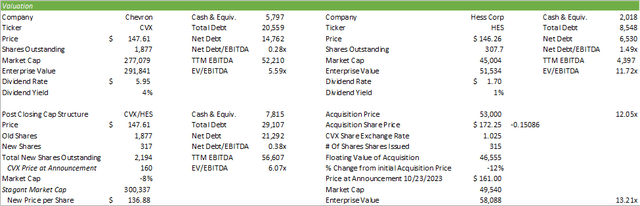

In a joint press release by Chevron Corporation (CVX) and Hess Corporation (NYSE:HES), Chevron announced their intent to acquire Hess in an all-stock deal valued at $53b for a share price of $171/share at the time of the announcement. Since the 10/23/23 date, the value of the share purchase has declined by -12% as a result of Chevron’s share price decline of -8%. Given the new share base of Chevron at 2,194mm shares outstanding, I provide CVX a SELL recommendation valued at $136/share and a BUY recommendation for HES maintaining the $53b market cap valuation.

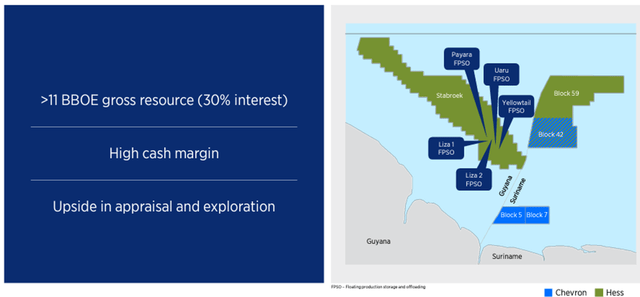

One of the biggest value adds, and I believe this is the sole purpose of the acquisition of Hess Corp, is the 30% stake in the Guyana assets. The Stabroek block in Guyana isn’t just some everyday, run of the mill find; this is an 11Bboe resource (11 billion barrels of equivalent). Net production is expected to be 110mboe/d attributable to Hess’s 30% stake, or ~366mboe/d in total, as a result of the first two FPSOs (floating production storage and offloading) with three more under development. This project will potentially have 10 FPSOs brought into play to drive growth over the next decade. In the near-term, 10-12 additional wells are planned for 2024.

In total, the development of the Stabroek block in Guyana comes with a $10b price tag split between primary operator Exxon Mobil Corporation (XOM) with a 45% stake, Hess at 30%, and China National Offshore Oil Corp. (“CNOOC”) with the remaining 25%. Hess alone invested 1,345mm in FY22 to develop the assets. Management had originally anticipated FY23 CAPEX to be $3.7b at the end of FY22 and has recently increased their annual capital budget to $4.1b to include the additional investment in Liza Unity FPSO in q4’23. Assuming a similar production rate with each additional FPSO, $80/boe, and a constant 45% EBITDA margin, we can anticipate Hess’s proportion of the Stabroek assets to produce 275mboe/d and generate $8,030mm in revenue and $3,614mm in EBITDA.

Investor Presentation

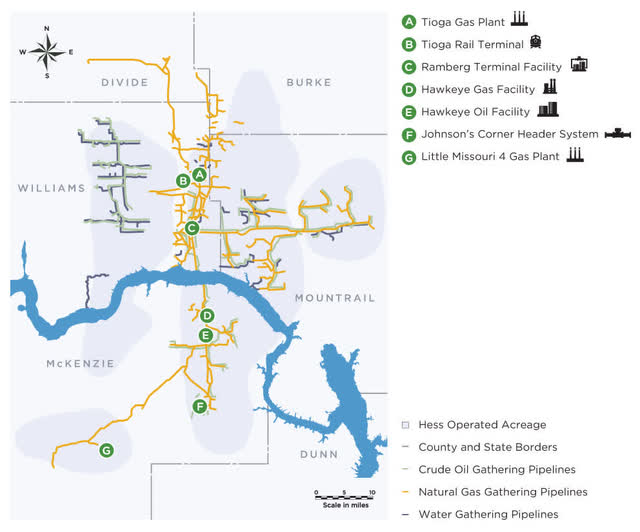

Hess comes to the table with a number of other properties in the acquisition, including properties in the Bakken shale, Gulf of Mexico, and Malaysia & JDA. In addition to these prime, low-cost assets, Hess owns a 38% stake in their divested midstream business with assets located in the Willison Basin (Bakken & Three Forks shale) in North Dakota.

Investor Presentation

The assets held by Hess will significantly broaden Chevron’s global assets as well as complement their current asset base. Considering international assets, the Guyana assets appear to be the primary purpose of this transaction. Domestically, the Bakken shale remains full of life with 15 years of inventory. This should complement Chevron’s domestic shale assets given Chevron’s presence in the Permian and DJ Basins. Overall, the Permian accounts for 25-30% of net production volumes. Once added, Hess’s total proved oil reserves will add 17% to Chevron’s base.

Hess will also bring to the table equity ownership in Hess Midstream. Hess Midstream operates a pipeline system in the Williston Basin in North Dakota with the purpose of transporting oil and natural gas out of the Bakken shale. Though Chevron doesn’t necessarily have operations in the Bakken, this asset acquisition will only diversify and broaden their domestic asset base. In another recent acquisition of PDC Energy in August 2023, Chevron acquired assets in the DJ and the Delaware Basins. In Colorado and West Texas. PDC Energy had 1,100mmboe of proved reserves assets valued at $19b on a PV-10 basis and produced 233mboe/d.

Outside of the acquisition, there are some near-term challenges for Chevron. With their global asset base, Chevron is prone to potential civil unrest and geopolitical tension, specifically in the Middle East. Because of the war between Israel and Hamas, Chevron was forced to suspend production at the Tamar gas field as well as halt exports via the East Mediterranean Gas (EMG) pipeline between Israel and Egypt.

Chevron is also facing delays in their Future Growth Project (FGP) in Kazakhstan and isn’t expecting the project to start up until 1h25. This project is expected to cost 3-5% more than initially anticipated with production delays leading to a bottleneck of 1mmboe/d from TCO. The result of this will be a $1.5b hit to cash flow in 2024 with a total hit of $2.5b across 2024-2025. Though that sounds like a large number, the $1.5b equates to roughly 3% of cash flow from operations for FY22.

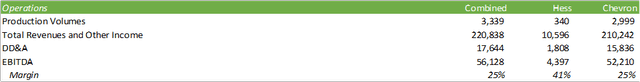

Combination Financials

From an operating standpoint, the acquisition of Hess is relatively accretive. With a 41% FY22 EBITDA margin, Hess will add some value when compared to Chevron’s 25%. That said, the impact may not be too meaningful on a nominal basis as Hess’s EBITDA addition will account for around 8% of the combined company. Production comes out to a similar scale as barrels of equivalent produced by Hess will account for 10% of Chevron’s production post-acquisition. Given the growth trajectory as a result of the developments in Guyana, this 10% can easily increase to 16% with the recent acquisition of the Liza Unity FPSO with anticipated production volumes of 390mboe/d.

Corporate Reports

Shareholder Value

Chevron has laid out a number of shareholder-enhancing features post-closing. The first is an increase of their quarterly dividend rate by 8% to $1.63/share, supported by their recent acquisition of PDC Energy and Hess’s potential free cash flow additions. Chevron also released guidance of increasing their share buybacks to $20b per year as a result of stronger upstream operations. Their future outlay in both growth capex and dividend distributions is supported by $50/bbl Brent oil, well below the price range throughout the last two years.

Considering the valuation of the deal, Chevron announced the deal priced at $60b in enterprise value, equating to $171/share in an all-stock acquisition. Chevron is currently offering 1.025 CVX for each share of HES, currently valued closer to $46.55b at Friday’s close (11/3/23). Intrinsically, the additional 317mm shares of Chevron issued would place a market cap equivalent on a per-share basis of $136.88/share of CVX stock. On the date of the announcement, CVX was trading at around $160/share and now trades at $147/share (11/3/23). Using back of the napkin math, at the close of market on 11/3/23, the combined enterprise value will equate to $343b for a multiple of 6x EBITDA. Standalone, CVX and HES trade at 5.60x and 11.75x EV/EBITDA. Though HES trades at a significant premium to the rest of the market, their asset base will add tremendous value to Chevron’s portfolio and justify the price. Though the acquisition premium at the time of announcement was only 10% above their trailing 20-day trading price, this premium will be overshadowed by the future cash flow resulting from the 30% stake in the Guyana assets.

Given investors’ reaction to the deal, Chevron may need to change the terms of the deal and blend a cash payment into the balance as the value of the acquisition has declined by 12% as a result of CVX share price decline post-announcement. HES shares were priced at $171/share at the initiation of the deal. The -15% decline in HES shares may require a cash base to maintain the value of the deal.

Though there is no guarantee of any change in terms of the acquisition, my game plan is to purchase shares of HES as the overarching price has already been stated and the acquisition remains under review. The only gears that can shift in the deal involve a sweetener of cash, additional equity, or a combination of the two. The worst-case scenario is that antitrust blocks the deal, resulting in holding an E&P valued at 11.75x EV/EBITDA with a 30% stake in this era’s greatest oil discovery. I don’t believe that would be very likely given the historical tradition of industry consolidation as well as the offer price of 12x EV/EBITDA.

Tying in EBITDA growth as a result of the Guyana assets as described above, HES’s FY24 EV/EBITDA might look something closer to 6.4x using a base of $8,010mm EBITDA, significantly more comparable to the domestic IOC market. Hess does hold a significantly higher proportion of debt on their balance sheet when compared to Chevron at 1.5x vs. 28% net debt/EBITDA, respectively. Assuming no debt extinguishment upon acquisition, Chevron’s new leverage ratio will rise to only 38%.

Because Hess’s stock performance is now tied to Chevron’s performance, owning either stock in the short term will offer a similar risk profile in the market. As far as greatest potential opportunity, owning Hess shares may offer greater reward given the potential sweeteners outlined above. My recommendation is to short CVX with a price target of $136/share given the new share base for a stagnant market cap and to go long HES shares throughout the duration of 2023 on a DCA basis with the anticipation of a valuation of $53b in equity value. Though there are no guarantees of a cash offer or increased stock to bring the value of the deal back up to its target, there still remains the potential. Given the initial outlay of $53b equity acquisition in an all-stock deal now being valued at $46.5b, I believe HES is a strategic BUY opportunity.

Corporate Reports

Read the full article here