Investment action

Based on my current outlook and analysis of PDD Holdings Inc. (NASDAQ:PDD), I recommend a buy rating for the company as the current strong consumer spending and sentiments are strong indicators of the overall health of retail spending, which plays a crucial role in PDD’s revenue model. In addition, these positive signals are also indicators for future revenue growth. Although PDD’s business is still strong, they are not sitting back, relaxing, and letting it idle. PDD is always at the forefront of technology development to ensure that its products are always at the top of the game. This is to ensure an excellent user experience, which I believe is going to enhance new adoption as well as user loyalty or stickiness. In addition, they are not just focusing on the user side; they are also focusing on the seller side. This multi-direction approach has really placed PDD’s product with one of the best ecosystems on the market.

Basic Information

PDD is a leading Chinese e-commerce platform that operates on a group-buying model, allowing users to team up to purchase items at discounted prices. The platform integrates social elements, encouraging users to share product listings with friends and family through social media channels to form purchasing groups. By leveraging this unique approach, PDD offers a wide range of products at compelling value points, catering to a vast consumer base. The company’s emphasis on user engagement, combined with its innovative shopping model, has positioned it as a significant player in the competitive e-commerce landscape of China.

Over the past 5 years, PDD’s revenue trajectory has been remarkable, consistently rising even in the face of challenges such as the COVID pandemic, inflation, supply chain disruptions, and fierce competition in the e-commerce sector. As of 2022, its growth remains robust, with high double-digit rates of 28%, showing no indications of weakness. A notable highlight for PDD is its positive net income in recent financial statements. In 2021, the company posted a net margin of approximately 8%, which impressively tripled to 24% in 2022. This growth is particularly commendable when considering that many of PDD’s competitors are just breaking even, with some still incurring losses.

Review

In the second quarter of 2023, PDD reported robust revenue growth, with total revenues of RMB 52.3 billion, marking a significant 66% increase compared to the previous year. This remarkable growth is largely attributed to a resurgence in consumer spending and the successful implementation of their high-cost development strategy. Delving deeper, the revenue from online marketing services and related areas reached RMB 37.9 billion, reflecting a 60% increase year-over-year. Additionally, transaction services revenue for the quarter stood at RMB 14.3 billion, a substantial 131% increase from the same period last year. Alongside this strong revenue performance, PDD also observed a notable uptick in consumer sentiment, evident in the increased demand across various product categories. In response to this growing consumer interest, the company proactively initiated a series of promotional campaigns, aiming to further stimulate and capture market demand.

A highlight of PDD’s marketing campaigns was their support of the June 18 shopping festival. PDD unveiled a series of enticing deals and discounts, aiming to stimulate consumer purchases. The response from these efforts was mostly favorable, indicating that their strategies resonated well with their target audience. Moreover, PDD’s marketing activities weren’t confined to isolated events. Throughout the period, they constantly launched diverse campaigns to strengthen consumer purchases. Their objective was straightforward: to bridge the gap between consumers and a broad spectrum of quality products offered at appealing prices. This approach was further enhanced by the company’s commitment to delivering top-notch customer service.

Throughout the second quarter of 2023, PDD showcased a steadfast commitment to high-quality development. This focus was not just a short-term strategy but was identified as their primary objective since the onset of the year. The company’s vision was clear: to ensure sustainable growth by prioritizing quality over mere quantitative expansion. To achieve this, PDD channeled its resources and efforts into key areas that would accelerate their progress towards this high-quality development goal. They recognized that in the ever-evolving e-commerce landscape, it’s not just about attracting more users, but about ensuring that these users have superior experience, access to top-notch products, and derive genuine value from the platform.

This commitment to quality was also evident in their approach to partnerships and collaborations. PDD sought to work with brands and suppliers that shared their vision for quality, ensuring that the products listed on their platform met stringent standards. Moreover, the company’s high-quality development strategy was not just limited to the consumer side of the equation. They also focused on providing sellers and brands with the tools and support they needed to succeed, fostering a holistic ecosystem where both buyers and sellers thrived.

For the upcoming quarter’s results, I anticipate revenue to be in line with the second quarter, and this is also in line with market estimates. With inflation easing, I expect consumer spending and sentiment to remain strong. Although inflation is easing, it is still above pre-pandemic levels. Therefore, I do not expect a huge increase in sales and demand. With PDD’s unwavering commitment to platform development as well as its current strong position in the market it operates in, I do not foresee them losing their market share in the quarter. Overall, my outlook for the third quarter and FY2024 remains optimistic.

Valuation

I project that PDD will maintain a high double-digit growth rate for FY2024 and FY2025, which is in line with market estimates. Several factors support these growth projections. Primarily, PDD’s strong revenue growth which is attributed to increased consumer spending and their strategic high-cost development approach. The company’s adeptness in leveraging the positive consumer sentiment, along with their impactful promotional campaigns, places them in a strong position for continued growth. Their commitment to providing consumers with quality products at competitive prices further bolsters their growth prospects.

Moreover, PDD’s steadfast commitment to high-quality development distinguishes them from competitors. Their growth approach prioritizes long-term quality over mere short-term gains. By directing resources towards crucial strategic areas, PDD is well-positioned to deliver an exceptional user experience in the dynamic e-commerce landscape. This quality-centric ethos is also evident in their partnership choices, reflecting their ambition to benefit both consumers and sellers. Given these factors, PDD’s future growth outlook appears promising.

Author’s work

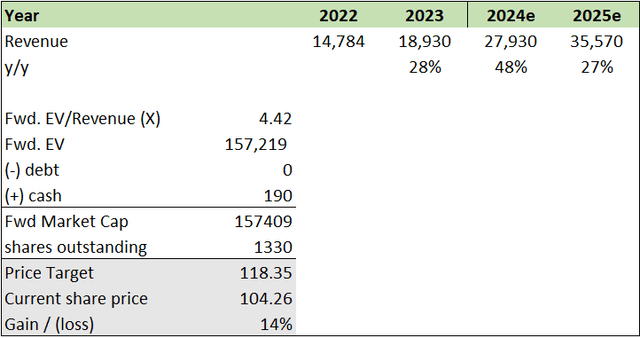

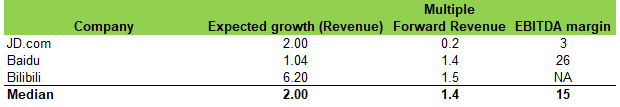

Currently, PDD trades at approximately 4.42x forward EV/Revenue, while its peers have a median of 1.4x. Considering PDD’s impressive EBITDA margin of 25.29%, which surpasses the peer median of 15%, and its remarkable revenue growth rate of 48% compared to the peer median of just 2%, it’s justified for PDD to command a higher forward EV/Revenue. The stark contrast in growth rates, with PDD at 48% versus 2% of its peers, underscores its dominant position in the market. My price target is approximately $118 for PDD, indicating a potential upside of 14%. Given PDD’s strong growth trajectory and EBITDA margin, I recommend a buy rating for the stock.

Author’s work

Risk and final thoughts

One downside risk to consider for my buy rating on PDD is the potential for increased competition in the e-commerce sector. As the e-commerce market continues to grow, it attracts more players, both domestic and international, vying for a share of the consumer base. This could lead to intensified competition, potentially eroding PDD’s market share and pressuring its margins. Additionally, as competitors innovate and offer similar or enhanced services, promotional campaigns, and user experiences, PDD might face challenges in maintaining its current growth rate and superior EBITDA margin. If PDD doesn’t continuously innovate and adapt to the changing market dynamics, it could impact its valuation and future revenue projections.

In summary, PDD has exhibited strong revenue growth, driven by renewed consumer spending and a well-executed high-cost development strategy. Skillfully leveraging the upbeat consumer sentiment, the company has rolled out promotional campaigns that have garnered positive responses from consumers. Their ongoing initiatives to amplify consumer demand, coupled with their dedication to superior customer service, strengthen their market foothold. PDD’s consistent commitment to high-quality development, prioritizing long-term growth and an exceptional user experience, differentiates them in the competitive e-commerce sector. Their purposeful partnerships with brands emphasizing quality, along with their unwavering support for sellers, highlight a comprehensive growth vision. Considering PDD’s leading market position, remarkable growth outlook, and robust EBITDA margin, I recommend a buy rating for the stock.

Read the full article here