Deal Overview

On October 30, 2023, Western Digital

WDC

NDAQ

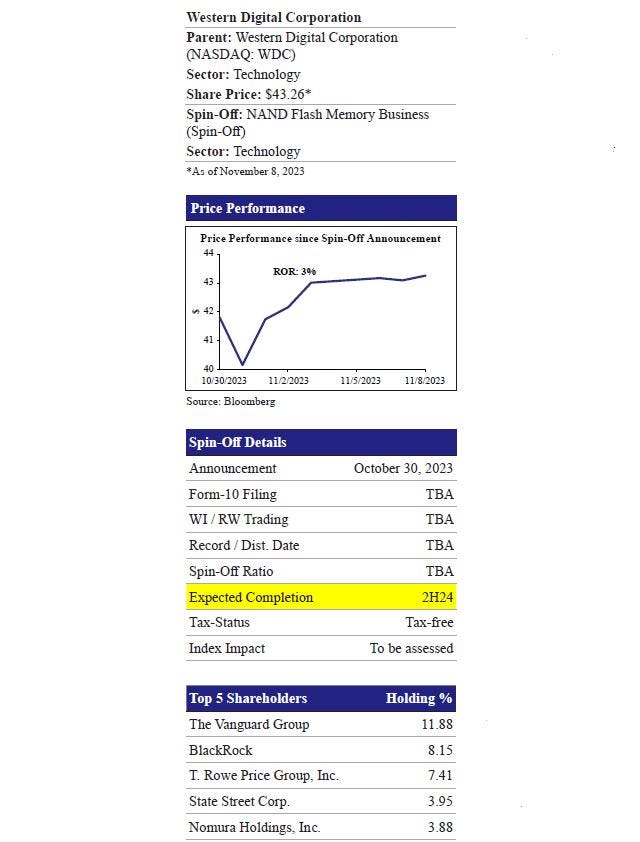

WDC expects to effect the transaction through a distribution of a Flash Memory business to WDC’s shareholders. The transaction is intended to be structured as tax-free for US federal income tax purposes. Post spinoff, WDC will continue to be publicly listed on the NASDAQ Exchange, whereas details regarding the listing of NewCo. will be announced at the later date. The transaction is expected to complete by the second half of 2024.

In May 2022, the investor group Elliott Investment Management recommended the WDC Board to conduct the strategic review and split the HDD and Flash business for maximizing shareholders value. Accordingly, in May 2022, at Investor Day, Western Digital publicly declared plans to explore options for repositioning with full Board support and consultations with external parties. On June 7, 2022, the company officially announced a strategic review to enhance long-term shareholder value.

The decision to proceed with the separation is contingent upon board approval, the completion of definitive documentation, obtaining opinions or rulings on the tax-free nature of the transaction, and meeting standard conditions. These conditions include the effectiveness of necessary filings with the U.S. Securities and Exchange Commission, the finalization of audited financials, and the availability of financing.

Qatalyst Partners, Lazard

LAZ

Merger News:

Since 2021, WDC was in talks with its manufacturer Japanese storage maker Kioxia Holdings Corp. (Kioxia) for a merger. Later in July 2023, the company announced it officially to merge its NAND Flash business with Kioxia. The move was in line to divest NAND business and focus on HDD business. However the deal was cancelled after the Kioxia investor SK Hynix which a major memory chip maker raised concern over the deal.

Deal Rationale

In the past, during a thriving industry phase, WDC struggled to secure market share, leading to a gradual decline compared to competitors in both segments. To address this challenge, Elliott, an investor firm, proposed a strategic review in a May 2022 through a letter to WDC’s board. They outlined reasons for separating both businesses, aiming to improve the operational and financial performance of each unit and ultimately enhance shareholder value for the company.

In 2016, WDC acquired SanDisk for $19.0 billion to diversify from its five decade-long standalone HDD business. The aim was to benefit from synergies like technology sharing and distribution leverage. WDC is unique in operating in both HDD and Flash, unlike competitors. Despite high expectations, managing both businesses posed challenges, leading to execution missteps and lost market share. This hindered the realization of set long-term financial targets.

To address this operational and financial underperformance, in 2020, CEO David Goeckeler decided to operationally separate HDD and Flash business units. This was viewed as a positive step amidst the company’s inability to efficiently manage the diverse portfolio of assets. The company had stated that “there are technical dynamics between both the businesses that are very different and that an operational separation would lead to better execution.” However, the separation has not yielded any tangible improvement in operational performance. The underperformance is also reflected in WDC’s current valuation which indicates these changes were unable to solve the problem.

Previously, Elliot pointed out that WDC hasn’t met its past strategic goals, affecting its efficiency in handling both HDD and Flash businesses. The current valuation reflects investor skepticism about the company’s structure, indicating dis-synergy in operations and finances, leading to discounted valuations. After thorough due diligence, Elliot believed that splitting WDC into two companies would be beneficial to unlock substantial growth potential and enhance shareholder value.

Later, in July 2023, the management were in talks to merge NAND Flash business with Japanese storage company to better compete with Samsung Electronics. However the discussions fell apart on over a issues of control, leaderships, economics and politics. The indirect shareholders of Kioxia, SK Hynix Inc. also backed out of the transactions.

Currently, the underperformance in the past few quarters is reflected in WDC’s current valuation, trading at a lower EV/Sales multiple (1.3x) compared to HDD peer such as STX

STX

Having thoroughly assessed various options, the Western Digital management team and board have concluded that the most feasible course of action at present is to spin off its Flash business. Western Digital Corporation, founded in 1970 and headquartered in San Jose, is a global technology company that manufactures, develops, and markets data storage devices. It operates through two business segments: hard disk drives (HDD) and flash-based memory (Flash), offering a broad line of data storage solutions to various end markets.

Flash Based Products

The flash division offers data storage solutions using flash technology, creating, and producing solid-state storage products for various applications such as enterprise or cloud storage, client storage, automotive, mobile devices, and removable memory devices. Over time, the company has advanced and brought to market successive generations of 3-dimensional flash technology, enhancing the storage capacity per cell in a progressively smaller physical size, thereby reducing costs. Significant research and development efforts are dedicated to creating highly reliable, high-performance, cost-efficient flash-based technology. expertise, resources, and strategic investments in non-volatile memories to explore a broad range of persistent memory and storage class memory technologies. Moreover, the company has taken the lead in establishing and developing standards to fulfill emerging market needs, aiming to encourage widespread adoption of flash storage standards by enhancing interoperability and user-friendliness.

Hard Disk Drives

The HDD division offer non-volatile data storage through the magnetic recording on a spinning disk. The company designs and manufactures most of the recording heads and magnetic media used in these products. By leading the industry in innovation, the company has aimed to enhance storage density and performance attributes. Advancements in HDD capacity, reducing product costs over time, have largely been achieved through progress in magnetic recording head and media technologies. Western Digital’s longterm product plan for high-capacity HDD involves integrating ePMR, OptiNAND, UltraSMR, and triple-stage actuators to create an advanced array of drives available in commercial volumes across various capacities. This approach positions the company strongly to take advantage of the opportunities in the expansive and growing storage markets. Additionally, the company dedicates significant resources to research and development, manufacturing infrastructure, and capital equipment for recording head and media technology, as well as other elements of the magnetic recording system such as HDD mechanics, controller, and firmware technology, aiming to secure their competitive position and cost structure.

1Q24

Total revenue fell 26.4% YoY to $2.8 billion (+3.5% vs consensus) due to a drastic fall in the HDD division, which fell 40.7% YoY to $1.2 billion and Flash division sales dropped 9.6% YoY to $1.6 billion.

Cloud revenue dropped 52.3% YoY to $872 million due to fall in shipments for hard drive and flash products. Client sales slumped 6.7% YoY to $1.1billion owing to decrease in flash costing, partially offset by Consumer revenues, which grew 7.8% YoY to $731 million aided by higher content per unit and unit shipments in flash. Adjusted Gross profit declined 19.4% YoY to $555 million while corresponding margins expanded 174bps to 20.2% (1Q23: 18.4%). Adjusted Operating loss came in at $443 million (+8.3% vs consensus; 1Q23: profit of $307 million), and margins were at (16.1)% (1Q23: 8.2%). Adjusted net loss came in at $554 million (+10.4% vs consensus; 1Q23: profit of $64 million), and margins were at (20.1)% (1Q23: 1.7%). Adjusted loss per share came in at $1.76 (1Q23: profit of $0.20), beating the consensus estimates by 9.2%.

FY23

Total revenue fell 34.5% YoY to $12.3 billion (+1.2% vs consensus) due to contraction in Flash 37.8% YoY to $6.1 billion, and HDD, which fell 30.8% YoY to $6.3 billion.

Cloud revenue dropped 34.5% YoY to $5.3 billion due to decline in both hard drive and flash product shipments, Client sales slumped 38.8% YoY to $4.3 billion due to declines in flash costs, and lesser client SSD and HDD unit shipments, and Consumer revenues which fell 26.0% YoY to $2.7 billion owing to price fall in flash and lower retail hard drive shipments. Adjusted gross profit declined 68.7% YoY to $1.9 billion; corresponding margins contracted 1719bps to 15.7% (FY22: 32.9%). Adjusted Operating loss came in at $594 million (+1.7% vs consensus; FY22: profit of $3.2 billion), and margins were at (4.8)% (FY22: 17.0%). Adjusted net loss came in at $1.1 billion (+6.0% vs consensus; FY22: profit of $2.6 billion), and margins were at (9.1)% (FY22: 13.8%). Adjusted diluted earnings per share came in at $3.59 (FY22: profit of $8.22), surpassing the consensus estimates by 0.4%.

Company Description

Western Digital Corporation (Parent)

Western Digital Corporation, founded in 1970 and headquartered in San Jose, is a global technology company that manufactures, develops, and markets data storage devices. It operates through two business segments: hard disk drives (HDD) and flash-based memory (Flash), offering a broad line of data storage solutions to various end markets, categorized into Client Devices, Data Center Devices and Solutions, and Client Solutions. The client devices comprise HDDs and solid state drives (SSDs) for computing devices. Data Centre Devices and Solutions comprises high capacity enterprise HDDs, high-performance enterprise SSDs, and platforms. Client Solutions consists of HDDs and SSDs embedded into external storage and removable flash-based products. As of June 30, 2023, the company had ~53,000 employees worldwide.

NAND Flash Memory Business (Spin-Off)

The NAND flash memory (Flash) business would be involved in manufacturing and developing solid-state storage products for a broad range of applications, including client storage, automotive, mobile devices, enterprise or cloud storage, and removable memory devices. All the supply need for flash-based products comes from WDC’s business venture with Kioxia Corporation (formerly Toshiba Memory), which consists of three separate legal entities: Flash Forward Ltd. (Flash Forward), Flash Partners Ltd. (Flash Partners) and Flash Alliance Ltd. (Flash Alliance). The business ventures involving Kioxia are mainly in Yokkaichi and Kitakami, Japan. Additionally, the company has internal assembly and testing operations based in Shanghai, China, and Penang, Malaysia.

Read the full article here