While shares of PBF Energy (NYSE:PBF) are higher than a year ago, they have fallen steadily in recent weeks and are now down over 25% from their recent high. This performance has been particularly disappointing given I rated shares a “strong buy” in November. They are down nearly 8% since that recommendation, while the S&P 500 has rallied over 26%.

A rise in gasoline inventories and decline in crack spreads have raised worries the refining cycle could be turning; however, I believe some of these fears may be overdone. With PBF underperforming and with more recent financials, we need to evaluate if investors should buy this dip or if my original recommendation was misguided.

Seeking Alpha

In the company’s first quarter reported on May 2nd, PBF earned $0.85 in adjusted EPS, which actually beat consensus by $0.20. Earnings were down from $2.76 last year, given a less favorable refining environment. Revenue fell by 7% to $8.65 billion. For refiners, I de-emphasize revenue, as that is driven by the absolute level of oil prices. Refiners earn a spread on the difference between crude oil and refined product (i.e., diesel and gasoline) prices, and this spread is not particularly correlated to the absolute level of oil. As such, revenue and profitability trends are much less in sync than for most businesses.

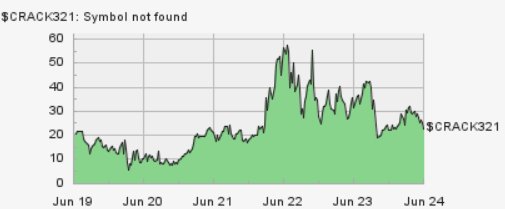

Now, over the past year, we have seen refining margins normalize from extreme levels in 2022-early 2023 when Russia’s invasion of Ukraine distorted product markets. As such, benchmark crack spreads narrowed from about $31.50 last year to about $21. Some of this volatility in crack spreads is apparent below.

Spreads blew out in 2022 as noted, creating a golden time for refiners where they generated excess, unsustainably high profits, and spreads have since come in. They are now similar to Q4 2019 levels. In other words, spreads are not particularly tight; they just are no longer particularly wide. I would note crack spreads have declined in recent weeks further, contributing to losses in PBF shares. I will discuss the outlook below, after reviewing recent results in more depth.

Energy Stock Channel

Ultimately, PBF cannot control the crack spread environment and is exposed to the refining macro in that regard. Because of tighter spreads, it generated $11.73 refining margin from $18.35 last year. Investors bearish on refining macro should generally avoid refiner stocks. While I will dive deeper into the macro, I think it is important to note that PBF is controlling what it can—operations and its balance sheet—quite well.

In particular, I would note that PBF had $8.02 in operating expenses per barrel, down from $9.78 last year. Additionally, G&A was up just 5% to $63 million. Refineries need periodic maintenance or “turnaround” work, which reduces their throughput. PBF used the weaker spread environment in Q1 to complete annual maintenance needs in the East Coast and mid-Continent facilities, with its California operations the focus of Q2 maintenance. This will create a runway for limited maintenance work in H2.

Because of higher turnaround work, there was $285 million of Q1 cap-ex. For the full year, management reiterated there is $800-850 million in cap-ex planned, as maintenance spending will be lower in H2. Even with turnaround work, PBF processed 909.5kbpd in Q1, up from 859kbpd in 2023, speaking to the efficiency of its maintenance activity. That represents about 90% of its 1.02mbpd capacity, and Q2 throughput should similarly be around 900k.

Over one-third of the company serves the West Coast, so CA turnaround work will have a meaningful impact on Q2 throughput. I view its exposure to this market quite favorably. Given its regulatory policies and stricter environment standards, CA’s gasoline market almost operates like an island, with most potential imported gasoline not meeting standards. This is a reason CA gasoline can be more expensive. It does make CA refineries attractive because they do not really compete with global refiners to serve CA, and with no new California capacity ever likely to be added, supply is structurally constrained.

One headwind for Q1 refining margins was that PBF’s heavy crude usage was down from 28% to 24%. That is because its mid-Continent facilities, which use more heavy crude, had turnaround work. Heavy crude tends to be cheaper than WTI because it takes more complex refineries to turn it into gasoline and diesel. We should see more heavy usage in Q2-Q4 this year, which will be a modest tailwind to margins, all else equal.

Aside from its refineries, PBF’s St. Bernand Renewables (SBR) operation produces about 18,000bpd in Q1, and it received a favorable provisional carbon intensity score, which will improve marketability. There was a $800k loss on SBR with $4 million of standalone EBITDA because the market for renewables is “soft.” Last year, in a well-timed transaction, ENI took a 50% stake in SBR, paying $845 million to PBF. While one would expect renewables demand to rise over time, I do not expect material cash flow contribution over the next 12-24 months.

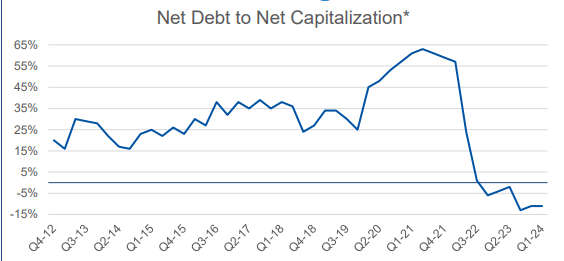

During Q1, PBF did $125 million of stock repurchases. Over the past year, it has cut its share count by 7.3%, and it also pays a 2.2% dividend yield. PBF has a stellar balance sheet with $1.4 billion of cash and $1.2 billion of debt. In fact, in Q1, it reported -$10 million of interest expense because it earns more on its cash than it pays on its debt. The company’s total debt to capitalization of 18% and net debt to cap of -4%. As you can see, this is a dramatic improvement from several years ago.

PBF Energy

With strong excess profits in 2022-2023 and proceeds from its SBR sale, PBF has reduced its debt burden and cut its environment liability, leaving it with a net cash position. As a consequence, management declared that balance sheet “cleanup is done.” I would expect PBF to continue buying back stock aggressively out of cash flow, especially as its ~$275 million of Q1 working capital headwinds reverse.

In the longer term, I view ~10% net debt to capital as a healthy place to be. That means PBF could return about $600-700 million of cash to shareholders beyond free cash flow. I would expect this to be very gradual and for the time being, PBF to use free cash flow to finance capital returns.

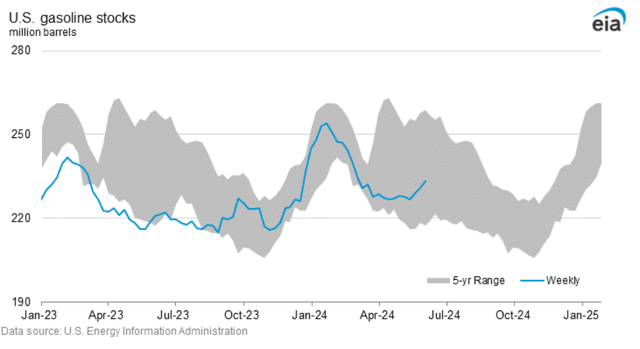

The question then becomes what happens to crack spreads. As noted in the chart above, crack spreads have narrowed below $20 in recent weeks, as markets have been concerned about rising gasoline inventories. As you can see below, inventories have risen in recent weeks whereas they typically fall during the summer driving season. I think it is important to note that while the rate of change is unusual, the absolute level of inventories is healthy.

EIA

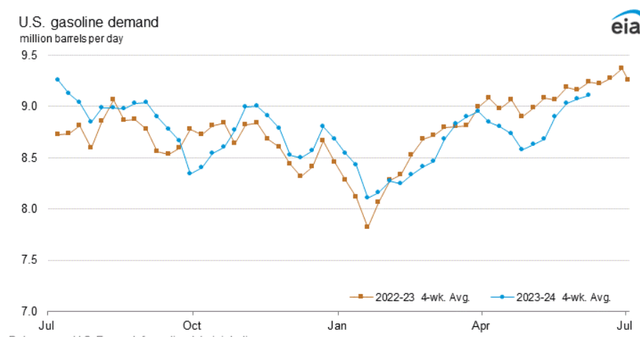

Moreover, this was due to a slowdown in US gasoline consumption. Whereas several months ago, gasoline demand was up year over year, it did slip below 2023 levels. In recent weeks, we have seen it bounce back and converge toward 2023 levels. Absent a recession, which I view as unlikely, I expect product demand to hold at least steady, if not rise slowly.

EIA

Crack spreads can be very volatile, but I am of the view we are through the worst of the pressures and more likely to see a recovery than further weakness. As noted in my prior article, there is no US refining capacity being added, and there is unlikely to be any. That means refining capacity is increasingly the bottleneck in the oil supply chain, which in my view supports long-term margins above pre-COVID levels, likely in the $20-25 crack spread area.

This is especially true on the West Coast given CA’s environmental policies. Moreover, the possibility of OPEC+ backing off supply cuts later this year could increase oil supply relative to gasoline/diesel supply, widening crack spreads and enhancing refiner margins.

Last year, I believed that the company could generate sustained free cash flow of $1 billion, given $800 million in annual cap-ex needs and about $7.50 in EPS. That drove my expectation shares could trade into the $70’s. Now, given some increased maintenance work and lower crack spreads, I expect $6-$6.50 in EPS this year, still resulting in over $700 million in free cash flow. Over the medium term, I do believe $7.50 is likely to be the run-rate earnings rate. I would also note this assumes no material contribution from SBR.

PBF has over $5.50 in free cash flow/share this year. After its $1 annual dividend, at its current share price, PBF can repurchase about 10% of the company without reducing its net cash position, for a total capital return yield north of 12%. I view this as extremely compelling. While a share price decline is never pleasant, it does have the benefit of making PBF’s buyback program even more compelling as it reduces share count more quickly, increasing long-term run-rate EPS.

Even at a 10% free cash flow yield in this more subdued environment, PBF shares can recover to the mid-$50’s. Again, this assigns no value for SBR; valuing PBF’s stake at ~$800 million would push its fair value into the low $60’s. Given near-term weakness in the renewables market, though, I hesitate to value it at 2023’s sale price. Importantly, PBF has significant upside just from its traditional refining assets.

With a 10% annual share count reduction, its fair value should push above $60 by year-end. That represents over 35% upside. Refining can be volatile, but investors have overly punished PBF, and with its strong balance sheet, it is a very resilient firm. I view it as one of the most compelling values in the market and would buy the weakness.

Read the full article here