SoundHound Stock Suffered A Steep Plunge

SoundHound AI, Inc. (NASDAQ:SOUN) investors who chased its early 2024 rally suffered a hammering in mid-March 2024 as the market pulled back. Given SoundHound’s remarkable gains over the past year and its unprofitable business model, I’m not surprised by SOUN stock’s bear market decline before bottoming in late April 2024.

Accordingly, SOUN fell more than 65% from its March highs toward its recent April lows. As a result, it likely stunned SOUN investors into submission, as they rushed out quickly to protect early gains from dissipating. Bag holders who loaded SOUN stock near its March highs have likely breathed a sigh of relief as dip-buyers returned to underpin its April bottom. With SOUN recovering almost 60% from its recent lows, could we see a further rally from momentum buyers?

In my March SOUN article, I urged SoundHound investors to be cautious. While I didn’t assess red flags in its thesis, I underscored, “SOUN’s price action suggests downside volatility is anticipated.” Despite that, I must admit SOUN’s battering was worse than anticipated, suggesting a bearish rating in March would have been more appropriate.

SoundHound’s Q1 earnings release in early May was robust, outperforming Wall Street’s estimates. As a result, SoundHound demonstrated strong momentum as it continues gaining adoption for its Voice AI technology in the customer service and automotive segments.

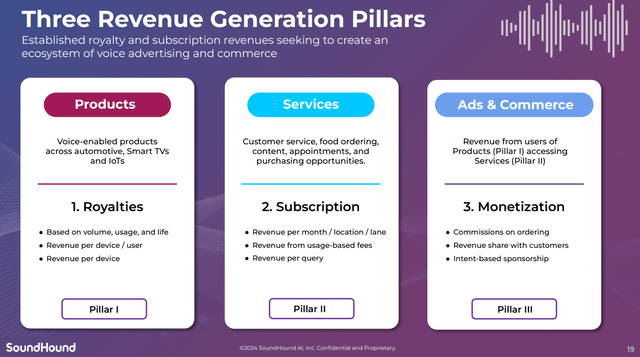

SoundHound’s Three Revenue Pillars

SoundHound Three Revenue Pillars (SoundHound filings)

As a reminder, SoundHound builds its business model predicated on three critical revenue pillars. While the model isn’t assessed to be “revolutionary,” it allows investors to understand the company’s progress in revenue generation.

Accordingly, in SoundHound’s Q1 earnings call, management underscored the growth momentum attributed to the revenue build out in Pillar 2 (services). SoundHound indicated that “about 30% of the revenue in the first quarter was from pillar two.” The company is optimistic about its long-term growth opportunities, estimating a total addressable market, or TAM, worth “over $100 billion, with millions of restaurants and businesses in North America alone.”

As a result, the increased potential attributed to SoundHound’s recent acquisition of SYNQ3 must be closely monitored. SYNQ3 is highlighted as the “largest voice AI provider for restaurants, with over 10,000 active locations.” It has allowed SoundHound to make significant forays into the global QSR market, securing “agreements with several major QSR brands, including Church’s Chicken.”

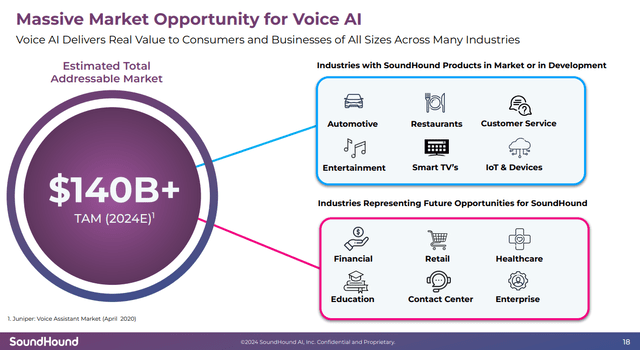

SoundHound’s Massive Opportunity

SoundHound TAM (SoundHound filings)

Notably, SoundHound envisages expansion across several growth verticals already in service or development. SoundHound’s automotive opportunity has also been strengthened as it furthered its partnership with Nvidia (NVDA).

Accordingly, SoundHound’s collaboration with Nvidia allows SoundHound to perform generative AI solutions at the edge, “without the need for cloud connectivity.” It should bolster SoundHound’s global opportunities to penetrate the auto OEM market further, deploying its market-leading voice AI solutions to improve auto competitiveness.

The recent integration of Perplexity AI’s LLM into SoundHound Chat AI is expected to improve its real-time capabilities, “enabling it to respond conversationally to a broader range of queries.” As a result, SoundHound’s growth opportunities can expand further as the company explores partnerships and agreements to broaden its offerings across its targeted verticals.

OpenAI’s recent launch of GPT-4o has also reignited a “spike in revenue.” The main highlight of OpenAI’s recent update is its improved voice AI capabilities. Therefore, I assess that SoundHound’s progress in its operating performance and recent developments has a solid foundation, as generative AI’s next growth phase could see a surge in voice AI capability developments.

Is SOUN Stock A Buy, Sell, Or Hold?

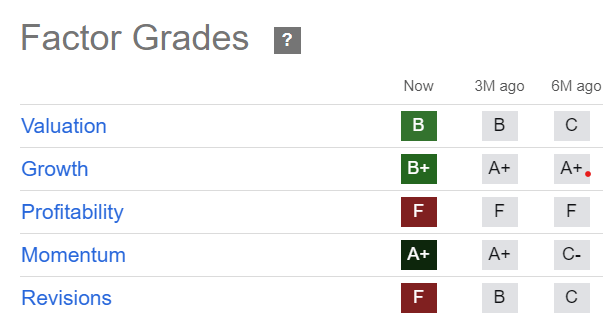

SOUN Quant Grades (Seeking Alpha)

SOUN’s “B” valuation grade remains relatively reasonable when assessed against its “B” growth grade. However, I must highlight that SOUN’s “F” profitability grade suggests SoundHound needs to validate its business model by achieving sustainable profitability.

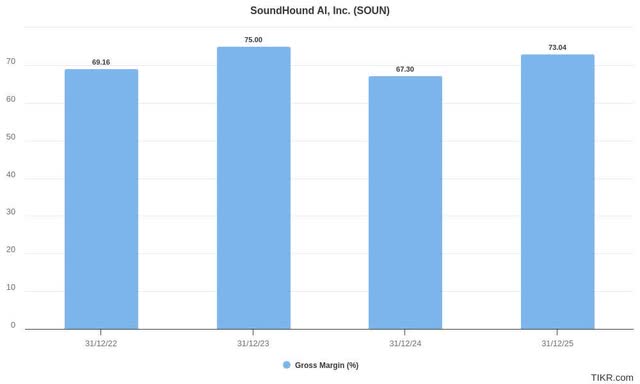

SoundHound GAAP gross margins estimates (TIKR)

However, the recent acquisition of SYNQ impacted SoundHound’s near-term gross margin, as the company reported a GAAP gross margin of 60% in Q1. SoundHound is confident that the impact is “temporary.” It expects to continue scaling to improve its bottom line “over time as synergies are realized, and operational efficiencies are enhanced.”

Wall Street estimates are aligned with management’s optimism, anticipating an inflection and recovery in FY25. Furthermore, SoundHound upgraded the lower end of its FY2024 revenue guidance range and kept its commitment to deliver $100M in FY2025 revenue and adjusted EBITDA profitability by FY2025.

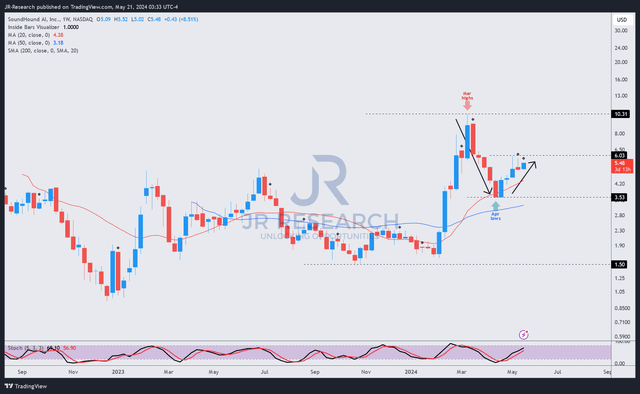

SOUN price chart (weekly, medium-term) (TradingView)

SOUN’s bottom in April was robust after it plunged over 65% from its early 2024 highs.

The recent recovery is also aligned with the recovery in the broad market, although SOUN remains well below its March 2024 highs. As seen above, SOUN’s price action suggests the buying fervor that led to its early 2024 surge has cooled. I assess this as a constructive development, as sharp surges suggest investors rushed in too quickly, and thus less constructive for savvy investors keen on accumulating their positions progressively.

SOUN’s price action over the past six weeks suggests a more progressive recovery. While I view a potential resistance zone at the $6 level, I expect SOUN’s uptrend continuation thesis to remain intact.

Its relatively reasonable valuation and robust growth grade should underpin buying confidence as SoundHound justifies its ability to achieve sustainable profitability.

With my caution proving effective over the past two months, I find it more reasonable to turn bullish on SOUN. Notwithstanding my optimism, I view the SoundHound AI, Inc. thesis as speculative, suggesting investors must allocate prudently and implement disciplined risk management strategies to manage their exposure.

Rating: Upgrade to Speculative Buy.

See the additional disclosure section below for important notes accompanying the Speculative/Cautious Buy rating presented.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here