Rising long-term interest rates make long-term treasuries more and more a viable alternative to equities, certainly much more than was the case the previous years. And one cannot exclude a drop in equity prices due to the rising interest rates.

Convertible bonds are often seen as a way to keep equity exposure but with a lower volatility and hence downside protection. Convertibles at the same time also offer bond exposure (to profit from the current high(er) bond yields) and hence higher income potential. Are convertibles indeed offering the best of both worlds? Or should we look for better alternatives to protect against falling equity prices and to earn income at the same time?

Convertible bonds

Convertible bonds combine characteristics of stocks and bonds. In rising stock markets convertible bonds, like stocks, offer upside potential and are less sensitive to rising interest rates. Like bonds, convertibles provide income and potential downside protection in declining equity markets.

Figure 1: Convertible bonds (Calamos)

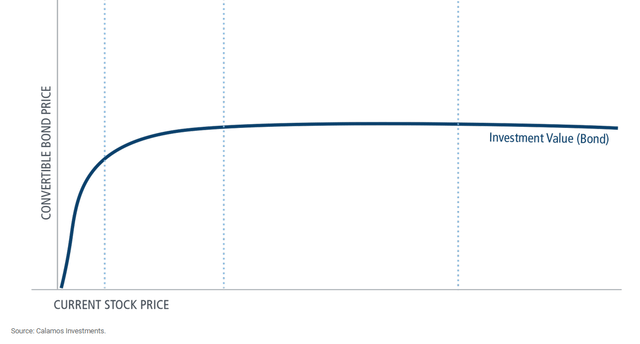

A convertible bond can be viewed as the combination a “normal” bond and a conversion option. The value of the first part is called the “investment value”. It’s the value of the convertible bond if it would not be convertible. A rising stock price has no real impact on the investment value. It’s only when the company gets into financial trouble and the stock price sinks that the investment value will reflect this financial distress.

Figure 2: Convertible bonds investment value (Calamos)

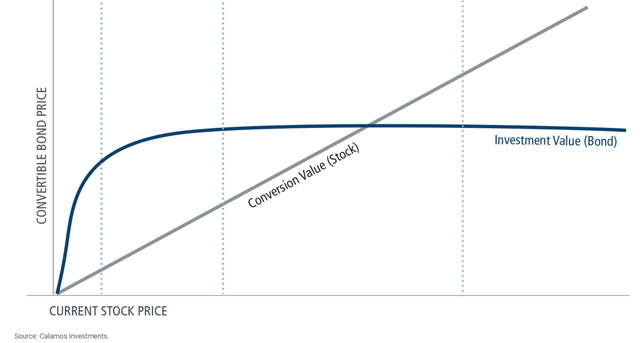

The conversion feature of a convertible bond is reflected in the so-called “conversion value”. It is the value of the convertible bond if it would be converted at current stock market prices.

Figure 3: Convertible bonds conversion value (Calamos)

Both the investment value and the conversion value can be seen as a minimum value for the price of the convertible bond.

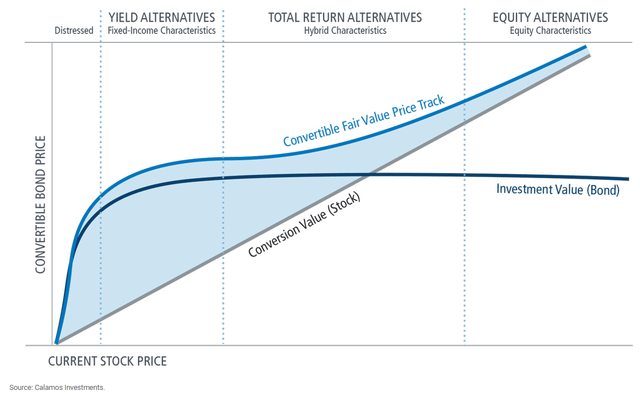

Figure 4: Convertible bond zones (Calamos)

Investors normally pay a premium above the conversion value (the blue zone in Figure 4). A convertible bond has an implicit (conversion) option, and as long as there is time remaining until the option expiry the option will have some value in itself. A convertible bond is also safer than the underlying stock and normally pays a higher coupon compared to the dividend yield of the underlying stock.

One can distinct four zones in Figure 4. The first is Distressed and is self-explanatory.

A convertible bond is a so-called “Yield alternative” (with fixed income characteristics) when it is valued at about the same level as its investment value.

The third zones is called “Hybrid”. The convertible is still a yield alternative but the sensitivity to the share price of the underlying stock is rising.

The final zone is “Equity alternative”. Here the equity sensitivity (or delta) is very high.

So, do convertibles indeed offer upside potential and downside protection? Let’s first check the past performance.

Performance

Convertible bonds combine characteristics of stocks and bonds and the total return performance of convertibles does indeed fall between those of equities and (high yield) bonds.

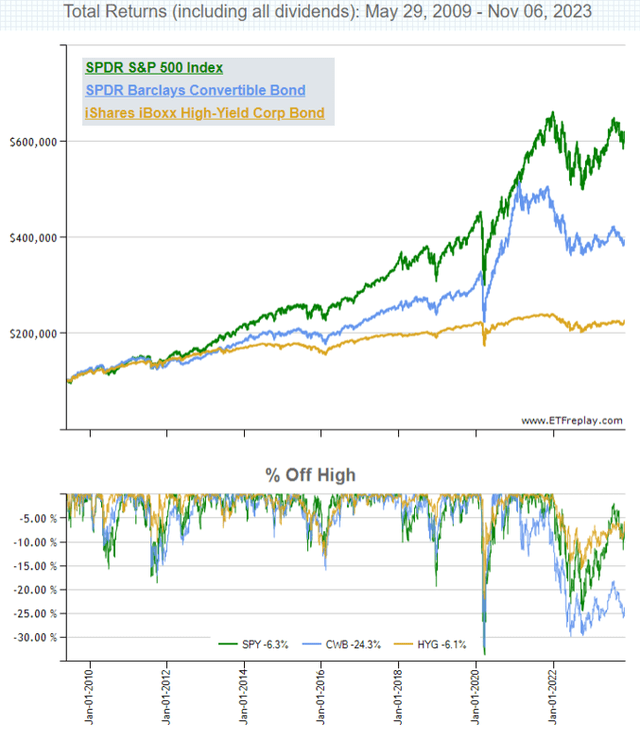

Figure 5: Total returns and drawdowns (ETFreplay.com)

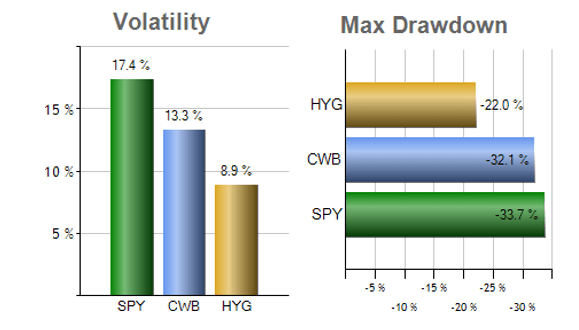

The same can be said of the volatility. However the same cannot be said about the maximum drawdown: convertible bonds’ maximum drawdown is almost as big as the one of equities.

Figure 6: Volatility and drawdowns (ETFreplay.com)

This drawdown occurred not surprisingly during the Covid crisis.

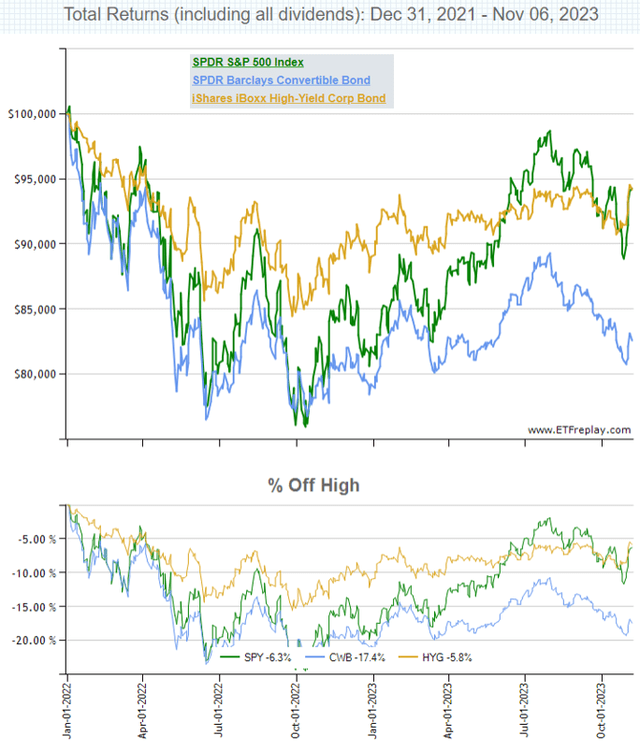

Equities, convertibles and high yield bonds had another big drawdown in 2022 due to rising interest rates. The maximum drawdown of convertibles was once again almost as big that of equities. And while equities and high yield bonds are much closer to their high (between 5 and 10%) convertibles are still almost 20% “off high”.

Figure 7: Total returns and drawdowns (ETFreplay.com)

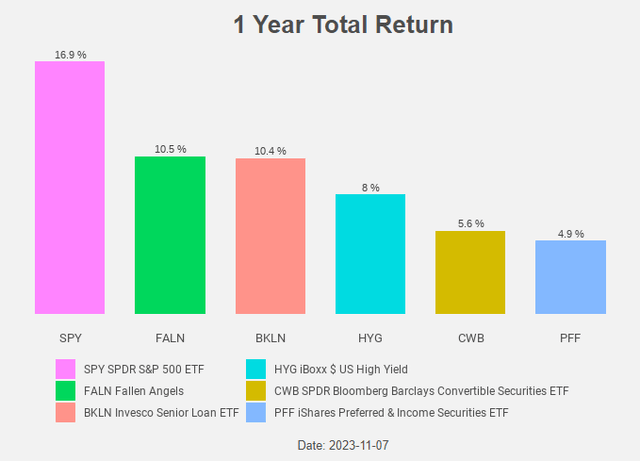

The past 12 months, convertibles are also underperforming both stocks and high yield bonds.

Figure 8: Tot al Return Chart (Radar Insights)

SPDR Bloomberg Convertible Securities ETF

The biggest convertible ETF is the SPDR Bloomberg Convertible Securities ETF (NYSEARCA:CWB).

CWB follows the Bloomberg US Convertible Liquid Bond Index. The expense ratio is 0.40%.

Convertible bonds are mostly issued by young, high-growth companies. It offers them an interesting cost of capital compared to equity or (high yield) debt. It’s also a way to secure financing without immediate dilution for current shareholders. The convertible debt will only be converted to equity when things go well for the issuing company.

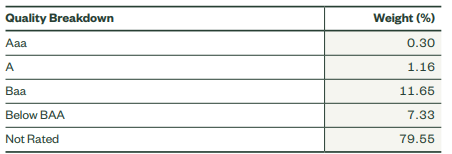

As a result, most of the bonds in the fund have no bond rating.

Figure 9: Quality breakdown (SPDR)

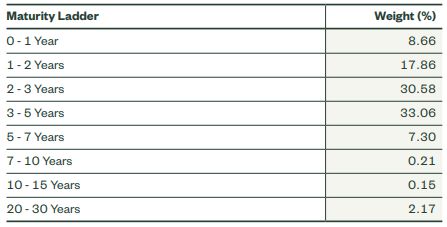

And most bonds have a relatively short maturity.

Figure 10: Maturity ladder (SPDR)

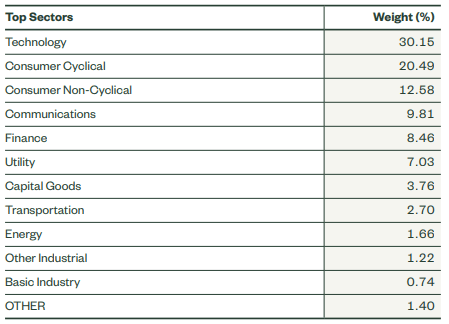

The biggest sectors are Technology, Consumer Discretionary & Staples and Communication Services.

Figure 11: Sector allocation (SPDR)

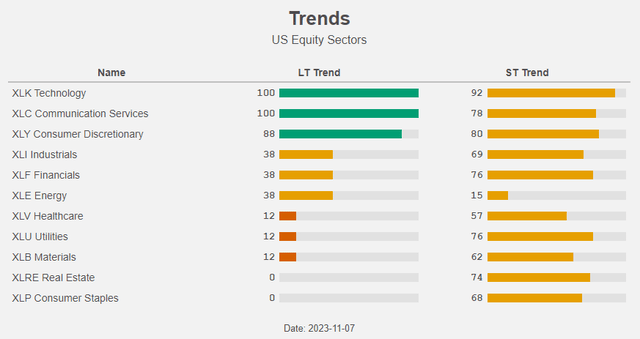

With the exception of Consumer Staples, this are the three sectors in a long term uptrend.

Figure 12: Trends (Radar Insights)

Delta

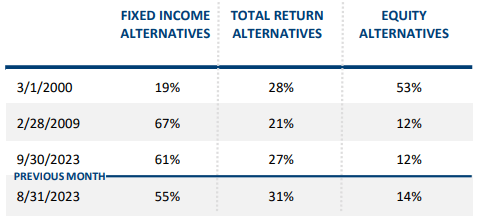

At the end of September more than 60% of the convertibles in the ICE BofA All US Convertibles Index can be found in the “Yield alternative” according to Calamos.

Figure 13: Convertible market composition (Calamos)

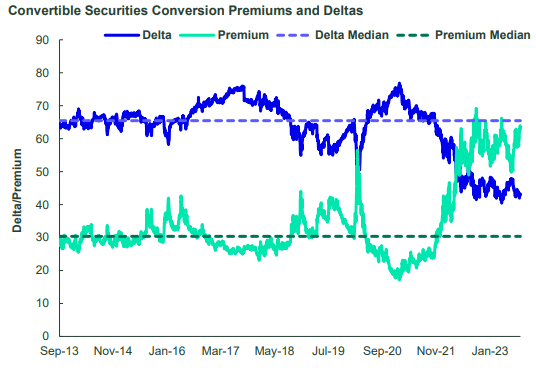

When convertibles trade as a “fixed income alternative”, the delta (or sensitivity to the underlying equity price) is lower and the premium above the conversion value is higher.

This is indeed the case: the delta is lower than normal and the premium is higher than normal.

Figure 14: Convertible market delta and premium (SPDR)

This implies that convertibles are currently less impacted by movements in the underlying equity price and hence can indeed offer downside protection if stock prices would fall.

But what about the income potential in particular and the valuation in general?

Valuation

We can only be disappointed with CWB’s current dividend yield of 2.4%. This isn’t really competitive with treasury yields above 4.5%.

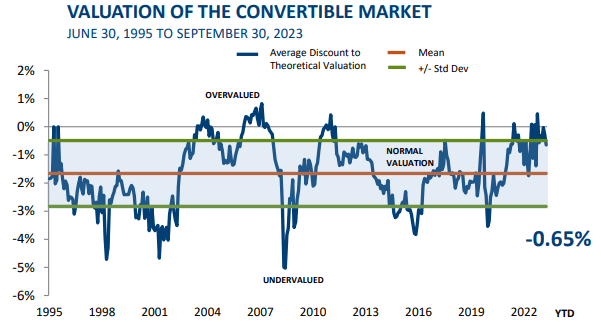

Research by Calamos also shows that convertible bonds are currently overvalued.

Figure 15: Convertible market valuation (Calamos)

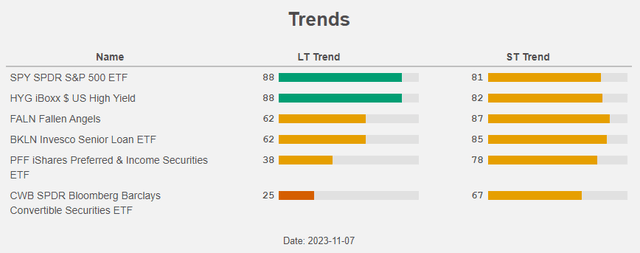

CWB is also in a long term downtrend, another reason for disappointment.

Figure 16: Trends (Radar Insights)

Conclusion

Convertible bonds have no history of strong downside protection. Currently the percentage of convertible bonds that “trade as a fixed income alternative” is rather high and this implies that the downside protection is now higher than was historically the case.

A second reason why we would consider convertibles is the bond exposure (and the accompanying income potential) they offer. CWB’s current dividend yield of only 2.4% cannot be called an exceptional income potential when treasury yields have risen above 4.50%.

CWB is also in a long-term downtrend. We would sell CWB and look for alternatives indeed.

Read the full article here