Investment Thesis

PENN Entertainment (NASDAQ:PENN) shares have rebounded strongly after the most recent Q3 results which I unfortunately believe to be caused mostly by hype rather than solid operational performance.

While the new ESPN Bet deal and launch of the service on November 14 should help generate stronger revenue growth for the firm, a difficult macroeconomic environment may dampen hopes of a sudden change in profitability for the firm.

Despite shares potentially being over 30% undervalued, I see significant uncertainty and risks associated with short- to mid-term results which, when combined with a market currently offering many blue-chip stocks at significant discounts, makes building a case for PENN difficult from a deep-value, quantitative perspective.

Therefore, I must downgrade PENN to a hold rating at the present time.

PENN Entertainment Background

Penn Investor Relations | Homepage

PENN Entertainment is a North American provider of entertainment, sports content, and casino gaming experiences. The company is one of a few highly consolidated market leaders in the market and operates an impressive portfolio of online sports betting and iCasino businesses.

The gaming firm operates multiple well-recognized brands including Hollywood Casino, L’Auberge, and now ESPN Bet. Their business strategy revolves around maintaining a highly differentiated portfolio with a significant focus on maximizing cross-selling opportunities.

PENN’s recent deal with Disney’s ESPN will see PENN rebrand their sportsbook service to ESPN Bet. The agreement between the two entertainment giants has sparked intrigue and interest in PENN shares with a recent 15% pop coming from the release of eagerly awaited Q3 results.

Economic Moat

I conducted a full in-depth analysis on PENN’s economic moat back in June 2023. Since then, there have been a few fundamental changes to PENN’s economic moat and revenue drivers.

To read a comprehensive analysis into the firm’s incredibly broad and robust economic moat, check out my deep-dive article “PENN Entertainment: A Deep Value Jackpot”.

In this update article, I would like to primarily discuss the divestiture of Barstool Sports back to founder David Portnoy along with the new ESPN Bet long-term licensing agreement.

barstoolsports.com | Homepage

In early August PENN simultaneously announced their new long-term deal with ESPN and the sale of Barstool Sports through press release. The sale of Barstool back to Portnoy came as a surprise to many as PENN had only fully acquired the sportsbook and cross-platform media business in February 2023.

The company stated that while Barstool had been a great partner and helped the firm to rapidly scale their digital footprint through early and mid-2023, the divestiture comes as a natural partition due to the diverging futures these two entities hold.

Barstool sportsbook was theoretically supposed to work in tandem with the brand’s extensive social media presence to bring a huge new raft of customers into the PENN Entertainment ecosystem of products and services.

However, due to the controversial nature of Portnoy, PENN and Barstool were denied licenses from regulators due to the highly polarizing nature of Portnoy.

Given the new direction PENN is taking with ESPN through their 10-year deal to rebrand their sportsbook as ESPN Bet, maintaining Barstool as part of their portfolio made little sense.

This resulted in PENN selling the brand and sportsbook back to David Portnoy for just $1 in exchange for multiple non-compete clauses and an agreement that permits PENN to benefit from 50% of any monetization events of Barstool or any subsequent sales of the company.

I believe this transaction ultimately was the best outcome for a deal with while initially enticing, was difficult to maintain due to the fundamental differences between how PENN operates and how Barstool does.

While I do believe that the loss of Barstool will limit PENN’s exposure to the online media business, I think the refocusing on their core integrated entertainment services provision is better for the long-term future of the company.

PENN FY23 Q3 Presentation

The ESPN Bet rebranding will cost PENN $1.5 billion along with $500 million in warrants tied to media, marketing, and other services from ESPN. While this is incredibly costly, I believe the agreement will allow PENN to tangibly benefit from ESPN’s leading name in the sports world and enable the firm to expand their consumer base significantly.

While ESPN does not have the same virality as Barstool online, I believe the overall reputation and image held by ESPN better match both the clientele and image PENN tries to convey with their services and products.

Nonetheless, I while PENN’s overall business structure and portfolio of products now make more sense from a long-term perspective, their economic moat has suffered very slightly from the loss of Barstool Sports.

The ESPN deal will enable PENN to still benefit from a significant online presence on many social media and entertainment platforms but in a different manner than with Barstool.

While the overall exposure may even be greater with ESPN, I believe Barstool enabled PENN to attract a younger generation of clients which could have benefitted the firm if the two brands could have successfully worked together.

Therefore, and given the relatively disappointing results presented by PENN in their latest Q3 results, I must downgrade my assessment of their economic moat from a midsized one to a narrow moat rating.

Significant successes from the ESPN Bet deal could warrant an upgrade in PENN’s moat rating should the licensing agreement see PENN earn outsized returns on their invested capital both from an absolute perspective and relative to their peers. However, at present time only speculative statements can be made about the new agreement’s success.

Financial Situation

On the whole, PENN’s fiscal situation remains mostly unchanged. The firm continues to generate slightly mixed fiscal results with some positive indicators often marred by lackluster performance elsewhere.

For an in-depth analysis into how PENN generates their revenues and profits along with a historic look into their financial situation, I once again recommend reading my previous article here. This update will deal with their most recent quarterly results.

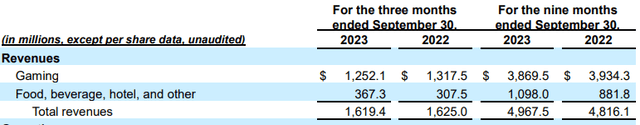

PENN FY23 Q3 Report

Q3 of FY23 saw PENN’s gaming revenues decline YoY while their food, beverage, hotel and other (FBH&O) revenues actually grew substantially YoY.

A weaker-than-expected consumer led to a decline in the overall demand and time spent by consumers on each of their platforms and in-person sites which impacted gaming revenues. Overall revenue was down only 0.3% YoY with the 5.3% gaming decline being offset by a stellar 20% increase in FBH&O revenues.

The decline in gaming revenues was mainly due to relative weakness from PENN’s South and West business segments. PENN’s Northeast and Interactive segments actually saw reasonable revenue growth of 2% and 24% respectively thanks to an increase in spend per consumer in these regions.

While the drop in revenues from their gaming segment was disappointing to see, I believe this weakness acts much more as an acid test of the U.S. consumer rather than PENN’s fundamental business model.

Gaming revenues are notoriously sensitive to macroeconomic conditions which (given the highly inflationary and elevated interest rate environment now prevailing in the U.S.) ultimately means that these results are not all too surprising.

The strong FBH&O revenues were due to continued strength among PENN’s core consumers resulting in strong customer demand for their leisure services.

PENN FY23 Q3 Presentation

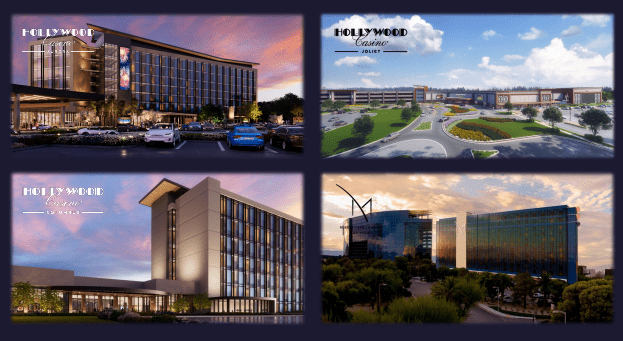

This strengthening in PENN’s FBH&O revenues is great to see and suggests the company’s significant investment into the leisure sector is beginning to bear fruit for the firm. PENN is hoping to break ground on four new retail projects later this year: Three new Hollywood gaming hotels and one new “M Resort”.

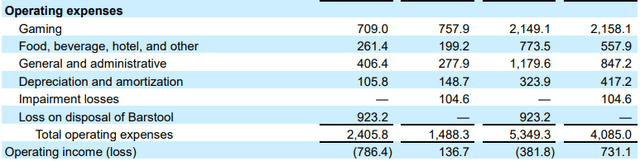

Unfortunately for PENN, operating expenses largely soured their surprisingly strong Q3 revenue performance.

PENN FY23 Q3 Report

While a decrease in variable costs associated with their gaming business along with continued expense control meant that overall operating expenses dropped over 6.3% YoY for the segment, the firm witnessed massive increases in their FBH&O operating expenses along with a large increase in general and administrative costs.

The 31% jump in FBH&O expenses handily offsets the 20% increase in revenues for the business resulting in contraction of the segment’s operating margin from 35% to 29%. While the difficult macroeconomic environment has resulted in an increase in supply costs for essentially every business in the U.S., the drop is still important to consider when evaluating PENN at the present time.

PENN’s sale of Barstool can largely be held responsible for the large increase in general and administrative expenses and I fully expect the firm’s Q4 results to indicate a return to the high $200M range for these costs.

Overall and including the loss on disposal of Barstool, PENN generated a loss of $786.4M in the third quarter. Not counting the Barstool divestiture costs and estimating a general and administrative expenses figure of around $295M, I estimate that PENN would have generated a net income of around $223M which while still down QoQ is relatively positive to see.

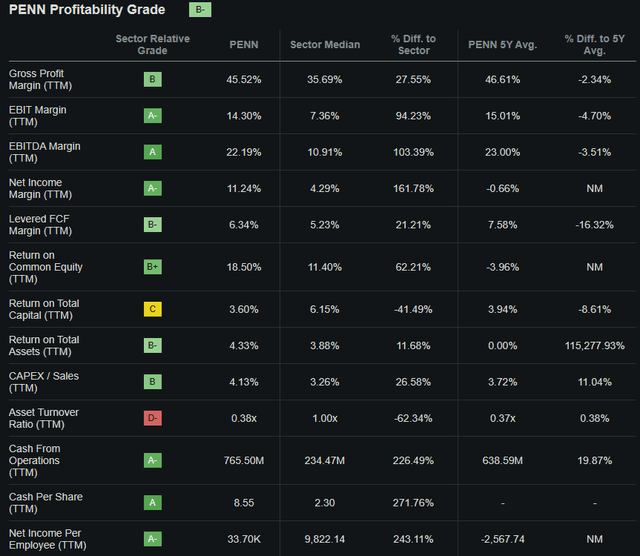

Seeking Alpha | PENN | Profitability

Seeking Alpha’s Quant derives a “B-” profitability rating for PENN which I believe to mostly be an accurate representation of the firm’s overall relative profitability situation.

PENN’s balance sheet continues to look a little shaky with the firm having a debt/equity ratio of 2.77x. While short-term liquidity is relatively positive (PENN’s quick ratio is 1.27x and current ratio is 1.41x), I believe PENN’s multiple large infrastructure-focused expansions may place additional debt on their balance sheets in the future.

Their debt schedule remains unchanged with no real maturities due before 2026.

Moody’s has affirmed PENN’s LT corporate family credit rating at a “B1”; the outlook is stable. PENN’s senior unsecured domestic notes are rated as B3. Moody’s defines B1 and B3 as being of “speculative grade” and subject to “high credit risk”.

Overall, PENN continues to generate a mixed bag of fiscal results with the most recent earnings report still showing some weakness in PENN’s key revenue streams.

While the mostly flatline gaming results and positive FBH&O revenues were nice to see, the increase in costs suggests additional expense control and fiscal responsibility are required at the firm.

PENN Stock Valuation

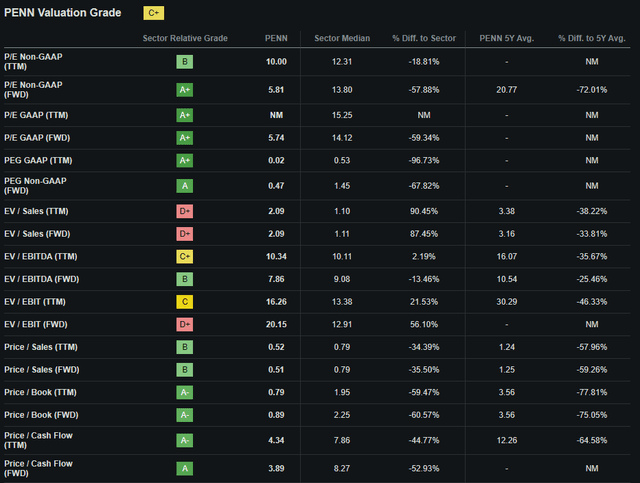

Seeking Alpha | PENN | Valuation

Seeking Alpha’s Quant has assigned PENN with a “C+” Valuation rating. I believe that while mostly accurate, this letter grade may be slightly pessimistic given the overall value present at the firm.

The firm is currently trading at a P/E GAAP FWD ratio of 5.74x and a P/CF ratio FWD of 3.89x. PENN’s FWD Price/Book ratio is very low at 0.89x despite the firm’s EV/Sales FWD of 2.09x.

Once again PENN has some slightly mixed basic valuation metrics. While the low P/E ratio, P/B, and P/CF ratios suggest a nice undervaluation in shares, the quite elevated EV/S metrics are a little concerning.

Seeking Alpha | PENN | Advanced Chart

From an absolute perspective, PENN’s shares continue to trade at an almost 5Y low (even despite the recent 15% pop in prices) with the gaming giant having underperformed the market on a 1Y timeframe by over 45%.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison certainly do little to help create a clear picture of any tangible value present in PENN shares, an intrinsic valuation calculation could help clarify the picture.

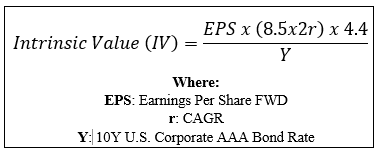

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using PENN’s current share price of $22.34, an estimated 2025 EPS of $2.06, a realistic “r” value of 0.05 (5%), and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.61x, I derive a base-case IV of $32.70. This represents an approximately 32% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.03 (3%) to reflect a scenario where PENN struggles to increase both revenue and net income due to a bearish macroeconomic environment harming their core customer base, shares are still valued at around $26, 13% above their current levels.

Considering the valuation metrics, absolute valuation, and intrinsic value calculation, I believe PENN is trading somewhere between a modest to significant undervaluation.

In the short term (3-12 months), I find it difficult to say exactly what may happen to the stock. While the strong future growth prospects presented by ESPN Bet are alluring, any negative short-term catalyst could result in a sudden drop in share prices.

However, even if in the short-term market sentiment turns particularly sour, I do not believe PENN shares have much room to drop further.

In the long term (2-10 years), I believe PENN can regain their stride and begin producing consistent profits and returns for their shareholders. While the Barstool tie-up appears exciting, I believe their new ESPN Bet deal is much more in line with their image, core client demands, and reputation.

While it may take a few years for PENN to begin extracting maximum returns from ESPN Bet and their leisure business, I believe the firm will get there eventually.

Risks Facing PENN

PENN continues to face significant risk from the firm’s exposure to a cyclical gaming market environment along with ESG risks relating to the intrinsic nature of the industry.

Considering the firm’s solid refocusing on their core gaming business, I believe PENN’s revenues are once again even more tied to the variable nature of the industry than before.

The divestiture of Barstool eliminates PENN’s media revenues and online presence which could have presented an opportunity for the firm to develop a lucrative third revenue stream.

However, given the divestiture (which I still believe to have been the right call) PENN is now once again at the mercy of the highly cyclical gaming industry.

The industry has historically performed very poorly during market downturns which could suggest short-term results at the firm may deteriorate significantly.

From an ESG perspective, no tangible change has happened at PENN with the firm still having to deal with the social and governance concerns associated with the gaming industry and gambling addiction particularly.

Given the unchanged and relatively serious social and governance risks associated with PENN’s operations, I would not easily recommend PENN to an ESG-conscious investor.

Summary

PENN had a mixed Q3 set of fiscal results which appear to have been largely overlooked by the industry in favor of hype around the highly anticipated launch of ESPN Bet on November 14.

Overall, PENN’s business economics have deteriorated with the firm’s overall operating margin having contracted significantly. When combined with the threat of a recession compromising the ability and willingness of consumers to engage in gambling activities, I see PENN facing tangible risk moving into 2024 from a profitability and revenue perspective.

While stock prices are mostly flatline since my last article, I believe the valuation scenario at PENN has degraded significantly as reflected by the more conservative 2024/2025 EPS estimates. At best, a 32% undervaluation is present in shares.

Therefore, I must downgrade PENN from my initial Strong Buy rating to a hold. The increasingly bearish macro environment and sudden change in business direction at PENN have increased the amount of uncertainty and risk associated with short/mid-term results.

I fundamentally believe that PENN is still a solid business but that current market conditions are unfavorable toward their turnaround.

To find other stock picks with potentially greater upside potential, check-out my recent articles on Bank of America (BAC), Microsoft (MSFT), and Disney (DIS): All rated Strong Buy!

Read the full article here