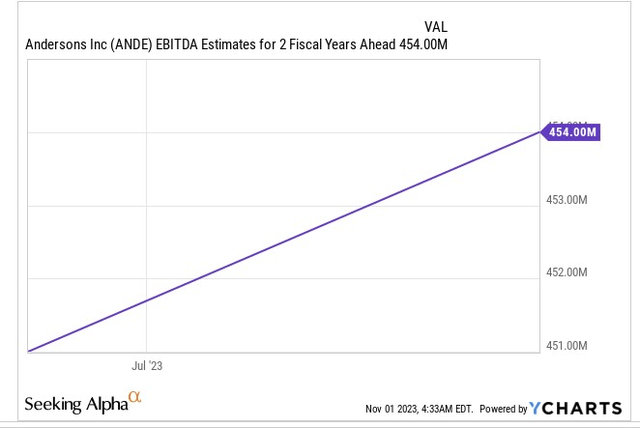

There’s a good chance one witnesses a re-rating of the multiple, as we feel that consensus is currently underappreciating the EBITDA improvement that could be seen through FY25, and may be forced to scramble and update their numbers.

Previously ANDE was only expected to deliver $375m-$400m of EBITDA by 2025, but management has since lifted the guidance to a target of $475m by 2025. Yet, if one looks at consensus figures for FY25 they are currently around 5% short of that target.

YCharts

Shifting focus to the charts, we first have a chart that helps shed some insight into ANDE’s rotational potential for those fishing in the broad consumer staples universe. Sure, the rotational prospects aren’t as attractive as they were in mid-2020, but even at these levels, the relative strength ratio of ANDE as a function of VDC is still around 38% off the mid-point of its long-term range, leaving room for further mean-reversion.

StockCharts Investing

Next up we have a chart capturing ANDE’s own weekly price movements over the last 18 months, and note that the imprints have broadly taken place within a certain ascending channel, which in itself is quite heartening. Then within the channel, the risk-reward right now appears to be rather fair, with the distance between the CMP and the two boundaries of the channel appearing to be relatively equal.

However crucially, note that since May 2023, ANDE has formed something akin to a bullish pennant pattern (highlighted in yellow), and currently what you’re seeing is a bout of consolidation before a potential breakout. All in all, it’s fair to say that bullish conditions in ANDE look relatively intact.

Read the full article here