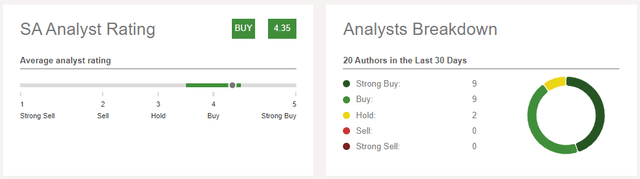

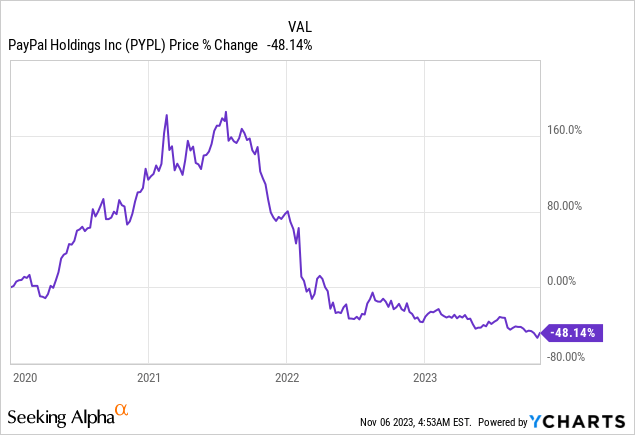

After falling nearly 80% from its recent highs, PayPal (NASDAQ:PYPL) has now turned into everyone’s favourite contrarian story. Analysts are now rushing to call the bottom as the stock appears very cheap.

Although I have turned bullish on the stock myself a couple of months ago, I have been warning against being too optimistic and rushing to call the bottom.

Although short-term challenges are likely to remain and the digital payments space is getting increasingly competitive, the company is among the well-positioned businesses to capitalize on its strong competitive advantages. Having said that, the share price could experience more pressures in the coming months (…)

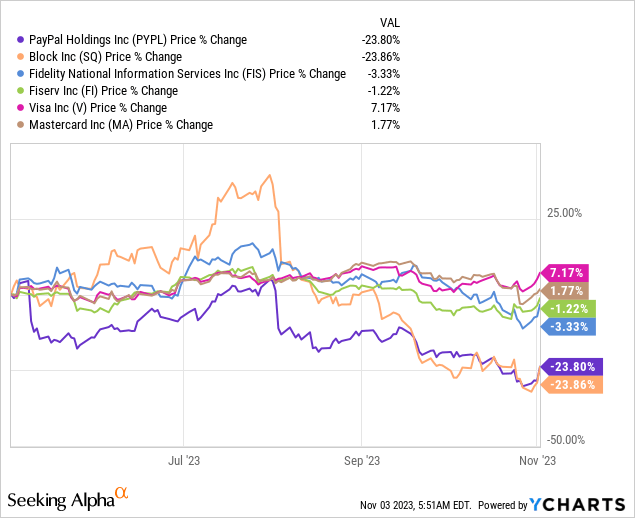

Source: Seeking Alpha

That’s why it doesn’t surprise me at all that PYPL has continued to be among the worst performers within its peer group over the past 6-month period. This has put the stock in the company of Block (NASDAQ:SQ), which has been my only sell rating within the group listed below.

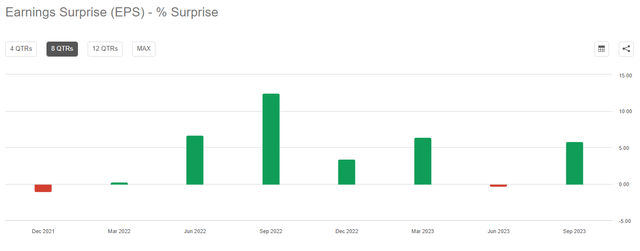

Nonetheless, the recent quarterly results of PayPal have given the much needed push for the bullish thesis as the company reported better than expected revenue and earnings figures.

Seeking Alpha

Although operational metrics are important, what caught my attention was the attitude of the new CEO, who is committed to profitable growth and doubles down on the company’s competitive advantages.

I can tell you right now what I care about most is high-quality customer growth and profitable revenue growth.

Going forward, PayPal will be focused on generating real profit for the company. I can’t emphasize that last statement enough. It is key to how I believe this company should be run, and it is how you should expect us to measure our performance. Unprofitable growth is counterproductive to the long-term prospects of this or any other growth-oriented company.

Source: PayPal Q3 2023 Earnings Transcript

As generic as these statements might sound sometimes, it reminds me of the sharp U-turn that Salesforce (NASDAQ:CRM) made recently by following the “Oracle Playbook” to profitability. That was one of the main reasons why I have changed my Sell rating to Hold on CRM and the stock is now within my watchlist of my investment group, awaiting to become a high conviction buy idea once management convinces me in its new approach.

In a similar fashion, the new management of PYPL is now making the right moves in my view, but once again I am not rushing to buy.

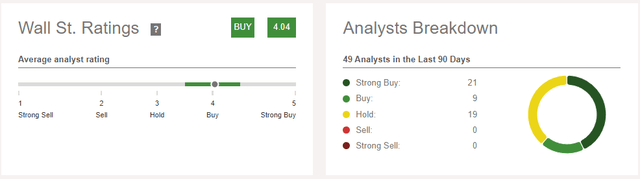

The recent wave of investor optimism around PayPal could create short-term risks for the share price, even if management continues to execute well on a quarterly basis.

Seeking Alpha

Seeking Alpha

The reason being that a turnaround process is hardly ever a smooth sailing and as we will see down below, PYPL is expected to experience some profitability headwinds. This could result is short-term volatility for the stock, especially if management fails to meet quarterly expectations going forward. Even though I remain bullish on the stock (for the reasons that I will cover below), I am sceptical of a quick turnaround story.

Things Are Getting Better For PayPal

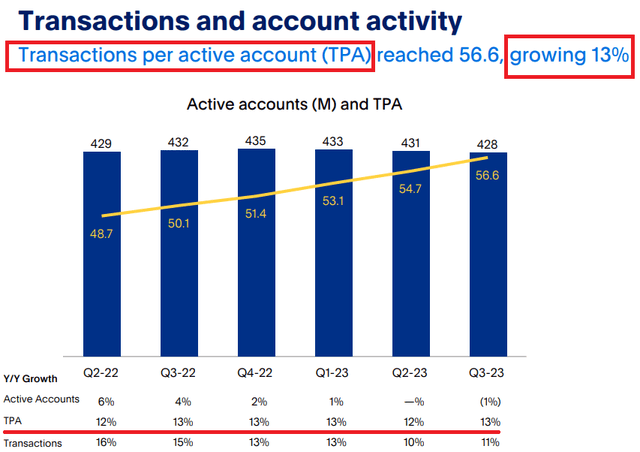

Over the past few quarters, the bearish thesis for PayPal has gravitated around the company’s decline in active accounts and worries that stiff competition would continue to put pressure on topline figures.

Although there were legitimate reasons to be concerned, it wasn’t such a big issue for PayPal and as we have seen in recent quarters active accounts did fall marginally but the quality of accounts have improved and with that transactions per active account continued to make new highs.

PayPal Investor Presentation

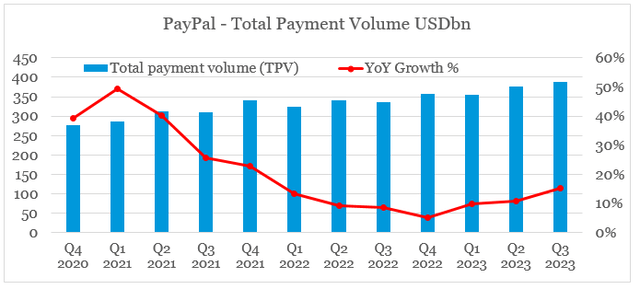

As a result, total payment volume (TPV) continued to improve and is once again growing at mid-teen levels on a year-on-year basis. This has driven PayPal’s revenue growth to above 8% during the most recent quarter, which as we’ll see below is solid performance relative to peers.

prepared by the author, using data from quarterly investor presentations

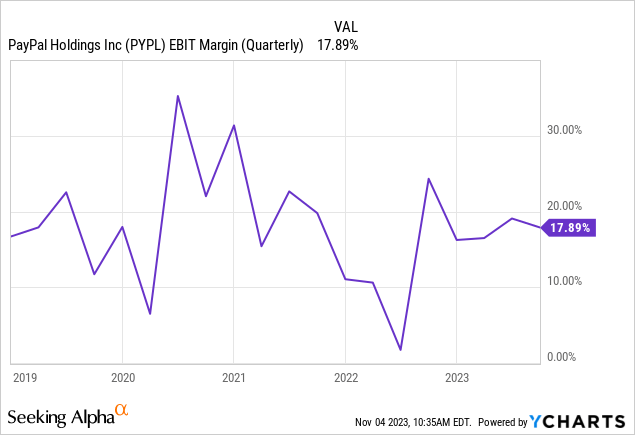

Within these growth numbers, however, higher margin branded checkout was lower than expected and Braintree volume growth accelerated which caused a drop in PayPal’s quarterly operating margin. Although this is still a major improvement on the company’s margins in 2022, fear of more competition in the space puts current margins at risk.

In my view, this is mostly a short-term issue as PYPL continues to pursue new growth opportunities and the company has a solid competitive advantage in the form of its strong brand.

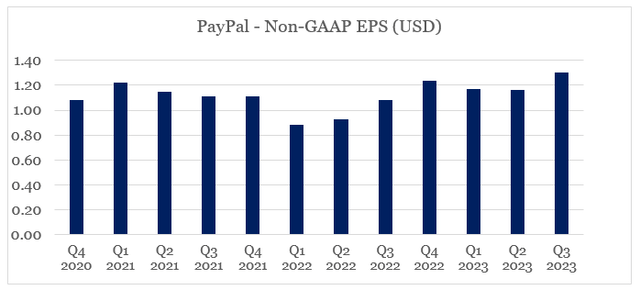

In the meantime, during the last quarter, PYPL reported an EPS of $1.30, which exceeded the high end of the previous guidance range by $0.06. Moreover, the guidance for the fourth quarter of the current fiscal year was increased to $1.36, which represents a 10% growth from a year ago.

prepared by the author, using data from quarterly investor presentations

What Is The Share Price Telling Us?

Even if we assume that PayPal would experience a sustained headwind for profitability going forward, it is important to take into account the valuation multiple that the company trades at.

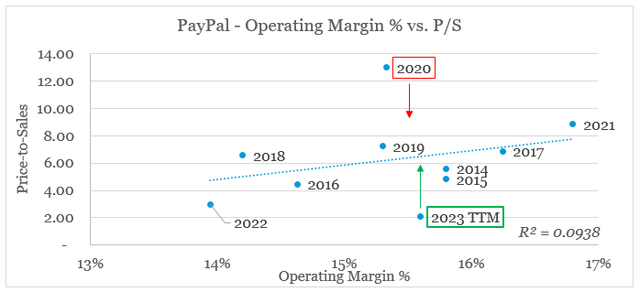

Over the long-run we observe a strong relationship between the company’s price-to-sales multiple and its operating margin, but FY 2020 and 2023 are two exceptions that have significantly reduced the coefficient of determination (r-squared) on the graph below.

prepared by the author, using data from Seeking Alpha and SEC Filings

More specifically, the double digit sales multiple that PYPL was trading at in 2020 has proven to be unsustainable and not supported by the company’s margins. As a result, everyone buying the stock at its highs in 2020 has suffered significant losses.

However, the current period is the exact opposite of FY 2020. More specifically, PYPL current sales multiple of around 2x suggests a significant drop in margins. Based on the trend-line in the previous chart, PYPL’s current multiple is pricing-in a drop in operating margin to around 11.5%.

This scenario is way too pessimistic in my view and does not correspond with PayPal’s current management expectations.

(…) we expect our non-GAAP operating margin to contract from the fourth quarter last year. (…)

The ongoing strength of Braintree volumes in conjunction with lower-than-expected branded checkout trends are resulting in incremental pressure on our non-GAAP operating margin. Relative to the 100 basis points of expansion previously expected, we now expect approximately 75 basis points of margin expansion.

Source: PayPal Q3 2023 Earnings Transcript

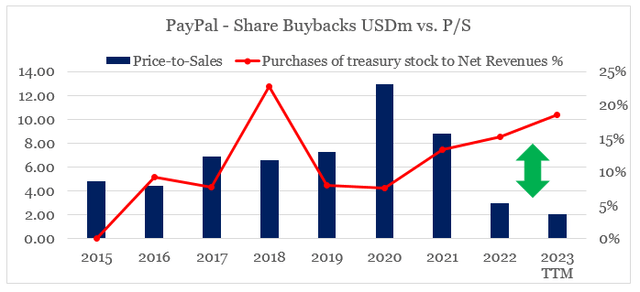

Additionally, PayPal’s management is taking advantage of its extremely low valuation by ramping up the amount spent on share repurchases. With the exception of FY 2018, the amount spent on buybacks in FY 2022 and for the past 12-month period (note the overlap between the two periods) is the highest since 2015.

prepared by the author, using data from Seeking Alpha and SEC Filings

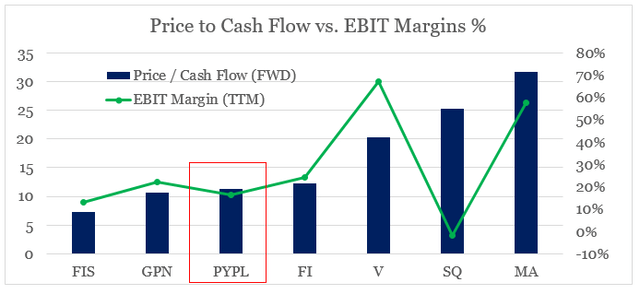

Lastly, PYPL’s price to cash flow multiple appears to be in-line with the company’s margins once we compare it to the extended peer group consisting of FIS (FIS), Global Payments (GPN), Fiserv (FI), Visa (V), Block (SQ) and Mastercard (MA).

prepared by the author, using data from Seeking Alpha

Although this goes against everything said above, there is a strong case to be made that some of these companies are also conservatively priced. Namely, Fiserv, which is one of my favourite picks in the sector and a high conviction idea within my investment group, and FIS which I recently covered.

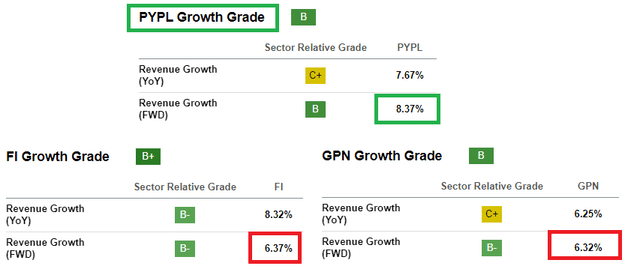

Moreover, PayPal is also expected to grow at higher rates than its similarly priced peers above which is yet another reason to expect a more premium valuation for the company.

Seeking Alpha

Conclusion

The most recent quarter was a step in the right direction for PayPal and clearly illustrated that the company’s strategy is working. The stock remains conservatively priced and with that is an attractive long-term opportunity. The market, however, would require a more sustained increase in margins, before any meaningful multiple repricing occurs. That is why, I remain cautious on PYPL’s returns over the short-term, given the highly optimistic investors’ sentiment at the moment and the usual noise contained within the quarterly results.

Read the full article here