The Set-up

I’m hearing that the last week of June after options expiration tends to be tough for the bulls. We do have the PCE on Friday, inflation is supposed to be 2.6%, and given the spate of moderating economic numbers I think the PCE will be a non-factor. Even if it surprises, we have 4 days to round-trip a trade or continue building a trading position to include Friday. Even so, I did hedge again, which we can discuss at the end of this piece. Let’s start with NVIDIA (NVDA), I think we get an entry point a bit lower than Friday’s close on Monday. If the week turns out to lose more ground in the next few days, we can always add equity or roll down the strike price if you prefer using options. The reason I feel that we could get NVDA at a bit of a lower level is something that I discussed with the Group Mind Investment Group, but I will make it brief. As part of the options’ expiration Friday, NVDA was going to receive a much larger weighting in all S&P Indexes. This was telegraphed well ahead of time. This meant that NVDA would be bought and other Super Six stock would be sold. Instead of NVDA rising with all the ETFs that follow the S&P 500 and the huge number of shares that would be bought. Instead, on Thursday and Friday, NVDA fell. My rationale was that since NVDA value has grown about 30% in 30 days, many portfolios are overweighted with NVDA shares. Basic portfolio risk management dictates that you don’t allow any one stock to get over a certain size, be it 5%, 7%, or 10%, it varies with the portfolio manager. The easiest trade in the world was to load up on NVDA, and very likely they all were overindexed. The best moment to do this is when you know there will be buying so that there is enough liquidity to support the stock price.

We now have a reason why NVDA fell on Thursday and Friday, why more selling on Monday?

Putting aside the notion that the following week of an options expiration, I think the money managers aren’t done. They are just as enamored of NVDA as everyone else on the planet, so they have perhaps a third of the shares they need to lighten up on this week. Simply stated, my notion is they sold ⅓ on Thursday, another ⅓ on Friday, and the final third on Monday. I bet they thought NVDA should rally this week, so why not leave over some to sell on the inevitable rally this week? Another part that I think will be at work is that momentum traders will be shorting the stock. They are assuming that all the other momentum trades will be doing the same, it is the summer with low volume, and if enough of them gang up, they alone could move the stock. I am not saying they are in cahoots, only that there are certain rules of the road, and NVDA like any other stock that is sliding, on high volume, is going to attract the shorts. So let’s look at the chart and see where NVDA has support…

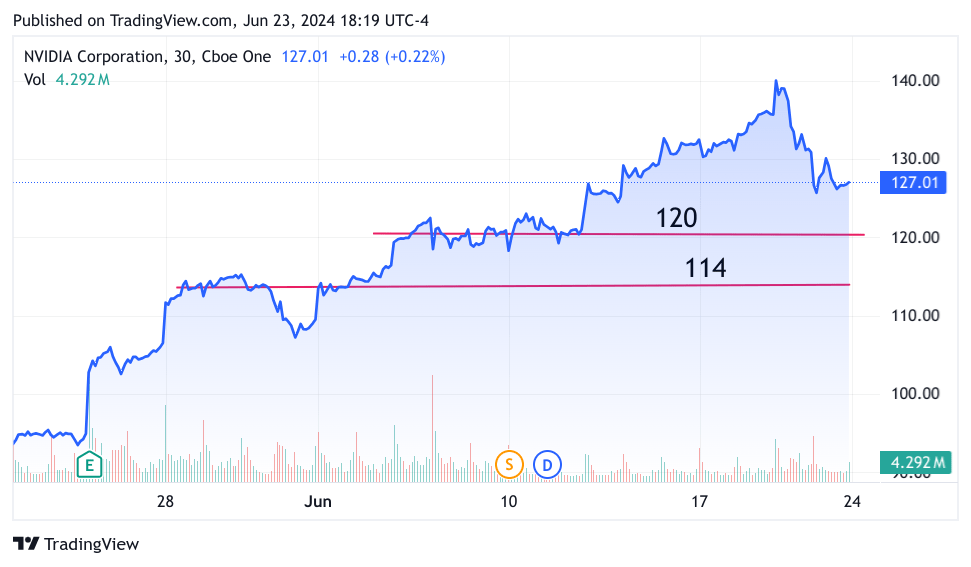

TradingView

This is the 3-month chart of NVDA, let’s bear in mind that NVDA has an intraday high of 140. We see strong support at 120, I would be a bit surprised if NVDA breaks under this level, if it does, I guess it means that the shorts are in control, and the next level is equally strong as the first at about 114. I would doubt we get here, but if we do, I certainly would try to establish a long trading position. Let me say that I don’t think NVDA is invulnerable to a macroeconomic shock, some issue with AI even a temporary narrative of oversupply or Advanced Micro Devices (AMD) getting closer to NVDA’s performance, any of those things, or things that I haven’t imagined could pressure NVDA. That is likely not happening to NVDA on Monday or any day soon. No, this is just one of those peculiar market mechanics issues, which are often called “technicals,” and if we are lucky, we can slide into a nice situation for a trade. I will hold off adding to NVDA my investment account for now. I would rather wait for the Fall, when the stock market customarily reaches for the lows of the year. What other “Titan” draws my interest?

Let’s look at Broadcom (AVGO) for a trade.

AVGO had a fantastic earnings report, showing 280% in optical and networking chips essential for AI. AVGO derives 58% of its revenue from chips and 42% from enterprise software. The excitement, however, derives from its AI-related chips. AVGO joined the stock split party and is splitting 1 to 10 shares the Ex-Date of July 15. I am invested in this stock and I think it could be an interesting trade. Wait! How is this a trade if the stock is currently trading at nearly 1660 per share? I hear you and have a suggestion check out Invesco PHLX Semiconductor ETF (SOXQ), the largest holding is NVDA at 15.30%, the second is AVGO at 9.40% the 3rd is AMD at 6.38 and 4th is Micron (MU) at 5.08% are like the 4 horsemen of the “AIpocalypse”. The thought is if NVDA does slide further on Monday these names will likely follow. Let’s look at the 3-month chart of SOXQ.

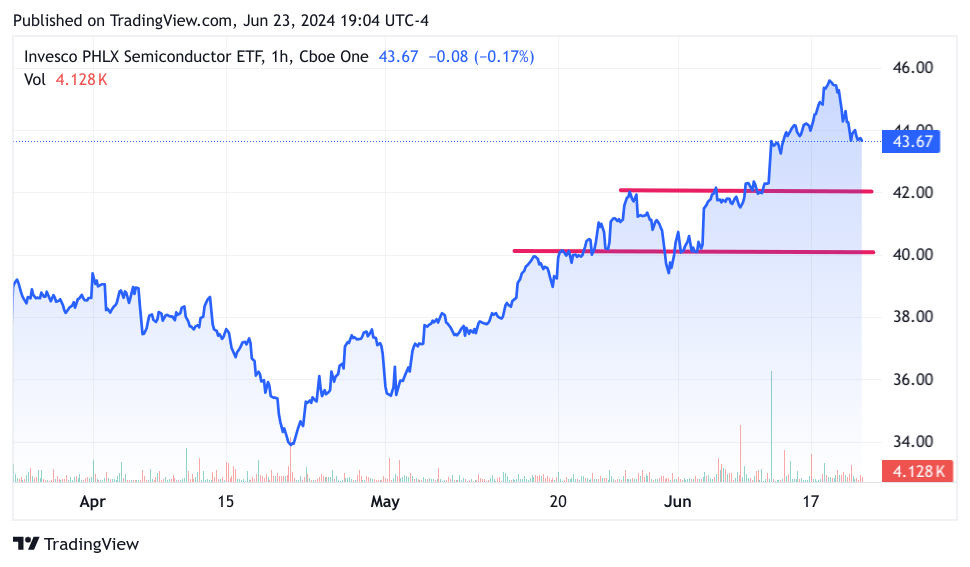

TradingView

It practically looks like a clone of NVDA… Let’s see what AVGO looks like. Here’s the 3-month chart.

TradingView

Wow, this chart is not at all like NVDA. In all fairness to AVGO, their earnings report was quite a surprise. The question is, does AVGO create a new support level that accounts for its new growth profile related to AI? I say yes, the question is how far does it correct? I think we should back away from jumping in quickly on trading AVGO, but the SOXQ intrigues me. What if AVGO drags SOXQ lower, albeit temporarily as it finds its new support? It could be a discount way to trade in the other three names. I recently became a long-term investor just before their earnings report, so I would love to add AVGO shares as an investment if it does fall in a more pronounced way. SOXQ as a trade needs AVGO to quickly find a base to make it a good trade. Trading 10 to 20 shares of AVGO and waiting for a 5% move is also a viable idea, that tranche will turn into 100 to 200 shares by July 15. You just have to buy it right.

I was going to chart Micron (MU) but it looks very similar to NVDA and AVGO, it looks like the “average” of the 2 combined. You are probably thinking we should just stick with NVDA and not bother with these others. I would be inclined to agree. I write these articles memoir-style, and I don’t look at the charts beforehand. I do have an insight from this exercise that I didn’t have before. I thought the portfolio adjustment was just confined to NVDA, but now I see that it is more widespread. I am going to keep an eye on SOXQ. I think these 4 names’ price action and effect on the ETF could create an opportunity for alpha. It’s going to be an interesting week.

My trades

Here’s what I did, I closed out my VIX calls, thinking that the VIX will likely fall back under 12.50. Now I am not so sure. I do have a hedge which I mentioned at the start and that is I have Long Puts on the 3X NDX-100 ETF. On the long side, I kept my promise from last week and got long Call Options on Zscaler (ZS), it was fortuitous because once again there are ransomware and other hacking exploits in the news this week. I was obliged by fate to take ZS below 180, so I had no excuse. If we do have downward pressure this week, I have the expiration out to August. I think the stock will hold up because they are in the zero-trust segment and that is seen as a hot area, as its fantastic earnings report illustrated. I have 2 AI-adjacent trades, that I believe I had last week, but this is my second iteration. First is Pure Storage (PSTG) which when it jumped to 69 I had to let it go, fortunately, it dropped under 64, so I got the same 65 Strike Call again. Vertiv (VRT) the stock jumped to 94, so I sold only half of my calls. After all, the 52wh is 109. The stock promptly dropped under 90, so I added back the prior tranche, and hopefully, the second time will be the charm and we reach 100.

I think it is going to be an interesting week. I am a careful bull with a little bit of a hedge and plenty to trade on the long side.

Good luck and happy trading!

Read the full article here