Investment Thesis

Matterport, Inc. (NASDAQ:MTTR) creates immersive 3D virtual tours for real estate, allowing users to explore properties remotely and gain detailed insights. The company goes further by evolving into a property intelligence agent, offering unique solutions that digitize physical spaces, streamline workflows, and revolutionize the way we interact with the built world.

Matterport recently reported its Q3 results that delivered investors with some positive surprises. That being said, I remain bearish on this name and argue that Matterport is overvalued for what it offers investors.

Quick Recap

In my previous bearish analysis, I said:

I maintain resolute in my assertion that sell-side analysts are being too flat-footed in downwards revising their revenue estimates for Matterport for 2024.

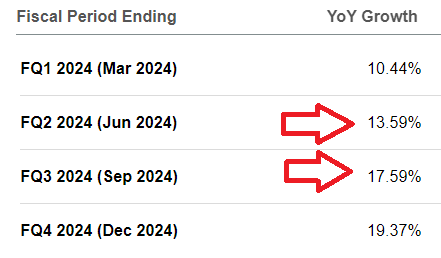

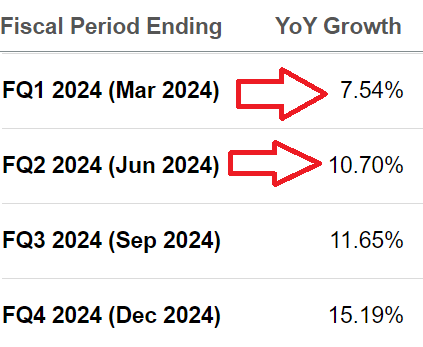

At the time, this was analysts’ expectations for 2024:

SA Premium; author’s screenshot of MTTR

In the ensuing months, this is what analysts are now estimating for Matterport’s 2024.

SA Premium

On the surface, the difference doesn’t look significant. But it’s a critical change that implies that analysts were too bullish on their assessment of Matterport.

And as you’ll soon read, even as I provide both the bull and the bear cases, this stock doesn’t warrant investors’ capital.

Matterport’s Near-Term Prospects

I’ll first describe the bull case before analyzing the bearish argument.

Matterport is a technology company at the forefront of reshaping the real estate industry through its innovative platform. Specializing in immersive 3D virtual tours and property digitization, Matterport goes beyond traditional approaches by evolving into a powerful property intelligence agent. The company provides unprecedented details and insights about homes, leveraging its platform to offer unique AI solutions to the built world.

Matterport’s offerings empower businesses and individuals to digitize physical spaces, enabling remote access, efficient workflows, and data-driven decision-making.

With a focus on customer success, global expansion, and strategic partnerships, Matterport is accelerating the digital transformation of the real estate sector, delivering valuable insights and revolutionizing how people buy, sell, rent, and manage properties worldwide.

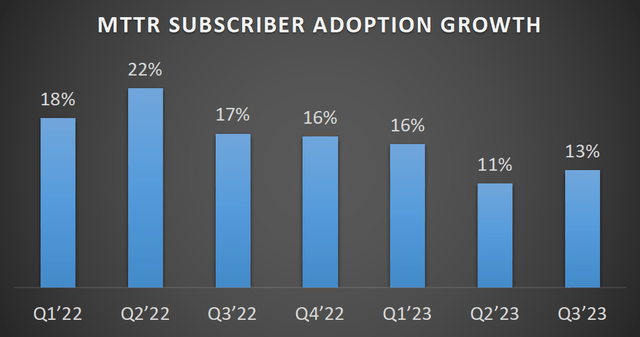

MTTR’s subscriber numbers, author’s work

Moreover, as you can see above, after numerous quarters of decelerating paid subscriber growth rates, Q3 2023 marked its first quarter of acceleration. Perhaps mid-teens subscriber growth rates will be where its subscriber growth rates will stabilize in the near term?

One way or another, despite an alluring narrative, Matterport’s growth rates are clearly not those commensurate with a growth company.

Revenue Growth Rates Flatten Out

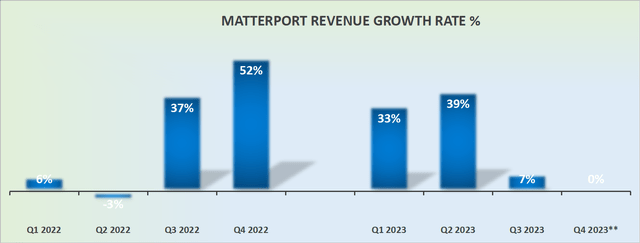

MTTR revenue growth rates

Recall, Matterport acquired VHT back in Q2 2022. This provided Matterport with strong revenue growth rates. Of course, those growth rates were inorganic, and now that Matterport comes to comparing against the prior year period, it will struggle to deliver to investors the sort of growth that gets its stock rewarded with a high premium.

Profitability Profile: Still Burning A Lot of Free Cash Flow

One significant aspect that is very bullish here is that Matterport’s balance sheet holds no debt. And since it has more than $400 million worth of cash and equivalents, the business is very well supported for its growth ambitions.

What’s more, this large cash sum equals more than 50% of its market cap. So that, if for whatever reason Matterport did turn into a strong and viable business, investors are not having to pay a large premium for its stock.

On the other hand, I don’t believe this detracts from the underlying reality, that putting aside its narrative, this business is still meaningfully unprofitable.

According to my estimates, Matterport will end 2023 by burning through $70 million of free cash flow. Even if in 2024, its underlying cash burn improves so that it ends up burning through $50 million of free cash flow, this is still not an economically viable business. Particularly given that its growth rates are so unimpressive.

The Bottom Line

As I reflect on Matterport’s trajectory and delve into the intricacies of its financial landscape, a lingering sense of doubt and uncertainty envelops my assessment.

While Matterport, Inc. boasts innovative strides in reshaping the real estate industry and holds a robust balance sheet, questions arise regarding the sustainability of its growth rates, especially as it grapples with the organic nature of past acquisitions.

The narrative of a debt-free, cash-rich entity provides a glimmer of hope, yet the persisting unprofitability and projections of substantial free cash flow burn raise eyebrows.

The divergence between a compelling narrative and the underlying economic viability leaves me cautiously skeptical about Matterport’s true potential and the sustainability of its market premium.

Read the full article here