Investment summary

My previous investment thought (published on March 22nd) was a buy rating because I thought Couchbase, Inc. (NASDAQ:BASE) could beat its FY25 guidance given the strong performance and demand momentum. I am downgrading my rating from buy to hold as I am concerned about the competitive landscape and the tougher-than-expected demand environment. In light of these two factors, I am now assuming BASE will only be able to grow top line in the mid-teens percentage range.

1Q25 results update

Released in early June, 1Q25 total revenue of $51.3 million represented growth of 25.2%, mainly driven by 27.2% growth in subscription revenue to $49 million. Relative to consensus estimates, BASE beat by 6%. Better than expected top-line performance drove the outperformance at the operating margin level as well, which came in at -13% vs. consensus at -16.5%. As a result, the company was also able to deliver its first quarter of positive free cash flow. In terms of the balance sheet, BASE continues to hold a net cash position, exiting 1Q25 with ~$160 million in net cash.

Demand environment worse than expected

The demand environment was worse than what I had expected, and it seemed to have worsened in the latest quarter. While subscription y/y revenue growth accelerated by 100bps (26% in 4Q24), the better growth metric, I believe, is annual recurring revenue [ARR], and this y/y growth for this metric has slowed down dramatically from ~25% in 4Q24 to 20.6% in 1Q25. Driving the weak ARR performance were several deals getting pushed out to 2Q25. From a net-new ARR perspective (sequential adds of ARR), it was down 59% from $8.5 million last year to $3.5 million in 1Q25.

Deals that got pushed back were broad-based, including a mix of renewals, new landing opportunities, and migrations, and the underlying causes were businesses remaining tight on budget and taking longer time to make decisions (more required authorization), which delays sales cycles. The worrisome part, and the reason why I think the demand environment has worsened, is because BASE saw several deals that got pushed out rather than just one or two deals (which I believe is pretty common given the timing of closing the deal). Recall that in the 3Q23 earnings call, management mentioned that delayed decisions did not have a material impact on the quarter. The situation has changed from no material impact to 410 bps of ARR growth deceleration.

Comments by other large software players also suggest that the macro environment has not turned any better. I cite the following:

PROserve also continues to see more and more pressure as customers are really just looking for shorter-duration projects. CRM 1Q25 earnings call

Number one, I think for the last year, year-and-a-half we’ve talked about, we haven’t seen any material change to the macro, meaning we haven’t seen any additional scrutiny one way or the other. In fact, it’s been rather consistent. WDAY 1Q25 earnings call

“We saw less seasonal improvement than expected, and this dynamic was true with customers across tenure, industry, size, and geography. We believe this indicates a more challenging macro environment than expected at the beginning of the year. MDB 1Q25 earnings call

Concern about competition

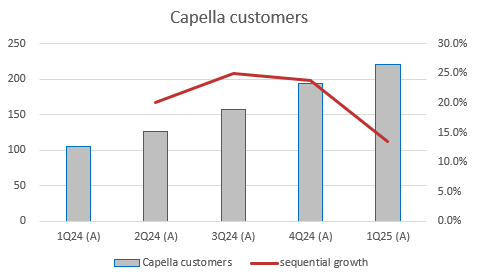

I previously mentioned that Capella (BASE’s database-as-a-service [DBaaS] product) is going to be a near-term growth driver for BASE, but 1Q25 results have gotten me very worried that BASE is facing more competitive pressure. While I do acknowledge that BASE has made good progress so far, with the total number of Capella customers now representing 29% of total customers (234 customers as of 1Q25), on a like-for-like basis (excluding the total customer definition change), the total number of Capella customers is 221.

Redfox Capital Ideas

Redfox Capital Ideas

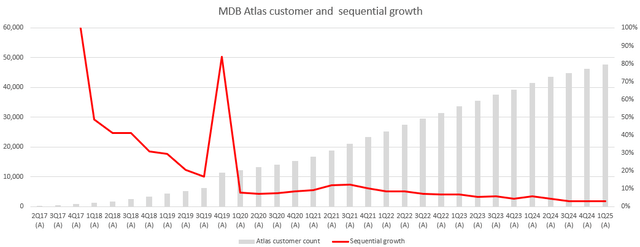

Adjusting for this change implies that BASE saw a massive decline in sequential Capella customer growth, from >20% to just 13.5%. This is very puzzling, as this is the area where management seems to have focused their resources. Capella was noted by management as the meaningful driver behind ARR. This contrasts deeply with the performance that MongoDB (MDB) had with its Atlas product, which saw very strong sequential growth when the product was launched. Sequential growth only slowed to a low-teen level after 3 years.

This led me to believe that BASE might be seeing a lot more competition than I originally believed. While it is a positive that this is a large and growing industry, the fear is that it attracts a lot more competition from large incumbents, not only from MDB but also from large hyperscalers. Amazon already has a product that is well known in the industry: DynamoDB; Microsoft has its DBaaS embedded in Azure (which continues to grow very strongly at ~30%); and Google has its DBaaS embedded in Google Cloud, which is also growing in the 30% range. These large incumbents have significantly more marketing and distribution capacity to capture market share than BASE.

Although on a sequential growth percentage basis, BASE is growing faster than MDB, on an absolute basis, the winner is clear, as MDB added 1,800 new Atlas customers in 1Q25 while BASE only added 26. Looking at it from an absolute basis matters (or relative absolute customer share gain) because it gives MDB (or the incumbents) more resources to invest in sales & marketing and research & development. As such, the continued market share gains by larger players could pose a structural risk to BASE’s ability to achieve its medium-term revenue growth target of >20% (which anchors on Capella’s success).

Valuation

Redfox Capital Ideas

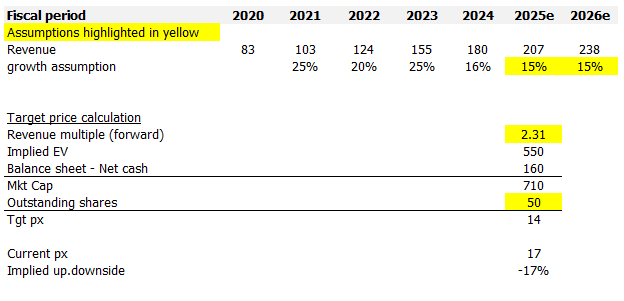

I model BASE using a forward revenue approach, and using my assumptions, I believe BASE could be worth $14 in the near term if the macro pressure continues and the competitive landscape gets more challenging. My previous assumption was that BASE could accelerate revenue growth to 20%. However, looking at the traction in adding Capella customers, I am concerned that BASE may be facing a lot more competitive pressure than I originally expected. If that is the case, BASE long-term growth could be structurally impaired. Alongside the tough macro environment that continues to pressure businesses to spend on digital transformation initiatives, I think a more conservative estimate is to assume growth will remain at the mid-teens level.

As such, I have also adjusted my valuation multiple expectation downwards from 6x to 2.3x. The basis for using 2.3x is that MDB has traded down largely since I last wrote about BAE (from ~6x to 3.2x today), and after attaching the BASE historical discount ratio (~70%) to MDB, it should trade at only 2.3x.

Conclusion

My view of BASE has changed from buy to hold due to a weaker-than-expected demand environment and potentially increased competition. While 1Q25 results showed revenue growth, ARR growth decelerated. Deals are being pushed out as businesses tighten budgets and lengthen decision-making times. Additionally, the steep slowdown in Capella customer additions suggests that BASE might be facing more pressure than I originally expected, especially from large incumbents given the attractiveness of this industry. Considering the tougher macro environment and competitive landscape, I believe BASE may not be able to achieve its target of >20% growth, and I’ve adjusted my valuation target price accordingly.

Read the full article here