Above: The MGM lion roars across the entire global gaming sector.

- The cyberattack on MGM Resorts International (NYSE:MGM) of September 10th could be mitigated by insurance and is reason why management refused to pay ransom.

- MGM’s footprint is the most global in the sector.

- Its diverse revenue streams insulate it best from recession.

Recession risk gaming sector: While latest reports continue to show a strong consumer component driving the economy, at the same time, recurring opinion that a recession will indeed arrive soon increases. This poses a dilemma in our view for holders of gaming and wagering stocks. On the one hand, happy data for GDP growth, consumer spend. Also the overall tone of revenue and arrivals at major gaming destinations remains highly positive. Las Vegas in particular is jammed wall to wall on weekends and according to my key intelligence network associates, weekdays are remarkably strong as well. In brief, Vegas is wall-to-wall jammed and MGM is a prime beneficiary.

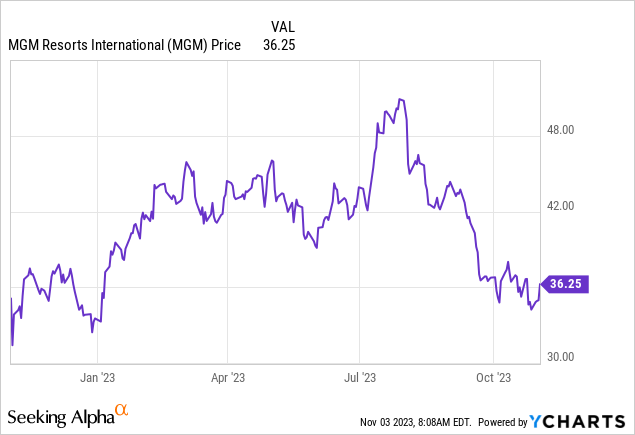

Above: The cyberattack and strike have produced a great “buy on the dip” opportunity right now.

On the other hand, there are ominous signs all over the place. National debt has reached a crisis point. Savings are beginning to erode as consumers pile up debt and spend wildly. Employment is good, but total open jobs are also beginning to fade. On top of this, we have a growing concern among some analysts that the post-covid boom in Vegas and other prime gaming destinations is starting to lose steam.

This is reflected in gaming stock valuations which are either dead pooled in lower trading ranges, or eroding slowly.

So, the core issue here: For participants in the sector: If a decision is made to stay invested, what’s the strategy in a risk of recession and thereafter a shot for a big upside downstream? For guidance there we look at the last cataclysmic economic collapse within memory to begin our rationale for our best recession resilient pick in the sector: MGM Grand International.

2007-2009 Vegas is the Petrie dish of gauging impact of recession in the gaming sector

google

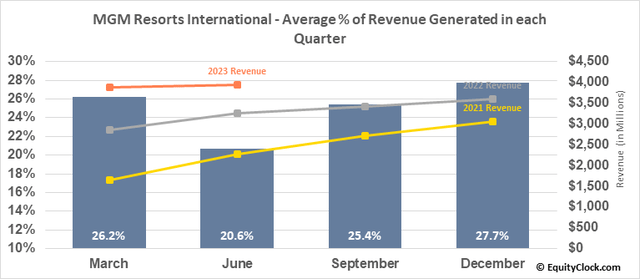

Above: MGM is moving into peak season across all its verticals.

The Las Vegas market has all the representative revenue streams running simultaneously that provide clues to how the sector in general can be expected to respond if and when a recession hits the U.S. and, by extension, the global economy.

Here is a capsule of how Las Vegas fared during the financial crisis of 2007/9:

2006: $14.9B. This year was the last of the pre-crisis full year when average spend was fueled by consumers flush with home equity loan cash, high employment, positive sentiment.

2007: $15.8b The financial crisis had not yet metastasized beyond Wall Street. The early months of the year remained strong, but began to wane toward 3Q07.

2008: $15.7b the early state of crisis impact with long term CAGR stopped cold as revenue began to erode.

2009: $13.7b The first evidence of a major hit Las Vegas was taking across the board: gaming decline, tourist arrivals down, convention delegations thinned, capex projects cancelled or postponed. Layoffs at casinos, closures or limitation of operational hours of dining outlets.

2010: $13.7b Revenue stabilized flat y/y. Cost controls imposed, arrivals inched up slightly.

2022: $19.6b Last year record breaking performance fueled by post covid surge that has eased somewhat since but still foreshadows another record year for 2023. The resilience of Las Vegas has resonated throughout the regional casinos driven by the same post-covid get out of home surge. Regional casinos, long dependent on core of older demo slot play, had suffered during covid as more vulnerable demos in ages 50 and up were gone. Their rapid return once travel bans were lifted and casinos fully open was a key element in their revenue recovery.

The 2018 legalization of sport betting contributed to the recovery by proving to be a potent marketing tool to bring younger demos into casinos. Their presence in meaningful numbers produced migration from sports books to the casino floor. This built blackjack and slot business and was the single major factor in casinos adding younger demos in large numbers to their rewards data bases.

The takeaway: Wall Street analysts and economists weighing in on the prospects for a recession ahead are all over the place from predicting soft landings to deep recessions. Investors are basically on their own as no matter the data trends cited to support a recession scenario, it’s all what if. For investors in the gaming sector the news we believe is this: Operators in the sector will feel some pinch but overall the industry has proven resilient in terms of its ability to sustain economic hits.

The proclivity to enjoy gambling as a leisure is well-proven over centuries. If a recession comes our best estimate now is that total revenues could drop by an average of 15.7% for a casino property across the board. And that recovery would take anywhere from 15 to 18 months to restore baseline revenue feeds. Overall it appears that staying invested in the sector rather than selling positions if recession begins to show may not be wise. Staying the course until recovery begins is what happened and furthermore, showed up in advances in valuations.

We do not imply the casino business is immune to economic disruption due to recession. It is not. But the relative damage inflicted by an economic decline on visitation is relatively small and usually sets the stage for a spike down in the stocks and then a sharp upward move as news of recovering gaming win hit public and media channels.

Pending strike: Culinary and some non-gaming workers have voted to strike Vegas properties imminently. This could trigger a slight dip in the sector that would include MGM. Labor history of Vegas suggests strike likely to be brief. If a dip follows, it’s a further buying opportunity.

Safest bet in the sector if recession comes: MGM

The MGM bull case presenting what we believe is the most resilient business model against recession to come is based on their total participation in every key node in U.S. and global gaming. Simply put, economic decline is not always uniform between geographic areas. Nor does is a recession an equal opportunity destructor of revenues. Some areas have economies far more resilient to economic distress than others. MGM by far has the most diverse revenue source spread in the entire industry:

Las Vegas fortress: 37,293 rooms in 9 properties on the strip positions it to market across the board to high and mid- level play, tourism, package tours, conventions, and major entertainment offerings and events. The strip properties represent over 60% of total revenue. Because of its sheer capacity, MGM’s advance convention book is always among the most quickly filled.

Regional casinos US: 9,563 rooms in 8 properties, 30% of revenue with a strong geographic footprint in the northeast (Atlantic City’s revenue leader), the Borgata. MGM Maryland, Empire City in suburban NY metro, MGM Springfield. Most likely winner of one of three downstate new gaming licenses to be issued by State of New York sometime before 2Q24. Also properties in Mississippi and other southern states.

BetMGM: The company’s 50% owned sports betting platform (With the UK’S Entain) now ranks as the leading revenue generator in the online gaming space after the two dominant sites of FanDuel (OTCPK:PDYPY) and DraftKings (DKNG) which jointly control over 70% of the entire sports betting market share. This year total revenue is expected to surpass $7.7b with a hold percentage inching a bit above historic hold of 7%, to near 8%. But the final number won’t be clear until the end of the NFL season. We are estimating that BetMGM’s market share could reach 22% this year, bringing it into third place behind the two sector leaders. We estimate that BETMGM’s sports and online casino revenue will reach $1b this year and begin to show positive EBITDA going forward.

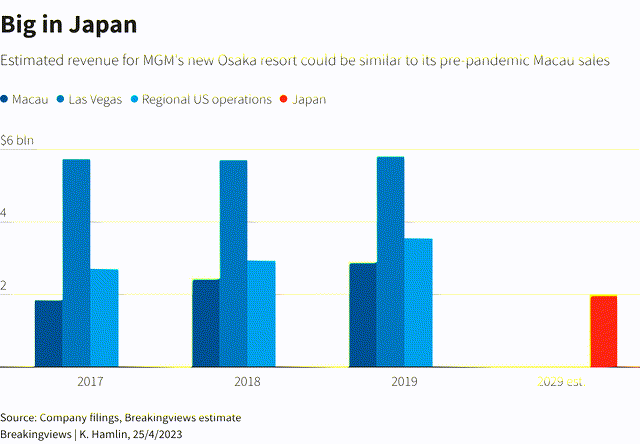

MGM China (Macau): Since China’s exit from its zero Covid policy last January, the Macau market has been on a rapid recovery ramp. October gaming win has reached $2b. The market has just about recovered its entire revenue flow from pre-covid baseline 2019. Our current forecast is that it will exceed 2019 in 2024 regardless of the shaky China economy. More to the point, MGM’s two properties, have now breeched double digit market share now estimated at 14.5% for this year. We are looking at Macau generating ~$26bE for 2023. MGM’s share if sustained will put its revenue total for the year at $3.6b which will be its strongest yet contributor to parent EBITDA. What is key here is that even if a recession hits the U.S., as past results have proven, Macau will continue to perform strongly. And that takes into consideration that the current woes of the China economy will remain.

LeoVegas: Last year, MGM acquired this EU based platform of live betting and social gaming with geographic spread throughout Europe. MGM paid $603m for the company. The company reported revenues of US$3.27b for 2022. This buy opens MGM to the entire EU online gaming market.

MGM Japan: This is the only global gaming leader now approved after a long, tortured process in Japan to develop a massive $10b integrated casino resort. It will be in Osaka, a major market, estimated to open by 2030. It exemplifies MGM’s global outlook and business model. All industry peers have abandoned development there due to political delays. MGM has hung in and likely will have little competition when it opens.

google

By any measure, MGM stands now as a sales growth play, a market share leader. But mostly it has a footprint in every single gaming node on the globe and will be well positioned through its diverse holdings to stand up well against negative sentiment on the consumer discretionary sector should a major recession hit. THE Key: The stock will take a hit as will all in the sector, but its recovery will be fast and exponential.

Take a look at this price action

July of this year $50.90.

September: $38,77—The cyberattack on the data hit on September 10. MGM refused to pay ransom. Estimates of anywhere between $60m and $85m in lost business by many analysts, But these forecasts were laid out not in full knowledge yet of the extent to which the loss would be covered by insurance. Thus far its mostly guesswork. My sources on the ground believe MGM’s calculation of lost business vs. insurance payouts produced a formula that suggested a better road followed would be to reject paying the ransom. Caesars (CZR) came to another conclusion.

We shall see. However, if we assume the worst case projection of $85m less perhaps as little as 40% insurance recovery, we have a quarterly loss against EBITDA of $28m—not pretty but far from justifying the hit the stock has taken.

Debt: Not pretty, but well covered

Long term debt: $8.4b as of year- end 2022.

Debt to EBITDA: 16X—not pretty but reflecting a period of expansion as part of a long-term strategy.

Capital lease obligations: $25.1b. This amount suggests to some observers that the company is paying far too much rent to its REIT landlords. Buying back the realty does not seem to us a viable option given the company’s strategy of asset light operation. On the other hand it does seem a practical possibility to us that if a serious recession overtakes the economy, that MGM would be well positioned to re-negotiate some relief from its REIT owners.

Current ratio: 2.04, well in the comfort range for debt holders.

Cash on hand: (mrq) $3.84b down from over $5.3b at the end of 2022, but still providing a significant enough cushion plus unused credit ability to permit execution of the business plan, which in brief: To be the most diverse holder of gaming assets in the U.S. as the globe.

Conclusion

At its knocked down price related to the cyberattack, we see a short-term level of support for a higher valuation forming. We think it’s a dip that is worth buying into even on a short term basis when more is known about the full extent of the damage from the cyberattack.

Longer term, we see continued ebullience in Vegas, recovery in regionals, progress in sports betting profitability, the supercharged recovery in Macau, and the expansion into the EU through LeoVegas as a recipe too good to pass up for a taste. This in my view is a strong buy situation.

Our Price Target: Next 90 days $47.85. By 2Q24 $63.5 Out years; This in our view is a $75 stock in hiding.

Read the full article here