Dividends concept. Stack of dollars and calculator.

The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) is a dividend investor favorite. Boasting an above-average yield and a miniscule 0.06% fee, it has a lot going for it. If you’d invested in SCHW 10 years ago you’d be only a little bit behind the S&P 500 on a total return basis, and have received much larger dividend payments. In a scenario where big tech stocks fall out of favor, SCHW shares may even outperform in the future.

With all that being said, SCHW is not the best take on the “high dividend” strategy. Its goal is to replicate the returns of the Dow Jones U.S. Dividend 100 Index (DJUSDIV). DJUSDIV has done reasonably well over the years, but it has lagged behind the S&P 500 on a price return basis. SCHD has lagged to a somewhat lesser degree on a total return basis.

Now, let’s consider reasons why people might invest in SCHD. We can start by looking at the fund’s marketing. SCHD’s full name is “Schwab U.S. Dividend Equity ETF,” a name that highly suggests the fund’s managers aim to attract dividend investors. “Quality and sustainability of dividends” is listed as a “highlight” on the fund’s website. The phrase “high dividend yielding stocks” appears in the second sentence under ‘Principal Investment Strategies’ in the prospectus. Finally, the word ‘dividend’ appears 20 times in the 3,070 word prospectus, indicating a 0.65% word density.

So, Charles Schwab (SCHW) is clearly aiming to attract the dividend investor demographic with SCHD. For the most part, it gives them what they’re looking for: with a 3.4% yield and 11.8% CAGR dividend growth, it beats the broad market indexes on income.

But is Schwab the best way to get high yielding dividend stocks in your portfolio?

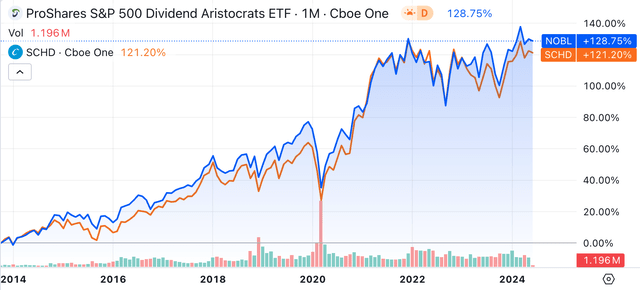

To answer that question, we need to look at the alternatives. One alternative to the Dow Jones Dividend 100 Index, is the Dividend Aristocrats Index. This index has outperformed the S&P 500 since its inception in 1990, and has also outperformed SCHD over the last 10 years. If you’d bought a diversified portfolio of Dividend Aristocrats when the index started in 1990, you’d have multiplied your investment many fold.

Dividend Aristocrats vs SCHD (Seeking Alpha Quant)

So, based on historical performance, the dividend aristocrats look better than the Schwab Dividend Equity ETF. Now, past performance does not always predict future performance. In many cases, what outperformed in the past, underperforms in the future. However, when you look at how Dividend Aristocrats are selected, you can see that they are likely to be financially sound companies.

To become an Aristocrat, a company needs to have not only paid its dividend without interruption for 25 years, it needs to have raised its dividend every single year in that timeframe. The requirement of a 25 year dividend growth streak makes it highly unlikely for a reckless company that pays dividends it can’t afford to make the Dividend Aristocrats list. After about 10 years of unsustainable dividends funded by bond and/or issuance, you’d expect serious financial damage to occur and eventually force a dividend cut. So a company being a Dividend Aristocrat is a good proxy for it being financially sound.

When I last wrote about the Schwab U.S. Equity Dividend ETF, I rated it a buy because it was then out of favour for reasons I didn’t see holding up long term. Specifically, the stocks in it had declined in price despite mostly performing well in fundamental terms. Since my article published, SCHD has delivered a 10% total return. That’s a little behind the S&P 500 (up 17.5%), but nevertheless a non-negligible gain. Factoring in the gains and some new things I’ve learned about the fund, I now consider SCHD a hold.

In this article I make the case that Dividend Aristocrats are better investments that Schwab’s SCHD ETF. Focusing on financial soundness and reliability, I argue that the Aristocrats ultimately have more going for them than Dow Dividend 100 stocks. Although there is considerable overlap between the two portfolios, the Aristocrats are preferable. In subsequent paragraphs I will explain why I feel this way.

SCHD vs. the Dividend Aristocrats: a Play by Play Comparison

To properly explain why the Dividend Aristocrats are preferable to SCHD’s portfolio, I need to look at both portfolios up close. They are fairly similar, but not identical. In the table below you can see the top 10 positions in SCHD’s portfolio along with the top 10 Dividend Aristocrats arranged by market cap.

|

Schwab Equity Dividend ETF Portfolio |

Dividend Aristocrats by market cap |

|

Texas Instruments (TXN) Amgen (AMGN) Pfizer (PFE) Lockheed Martin (LMT) Coca-Cola (KO) PepsiCo (PEP) Verizon (VZ) Chevron (CVX) Cisco (CSCO) BlackRock (BLK) |

Exxon Mobil (XOM) Johnson & Johnson (JNJ) Chevron Abbvie (ABBV) Coca-Cola Pepsico NextEra Energy (NEE) IBM (IBM) Medtronic (MDT) Target Corp (TGT) |

SCHD’s top 10 positions overlap 30% with the top Dividend Aristocrats by market cap. So the two portfolios are fairly similar, but not identical. The following differences between the two partial portfolios seem to mostly favor the Aristocrats:

-

The Aristocrats have more energy exposure, with two names compared to SCHD’s one. Many top investors including Warren Buffett are betting big on energy this year, as today’s market fundamentals (e.g. low OPEC supply and slowly rising consumption) tend to support positive oil price appreciation. I tend to agree with the investors who are bullish energy. The Saudis and Russians are both cutting output, some countries remain skeptical of nuclear, and renewables can’t yet provide all the world’s energy needs. These factors point toward relatively high oil prices going forward.

-

Both SCHD and the Aristocrats have a high yield stock in the top 10: SCHD has Verizon while the Aristocrats have Chevron. VZ has the higher yield, but CVX has a lower payout ratio, indicating greater dividend safety.

-

SCHD’s portfolio includes at least two secular under-performers, CSCO and VZ, which are down over the last year as well as the last five years. None of the top 10 aristocrats are down over a five year timeframe. NEE, the worst 1-year performer among the Aristocrats, is nevertheless up 50% over five years.

-

The top 10 Dividend Aristocrats have more long term dividend growth than the top SCHD stocks do. SCHD’s dividends have grown at 10.8% per year over the last 10 years, while a comparable Dividend Aristocrats fund has grown its dividends by 20% per year in the same timeframe. There are other timeframes in which SCHD has the edge, but the 10-year timeframe is the longest one Seeking Alpha Quant has for these ETFs. So, it represents “the long term.” Therefore, the Aristocrats take the cake in long term dividend growth. SCHD’s stocks also have positive dividend growth, but some (like Verizon) have only a paltry amount of it.

-

Some SCHD stocks have high payout ratios, most notably TXN, which pays nearly 80% of its earnings as dividends.

In general, it looks like the dividend aristocrats are performing better than SCHD is. They are up more in the markets and their dividends are rising: not all SCHD stocks have these distinctions. When you look at the factors listed above, you get the feeling that the Aristocrats’ comparative strength over SCHD will persist. So, I’m inclined to favor a diversified dividend Aristocrat portfolio over the SCHD.

Financial Strength

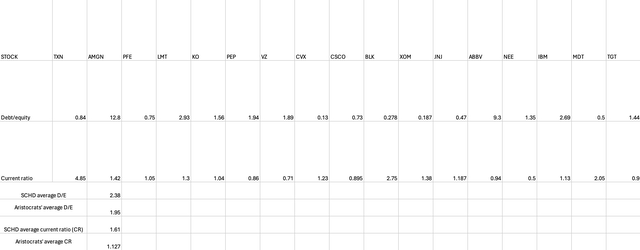

Another advantage that the dividend aristocrats have over SCHD is balance sheet strength. Although SCHD’s top stocks have somewhat higher current ratios than the Aristocrats do, the Aristocrats have lower debt/equity ratios, which implies that they are less likely than the top SCHD stocks to experience solvency issues. The debt/equity ratio is the more relevant of the two mentioned from a risk management perspective, as it tells you more about the company’s ability to survive. So, the top Dividend Aristocrats have less balance sheet risk than the top SCHD stocks. You can view the data I used to arrive at this conclusion in the table below.

SCHD and Dividend Aristocrats balance sheet metrics (The Author)

SCHD Valuation

One reason why I’m less bullish on SCHD today than I was in the past, is because the fund is fairly richly valued for what it is. When I last wrote about SCHD I felt it was cheap, citing stocks like Chevron, which was trading at 10.5 times earnings at the time. Today, CVX is valued at a pricier 12.39 times earnings. It’s much the same story with the portfolio at large. According to its fact sheet, SCHD trades at:

- 16.2 times earnings.

- 3.18 times book value.

- 9.95 times cash flow.

The fact sheet also states that the fund has a 9.96% five year CAGR dividend growth rate. Although the multiples above may appear cheap on the surface, remember that the S&P 500’s multiples are heavily influenced by some large, high-growth names like NVIDIA (NVDA) and Microsoft (MSFT). SCHD is only growing at 9.96% CAGR (that’s also from the fact sheet), which means it has a 1.62 price-earnings-growth (“PEG”) ratio. That’s relatively high PEG ratio. For reference, PEG ratios below one are usually considered “good.”

SCHD’s Two Advantages

Although I’m slightly less-than-bullish on SCHD’s portfolio, the fund does have two major advantages:

Low fees and high liquidity. These characteristics are good, because they reduce the amount of the return that is given to fund managers and traders. SCHD has both characteristics in spades. The fund’s fact sheet says that it has a 0.06% management fee. That’s almost as small as the fees charged by S&P 500 funds, yet SCHD is much more ‘niche’ than they are. Seeking Alpha Quant reports that the fund has 3.175 million shares or $247 million in trading volume, and a 0.01% bid-ask spread. These qualities imply high liquidity and low trading costs. SCHD scores an ‘A+’ on expenses in Seeking Alpha Quant because of its low fees and bid-ask spread.

It is comparatively harder to get access to the full Dividend Aristocrat portfolio at such a low cost. The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) has a 0.35% expense ratio and a 0.02% bid-ask spread, scoring a B on expenses in Seeking Alpha Quant. That’s not to say that NOBL is an expensive fund: it’s fairly cheap. But it is more costly than SCHD is.

Fortunately, the Dividend Aristocrats list is not especially long, so you can probably replicate NOBL fairly closely by buying the individual stocks in its portfolio.

The Bottom Line

Is the Schwab Equity Dividend ETF a bad fund? Hardly. It has extremely low fees, high liquidity, and many good portfolio components. Those buying the fund will likely make money over the long haul. However, they may not outperform the S&P 500, if past history is any indication. After reviewing SCHD’s portfolio, I think that the fund probably won’t match the S&P 500 in the near term; its top holdings don’t have much growth. The Dividend Aristocrats aren’t thought of as high growth names either, but they are pre-screened for dividend growth, which correlates with earnings growth over a long enough period of time. So, I’m inclined to favor the Dividend Aristocrats over SCHD.

Read the full article here