Shopify Inc. (NYSE:SHOP) (TSX:SHOP:CA), headquartered in Ottawa, Canada, is a $69-billion market cap firm that offers a cloud-based e-commerce platform designed for small and medium-sized enterprises. Their software empowers users by giving them a unified perspective across various sales channels, encompassing online platforms for both web and mobile, brick-and-mortar retail establishments, social media shops, marketplaces, and other avenues.

The last and only time I wrote about SHOP stock was 3 months ago before the company released its Q2 results. Unfortunately, my expectation of a positive reaction to the financial results did not materialize: The stock corrected quite a bit after the report was released, mainly because the market wanted to see a more impressive operating profit from the company.

As for Shopify’s long-term potential, I don’t think the second quarter results showed anything bad. On the contrary, the company has exceeded market expectations in many ways by continuing to invest heavily in its growth and expanding its potential addressable markets. From a speculative trade idea that didn’t work out, SHOP started to look like an exciting long-term investment in my eyes. Let me tell you why.

The Q2 Results

In Q2 2023, Shopify posted robust financial results, reporting revenue of $1.69 billion, a 31% increase YoY and 12% higher sequentially. This revenue exceeded the consensus forecast of $1.62 billion. Notably, the company achieved a non-GAAP profit of $0.14 per diluted share, a substantial improvement compared to $0.01 in Q1 2023 and a $0.03 non-GAAP loss from the previous year, accounting for the 10-to-1 stock split in 2022.

This year Shopify undertook significant actions, including staff reductions and the sale of its logistics business to Flexport, which included the Deliverr business acquired for $2.1 billion in 2022. In exchange, Shopify gained a 13% stake in Flexport. The company also sold its warehouse robot business, 6 River Systems, to UK-based Ocado, which had been purchased for $450 million in 2019.

In the financial breakdown for Q2, Merchant Solutions revenue reached $1.25 billion, representing 74% of the total and growing by 35% YoY. Subscription Solutions revenue amounted to $444 million (26% of the total), showing a 2% annual increase. Monthly recurring revenue (MRR) reached $139 million, marking a 30% YoY increase.

SHOP’s Gross Merchandise Volume (GMV) across customer platforms reached $55.0 billion in Q2 2023, a 17% increase from the previous year. Gross Payments Volume (GPV) was $31.7 billion, growing by 27% YoY and accounting for 58% of GMV, an all-time high.

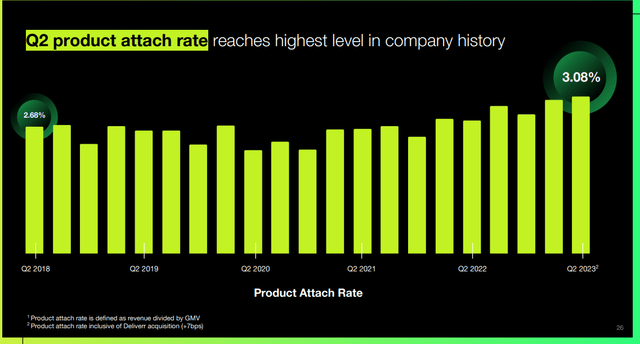

In terms of unit economics, SHOP’s business is also doing better: the attach rate [the percentage of customers who buy or “attach” additional products, services, or accessories to their primary purchase] reached 3.08% in the second quarter, which is the highest in the company’s entire history:

SHOP’s IR materials

According to the management’s commentary from the earnings call, despite the absence of logistics and warehouse robotics in the financials, Shopify is projecting a low-20% annual revenue growth in Q3 2023, adjusted to exclude logistics from comparisons. Also for Q3 2023, Shopify anticipates an improved gross margin, estimated to be 2-3% higher than Q2 2023. Operating expenses are projected to remain steady or experience slight growth compared to Q2, excluding one-time items. Stock-based compensation is expected to reach ~$110 million in Q3. The company’s CAPEX for the entire year of 2023 is forecasted to be ~$45 million. Furthermore, Shopify expects that its FCF in Q3 will surpass the cumulative FCF generated in 1H FY2023.

Shopify’s strategic focus areas involve expanding from the initial sale to full-scale operations, going global, and cultivating customer relationships. They are introducing AI-driven features like Commerce Components by Shopify, Shopify Magic, and Sidekick to enhance the merchant experience. These tools aim to empower entrepreneurs by providing better, faster, and more creative ways to grow their businesses. Shopify also facilitates international expansion for merchants, with a growing presence in Europe. Additionally, the company offers a suite of commerce services and solutions to help brands engage with consumers across various platforms, with a focus on building the B2B market.

During the earnings call, SHOP’s President Harley Finkelstein mentioned that they recently increased prices, and merchants were willing to pay for the added value, which demonstrates that the value-to-cost ratio of Shopify’s product is favorable.

Practice shows that SHOP is developing harmoniously from an operational point of view – long-term investors, in my opinion, have nothing to worry about.

But what about the stock’s valuation?

Valuation & Expectations

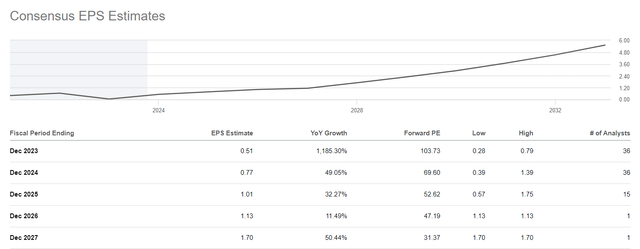

In my opinion, looking at SHOP’s P/E ratio for next year of ~103x is a bit meaningless – analysts are forecasting that the company will show multiple EPS growth rates in FY2023, so such a high P/E ratio may seem reasonable from a growth stock perspective.

SHOP’s EPS estimates, Seeking Alpha

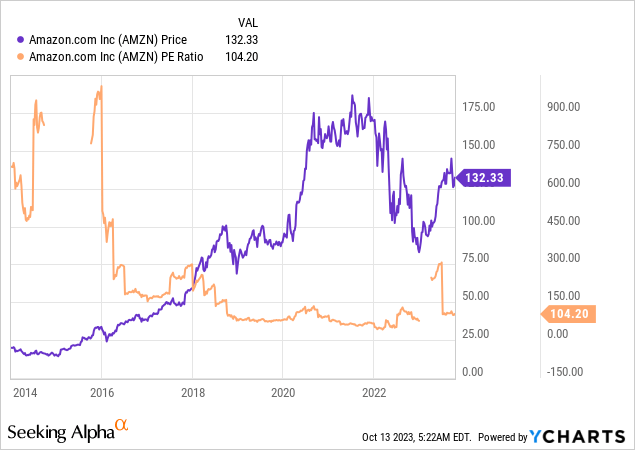

If you look at the P/E ratio Amazon (AMZN) was trading at in its early years, this becomes even clearer.

What then makes sense to look at?

As with all growth companies, we should always include projected EPS growth rates and implied price-to-earnings ratios in our valuation analysis and preferably compare these numbers to those of peers. So I did.

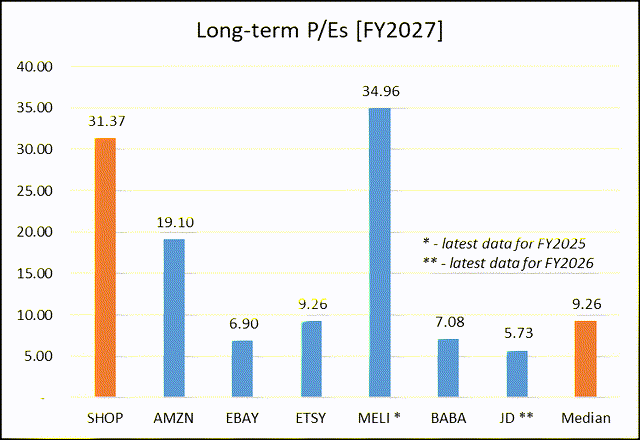

Looking at the long-term implied price-to-earnings ratios (P/E ratios) obtained by dividing today’s price by projected earnings per share, we find that SHOP’s ratio for fiscal 2027 is 2.3 times higher than the median of the peer group I used as the basis for analysis.

Author’s work, Seeking Alpha data

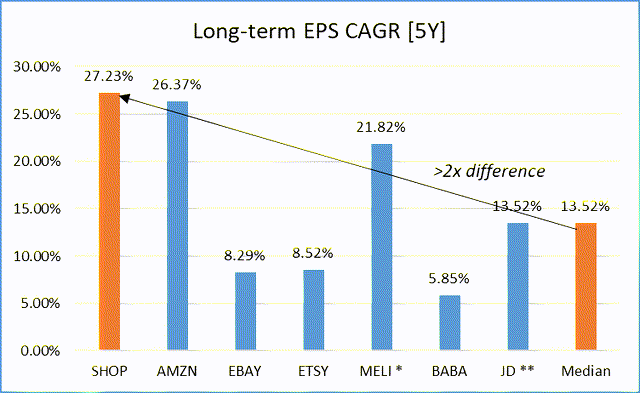

However, SHOP’s estimated EPS growth [CAGR for FY2023-27] is also ~2 times greater than the median in the peer group:

Author’s work, Seeking Alpha data

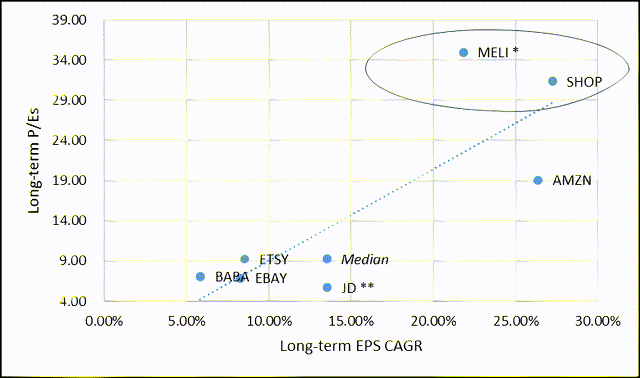

Translating this data to a 2D level, we see that SHOP is ahead of MercadoLibre (MELI) in its projected growth, while its valuation multiples are slightly lower. At this point, it should be noted that the data for MELI’s EPS numbers are limited to FY2025, but anyway – SHOP doesn’t seem that overvalued when we consider its projected growth rate.

Author’s work, Seeking Alpha data

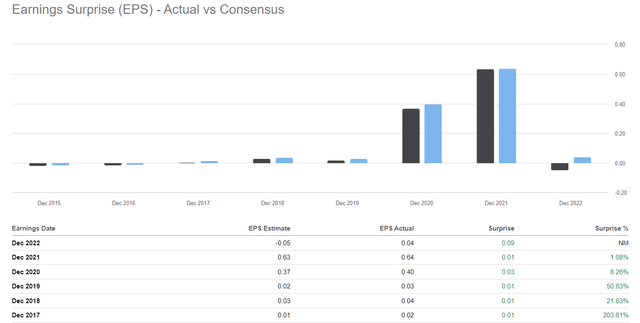

SHOP consistently shows positive earnings surprises – for example, the consensus expected a bottom-line loss for FY2022 but the company confidently defended its profit:

Seeking Alpha data

So I wouldn’t be surprised if we see another EPS beat this year and maybe next year – that will allow SHOP to grow out of its high multiples faster.

The Bottom Line

Of course, investing in Shopify stock comes with some very important risks that everyone should take into account. First of all, the valuation concerns are noteworthy due to the high price-to-earnings ratio, which makes the stock vulnerable to market corrections – the valuation analysis I have done above represents only my view, not Mr. Market’s. Second, market competition poses a challenge as Shopify competes with giants like Amazon and evolving platforms, necessitating ongoing innovation. Third, the company’s revenue is closely tied to merchant success, which makes it sensitive to economic downturns. Moreover, regulatory challenges can affect its operations and compliance costs, and currency fluctuations expose Shopify to currency risk in its global operations.

However, if you are willing to accept these risks and wait 3-5 years or more, SHOP looks like a pretty exciting investment in the long run thanks to its qualitative growth (GMV expansion + margin expansion). And it seems to me that management has the right vision of where the company should move next. Therefore, I am moving my previous speculative “buy” rating to a long-term “buy” rating.

Thanks for reading!

Read the full article here