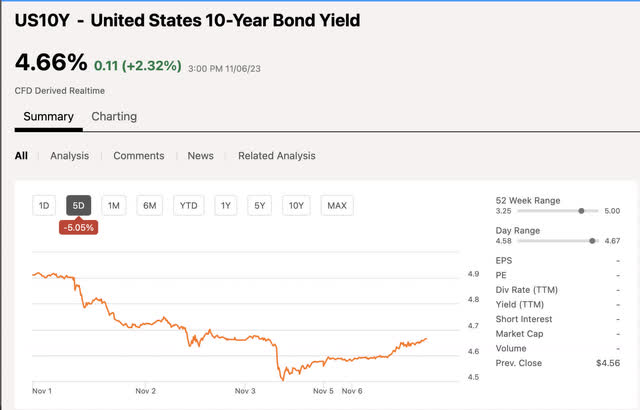

Is the Fed done hiking?

It might be. A big segment of the market seems to buy the narrative after Jerome Powell’s recent comments. The 10-year Treasury quickly gained traction as demand increased at the hint of rate hike pauses and possibly reversion shortly.

Seeking Alpha

A quick drop in the 10-year led to some popular articles surrounding long-duration U.S. Government debt (TLT). I am still sticking to the narrative that what Peter Lynch taught us remains true. Do not bet on long-duration U.S. Treasuries unless they yield more than 600 basis points over the dividend of the S&P 500 (SPY). There’s too much additional capital gain upside and implied future gains in the market over a 10-20-year period to lock precious capital up into mediocre yields.

If you are in or close to retirement, that’s a different story. If you have at least 10-15 years before retirement on the table, why not get some hybrid investments at the very least? The U.S. Government will never raise your fixed yield. Dividend stocks will not only have a capital gain upside for appreciation sake should they continue to grow revenue and earnings, but the best-of-breed dividend stocks normally raise their yields at a greater pace than inflation per annum. You just won’t get that kind of benefit from fixed-yield bonds. The rates are not high enough yet to make a compelling case.

Dividend Kings and Aristocrats

An alternative to buying debt and credit right now is large dividend-paying stocks with yields greater than 3%. There are quite a few high-quality names in non-commodity-based industries right now that are paying bond-like yields which are at or near 10-year highs. I consider this one of the anti-bubbles of the market. As many investors conflate these assets with fixed income, many dividend-centric funds like Schwab U.S. Dividend Equity ETF (SCHD), have been sold off in favor of the “risk-free” money out there.

On the short end of the yield curve, I agree, that money markets and high-yield savings accounts, short Treasuries, and CDs are an excellent place to stash cash. Once you put your duration out longer than 2 years, you risk the possibility of severe underperformance should you lock too much up in this segment. At the very least, grab debt-based instruments for your fixed income that have the potential for equity-like returns in the BDCs and high-yield debt fund space. With credit spreads widening, this is very feasible.

My current focus has shifted to diversified high-quality, high yield equities for a lot of new capital as a hedge against potential rate cuts on the horizon. These should gain a lot if a cut does happen as they are a proxy for fixed income.

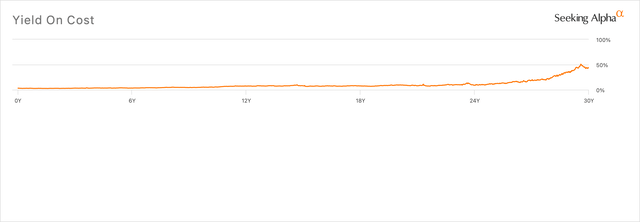

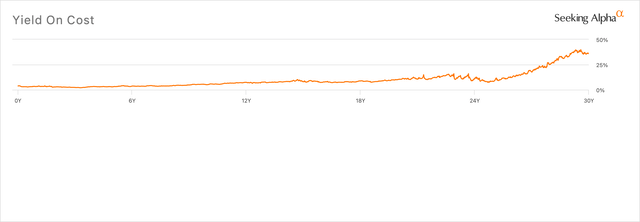

Yield on cost, a demonstration on how dividend growers beat fixed yields

Most of us won’t have the stomach to hold on to any stock for 30 years. Included below are two of the discussed aristocrats/kings touched upon in this article. Johnson & Jonson yield on cost if you bought and held from 30 years ago? Near 50%. Clorox is around the 30% level.

Wouldn’t you love to eventually own a 30-50% annual cash flowing asset? I know I would and it would beat the socks off any long-duration Treasury. Starting at a higher level gives you all the more leg up to eventually hit the big bucks.

Johnson & Johnson

Seeking Alpha

Clorox

Seeking Alpha

The high 5

Here are 5 quick picks that are either dividend aristocrats or kings having 25-50 years of dividend payments with no cuts, and a 10-year high or near-high covered dividend. When considering a high 10-year yield, I am excluding the Covid “flash crash” which spiked yields for a brief period.

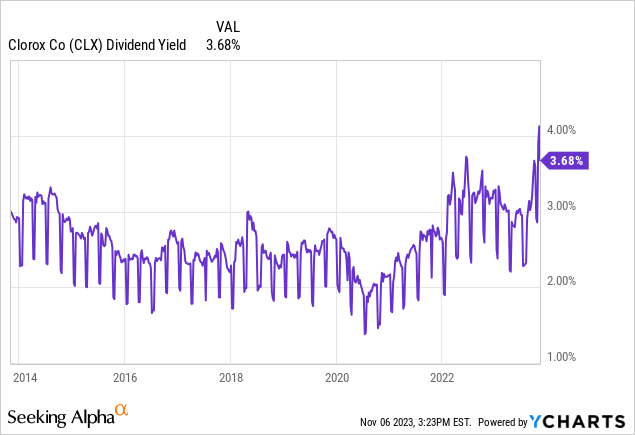

1. Clorox (CLX)

Revenue exposure from FactSet:

- Household cleaning products 63%

- Other leisure goods 16%

- Food production 10%

- Home office furnishings manufacturing 4%

- General Personal Care and Cleaning Products Makers 4%

Even household cleaning companies can be hit by a cyberattack.

Oct 4 (Reuters) a U.S. maker of cleaning products, said on Wednesday it expects to post a first-quarter loss after a cyberattack in August caused product outages and disrupted supplies and operations.

“The company expects to experience ongoing, but lessening, operational impacts in the second quarter as it makes progress in returning to normalized operations,” it said in a statement.

It is also assessing the impact the attack might have on its financial performance in fiscal 2024 “and beyond,” it said.

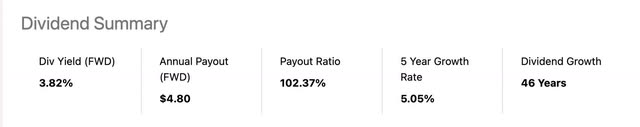

A strange negative catalyst. Expecting a loss of earnings on a per-share basis of 35-75 cents a share and a bad yoy print for revenue, have sent this near dividend King into a unique buying opportunity. One of the most ubiquitous household consumer defensive names is now trading with a decade-high dividend that has a 5% five-year growth rate [better than inflation targets]. I have started buying.

With inflation subsiding, we shouldn’t expect a stellar 2024 according to company guidance, with supply chains hurt by the attack, but we also shouldn’t expect to be swing trading a 46-year dividend payer. Keeping the decade-high dividend in tact is my only request.

Forward yield and history

Seeking Alpha

FWD dividend per share to free cash flow per share TTM

- $4.80 FWD Dividend

- TTM FCF/share $6.42

- 74% payout ratio of FCF

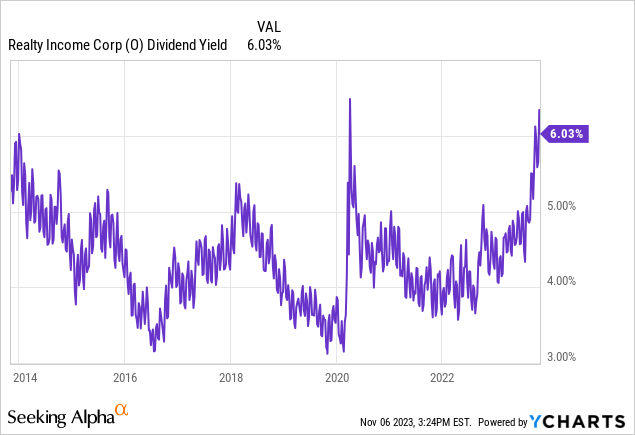

2. Realty Income Corporation (O)

The ultra-popular triple net lease king has been driven down in price as the risk-free rate has ascended. This monthly dividend payer that caters to some of the best names in defensive retail real estate is also a dividend aristocrat. The acquisition of Spirit Realty Capital (SRC) and the stake in the Bellagio have sent this down further than it should have cratered. Bellagio in my opinion is a mixed-use property with lots of restaurants and retail to boot. Bellagio is also preferred equity interest, it’s not like they’re taking over and have to run the place. There are also some nice triple net escalator clauses in the deal:

The existing Bellagio triple net lease structure with MGM includes 2.0% annual rent escalators for the next six years, the greater of 2.0% or CPI (capped at 3.0%) in years 7-16, and the greater of 2.0% or CPI (capped at 4.0%) in years 17-26. Realty Income’s common equity ownership interest will be subordinate to its $650 million preferred equity investment in the venture. Additionally, the Bellagio has property-level debt with an outstanding principal balance of approximately $3.0 billion, a remaining tenor of approximately 6.2 years and a 3.67% (fixed) all-in interest rate.

The Spirit deal created the once-in-a-decade yield that neared 7% for a brief moment. Again this is not including the Covid flash crash. The properties are like kind, triple net and the deal is accretive to the FFO yield as the exchange is less than a one-for-one swap and Spirit has a higher FFO yield at the current price not inclusive of the additional discount Realty Income Corporation will get on the swap.

Forward yield and history

Seeking Alpha

FWD dividend per share to free cash flow per share TTM

- $3.07 FWD Dividend

- TTM FCF/share $4.29

- 71% payout ratio

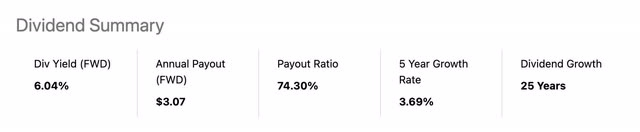

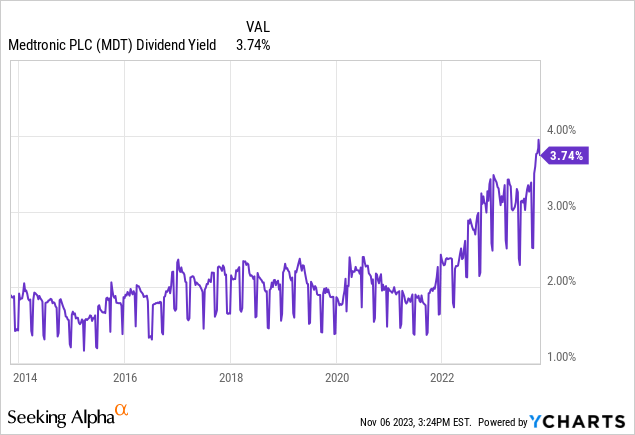

3. Medtronic plc (MDT)

System-Specific General Medical Devices is the name of the game for this company. With a new lead-less pacemaker in the market, this could provide a growth catalyst for an otherwise slow grower. Knowing a hand full of people with pacemakers, the battery under the skin can make for a daily encumbrance when the chest area interacts with items that can cause friction like seatbelts and clothing. I’ve even had one friend have leads detached after having a seatbelt accidentally pulled across the battery area. This could be a game-changer.

The wide list of surgical devices and products that Medtronic supplies to the operating room is staggering. You can view the full list of products here. This is the largest play on advanced medical devices you can get. Although Seeking Alpha has dividend growth listed at 9 years, outside resources have the company slated at 46 years of dividend growth and payment. The firm has more than 50% of the product line stemming from cardiovascular-related devices and a significant portion in diabetic insulin pumps.

Again, a business that is non-commodity based with fairly inelastic products. Just the kind of profile that we’ve come to know and love about the aristocrats and kings.

Forward yield and history

Seeking Alpha

FWD dividend per share to free cash flow per share TTM

- $2.76 FWD dividend

- $3.34 TTM FCF/share

- 82% payout ratio of FCF

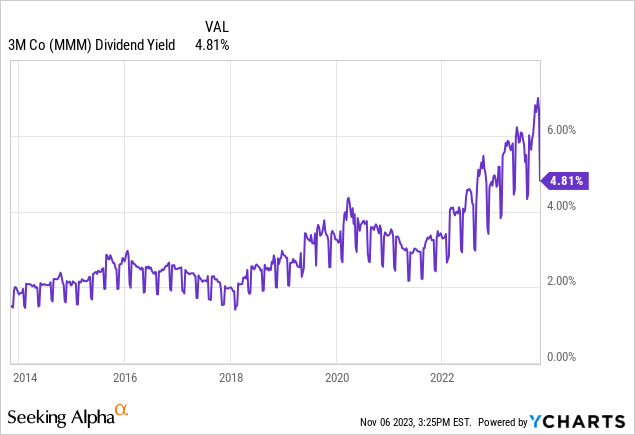

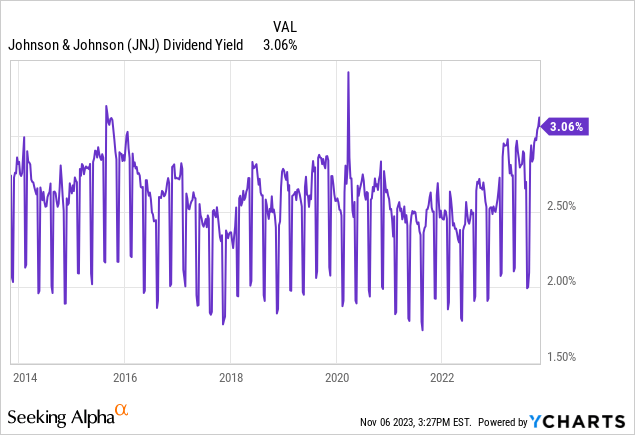

4. 3M (MMM)

Revenue exposure from FactSet:

- Adhesive, Sealant, Coating and Paint Products 24.41%

- Medical Supplies 13.45%

- Defense Manufacturing 11.44%

- Other Specialty/Performance Chemical Manufacturing 9.81%

- Nonmetallic Minerals Products 7.44%

3M is going through some pain. With a couple of large doom and gloom lawsuits getting closer to the rearview mirror, this all-time high-forward dividend is amazing. Sure, it’s expected that there may be a dividend “stealth” cut when the medical supplies business gets spun off, it’s 13-14% of the business after all. But you’ll get shares that will have their dividends too. I am now planning to hold them all. These businesses that 3M provides to society are just too essential to go away in a plume of smoke.

If the dividend even gets reduced by 1/3rd we’re still getting close to an all-time high yield. I’ll hold and compound both 3M and the spinco. The product lines are all vital to a functioning economy, non-commodity and very inelastic.

Forward yield and history

Seeking Alpha

FWD dividend per share to free cash flow per share TTM

- $6.00 FWD dividend

- TTM FCF/share $8.77

- 68% payout ratio of FCF

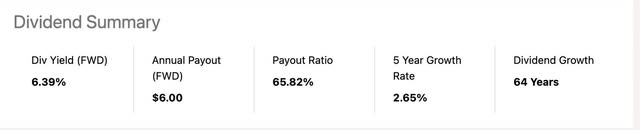

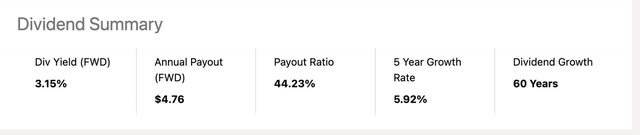

5. Johnson & Johnson (JNJ)

Revenue exposure from FactSet:

- System-Specific General Medical Devices 19.25%

- Immunology Biopharmaceuticals 17.84%

- Oncology Biopharmaceuticals 16.83%

- General Personal Care and Cleaning Products Makers 7.71%

- Neurology Biopharmaceuticals 7.26%

Johnson & Johnson has been one of the, if not the most highly regarded of dividend kings in the market. They’ve hit some speed bumps as of late, especially with the talc lawsuit that will continue to linger. Of course, there would need to be an issue to get a near decade-high dividend yield on a AAA credit-rated Dividend King who again, provides vital medical, pharmaceutical, and healthcare products to society. The products have demand regardless of where we sit in any economic cycle.

Regarding the unsettled lawsuits, most analysts tend to think that the final liability will be about $8.9 Billion. The hit to free cash flow will be more or less muted as long as the payout duration is sufficiently long. Johnson & Johnson is expected to divest its remaining investment in Kenvue (KVUE), which will also drum up cash.

Forward yield and history

Seeking Alpha

FWD dividend per share to free cash flow per share TTM

- FWD dividend $4.76

- TTM FCF/share $6.09

- 78% payout of FCF

Some other high yield angles

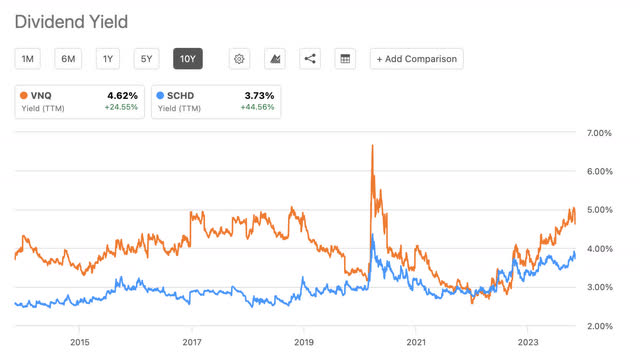

Some other high-yield angles that I am consistently putting money into include the aforementioned Schwab U.S. Dividend equity ETF and Vanguard’s REIT ETF (VNQ). Both are also at or near 10-year yield highs if we discount the Covid flash crash where prices dropped and yields spiked:

Seeking Alpha

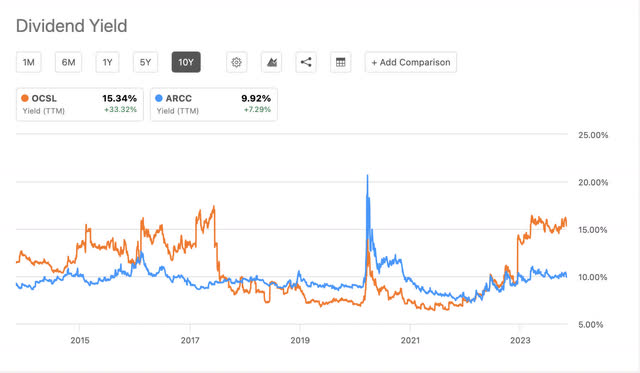

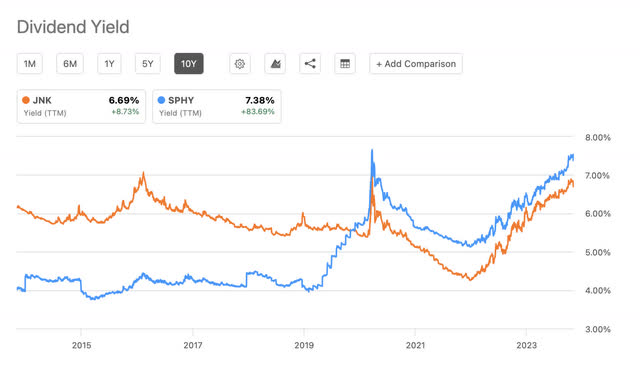

BDCs and high yield debt

The yields in some junk and high-yield below-investment-grade bond funds are also at or near 10-year highs. Their yields are also high enough to compete with equity in the coming decade with some appreciation to be expected should rates revert even slightly. BDCs like (ARCC) and Oaktree’s (OCSL) have been other places I’ve been allocating capital. Some Seeking Alpha members have been pointing out some excellent high-yield debt ETFs like (SPHY) and (JNK) that should be a better play than TLT or long-term treasuries with their wide diversification and comparatively high yield.

BDCs

Seeking Alpha

High Yield Debt

Seeking Alpha

Risks

If the market is calling this wrong regarding a rate pause eventually rolling over into a cut, fixed income substitutes like dividend stocks could get hit once again. The more I look at the situation, I believe the government will need the rates lowered eventually or interest payments will become unbearable. However, I am also in the camp that says inflation needs to be tackled and higher for longer is probably correct, it just might not stick due to external influences outside the FED.

Even an index fund can beat these long rates

A final demonstration as to why you need at least 600 basis points more than the S&P 500 dividend yield to make decade or multi decade long sense, let’s see what happens to the dividend yield of a common S&P 500 ETF’s yield over a decade. Here’s the Vanguard S&P 500 ETF (VOO):

Seeking Alpha

If you bought and held this 500 stock index fund just over a decade ago, the dividend yield on cost has now increased to near 5% due to the increases from the underlying holdings. Not only do we get appreciation upside, but the yield now matches what many are considering to lock their funds into for the next decade or two. A fixed yield with no increases possible.

Conclusion

I sense it. The market is salivating at rolling into long-duration Treasuries and locking in close to 5% guaranteed rates. Again, fixed rates. Never ascending, possibly appreciating a bit, but without an increase in yield. I love income from investments as much as the next person, but I trust high-yielding dividend stocks and specialty credit will do better in the long run than locking money into 4.5-5% for a decade.

Just my opinions, but I need more yield before I jump on Treasuries. Maybe we’ll get it [more yield]. However, I doubt it and the market may be on to something here regarding an imminent reversal. Dividend stocks are cheap and for good reason when the risk-free rate is so high. When it drops, we’ll all be wishing we picked up some decade-high dividends of consistent dividend growers. Just remember, there are owners of Johnson & Johnson getting paid an enormous yield on cost owning a AAA credit-rated investment, don’t risk a decade on mediocrity.

Read the full article here