I’ve had my eye on Costco Wholesale Corporation (NASDAQ:COST) for a long time now. This is my first time covering the company on Seeking Alpha, and I initiate my coverage with a “HOLD” rating.

Costco has always intrigued me because it consistently trades at high valuations. Right now, the stock is trading at a Forward PE of 35.92x for FY24, which seems really steep for a retail company, in my opinion.

Just to put things in context, Walmart (WMT) is already a bit too pricey for my taste, with a Forward PE of 24.69x, considering its growth prospects.

Meanwhile, retailer Target (TGT), which is more sensitive to consumer trends, has a Forward PE of 14.90x.

So, it’s pretty clear that Costco is trading at a premium.

The big question is, why? Is it justified, or are we looking at an overvaluation situation that could drag down the stock in the next decade?

Remember, to make great returns, you need to invest in fantastic companies at the right price.

Costco is undeniably fantastic, but only if you get it at the right price. Otherwise, despite its quality, investors might end up with flat or even negative returns.

Recession-Proof Business Model

Costco’s business model is refreshingly straightforward. Customers pay an annual fee to become members, granting them access to Costco’s stores where a wide array of products is available, including food, candy, liquor, tobacco, appliances, electronics, office supplies, sporting goods, and much more.

You might be wondering, why would someone pay a fee just to enter a store, especially if they’re already planning to spend money there?

Well, Costco operates as a wholesaler, selling products in bulk, allowing them to offer arguably the lowest prices available, coupled with a very customer-friendly return policy.

This approach makes Costco a recession-proof business. Particularly in times of elevated inflation and economic hardship, such as the situation we are currently facing, people tend to flock to retailers that provide better deals.

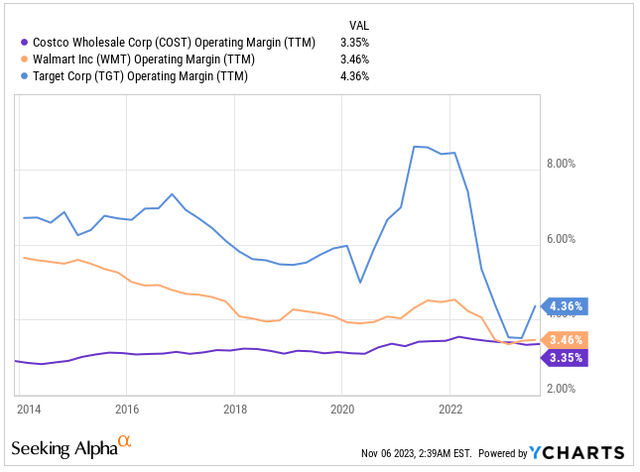

The membership concept forms the backbone of Costco’s business model. As a result of the consumer friendly pricing, Costco doesn’t enjoy hefty profit margins.

However, they wield significant influence over their suppliers and their ability to buy in bulk secures them favorable sourcing terms. Nevertheless, Costco operates on thin margins, standing at a mere 3.35% today.

Operating Margin (Seeking Alpha)

Despite the narrow profit margins, Costco’s business model remains remarkably resilient. The company employs a cost-plus pricing method, where products are priced at the cost of goods plus a small margin.

Consider it akin to a subscription-based service. The groceries and other items people purchase at Costco are essentially the bait, drawing customers into the store. It’s the membership fees that significantly bolster Costco’s bottom line.

These memberships are particularly lucrative because they come with nearly 100% profit margins. This setup creates a favorable cash cycle for Costco. Members pay for their memberships in advance, fostering a loyal customer base. Additionally, unlike other retailers struggling with issues like shrinkage or theft, Costco faces fewer challenges. Once customers have invested in their memberships, they are less likely to jeopardize their status by engaging in theft or fraudulent activities.

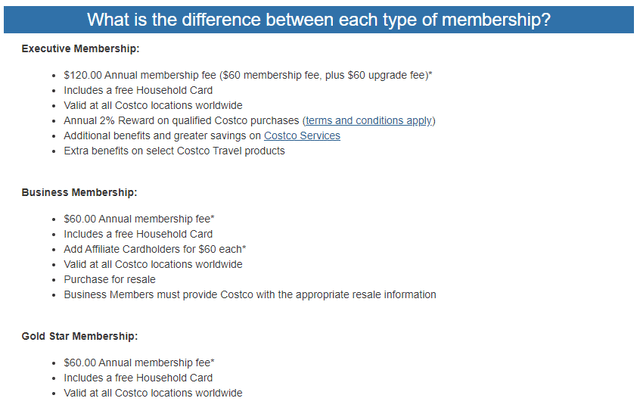

Currently, Costco offers three different types of memberships. With a presence in 13 countries, the company boasted 71 million member households as of its last quarter, representing a 7% YoY growth. Globally, there are 127.9 million cardholders benefiting from Costco’s offerings.

Membership Types (COST IR)

To put it in perspective, Costco’s membership fees generated $4.58 billion in revenue in FY23, accounting for approximately 1.9% of total sales. However, considering this operates as a nearly 100% margin business, it contributed to around 54% of the Operating Income for the year.

Traditionally, Costco raises its membership fees every five years. Interestingly, this time seems to be an exception, possibly due to inflationary pressures. The company appears to be prioritizing customer acquisition during this period. It’s likely that once inflation subsides, Costco will increase its membership fees, possibly in the middle of next year.

Crucial to understanding Costco’s financial strength is its ability to maintain high renewal rates on memberships. Globally, the renewal rate stands at an impressive 90%, with North America boasting an even better rate at 92.7%.

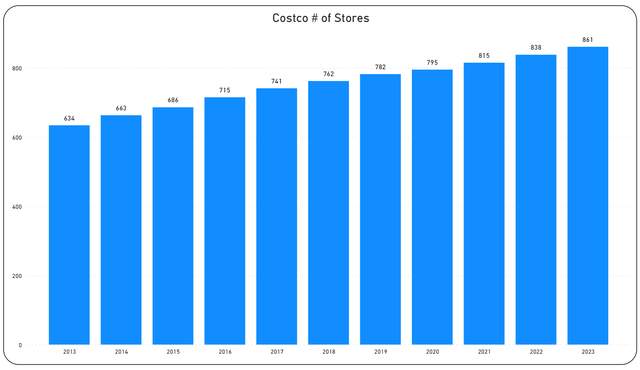

In essence, future earnings growth for Costco will heavily rely on expanding its membership base. This growth is primarily fueled by opening new stores, tapping into new demographics, and reaching out to different communities.

As of the end of FY23, Costco operated 861 stores worldwide, with 68.6% of them located in the United States and Puerto Rico. This represents a CAGR of 2.82% since 2013. While this growth rate is somewhat conservative, it aligns with Costco’s target of having between 20-30 net openings each year, a goal they have consistently pursued.

Looking ahead, Costco plans to add another 150 locations in the US. However, as the domestic market becomes saturated, further expansion will need to be sought abroad. Europe and Japan are the preferred choices, with a potential adjustment of the business model to accommodate local preferences, possibly with smaller stores tailored to specific communities.

Count of Stores (Author’s Graph)

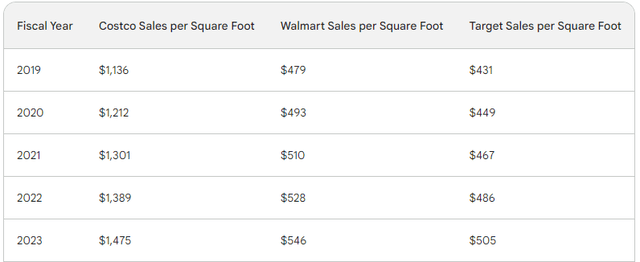

My favorite metric for gauging Costco’s superiority over its peers is the sales per square foot. From what we can observe, Costco’s sales per square foot are approximately three times higher than both Walmart and Target. This stark difference speaks volumes about the robustness of Costco’s business model and its adeptness in efficiently managing its warehouses.

Sales per Square Foot (Forbes)

Too Rich Valuation for my Liking

The main issue I see with the company right now is its valuation.

Costco rarely trades at a significant discount, and the fact that they haven’t raised their membership fee as many would expect, has impacted their valuation negatively, yet it should bring fruit down the line.

On the positive side, Costco operates on a recession-resistant and inflation-resistant business model, which is particularly appealing given today’s economic uncertainties.

However, in my opinion, as the economy improves and inflation decreases, investing in Costco at its current valuation might result in a negative return over the next 2-5 years.

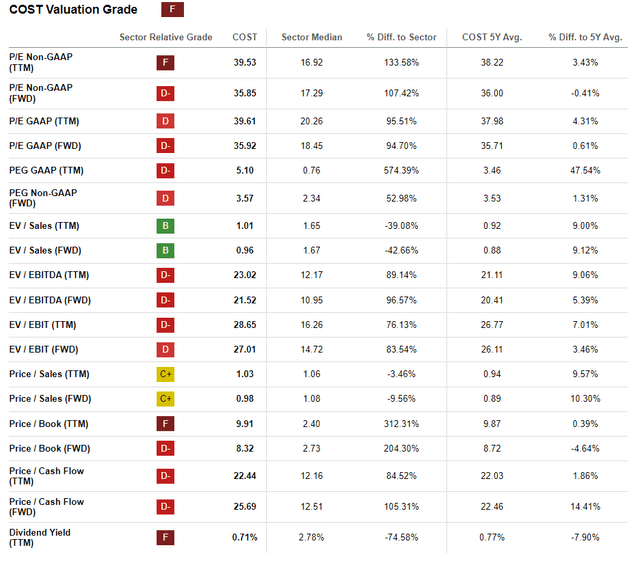

Costco has been given an F valuation grade.

Its Forward PE is roughly in line with its 5-year averages. Interestingly, the Forward EV/EBITDA, currently at 21.52, is actually 5.4% higher than its 5-year averages, indicating a potential overvaluation based on historical performance.

Valuation Grade (Seeking Alpha)

Personally, I’m not inclined to buy at what I consider elevated valuations. I prefer to wait for a better entry point, perhaps after Costco raises its membership fees and the market sentiment becomes more “risk-on,” potentially leading to money flowing out of this stock.

Considering that Costco earned $13.14 for its FY23, I would contemplate investing at around $395. This price point would still imply a multiple of 30 times its FY23 earnings, but for such a high-quality business, I find it more appealing.

However, this would mean a 30% decrease in the stock price, and in my view, that’s highly unlikely for a business with such a strong competitive advantage.

Conclusion

Costco is a company that seldom trades at a fair valuation; it’s almost always richly valued. Today is no exception, with Costco trading at 35.92x times its FY24 earnings, a valuation that I find too steep for my liking. There isn’t much of a margin of safety at this level, and the upside seems limited in the near term.

However, I can’t overlook Costco’s fantastic recession and inflation-resistant business model, heavily reliant on its membership subscriptions, which go hand-in-hand with opening new stores.

Despite the company’s low profit margins, they remain stable, thanks to membership fees contributing to over 50% of the total income.

Considering Costco’s consistent strategy of opening new locations in the US, Europe, and Japan, I hold a very favorable view of its business model. Yet, I’m not willing to invest at the current price. I would be interested if the shares were around $395 each, although I’m not holding my breath for that to happen in the near term.

Read the full article here