Nike (NYSE:NKE), the athletic apparel and footwear giant whose stock has fallen about 50% from its late November 2021 highs of $179, reports their fiscal Q4 ’24 earnings next Thursday night, June 27th, after the market close.

The stock has been basing in the high $80s, low $90s since the third week of April.

Sell-side consensus is expecting $0.84 in earnings per share, and $1.54 billion in operating income on $12.85 billion in revenue, for expected year-over-year (YoY) growth of 27%, 26% and 0% or flat revenue growth. (Nike has an easy comp for operating income vs. fiscal Q4 ’23.)

The expected 26% operating income growth is only the 2nd time in the last 11 quarters that Nike has generated YoY growth in operating income, which is pretty surprising. A lot of that operating income drag could have been the inventory glut, but that is now history and discussed lower in the preview.

No question the sports giant has struggled since Covid struck. Here’s Nike’s average revenue, operating income and EPS growth since the stock peaked in November ’21 (10 quarters):

- Revenue growth: +5%

- Operating income growth: -8%

- EPS growth: -1%

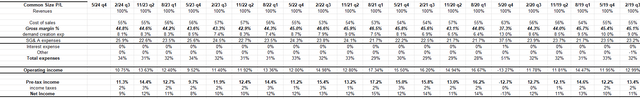

Here’s the issue from modeling Nike’s spreadsheet:

This “common size” income statement from Nike shows that SG&A expenses have risen modestly since late 2019, while operating income has slowly eroded since late 2019.

It’s not the end of the world, but it could be indicative of the “stale brand” and the stale footwear that Nike CEO John Donahoe wants to invigorate.

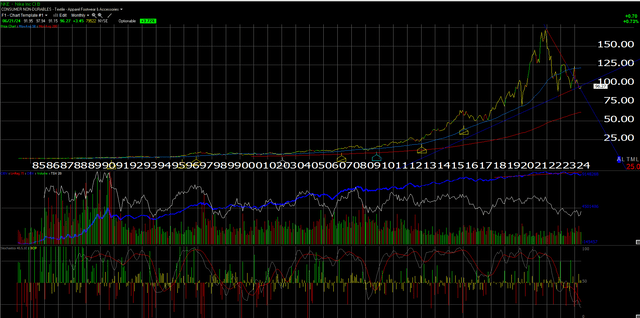

Technical look at the stock

What’s intriguing with Nike’s monthly chart is that the stock will clear congestion if it can trade up and through $100, and then has room to run until the 50-month moving average or roughly $120-121 per share.

Maybe more importantly, if you look at the bottom 1/3rd panel, Nike is now more oversold on the monthly chart than it was in 2008.

The problem from the fundamental perspective is that the brand truly could be stale and worn out, i.e. tired. If that’s the case, it will likely remain bouncing around at these levels.

The late September, ’22-early October ’22 lows for the stock were in the $80-$82 price level.

That’s your exit price or loss limit, since a trade through that level on heavy volume means much deeper problems at the “Swoosh”.

Valuation

The issue with Nike, both with fiscal ’24 and fiscal ’25 is that Nike expects just 1% revenue growth for both years, and while there is just 1 quarter left in fiscal ’24, the fact that fiscal ’25 consensus (started on June 1, ’24) expects 1% revenue growth to generate 4% EPS growth, (down from an expected 16% EPS growth this year) continues to tell us that analysts are loath to lift numbers and don’t expect much to change.

Nike’s fiscal ’25 guide will be critical on next Thursday night’s conference call. For fiscal ’25, the current consensus is expecting $3.88 in EPS on $52.1 billion in revenue. Again, Nike should be generating better than 1% revenue growth.

At $95 per share, Nike is trading at 24x expected EPS of $3.88 on expected revenue growth of 1%. That really is not much to excite investors. Nike is also trading about 2.5x revenue and 18x and 21x cash flow and free cash flow (ex cash).

As a valuation positive, Morningstar has a $129 fair value estimate on the stock, which – according to Morningstar’s model – leaves the stock trading at a 25-26% discount to fair value.

Summary/conclusion

If fiscal ’25 turns out like the current sell-side consensus expects, then Nike will have generated 2 consecutive years of 1% revenue growth. That’s not good. This blog’s financial model goes all the way back to 1992, and Nike has experienced single years with 1% revenue growth, but never 2 years in a row. Fiscal ’25 guidance will be critical on the call.

The inventory glut, which many retailers experienced in late ’21 and through ’22, Nike has now fixed. So in the last 4 quarters, Nike’s YoY revenue growth has exceeded YoY inventory growth nicely. An inventory glut like that is ultimately a drag on cash flow.

China is roughly 17% of Nike’s total revenue, and 53% of EBIT (which is how Nike discloses their operating income) but it’s misleading since the Global Brand Divisions and Corporate are big negative numbers within EBIT disclosure. The US and China EBIT sum up to 157% of total EBIT thanks to how Nike discloses it, so its analytical value is questionable.

Still, China is important to Nike. Keeping an eye on China’s economic data, I don’t think that much has changed for China growth prospects in the last few years. There is nothing compelling yet to cause investors to jump aggressively into accumulating the stock. Be patient and watch the numbers.

One reason I worry about Nike, as many seem to be from an “obsolescence” perspective, is Nike’s reporting of earnings. Nike is one of the few major brands, retailers and iconic companies that doesn’t report the cash flow statement with earnings.

It sounds like something that isn’t even worth mentioning, but since the 1990s and the passing of Reg FD (Full Disclosure), companies have been increasingly reporting the cash flow statement with the earnings release.

All the mega-cap tech companies report the statement of cash flow with the quarterly earnings release. Nike is still stuck in the dark ages when considered from that perspective. Investors still need to wait 3-4 weeks for the 10-Q to be released to see the actual numbers.

Previous articles on Nike (here, here and here).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here