The Federal Reserve is saying very little about the debt creation of the U.S. federal government.

So, any concern about the U.S. government deficit is coming from private sources and, at this time, is rather muted. Some debate is taking place, but the ‘noise’ is very modest.

Not so in Euro.

The European Central Bank has put out a warning:

“Eurozone countries are facing ‘significant fiscal burdens’ from aging populations, extra defense spending, and climate change, making it more urgent that they cut their high debt levels….”

“Officials at the central bank estimate Eurozone countries have to reduce their budget deficits by an average of 5 percentage points of GDP, which would require savings or extra revenue of 720 billion Euros at current output levels.”

“The ECB said the pressure on public finances in the bloc would only increase in the coming years.”

“There is no room for complacency, as the longer the adjustment is postponed, the larger the eventual adjustment cost will be.”

So, the ECB believes that the current creation of debt by the governments of the European Union is not “sustainable.”

Sustainable seems to be the crucial word here.

Yes, current and future budget deficits can be sustained.

Yes, the expansion of the government debt can be sustained.

But, there eventually will be an “eventual adjustment.” And, the longer countries are able to “sustain” their deficits, the “larger” will be the eventual adjustment that the countries will have to make.

The ECB is basically saying that the current situation is really a “no-win” situation for the countries involved.

Eventually….

The expansion of the government debt is sustainable…until it cannot be sustained any longer.

So, we are dealing, once again, with uncertainty.

In essence, we are dealing with the question of how long can the “eventuality” be postponed.

And, the feeling is that the longer the “eventuality” is postponed, the greater the cost of the “eventuality” will be.

Thus says the European Central Bank.

So, how long do you try to postpone the “eventuality”?

Neither cutting expenses nor raising revenues is a desirable stance for a politician.

One could argue that there will be no real talk about turning around the growing debt load at this time in the United States.

There is a presidential election taking place.

So, Paul Krugman, Nobel prize-winning economist, writes in the New York Times: “Why You Shouldn’t Obsess About the National Debt”.

Mr. Krugman dismisses the debate about the debt by claiming that the only reason the issue of the debt is being brought up is “political.”

He concludes, “So politics…rather than the size of the debt is the problem.”

And, adds…”Which explains why I don’t talk about the debt.”

Tell that to the European Central Bank.

Conclusion

What does the debt picture look like?

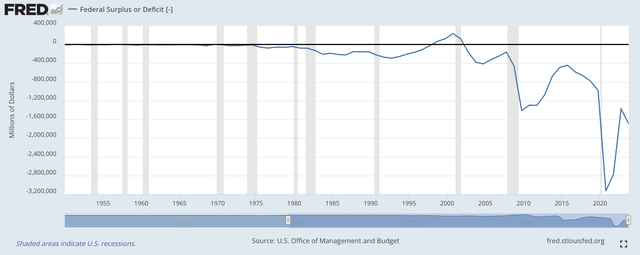

Well, here is the federal surplus or deficit since World War II.

Federal Surplus or Deficit (Federal Reserve)

Looks like the federal government, whether controlled by the Republicans or the Democrats, has exhibited little or no control over the production of government debt since the Clinton budget surpluses around the year 2000.

No one in the government seems to be interested in controlling the government debt. Must be that both political parties believe that the growing government debt is “sustainable.”

So, it doesn’t appear that the growing government debt is a political issue…unless you are “out of office.” Then you can raise the budget issue…but don’t talk too loud.

If you are now out-of-power and then are elected…you might be held accountable for talking about controlling the government budget, which you really don’t plan to do.

And, when does “eventually” show up?

Read the full article here