Closed the short last week

Just last week, I closed the short position the on S&P 500 (SP500) and went tactically neutral. Specifically, I closed the naked short call position on S&P 500 futures (SPX), which went out of money, and given the value decay due to time expiration (open since January), it was closed profitably.

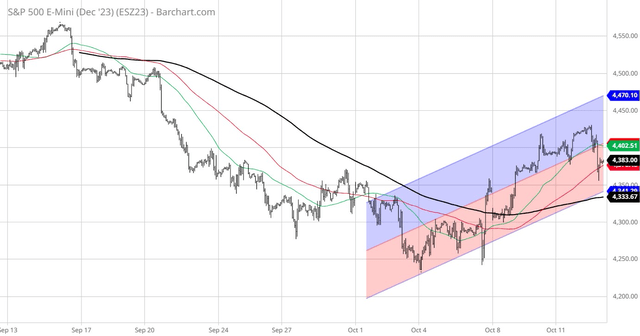

My strategy at the time was to evaluate the potential for the end-of-the-year rally, or to re-short the key breakdown below the 4200 level. But this is what happened over the last 5 days – the S&P 500 spiked by about 200 points. Here is a 1-month chart.

Barchart

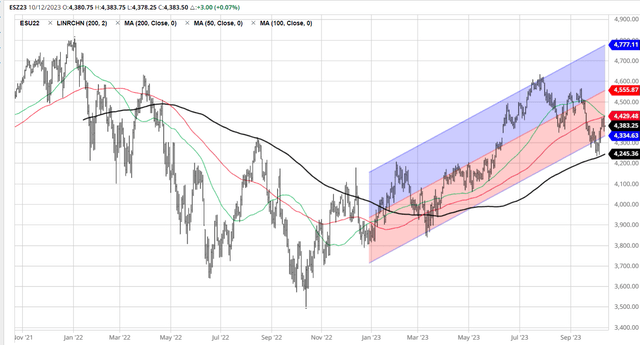

On a 5-year chart, the S&P 500 touched the key support at the 200dma level, and bounced strongly to the 100dma resistance (red line). More importantly, the 50dma (green line) is at the same level, and crossing the 100dma – this is a sort of “junior death cross,” which is a bearish sign. The real “death cross” will happen when the 50dma crosses 200dma, and that will signal the major breakdown I have been talking about.

Barchart

So, I covered the short position at the 200dma support since I did not anticipate an imminent breakdown. In my playbook, the trigger for the 200dma breakdown would have to be something major, such as an imminent recession. Given the strong labor market, I do not see an imminent recession yet.

Recently, the Fed officials have been talking dovishly, suggesting that the Fed could be done with increasing the interest rates – and the Federal Funds futures have priced the Fed pause accordingly. The fact that the U.S. economy is still growing strongly, and that the Fed seems to want to pause the interest rate hikes, increases the probability of the end-of-the year rally.

Thus, tactically, it seemed appropriate to cover the short position, especially the out of money naked call option.

After 5 days – short again

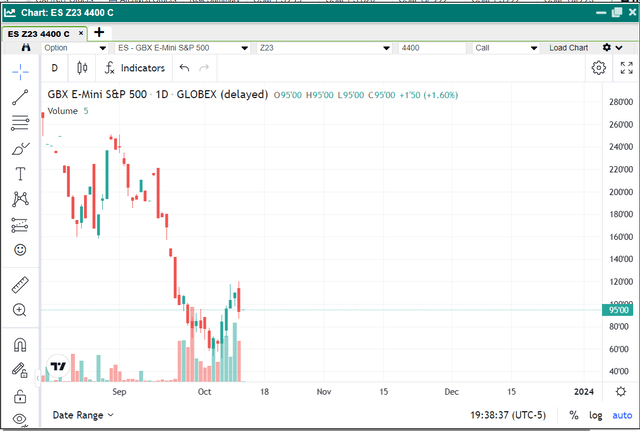

So, the bounce happened, quickly just like the “bear market” rallies are – quick and sharp. And the bounce stopped at the key resistance. Thus, rather than waiting for the 200dma breakdown, I re-shorted at the resistance. Again, my choice was to short the Dec call option, 4400 expiration, which actually was the “in the money option” at the time of the transaction.

Essentially, this call option doubled from around 50 to around 100 over the last 5 days. Thus, when priced at 100, the option has the breakeven point at SPX 4500. So, my new bet is that S&P500 will close below the 4400 level for full profit, while at the 4500 level, the trade is breakeven.

This is not a bet that the S&P500 will crash, it’s more of a bet that it will not go much higher from these levels. This is appropriate for now, until S&P 500 revisits the 200dma resistance and the 4200 level, at which point the probability of crash increases – if the support is broken accompanied by a fundamental trigger.

RJO Brian

What caused the recent bounce?

First of all, what caused the selloff in the S&P 500 (SPY) from late July? The July selloff was triggered by the decision by the BOJ to allow JGB yields to increase to 1% – the tweak in BOJ monetary policy. This triggered the trend of higher 10Y yields due to the fears that Japanese investors would start selling US Treasuries (TLT).

Since then, there were several events that contributed to the rising U.S. long-term interest rates. Most importantly, the US Treasury increased the size of bond offering due to the rising U.S. fiscal deficit – and the auctions were weak, which supported the theme that the foreign demand for US Treasuries is waning. Thus, the higher supply of Treasuries has been met with a lower demand – and that’s been causing the increase in the real yields.

The increase in real yields is not good for the overvalued stock market, and thus as the 10Y yields continued to rise, the stock market continued to fall, mainly due to P/E valuation contraction.

So, what caused the bounce?

After the blowout labor market report last Friday, the bond market initially sold off, which is a normal reaction – a tight labor market might require “higher for longer” interest rates to bring inflation down to 2%.

However, the bond market is notoriously famous to reverse on the labor-report-Friday, so it reversed last Friday, possibly as some traders took profit on the short bond positions.

But then over the weekend, a horrible attack on Israel happened, which caused some flight to safety to Treasury Bonds, and the 10Y Treasury Bond futures continued rising (lower interest rates).

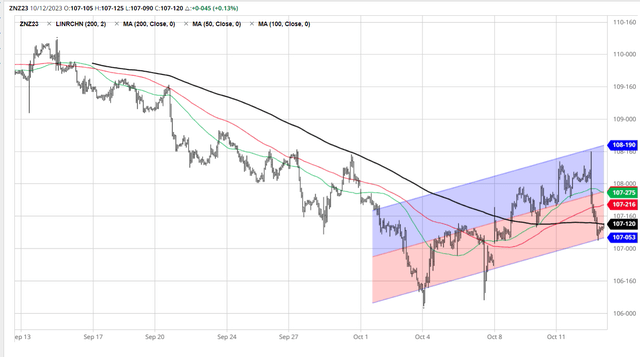

Here is the chart of Dec 10Y Treasury Bond futures:

Barchart

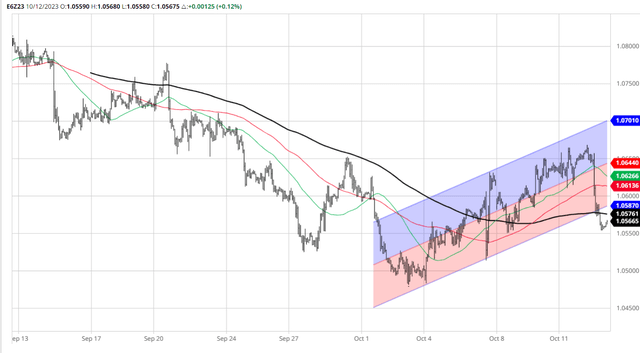

Further, the bounce in bond prices (lower interest rate) caused a weaker USD (UUP), here is the chart of the Euro futures:

Barchart

The two major headwinds for the falling stock market since late July have been: 1) higher yields; and 2) a stronger dollar. Both of these reversed after the attack on Israel due to the fight to safety to US Treasuries. Thus, the stock market bounced strongly.

The failure to breach the resistance at 100dma on 10/12 was due to: 1) a hotter CPI report; and 2) a weak 30 Treasury Bond auction. The yields increased, the USD strengthened, and the S&P 500 sold off.

Implications

We are in an inflationary environment due to the labor shortage and deglobalization. Plus, the process of deglobalization appears to be turning violent with severe geopolitical escalations. In this environment, the supply of Treasuries, which is only going to increase, will continue to meet lower demand, and thus interest rates will continue to rise, until a very serious recession. In addition, inflation will continue to be well above the 2% level, and the Fed will find out it will be very hard to pause the interest rate hiking cycle. This is a bearish environment for stocks.

Over the near term, I expect the “round-trip” back to the 4200 level due to the higher yields, and a stronger USD – it’s still the same theme. Once we’re at the 4200 level, we need to monitor what could cause the breakdown – which is the next phase of the bear market. Or we bounce again?

Read the full article here