Investment thesis

The story of Moncler (OTCPK:MONRY) (OTCPK:MONRF) is a fascinating tale of evolution that has taken this company from its humble beginnings in France in 1952 as a manufacturer of high-quality cold-weather clothing to its current status as an Italian semi-luxury brand. This remarkable transformation experienced a pivotal turning point in 2003 when the visionary entrepreneur Remo Ruffini acquired the company and completely revamped its strategy and direction.

My investment thesis in Moncler is grounded in the fact that we are still in the midst of this transition from a premium clothing brand to a luxury brand, and as investors, we can capitalize on this process. In this article, I will attempt to explain why I believe Moncler has the potential to establish itself as one of the leading luxury brands, and the benefits this could bring both to the company and investors. Furthermore, given the recent declines in the sector, we may be presented with an intriguing buying opportunity, so I will endeavor to conduct a valuation to determine a target purchase price.

What sets apart a luxury brand from a premium brand?

This is a complicated question to answer, but it is crucial when analyzing a luxury sector company. From my point of view, a luxury brand is one in which its customers have such high purchasing power that even during a recession, they can still comfortably buy their products and can accept periodic price increases. In contrast, a premium brand is sensitive to economic cycles, and price increases are limited due to a more elastic demand. I believe that an example makes this much clearer; A luxury brand, in my opinion, would be Hermes or Christian Dior, while a premium brand might be Michael Kors-.

I think the advantages of being a luxury brand are clear, but what does a company need to reach this status? In my view, it is necessary for the public to perceive it as exclusive and not within everyone’s reach. Keep in mind that the goal of these products is precisely to allow high-level consumers to differentiate themselves from the rest. To achieve this goal, I believe there are three fundamental aspects that Moncler is handling very well: history, marketing and experience.

History

History is crucial for these types of brands because the longer you’ve been in the market, the more you’ve been able to establish yourself in the minds of consumers, and the more recognizable your brand becomes. Just look at the years when brands like Hermes (1837) or Louis Vuitton (1854) were founded. Moncler was established in 1952 as a manufacturer of cold-weather clothing. Today, they have successfully positioned their flagship product, cold-weather jackets, in the minds of all consumers. When you think of luxury jackets, you think of Moncler, and this would have been impossible to achieve without their roots as a manufacturer of these products and more than 70 years of cultivating this brand image.

monclergroup.com

Marketing

In the world of luxury, marketing isn’t the same as in consumer markets. It’s not about having your brand everywhere but about having it in the right places. For instance, it’s not about seeing the LV brand on television every day, but about presenting it in exclusive settings, like at the World Cup final or the Monaco Grand Prix, where the trophy arrives in a custom-designed box.

In this regard, Moncler is doing what I consider an excellent job. They’ve organized top-tier events with influential figures in the fashion world, such as Pharrell Williams and Lewis Hamilton. The idea is to gradually elevate the brand’s status through this more selective marketing approach, focused on enhancing the perception of exclusivity.

Experience

Apart from effective marketing, providing an exceptional customer experience is crucial for a luxury brand. This encompasses everything from the moment a customer steps into the store to post-sales service. Moncler excels in this aspect. Their stores are located in prime city locations and boast stunning designs. During the buying process, a dedicated salesperson is always available to assist and meet your needs. After the purchase, you can directly contact their sales team for inquiries, information on future events, or to schedule appointments in the store. All of this elevates the brand’s perception among customers, making them more willing to invest in their products.

Luxury Retail Magazine

The transition from a premium brand to a luxury brand takes decades of successful execution, and the difficulty is immense. However, the reward at the end of the journey is well worth it. Moncler is executing their strategy correctly and has a clear goal. For this reason, I trust that over time, they will be able to increase the value of their brands and complete this transition. Now, let’s see how all this fundamental analysis has translated into concrete numbers.

Income statement

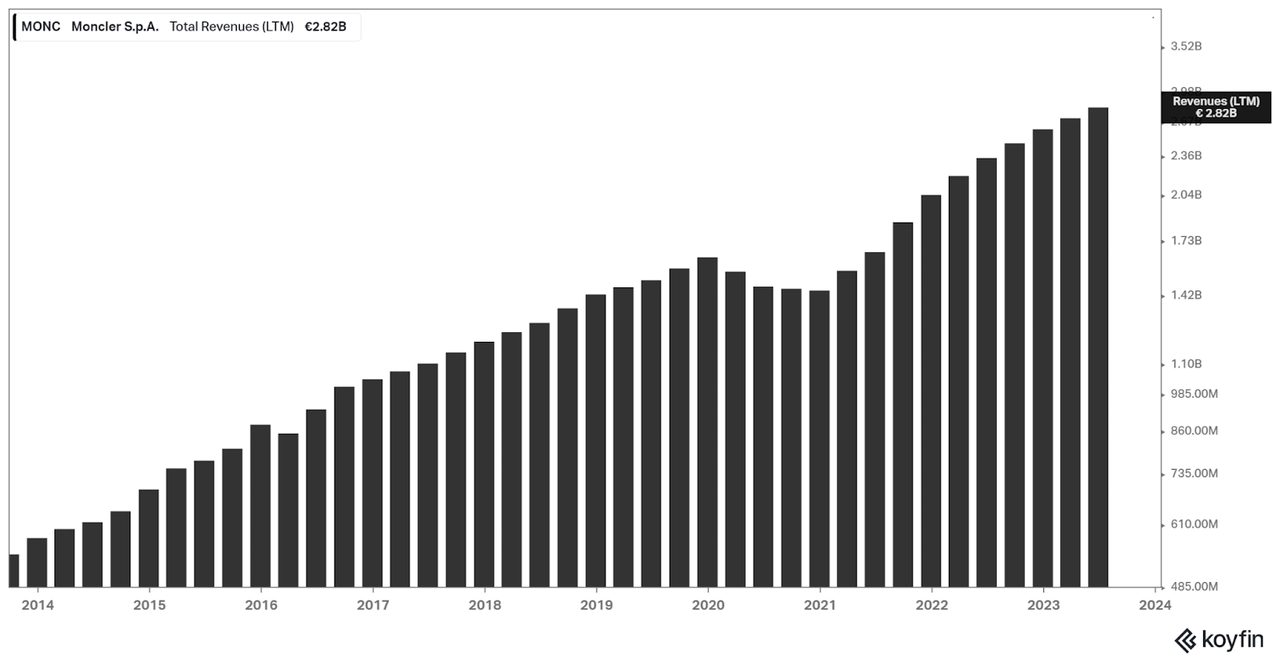

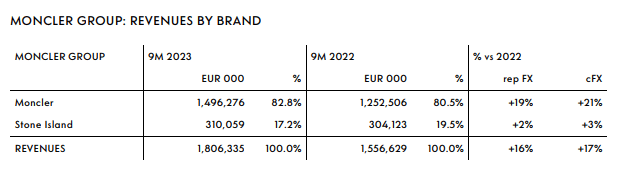

Before delving into the numbers, it’s important to note that Moncler recently acquired the brand Stone Island. We will discuss this acquisition in more detail shortly, but for now, it’s crucial to understand that it currently accounts for 15% of the company’s revenues. As seen in the following chart, the company’s total revenues have surged from 610 million euros in 2014 to 2,820 million euros in 2023, representing a remarkable compound annual growth rate of 18%.

Moncler Revenue (Koyfin)

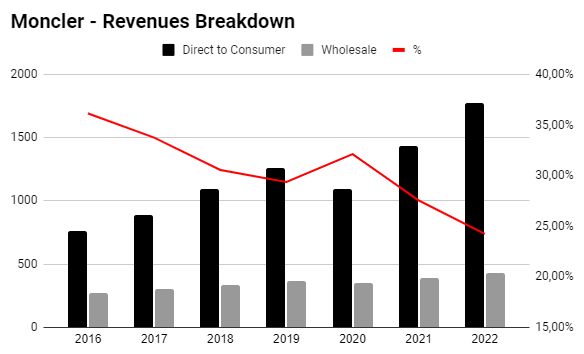

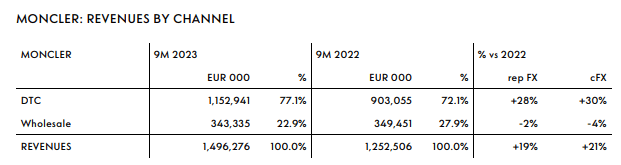

Something very important to note is that Moncler sells its products in two different ways: firstly, through multi-brand stores, and secondly, in its own retail stores. Taking into consideration everything we discussed earlier, it is far more advantageous to sell products in your own stores to maintain full control over the customer experience, with the ultimate goal of enhancing brand perception. In fact, the foremost luxury brands exclusively sell through these types of stores, completely eschewing multi-brand retailers.

Moncler, due to its somewhat lower status, is not yet capable of selling the entirety of its products through its own stores. However, it’s crucial to observe the trend in this data. This trend is highly favorable in Moncler’s case, as the percentage of sales through multi-brands stores has decreased from representing 38% of sales in 2016 to only 25% in the past year.

As you can see, Moncler’s strategy is centered on elevating the brand’s value, and all decisions made by the management are oriented in this direction. Selling the majority of their products through their own means is just one more method to achieve their long-term goal, serving as another example of the effective execution of their strategy.

Moncler Revenue Breakdown (self-made)

Capital allocation

Capital allocation is a key aspect for a company’s long-term growth, and undoubtedly, it is one of the points to which I pay the most attention when analyzing a company. In this regard, Moncler and its management, led by Remo Ruffini, seem to be doing a spectacular job.

First and foremost, organic growth of the Moncler brand is of utmost importance. To achieve this, they spare no expense on marketing and events, as we have previously discussed in this analysis. In the short term, profit margins could be higher by reducing this investment. However, in the long term, the return on this investment far exceeds the current one-time cost. I appreciate that the management understands and applies this strategy.

Inorganic growth is not a pillar for the company’s expansion. They have only completed one acquisition in their history, that of Stone Island, as mentioned earlier. Nevertheless, despite their limited experience in acquisitions, I believe that this purchase was a masterstroke on Moncler’s part. Let’s delve into it in detail.

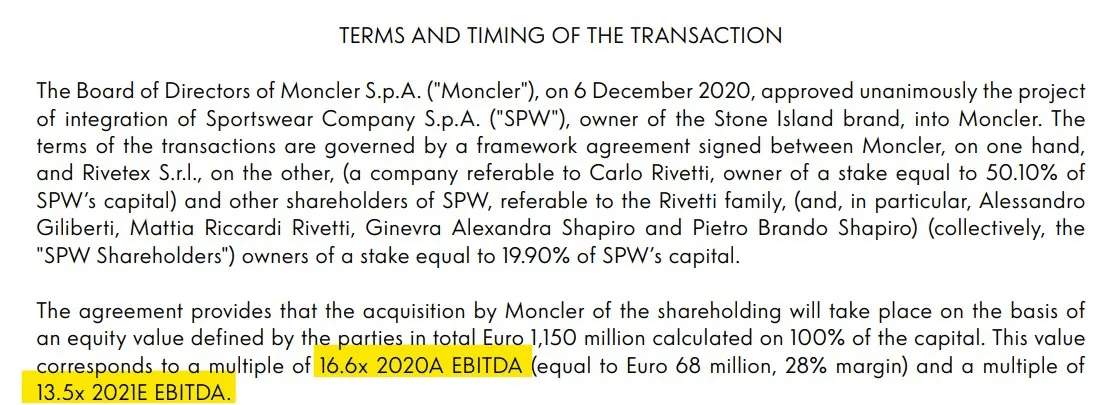

Stone Island, much like Moncler, is an aspirational luxury brand, probably a few steps below Moncler in the hierarchy. It focuses on premium clothing with a more sporty style, emphasizing the quality and durability of its garments. Moncler decided to acquire Stone Island in 2020 for 1.15 billion euros. The acquisition was executed with 50% in cash and 50% by issuing Moncler shares. Some might raise concerns at this point, as the prevailing wisdom on Wall Street often leans towards the belief that issuing shares is always a bad move. However, let’s dig a bit deeper.

If we look at the information provided by the company itself, the purchase of Stone Island was made at a multiple of 16.6x EBITDA, while the shares issued to finance the acquisition were at a P/E ratio of 38. What does this mean? It means that the dilution to the shareholders was much lower than the asset acquired, resulting in an immediate creation of value. The golden rule of investment is that the return on investment should exceed the cost of capital, and this appears to be a perfect example of that rule.

World Stocks Blog

Furthermore, considering the growth of Stone Island in recent years, the multiple paid in 2020 is now less than 10 times EBITDA. The management has indicated that they see Stone Island in a situation similar to Moncler in 2003, and given how effectively they have optimized their flagship brand, the potential for growth in Stone Island is very promising for shareholders. The strategy they are pursuing is the same as with Moncler: enhancing the brand’s value through proper marketing and increasing control over the value chain.

Finally, any surplus capital from reinvestment is returned to shareholders in the form of dividends. The dividend has experienced a remarkable compounded annual growth rate of 35% since 2016. Currently, it offers a yield of 2.26%, with a payout ratio hovering around 49%. Therefore, this appears to be a very attractive stock for dividend investors.

Q3 revenues

A week ago, Moncler presented its figures for the third quarter of 2023. Despite an impressive 17% organic growth in the first nine months of the year, growth in the third quarter has slowed down to 9%. This is not necessarily negative in the luxury sector, as I discussed in my recent article on LVMH.

Moncler Investor Relations

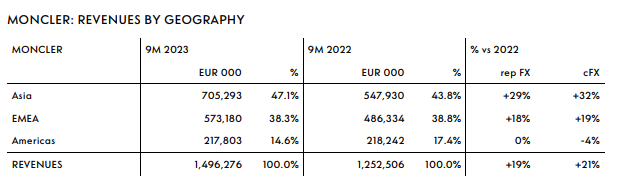

If we break it down by regions, we can see that Asia is undoubtedly the most significant and fastest-growing market. The Moncler brand has managed to penetrate this market very successfully and is benefiting more than others from the region’s recovery. Europe remains strong, driven especially by tourism, while the American market is currently the most affected.

Moncler Investor Relations

However, it seems more important to highlight that direct sales have increased by 30%, while wholesale sales are declining. We have already discussed the benefits of this transition, and here we can see it continuing to accelerate, which is excellent for the future of the business.

Moncler Investor Relations

In general, the results show that the post-COVID boom has come to an end, and it’s time to return to healthier and more sustainable long-term growth. Even though this slowdown is evident, it is worth noting that Moncler has remained much more resilient than other comparable companies like Kering, achieving performance similar to that of LVMH or Hermes.

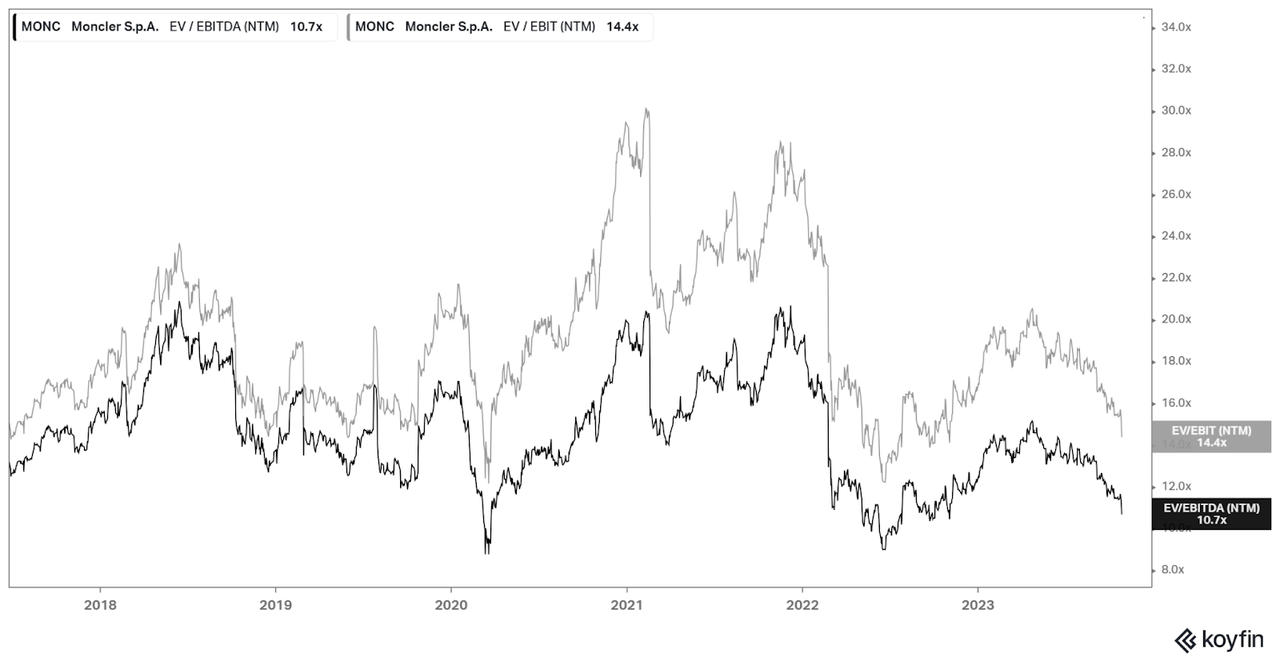

Valuation

Moncler is currently trading at valuation levels nearly identical to those it had in March 2020, at the height of the pandemic, with a price-to-EBITDA ratio of 9.7x and a price-to-EBIT ratio of 12.5x. Today, these figures stand at 10.7x and 14.4x, respectively. These valuations are significantly below their historical average, providing a substantial margin of safety for considering the possibility of purchasing shares in the company.

Moncler Valuation (Koyfin)

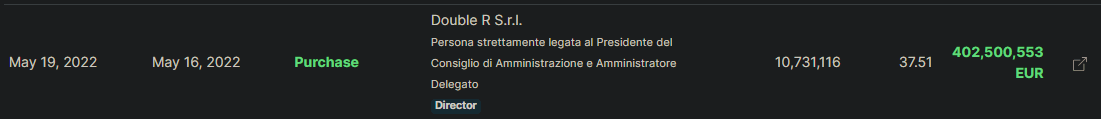

In May of last year, Moncler’s shares were also trading at very similar multiples to the current ones. At that time, Remo Ruffini, the CEO chose to buy shares at the same valuations we see today. This could be interpreted as a positive signal, as it suggests that the executives find the purchase prices at that level attractive. Furthermore, it’s important to note that after the executives’ purchases last year, the value of the shares increased by nearly 100%. Therefore, if we observe new purchases by the executives, it could be an encouraging sign to consider buying Moncler shares.

Screener Insider

It’s worth noting that I typically prefer using the discounted cash flow (DCF) method to evaluate these companies. However, I believe that Moncler is still in an early stage of its growth, which makes it difficult for me to estimate its terminal value. This value will depend on whether the company’s management can successfully achieve their goals of elevating the value of their brands to higher levels within the luxury hierarchy. One option would be to make a conservative estimate of this terminal growth to limit potential losses in case of failure. But for now, I will refrain from conducting this valuation until I have a clearer picture of the terminal growth they can achieve.

Risks

The main risk when investing in Moncler, in my view, is its exposure to Asia. Even though its products are not considered as strategically vital as semiconductors, we have already seen that Asia accounts for 50% of its sales, and any recession or conflict in the region could impact its results.

Another potential risk is the poor execution in brand management and product expansion. Moncler has achieved impressive growth in recent years, but market saturation in the luxury sector or a shift in consumer preferences could affect its financial performance. Additionally, the company must maintain the integrity of its brand and avoid strategies that dilute its image of exclusivity.

Conclusion

In conclusion, we can summarize the investment thesis for Moncler as the potential for its brands to ascend to higher echelons within the luxury market. Central to this endeavor is the pivotal role of the management, as we have seen in their mission to enhance the value of their brands through marketing, history, and customer experience. This is a challenging objective, but given their strong execution over the past decade, I have confidence that the management will continue to perform well in the coming years. Considering the growth prospects and the current appealing valuations, I assign a ‘Buy’ rating to Moncler’s stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here