There isn’t a singular methodology for investing, as each investor is unique and has different objectives. There is a cohort of the investment community that only cares about alpha and beating the market, some stick with funds, while another group is focused on utilizing their capital to generate income. While these methodologies are different, investors are all implementing a plan to reach their desired results. I am a hybrid investor, as I have different segments of my portfolio working to accomplish different goals. Within the income side, I invest in individual equities, real estate investment trusts (REIT), business development corporations (BDC), exchange-traded funds (ETF), and closed-end funds (CEF). My preference is to build a diversified stream of income to mitigate risk and keep a continuous flow of income hitting my account.

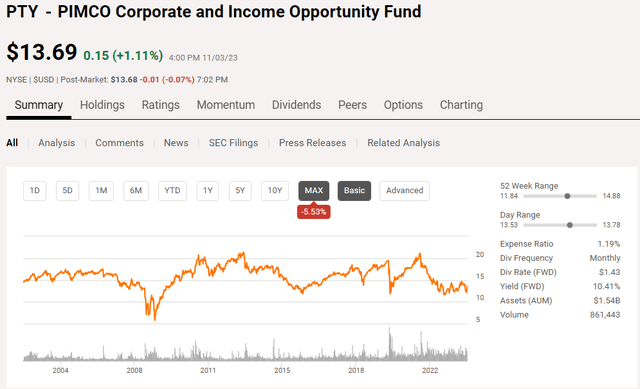

After listening to Jerome Powell’s latest speech and reading through the FOMC minutes, I am more convinced that we are at the end of a tightening cycle even if the Fed decides to raise rates by another 25 bps in the short term. Many high-yield assets have been crushed for numerous reasons, and when the risk-free rate of return exceeds 5%, those looking for income are less inclined to take on equity risk. I have been adding to several CEFs from PIMCO and feel that the PIMCO Corporate and Income Opportunity Fund (NYSE:PTY) is an appealing CEF for future income. PTY has a track record that exceeds two decades of producing income, and I believe that as the Fed transitions from a tightening cycle to lowering rates, credit markets and debt investments will benefit. For long-term income investors, PTY could serve as a diversification tool into these areas that should rebound over the next several years while generating above-average yields. Allocating capital toward PTY can lock in a yield on cost that exceeds 10% while having prospects for capital appreciation during the next phase of Fed policy.

Seeking Alpha

Following up on my previous PTY article

At the beginning of August, I wrote an article about PTY (can be read here) where I discussed PTY as a fund, where the macroeconomic environment was, and why I was bullish on PTY moving forward. Since 8/6, the S&P 500 has declined -2.99% while PTY declined -5.91%. When the income PTY generates is factored in, its total return is -3.42%, still below the S&P 500. I am following up on this article as there is more clarity on a macro level after several additional CPI reports and FOMC meetings. I am also going to explain my reason for adding PTY as a component of an overall income strategy and why I feel it will rebound in the coming years.

We now have more clarity on a macro level, and the Fed looks to be at the end of its tightening cycle

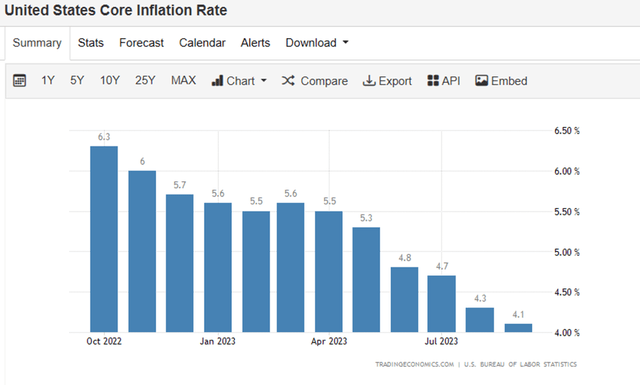

The Fed has been threading the needle between two difficult tasks of maintaining maximum employment and price stability. We have seen core CPI fall from 6.3% to 4.1% over the past year, with six consecutive MoM decreases. Inflation continues to come down, and while we’re not at the Fed’s 2% goal, inflation is declining. U.S. Treasuries tumbled on Friday, 11/3, as the 2-year fell 13 bps to 4.85%, which is its lowest level since September 1st, and the 10-year fell 14 bps to 4.51%, which is its lowest level since September 29th. This came on the heels of the latest nonfarm payroll report indicating that job growth is slowing after adding 150,000 jobs, which was below the forecast for 180,000. The bond market is signaling that the Fed is done hiking, and when I look at the commentary from Jerome Powell, I tend to agree.

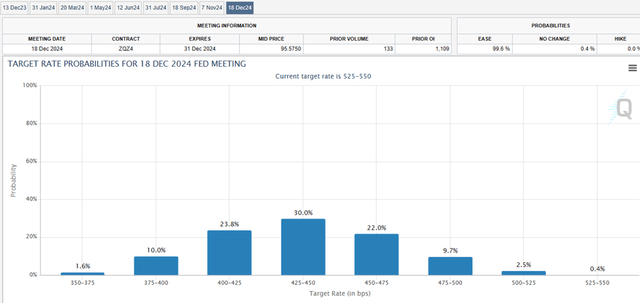

Trading Economics

On 11/3, the Fed decided to maintain the current Fed Funds Rate with another pause as the economy made progress toward its goals. While Jerome Powell left the door open for another hike, he was clear that the Fed understood how their actions of maintaining rates at a higher level impact families and businesses across the country. The Fed remains data-dependent, and the CME Groups Fed Watch Tool indicates that there is a 25.9% chance that we see our first 25 bps cut in March 2024. When I look out to the end of 2024, the data is indicating the most probable range is 425-450 bps on the Fed Fund Rate, while there is an 11.6% chance we have a three handle on rates rather than a 4. In addition to the data, we’re headed into an election year, and many American families are being more impacted by higher rates rather than inflation as the carrying cost on credit cards and the cost of new debt are at their highest points in years. While the Fed operates independently, I think there will be overwhelming pressure for rate cuts and that the data will also support the decision as inflation looks as if it will continue to decline.

CME Group

Why PTY should be a prime beneficiary of looser Fed policy

PTY looks to generate a total return through a combination of distributing monthly income to its investors while its underlying assets recognize capital appreciation. PTY utilizes an asset allocation strategy throughout multiple fixed-income sectors in global credit markets. Its investments include corporate debt, mortgage-related and other asset-backed securities, government and sovereign debt, taxable municipal bonds, and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers. The higher rate environment has negatively impacted many of these markets as these are primarily debt instruments that generate yields.

We went from a yield-starved environment to an abundance of risk-free products where yields exceeded 4-5% quite quickly. This is problematic for credit markets, bonds, mortgage-backed securities, and funds that hold these investments. When new debt in any of these forms is issued with a higher yield, the previous debt becomes less attractive as it is offering a lower yield. Nobody is going to pay $100 for an investment yielding 3% when the newly issued debt at 5% costs $100. As new debt is issued with higher yields, the older debt declines in value and trades at a discount to its par level, causing its yield to increase and become similar to newer issued debt. In an elongated rising rate environment, several tranches of debt investments sell at discounts, which causes the underlying portfolios of funds such as PTY to lose value. This is negative for the overall value of the portfolio, but for newer investors, this can be an opportunity.

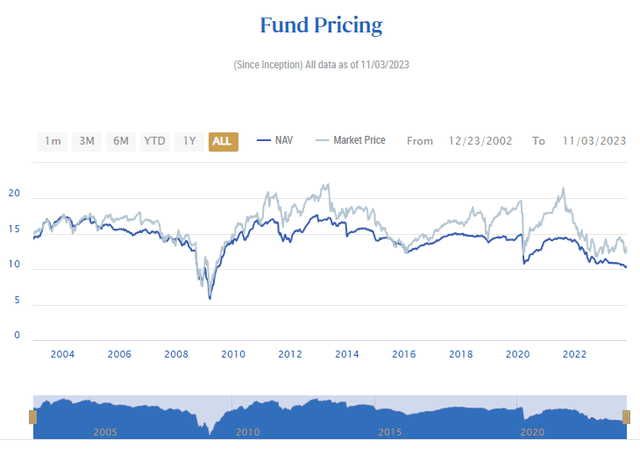

PIMCO

During periods of lower rates, PTY has seen its underlying assets have a larger net asset value (NAV) and the fund’s price trades at a larger premium to its NAV. In low-rate environments, the choices for yield are limited as risk-free investments aren’t as attractive at 2% as they are at 5%. Debt investments are typically more expensive as they offer a more lucrative yield, and funds such as PTY become more attractive. PTY has 629 holdings with an average coupon of 8.31%, as they have continuously invested throughout the tightening cycle.

I believe that PTY will generate capital appreciation from these levels over the next several years. As rates decline, it will cause its assets to become more attractive as they have larger coupons attached to them. Eventually, discounted debt will catch a bid as there will be a rejuvenated appetite for yield because the risk-free rate of return will no longer be as appealing for income investors. This could cause PTY’s NAV to rebound to where it was in 2021 and cause the spread between the fund’s price and its NAV to expand as it has in previous periods.

PTY should remain an income-generating machine for investors

PTY started trading on 12/27/02 at $15 per share at a 4.9% premium to its NAV. Throughout the past 21 years, we have seen PTY’s share price exceed $15 for long stretches, and we are currently in a period where shares have retraced. While shares have currently declined by -8.73% since inception, this doesn’t mean that PTY hasn’t served a purpose. This is where the income investing mindset comes in, as not every investment has to be a multi-bagger, generating large amounts of alpha.

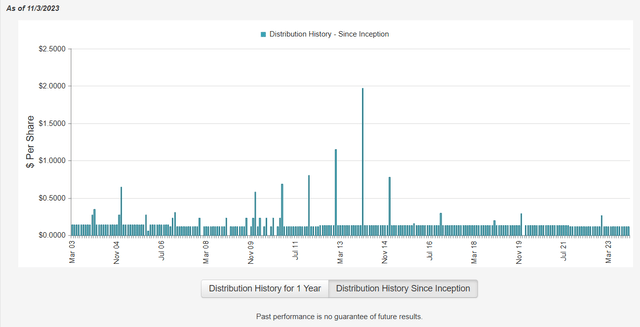

Since its inception, PTY has generated $39.01 in distributed income. There has been $33.96 produced from its distributions, $1.10 from special distributions, $3.11 from long-term capital gains, and $0.84 from short-term capital gains. PTY has distributed 260.07% of its initial share price in income over the past 21 years. When you factor in the current share price of $13.69 and the $39.01 of distributed income, there is $52.70 of value, which is 251.33% of returns on the initial $15 investment. Over the past 21 years, PTY has generated an average return of 11.97% without factoring in reinvesting the distributions.

From an income perspective, I look at this as an asset I could have purchased and held for over two decades that would have generated 260.07% of my initial investment in distributed income, and I still own the asset that is generating a 10.41% yield on a forward basis. I don’t mind that my underlying investment has declined by -8.73% because it’s still an asset-producing income that I have more than made my money back from.

CEF Connect

There are risks to my investment thesis that fall within my risk threshold

Nobody can predict the future, and there is certainly risk to this investment. If the Fed keeps rates higher for longer or the data dictates that the Fed goes higher with rates, it could cause a scenario where defaults on debt rise. If this occurs, some of PTY’s portfolio could be impacted. While the rising rate environment may have created an opportunity, nothing is guaranteeing a Fed pivot, and a credit crunch and default cycle could occur. Investing in corporate debt isn’t easy and has elevated risk. If you are interested in PTY, you should look into how rates impact debt and the risks to credit markets, as PTY has an elevated level of risks that other investments may not have.

Conclusion

Looking at the future, I ask myself, what has changed? Sure, the distribution has fluctuated, but I am able to lock in a yield on capital that exceeds 10%, and PTY has more than two decades of distribution income throughout every economic crisis I can think of. My investment thesis revolves around the fact that the Fed will start to pivot in the first half of 2024, which should cause PTY’s underlying assets to appreciate. I see a path for PTY’s NAV to appreciate as new debt is issued at lower yields, pushing the value of existing underlying assets higher while generating ongoing distributions. I am continuing to add to my position in PTY as it’s part of an overall income strategy, diversifying my investments into credit and debt markets. PTY may not be right for everyone as a higher for longer rate environment could occur, but I believe that PTY can replicate the past, and I am planning on holding for the long term and reinvesting each distribution along the way.

Read the full article here