The urban air mobility market should start getting interesting in 2024 with the initial entrance of electric vehicle aircraft with plans for the launch of services shortly thereafter. Blade Air Mobility, Inc. (NASDAQ:BLDE) continues building an urban air mobility, or UAM, service to allow for an easy shift into electric vertical take-off and landing aircraft, or eVTOLs, over the next few years while competitors wait for new aircraft to just launch networks. My investment thesis remains ultra Bullish on the stock of this leading global air mobility platform.

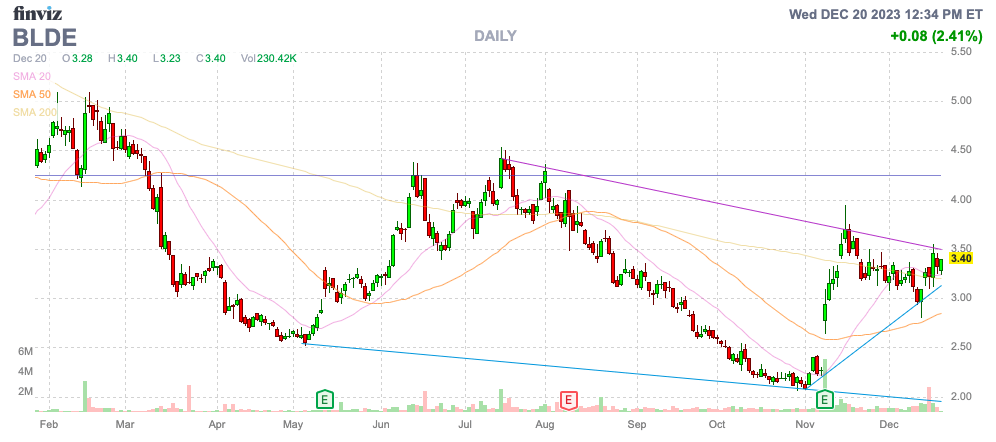

Source: Finviz

Building A Global Platform

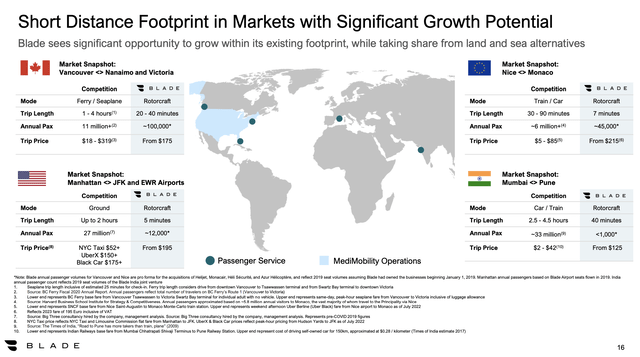

Blade Air Mobility took the path to build a UAM platform ahead of the global push into electric vertical aircraft, or EVAs, where short distance flights can be greatly expanded via quiet and more efficient aircraft. The company has utilized SPAC cash to expand into Canada, Europe and medical flights in areas where random helicopter operations struggled to produce an attractive business model.

The company can now utilize a shared business platform to reduce costs and prepare the platform and the brand for the expanded flight opportunities of the future. Blade Air Mobility already has a global market now, with a short distance revenue base approaching $70 million.

Source: Blade Air Mobility Q3’23 presentation

The MedMobility Organ Transplant business has expanded far beyond the passenger business. Blade has successfully expanded into a fragmented market and used scale to gain market share with a TTM revenue base of $116 million now.

The major expansion opportunities are naturally in the Blade Airport segment where NYC airports alone have 27 million passengers annually needing a better transport route to work or other destinations while the U.S. organ transplant business is only ~43,000. The UAM platform only needs 1% of NYC airport passengers to turn the business into a massive annual opportunity at $195 a ticket compared to the current passenger business of only 12,000 annually.

Cash Flow Positive

As with a lot of former SPACs, the market incorrectly extrapolated weak financials far into the future. A lot of companies like Blade Air Mobility were able to combine sales growth with cost reductions to quickly turn profitable.

In the Q3’23 earnings report for the peak summer period, Blade reported revenues hit a record of $71 million after the prior quarter was a record at just $61 million. The air mobility platform will face the seasonal dip during the winter months, but the market forecasts 2024 revenues grows again to reach $257 million.

Blade is now generating positive cash flow to fund future growth in UAM. The Q3 ’23 operating cash flow hit $2.0 million, with free cash flow at $1.3 million due to the company having an asset-light model with operators owning the aircraft.

The company already has a Blade Airport business in NYC that will just plug in new eVTOLs while competitors will have to build up the service. The business in Nice is already expanding services to utilize on-tarmac security to directly connect passengers to commercial airlines and reduce passenger time by 45 minutes.

Looking to 2024, the company forecasts even better results with significantly improved adjusted EBITDA versus 2023. Blade now has $173 million in cash to acquire assets to build the UAM network prior to the entrance of other competitors in the next few years with eVTOLs. These companies don’t have the desire or ability to consolidate similar helicopter services to build a network and a brand while Blade will only have to plug and play with the new aircraft.

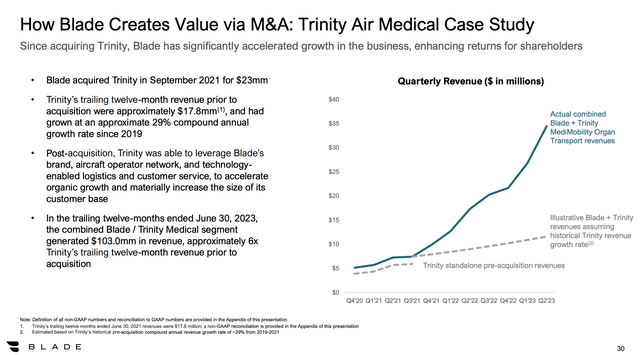

Blade Air Mobility has already shown the ability to acquire a business and growth the service with the Trinity Air Medical business. The company turned a quarterly medical organ transport business from far under $10 million in quarterly revenues to nearly $35 million now.

Source: Blade Air Mobility Q3’23 presentation

The stock only trades at ~1x sales targets with a market cap of just $275 million, while the cash balance of $173 million is now a major protection to downside risk. The EV/S multiple is now far below 1x for a company with a unique business opportunity ahead for the rest of the decade.

Takeaway

The key investor takeaway is that Blade Air Mobility, Inc. stock is far too cheap here. The company now has their financial house in order protecting further downside while growth metrics are clearly in place for the future of air travel.

Read the full article here