Dear readers,

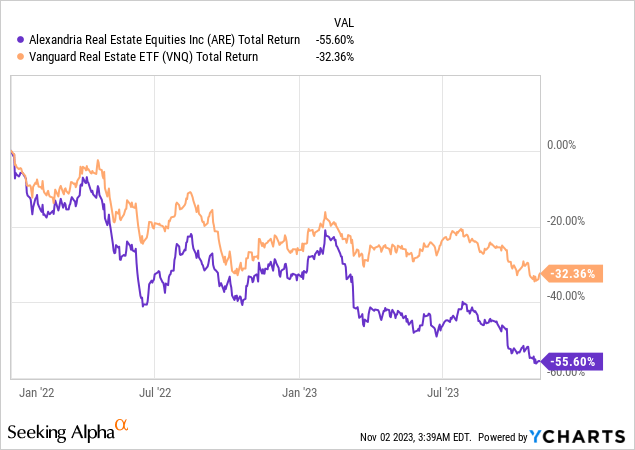

Alexandria Real Estate Equities (NYSE:ARE) is a one of a kind life-science REIT which has seen its price decline by over 50% over the past two years.

I believe there are several reasons for this.

First and foremost, interest rates and yields have increased significantly, which has caused all REITs to sell off, as evident from the 30% decline of the REIT index (VNQ). This is hardly surprising. REITs have leverage, though it isn’t high at all, and generally have long durations. Moreover, some REITs have a limited ability to raise rents and may not be able to sustain their cash flow if interest rates remain higher for longer.

I’ll show you later-on why I think that ARE is actually very well positioned for higher rates. But before that let’s talk about why ARE has underperformed the REIT index so much when it’s supposed to be one of the highest quality REITs out there. I believe the reason is that the market is worried about ARE facing a lot of the same challenges that office space faces. This mainly means tenant downsizing due to work-from-home and to a lesser degree a large amount of conversions from office to life science space. Don’t you think these two bear arguments contradict each other? If life science faces the same challenges as office, then why bother with conversions…

My last article on ARE was focused on de-bunking these two main bear arguments by looking at electricity consumption, discussing the challenges of converting an office building into a life science building and most importantly looking at ARE’s recent leasing which confirmed to me that tenants value their space and show no signs of downsizing. I issued a STRONG BUY rating at $115 per share, which is just below my cost basis of $119 per share. Since then, the stock has declined by 20% to $93 per share and ARE has reported their Q3 2023 earnings, which I want to go over in this article.

Recent earnings confirm my thesis

ARE has done an exceptional job of responding to bear arguments. This was true of their response to Jonathan Litt’s short report and it’s true with regards to their most recent earnings presentation which focuses on one key point – strong leasing showing no signs of tenant downsizing.

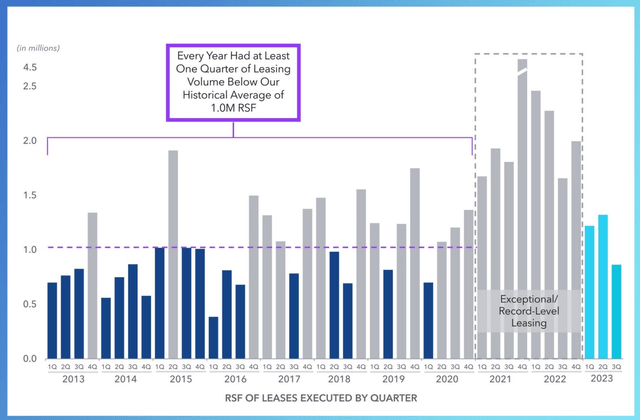

During the third quarter, Alexandria has leased 870 ths. sft of space, which is down from 1.3 Million sft last quarter. The drop can, however, be in large part attributed to the fact that near term lease expirations for the rest of the year were quite low at the start of Q3 – only 650 ths. sft. And low near-term expirations somewhat justify low leasing, because no landlord is trying to renegotiate lease agreements that expire a year or more from now.

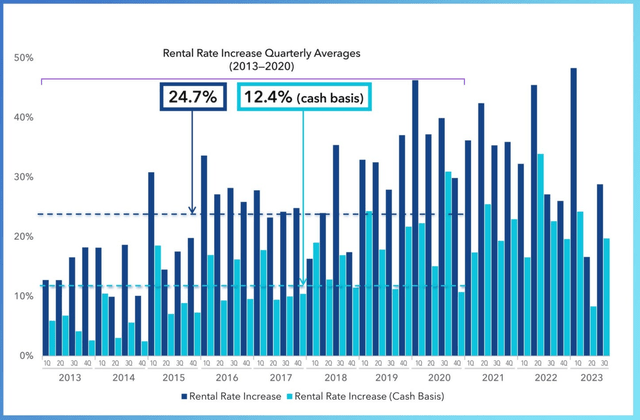

On a quarterly basis, leasing in Q3 was admittedly slightly below the historical normalized average of 1 Million sft. But on a year-to-date, ARE has leased 4.6 Million sft of space which is above the 2013-2020 average of 4.2 Million sft. Leasing has never been linear (see chart below) so I don’t think we should put too much emphasis on the QoQ slowdown, unless it persists for multiple quarters.

ARE Presentation

Admittedly, leasing hasn’t been exceptional, but it has been solid and ARE has maintained a 93.7% occupancy, up 10 bps from last quarter. More importantly, the leases signed in Q3 had an above average term of 13 years. For comparison, over the past 9 years, the lease term has averaged just 8.7 years. So life science tenants are clearly willing to commit for longer periods, which is very different from what’s happening in the office sector where tenants often demand shorter than usual lease terms.

Moreover, new leases continue to be executed at very high rent spreads. In Q3 rent increases on new leases reached 29% and 20% on a cash basis, above the 2013-2020 average for both. Once again, I want to point out that this is the single most important piece of evidence that tenants like the space and want to keep it. This is also confirmed by the fact that at renewal, tenants have retained 99.7% of their space on average. In other words, nobody chose to downsize their space (on average).

ARE Presentation

Future growth prospects remain intact

ARE has had an exceptional run, growing their AFFO by a CAGR of 7.4% over the past 10 years. During Q3, NOI has increase by 7.9% YoY while same-store cash NOI has increase by 4.6% YoY.

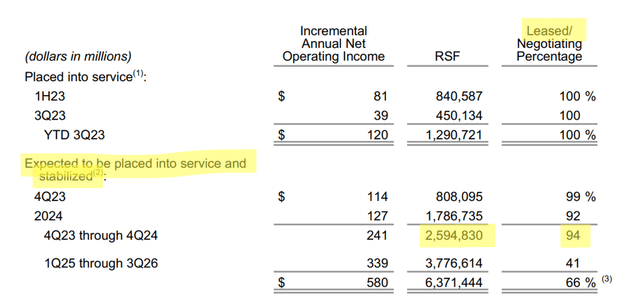

Going forward, ARE has a lot of potential to grow their rents further, for three reasons. Firstly, their build-in rent escalators are amongst the highest in the REIT sector at 3%. Secondly, high rent spread that average around 15% on a cash basis enable the REIT to increase rents substantially when leases expire. Increasing rents at expiration is arguably the best way to fight inflation for a REIT. About 9% of leases will expire in 2024 and 2025, which means that ARE should be able to increase their total rent by another 1.35% each year. Finally, the REIT is able to grow through acquisitions and development of new projects. ARE has a sizeable pipeline of projects under construction. Over the next five quarter 2.5 Million sqft of space will be finished and generate an additional $241 Million in NOI. And this growth which should increase NOI by another 10-12% is highly visible, because these projects are 94% leased!

ARE Supplement

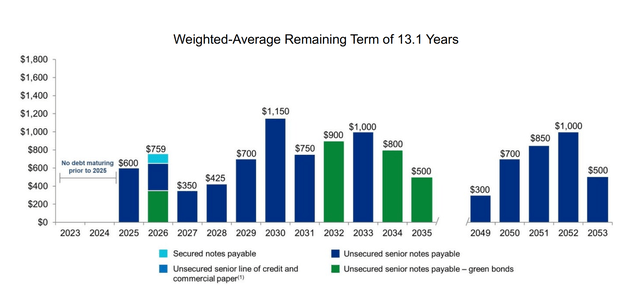

Internal growth of 4.35% and highly visible external growth of 5-6% per year are key amidst high inflation and high interest rates. But so is a strong balance sheet. ARE has a BBB+ rating and one of the longest weighted-average terms of 13.1%. No maturities next year and 99% of fixed-rate debt put the REIT in a very strong position to fight higher interest rates.

If interest rates stay higher for longer, then ARE’s increase in net interest expense will be very slow and gradual. Assuming the fed funds rate stay at today’s level until 2026, I expect about a $20 Million increase in net interest expense in 2024 and 2025. But rent escalators alone will result in $55 Million of additional rent each year. Therefore, it’s not an overstatement to say that ARE is very likely to grow its cash flow regardless of what happens to interest rates.

ARE Presentation

ARE trades at a low valuation

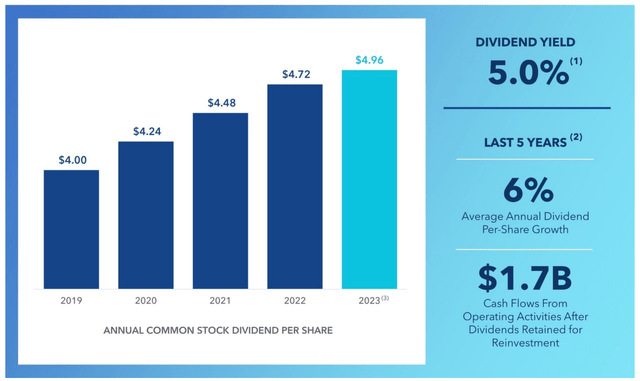

The stock pays a 5% dividend yield with a low 55% payout ratio. It has increased its dividend with a CAGR of 6% and I expect the same going forward.

ARE Presentation

The stock trades at just 10.5x FFO. For comparison, during 2005-2006 when interest rates were just as high as today, the stock traded closer to 17-19x FFO. And the only time it traded lower than now was in 2009 when it bottom around 5.5x FFO.

The implied cap rate stands at 6.6%, which is 190 bps above the 10-year treasury yield. Historically, a spread of 2-3% has been considered fair and since ARE is one of the highest quality REITs, it likely deserves to trade at the low end of that spread.

The fundamentals are strong, rent spreads remain high and the development pipeline is well pre-leased. Setting a price target here is difficult, but looking through the noise, I expect FFO to reach $10 per share by the end of 2025. At that point in time, I see ARE trading at least at the bottom of the range seen during the 2005-2006 period of 17x FFO. That gives me a rough price target of $170 per share.

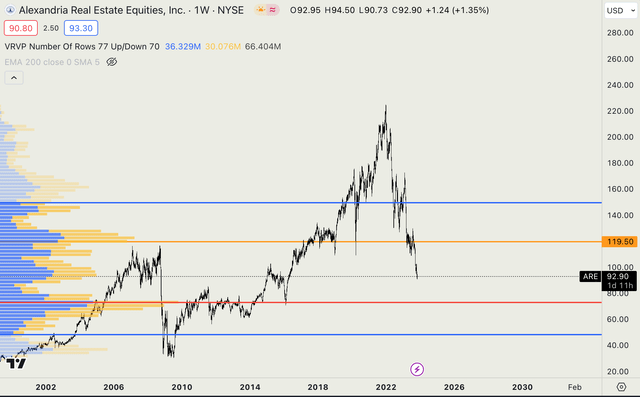

Over the short-term, however, price action will continue to be driven by interest rate expectations, which I can’t predict. My break-even is at $119 per share and I only plan to add more to my already large position if the price reaches a strong technical level around $73 per share. For now, I reiterate my STRONG BUY here at $93 per share.

Tradingview

Read the full article here