Essex Property Trust, Inc. (NYSE:ESS), founded in 1971 and headquartered in San Mateo, CA, focuses on the acquisition, development, and leasing of multifamily properties in West Coast markets.

Though the REIT is geographically concentrated, its operational performance depicts sufficient growth in my view. Further, its leverage is within manageable levels, it has adequate liquidity and is a long-time dividend grower with sufficient cash flow to support the distributions. However, the yield and modest discount to NAV do not justify an investment right now in my view. Below, I will give more details

Portfolio

As of the end of the third quarter, Essex owned or had ownership interests in 252 apartment communities which consisted of 61,997 apartments. These are spread across Los Angeles, San Diego, San Francisco, Seattle, Orange, and Ventura.

Based on the number of apartment homes, the portfolio has 43% exposure in Southern California, 37% exposure in the San Francisco Bay Area, and 20% in the Seattle metropolitan area.

Further, its apartments were 96.4% occupied as of the end of the third quarter, slightly higher than the 96% reported in the same quarter in 2022.

Performance

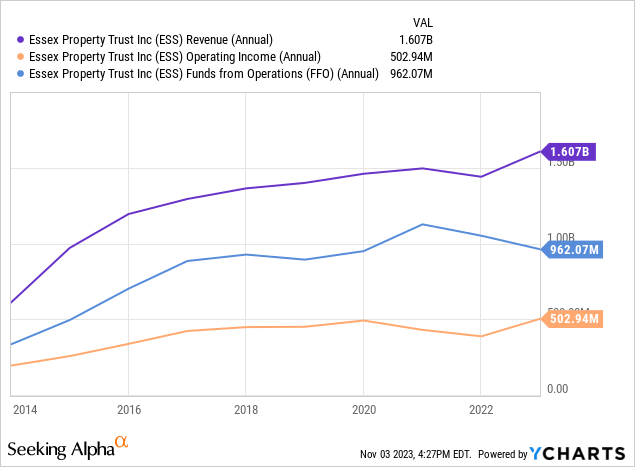

The long-term operating performance of Essex shows increasing profitability, but FFO growth has been modest considering the 10 years of operation depicted below:

The same modest growth is shown in more recent results. Consider that the Q3 annualized rental revenue marks a 10.71% increase from the average annual figure in the last 3 years. Similarly, same-store cash NOI increased by 14.36% when comparing the last quarterly figure annualized with the 3-year average one. The same applies to AFFO which reflects 13.92% growth.

Leverage

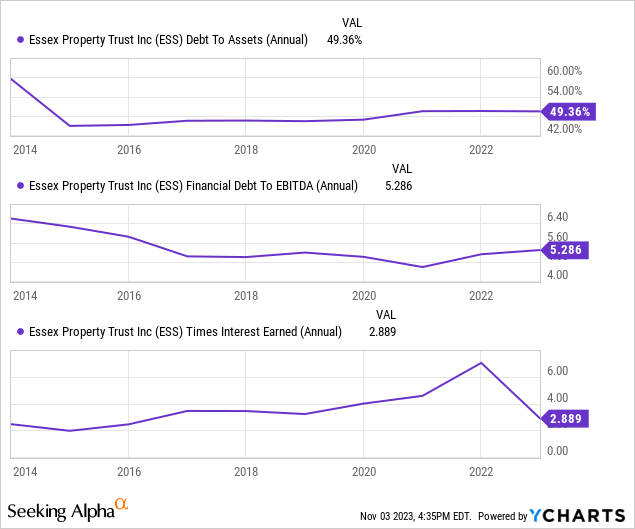

When it comes to handling debt, Essex has been conservative in its use for a very long time. Right now ~50% of its total assets are funded by mortgages, term loans, and bonds. Further, its debt to EBITDA ratio is at 5.2x and interest coverage at 2.9x, representing an adequate level of liquidity.

As of the end of the third quarter, Essex carried mortgages of ~$888 million at a 4.3% interest rate, term loans of ~$300 million at 4.2%, and bonds at 3.3%; most of it is fixed.

In 2024, the REIT will have to refinance about $400 million which currently carries a 4% rate. While this is early enough to represent a potentially higher cost in the near term, the amount is not that large and I don’t think that the impact will be significant. As for the rest of the maturities, they concern larger amounts; ~$630 million and ~$550 million in 2025 and 2026, respectively, both at a 3.5% rate, as well as ~$420 million at 3.8% fixed and ~$385 million at 4.2% variable in 2027.

Dividend & Valuation

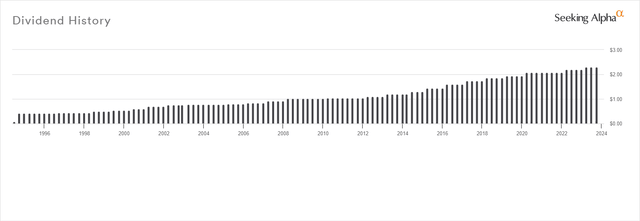

Right now, Essex offers a quarterly dividend of $2.31 per share which represents a 4.25% forward yield. I believe that to be safe based on the very long record of dividend payments and the low payout ratio.

First, Essex has increased its dividend for 28 straight years:

Seeking Alpha

And if this isn’t remarkable and persuading enough on its own, I would say that a 63.97% payout ratio based on AFFO is.

With that being said, it’s obvious that the current yield doesn’t represent good value both relative to treasury yields and what REITs have to offer these days. However, its FFO multiple is only slightly higher than the average of competitors:

| Stock | P/FFO |

| ESS | 14.09 |

| MAA | 13.13 |

| UDR | 12.96 |

| CPT | 12.79 |

| EQR | 14.31 |

| Average | 13.45 |

Regardless, ESS is trading at a 5.31% implied cap rate. Even if I were to assume a 5% rate as appropriate for its portfolio, that would suggest a ~9% discount to NAV (~$240 per share). And this is where it gets personal. I aim to buy REITs at an at least 20% discount to NAV; I can make exceptions when the dividend yield is attractive but that’s not the case here.

That said, you might find the margin of safety attractive and, therefore, view ESS as a buy. But if you don’t, it might make sense to wait for a bigger drop as I do.

Risks

When it comes to risks, the thin margin of safety presents the opportunity risk I am trying to avoid, especially when it comes to REITs that offer a low dividend yield and there’s no compelling case for them to go back to trading closer to NAV fast enough. When it comes to ESS, I simply think it’s not worth it even though it’s obviously a dividend grower.

Coupled with the geographical concentration and the pending maturity in 2024 where interest rates are unlikely to be much lower than they are today, I don’t have a compelling reason to add ESS to my portfolio.

Verdict

I therefore assign a HOLD rating to ESS for now and I’ll wait for a better price; around $180. Please be mindful that this is not a price target/forecast and I have no reason to think that ESS will fall to such a level.

This is just a price that would motivate me to take a much deeper dive here. If you appreciate the current NAV discount, I think you shouldn’t add too much weight to my HOLD rating and simply read more analyses on ESS before you make any decision.

Do you agree or disagree with my thesis? Let me know below and I’ll get back to you as soon as possible. Thank you for reading.

Read the full article here