It is a nightmarish 2023 for Eagle Bancorp (NASDAQ:EGBN), in fact since the beginning of the year the bank has seen its valuation plummet by 55%. However, in the last week the stock has rallied more than 10% following the release of Q3 2023, giving the bearish trend a breather.

- Normalized EPS was $0.91, a solid $0.19 above expectations.

- Revenues were $70.72 million, $86.67k less than expectations.

In short, revenues disappointed slightly but EPS surprised to the upside: market expectations were so bad that it would have been hard to do worse. The recent enthusiasm does not mean that Eagle Bancorp has solved all its problems, but that we simply see a little light at the end of the tunnel. Since early 2022 the bank has lost about 70%.

Highlights Q3 2023

Eagle Bancorp, Inc. (EGBN) Q3 2023 Earnings Call

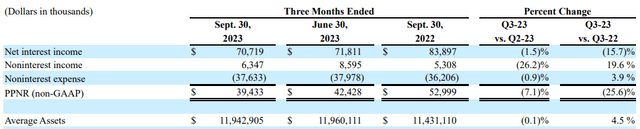

Net interest income for Q3 2023 was $70.71 million, lower than the $71.81 million in the previous quarter and lower than the $83.89 million in Q3 2022. There are mainly two reasons for this deterioration:

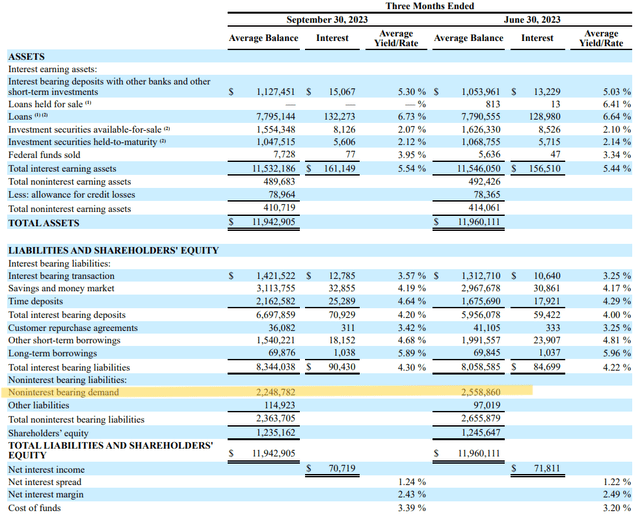

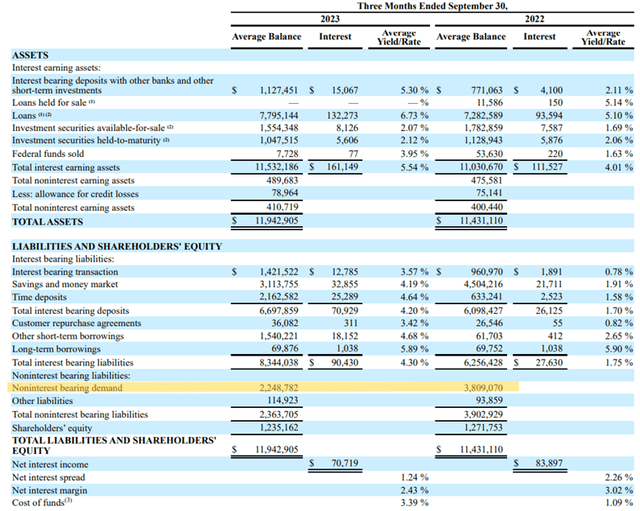

The first concerns the migration of customers from non-interest-bearing deposits to interest bearing deposits. No longer satisfied with receiving low remuneration, customers are increasingly driving up the cost of deposits. As a result, since Eagle Bancorp has to pay higher interest, it will necessarily have a lower net interest margin. This problem has been present since the Fed began raising interest rates in early 2022.

The second reason concerns a $1.6 million write-off due to the non-performing entry of a multifamily loan in the District of Columbia.

Eagle Bancorp, Inc. (EGBN) Q3 2023 Earnings Call

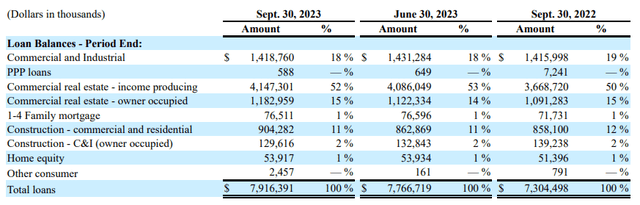

The loan portfolio reached $7.91 billion, up 1.90% from the previous quarter and 8.40% from Q3 2022. Much of this growth came from the largest segment, which is CRE income producing. Compared to the previous quarter this segment achieved an increase of $61 million; compared to last year there was an increase of $479 million.

Since the weight of CRE income producing loans is more than 50%, the market may be concerned about the performance of this bank in a recessionary environment, which is why the price per share was hammered in 2023. In fact, this category is among the first to suffer when the business cycle is no longer expansive. In particular, analysts often focus on exposure to CRE offices, as the latter are among the loans with the most cyclical performance.

In the case of Eagle Bancorp, CRE office loans represent 12% of the entire loan portfolio, or $950 million. These office properties are primarily located in the Washington DC market, with 24% in the District of Columbia, 34% in the Maryland suburbs, and 34% in Northern Virginia, and an additional 7.6% located outside these markets.

We are talking about significant exposure after all and that justifies the market’s concern. Management stated during the conference call that they are willing to work collaboratively to achieve win-win outcomes for both the bank and any struggling borrowers given the current high interest rates, but I personally remain doubtful about this. I tend to avoid investing in banks with such exposure to loan categories that are too cyclical.

There is a risk that in a stressed cycle of the economy there will be an excess of nonperforming loans, consequently reducing the bank’s profitability. In fact, there are early signs.

In Q3 2023 NPLs were $70.40 million, or 0.89% of total loans. Three months ago they were 0.37%; a year ago they were 0.10%. In short, it is clear that something is gradually crumbling. After all, it is not easy for borrowers to repay a loan that in some cases has seen the interest rate double or triple.

Eagle Bancorp, Inc. (EGBN) Q3 2023 Earnings Call

As for loans, the collapse of non-interest bearing deposits continues, declining by $310 million from the previous quarter. These free funds have been replaced by expensive time deposits and savings deposits. Not surprisingly, therefore, the net interest margin is declining and has reached 2.43%, a rather low figure when compared to the average peers, 3.28%.

Eagle Bancorp, Inc. (EGBN) Q3 2023 Earnings Call

On an annual basis, the comparison amplifies the bank’s stress situation. In fact, compared to last year, non-interest bearing deposits decreased by a whopping $1.56 billion (41 percent), a huge figure for a bank of this size. Total deposits have increased by about $600 million, but their cost has been completely disrupted since the Fed raised interest rates and since there was the banking crisis at the beginning of the year. In other words, Eagle Bancorp has a much worse financial situation than last year, so the more than 50% drop is justified in my opinion. Historically this bank used to have non-interest bearing deposits above 30% of total deposits, today we are on 25%. However, there is a glimmer of hope.

According to CFO Charles Levingston, the migration of deposits may have come to an end, and this could kick-start the recovery of the net interest margin:

My sense is that we have a very solid base of non-interest-bearing deposits here, I would expect us to maintain around where we are.

And at the same time, there will be continued efforts to build out treasury management services in order to attract additional operating accounts and to continue to pour more in as maybe we see some migrating and looking for some yield there. But my expectation is we’re in a pretty happy place with where those are in terms of the baseline.

Conclusion

Eagle Bancorp is a bank that has been turned around in the past year and the price per share reflects all its difficulties. The net interest margin is well below that of peers due to excessive cost of funds, while assets are dominated by the CRE loan segment, which is typically quite cyclical and risky.

The change in the macroeconomic environment has had a devastating impact on the financial strength of this bank, but if non-interest-bearing deposits remain stable there is still a chance to regain lost ground.

Seeking Alpha

To date, the dividend yield is 9.24% and could attract many dividend-seeking investors. The payout ratio is still sustainable, 46%, but it would be a mistake to think that such a high dividend is without risk. Over the past year this bank has been turned upside down and the same could happen in the next 12 months, for better or worse. In these cases my call is to keep your attention high and always consider a very high margin of safety. What is at a discount does not always turn out to be a good deal.

Read the full article here