Investment brief

The Federal Reserve’s decision to hold the policy rate at a 5 handle in its November FOMC meeting is a potential bullish turning point for US equities over the coming 12—18 months. Investors have already lifted the bid on U.S. indices since Fed Chair Jerome Powell spoke this week, with the S&P 500 index futures rallying some 70 points in yesterday’s trade. The concentration of the benchmark indices is to be heavily factored, and the overweighting to tech may actually prove to be a constructive crosscurrent for investor returns in the coming periods in my opinion.

Of course, markets are not out of the woods just yet. There is still a series of policy meetings in the coming months that may impose further restrictive conditions on the economy. For now, however, Powell has noted that the committee is closely monitoring economic data to make its decisions.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy.”

— Federal Reserve November FOMC Statement

A potential change in risk appetite means high beta names are once again attractive, and that means potential allocation to growth sectors such as tech and communication services. The latter, in particular, has compelling risk-reward opportunities when looking out 1 to 3 years into the future based on my analysis. For investors seeking direct exposure to this thematic, The Vanguard Communication Services ETF (NYSEARCA:VOX) is one issue to consider.

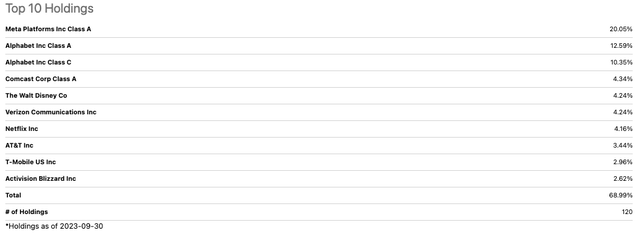

The fund offers concentrated exposure to ~120 holdings within the communication and tech sector, although ~97% of the weight is in communications. Critically the top 10 holdings comprise 69% of the portfolio’s weighting. It has $3.12Bn in AUM and charges an expense ratio of 0.1% on this, with dividends of $1.12 in the TTM.

Figure 1.

Source: Seeking Alpha

Like most sectors and markets, the fund has crossed beneath its 200DMA, and 50DMA in the last few months, coinciding with the reversal in broad equities. However, with a combination of (1) the Fed’s pause on rates, (2) recent earnings growth in Q3 for the communication services sector, (3) projected growth rates moving forward, and (4) a potential end-of-year rally in equity markets, there is scope for VOX to continue compounding wealth in the coming years in my opinion. They critical risk is the sector’s (and VOX’s) starting multiples, which may pressure returns in the coming 12-month period.

In that vein, my recommendations for all 3 investment horizons are as follows:

Fundamental—

- Short-term (next 12 months)- Bullish; Starting valuations are still high at 19.3x earnings. But these have come down considerably in recent months, and there is a case to be made for this sector to trade at a premium given the earnings growth and underlying fundamentals within. Adding on weakness and sizing up positions with a reversal rally towards the end of the year is advocated.

- Medium-term (1-3 years)- Bullish; Sales + earnings growth projections came in surprisingly stronger than expected for Q3, with communication services leading the way in upside surprises and YoY growth. This bolsters prospects for capital appreciation and multiples expansion from 1 to 3 years ahead. Sharp pullbacks within the long-term trend are compelling entry points to improve money-weighted returns.

- Long-term (3+ years) – Bullish – in the long run, the US still offers the most compelling risk/reward calculus when considering the blend of fundamentals, speed of innovation, and economic growth forecasts. Continued allocation to instruments such as VOX is attractive based on the performance of these factors. Allocation is therefore warranted over the long term.

Technical—

- Short-term (coming days to weeks): Bullish; recent rally from 6-month lows has seen key levels taken out with a potential recapture of the August highs, which saw a triple top formation across August to September.

- Medium-term (coming weeks to months): Neutral; still awaiting confirmation on bullish signals and range trade may be supported until we take key levels. Still has not recaptured previously attempted breakouts.

- Long-term (coming months): Neutral; related to the above.

Net-net, I rate VOX a buy based on the factors raised in this report.

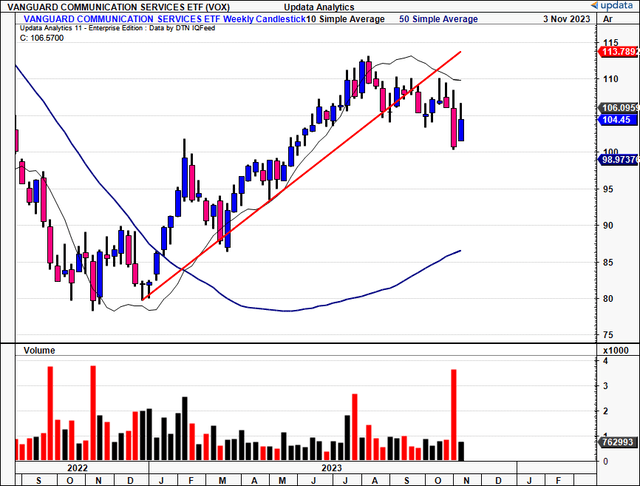

Figure 2. VOX trading in 3-month downtrend with bullish harami formation forming, taking out open of final week in October.

Data: Updata

Talking points

- Further tightening off the table—for now, at least

The Fed’s decision to hold its policy rate steady this week has been a short-term catalyst for equities in my view. This, combined with stronger-than-expected earnings growth and projections. (discussed later) have investors well-positioned in the long account.

It appears that companies are firing on all cylinders coming out of the 3rd quarter, which doesn’t necessarily imply a hard landing scenario in the U.S. But we shouldn’t get too excited just yet. There is scope that the pause in the hiking cycle may boost the size of Treasury auctions across all sections of the yield curve to fund the government’s deficit. This may see the net effect of pushing yields higher, and therefore clamp the upside for stocks.

Nonetheless, this is the second decision where the Fed has chosen to keep its policy rate within a 5-handle since July, around about the time when equity markets began to roll over. Still, Fed chair Jerome Powell did acknowledge in his speech that “the process of getting inflation sustainably down, 2% has a long way to go”.

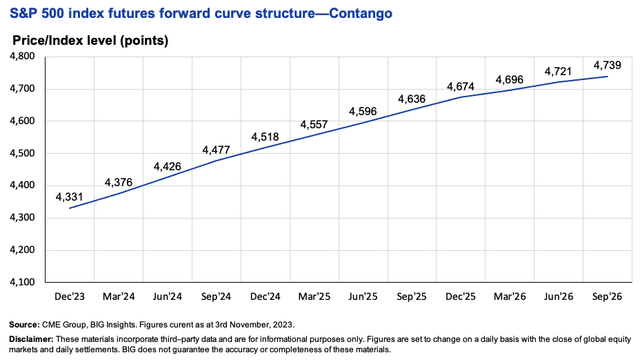

The phrase “long way to go” should not be ignored and certainly isn’t a signal of the end of the hiking cycle. But what is clear is that markets have certainly discounted a more optimistic view of what business may look like going forward. The yield on the US 10-year has contracted ~50bps off its highs of 5%, and now trades around at a 4.5% handle, levels not seen since September. Secondly, the U.S. futures market remains optimistic on the growth of domestic stocks. The forward curve of the S&P 500 index futures is still in a state of contango, indicating market participants are bullish on equity market gains (and the underlying fundamentals driving them) out until 2026.

Figure 3.

BIG Insights

- Earnings performance + projections remain on point

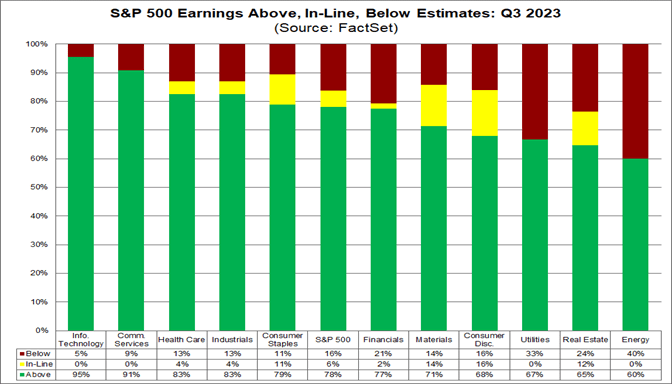

The outsized performance across sectors in Q3 earnings cannot be overlooked either. Companies not only surprised on both lines to the upside by a large magnitude but are projecting better business over the next 1—2 years. Markets have appropriately discounted this sentiment into stock prices, reversing the U.S. benchmarks from the October lows.

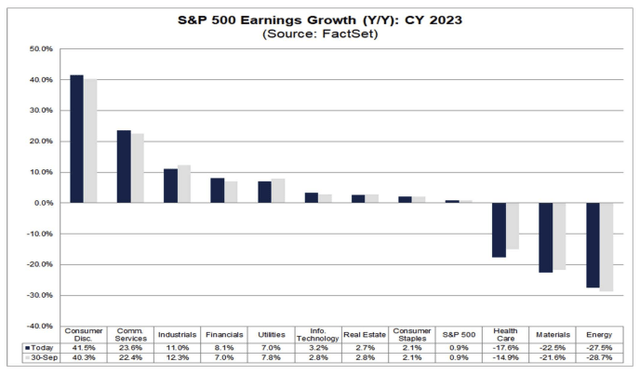

Specifically, 8 out of 11 sectors reported year-over-year earnings growth, with communications services leading the way. A total of 73% of companies reporting within the sector reported above revenue estimates, and 91% reported earnings above what Wall Street was expecting. On a blended basis, FactSet reports “the earnings growth rate for the Communication Services sector increased to 42.2% from 32.2% over this period”. Growth was driven by key names within the sector, including Meta (META), Alphabet (GOOG), and Comcast (CMCSA). Each are highly weighted constituents within VOX, thus a positive sign for investors.

Figure 4.

Source: FactSet

Figure 4a.

Source: FactSet

This performance has led the crowd at Citi to maintain its overweight rating on the communication services sector as we roll into the fourth quarter. It has provided an extensive list of buy ratings across large-cap names within the space. The estimated total return shown in Figure 5 ranges from 21% to 65% across the firm’s top selections. A number of these names are held within VOX.

Figure 5.

Source: Citi, via Seeking Alpha

- Are premium multiples justified?

Coming 12 months’ returns for any investment class are heavily impacted by starting valuations. VOX trades at 19.3x earnings, ahead of the broad fund average ETF universe, and ahead of FactSet’s 13.2x segment average. The question is what bearing this may have in forward returns over the next year.

For instance, there are particular funds trading at statistical discounts, such as those concentrated in Europe and utilities, where the potential for reversions or attracting inflows is quite high.

However, there is equal scope for those ratings to be justified, just as there is scope for the communication services sector to justify its premium multiples in my opinion. Given what was discussed earlier around Q3 earnings growth, and projections for sales and profit growth moving forward, it is entirely reasonable that investors are pricing in higher expectations for the sector relative to the non-US and adjacent markets.

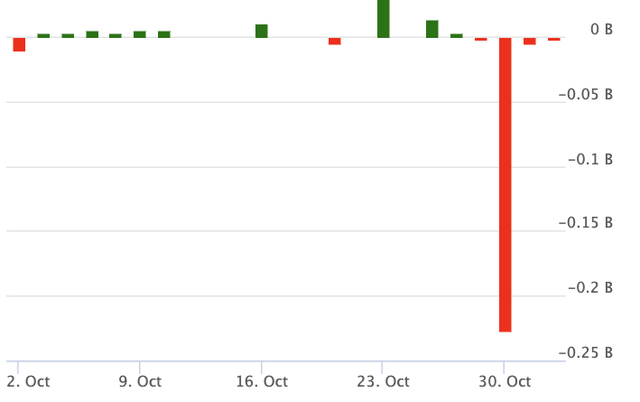

At 19x earnings, this is also below the broad market and in line with 2018–2019 levels, even as far back as what we saw in 2013, and 2014. Still, this wasn’t enough to keep investors invested in VOX at the end of Q3, with the fund realising its largest net outflow over the last 12 months, as seen in Figure 6. In summary, it appears that investors are pricing another period of outperformance for communication services. This is supported by research from FactSet that found, of the 11,270 ratings on stocks in the S&P 500, 62% of communication services sectors have buy ratings, in contrast to consumer staples with 47%, for example.

Figure 6. VOX fund flows, October ’22—October’23.

Source: VettaFi ETF Database

Technical considerations

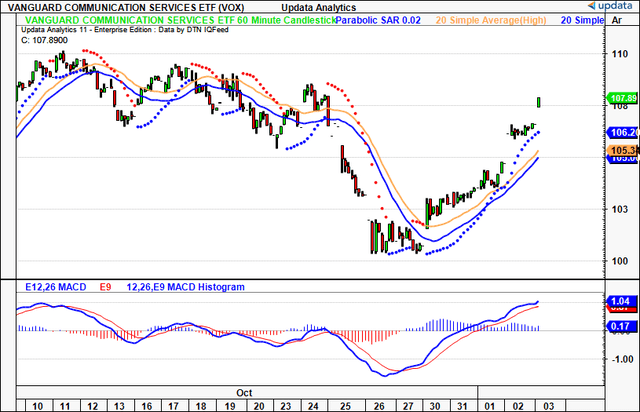

1. Regarding momentum

We have indeed activated key momentum levels rolling into November. On an hourly frame, we have seen 2 remarkable facts that point to a period of upside in the coming days to weeks. One is the bullish cross of the MACD at the end of October, which reversed the trend of the MACD.

Figure 7.

Data: Updata

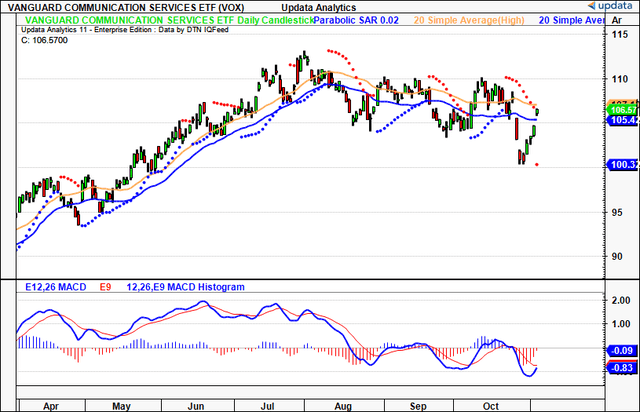

Second, we had a price gap to the upside leading into November, which retook the second gap down from earlier in the month. Three, the parabolic SAR gave an early by signal last month as well—along with the bullish cross of the MACD—and the price line also crossed above the 20DMA’s of highs and lows. This corroborates the fact that VOX is setting higher highs and higher lows. On the daily chart, we have yet to cross the MACD, but we are now testing the 20DMA of highs as I write, so the coming weeks of trade are crucial to gauge where we might sit within the trend.

After backing and filling since July, the fund has done very little in terms of directional bias, but held off the downside quite well, considering the rest of the market has performed.

Figure 8.

Data: Updata

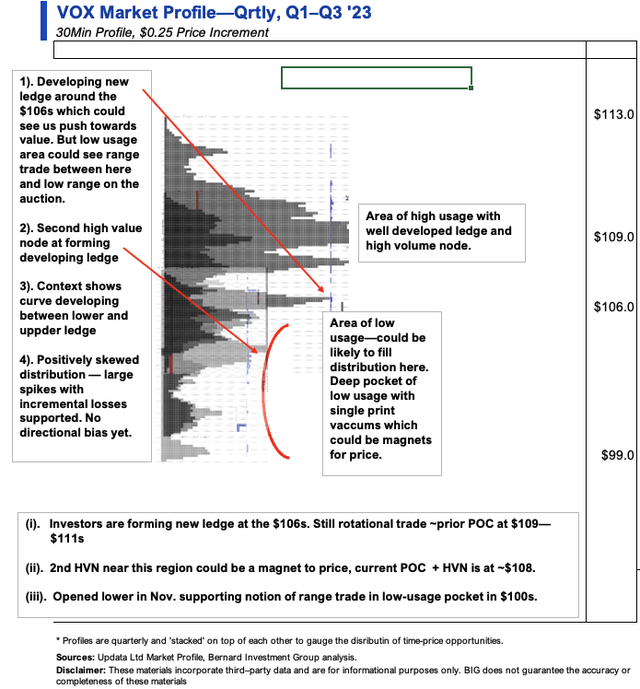

2. Skew, directional bias of price distribution

- Observations: A full distribution was completed in September, calling for a directional move. Providing historical context back to Q1, there was a clear pocket of low usage from the $109s—$100s. This was the directional bias the fund would venture to. We opened October lower as expected and began to fill this low-usage area. Investors have since begun to form a ledge at the $106 region, with a second high-value node forming a ledge in the $100 region (Figure 9). The context shows a curve developing between the upper and lower ledges, with the unmatched lower ledge being filled as we speak. The fact this low usage pocket is also being filled suggests that we could rotate between these levels in the coming months. The distribution is positively skewed, with large spikes forming the bell curve, sporting the notion of incremental price movements with sharp, snapback rallies. Unfortunately, the scope for directional trade is not yet supported.

- Key levels: $109-$110 is the high-volume node and high-usage area acting as resistance. Longs below the $100s and from $100–$105 are supported with the recent breakout. Matching ledge from $103–$105 could prove to be strong areas of support.

- Actionable strategy: Given that (i) distribution is not completed, (ii) positively skewed data, and (iii) low usage pockets, directional trade is not yet supported. Range trade is instead between the two value areas. Once the distribution is completed, I would be looking to the upside.

Figure 9.

Data: Updata

3. Directional bias of trends

There are mixed signals over the horizons on the bias of trends.

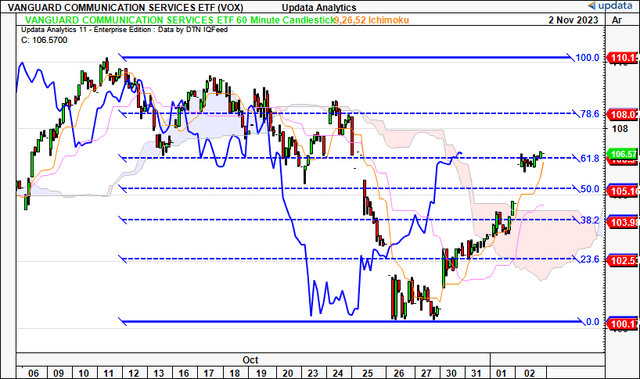

Figure 10. Short-term (60-minute chart, looking to coming days)—

Observations + key levels:

- Now bounced from October lows and tracking to previous highs.

- Bullish cross into cloud, retraced 61.8% of the move on the fibs.

- Currently testing this level, looks like a fight between bulls + bears with series of tight closes after large upside gap.

- Key levels are $108 on the upside, then $110 at the former high. On the downside, $103–$105 are the two levels, which would break us back into the cloud.

- We are bullish on the short-term.

Data: Updata

Figure 11. Medium-term (daily chart, looking to the coming weeks)—

Observations + key levels:

- Pulling back to 4-month range with latest reversal, with A being the marubozu line that tested + failed in August.

- We’ve just broken the marubozu line from October at C, and the next level would be $107 at B, corresponding to the August marubozu line and cloud top by the end of November.

- Tremendous selling volume in October has brought more supply on market and these were quickly gobbled up as shown by the intra-trend hammer this week.

- We need a break above $107 to be bullish, and lagging line cross to support this.

Data: Updata

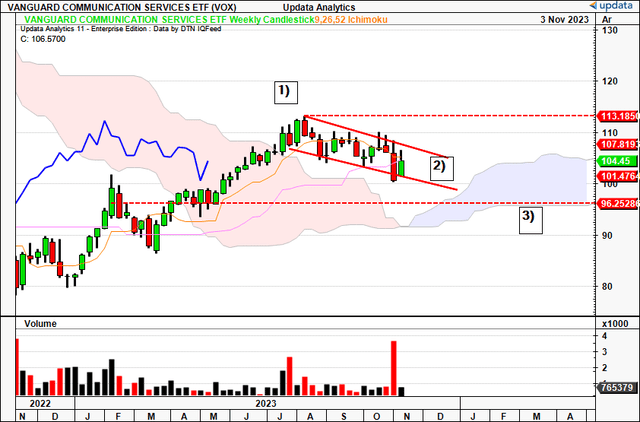

Figure 12. Long-term (weekly chart, looking to coming months)—

Observations + Key levels:

- Haven’t broken downtrend that started at 1) yet but looking more constructive. Bullish harami formation forming with shadow closing above last week’s close.

- Lagging line within the cloud, needs a cross above the $107 mark in the coming weeks for a bullish view.

- Next level is $111 on the upside, and we need to stay away from $96 which was a key level from 2022.

- Neutral on this chart for the time being.

Data: Updata

Discussion Summary

In short, communication services is primed to rally given the set of near-term catalysts discussed in this report. Beyond that, the outlook for the sector remains strong in my opinion. Investors have already lifted the bid on VOX since its 3-month consolidation after the Fed’s decision to pause. Being a high-beta sector, any rally in the broad indices will inflect positively on the fund. I would still be prepared for further range trade from the $100–$110 region until price distribution completes its bell curve from Q1–Q3, which we are approaching based on my analysis. Afterwards, I would be looking to the upside. As a reminder, the recommendations are:

Fundamental bias— Bullish across all time frames.

Technical— Short-term bullish, need confirmations on mid to long term.

Net-net, I rate VOX a buy on the culmination of these factors.

Read the full article here